🧠 AI Stocks up 60%. $250M of Funding.

For over 5 years, HolonIQ has been tracking and analyzing Impact Capital Markets, Foundations and Philanthropies, Venture and Growth Capital, Private Equity and Public Markets.

Now, with more than 50 stock indices being tracked, we're kicking off 2024 with a new daily newsletter for data-driven, global leaders looking to understand trends in strategic industries.

Today's Topics

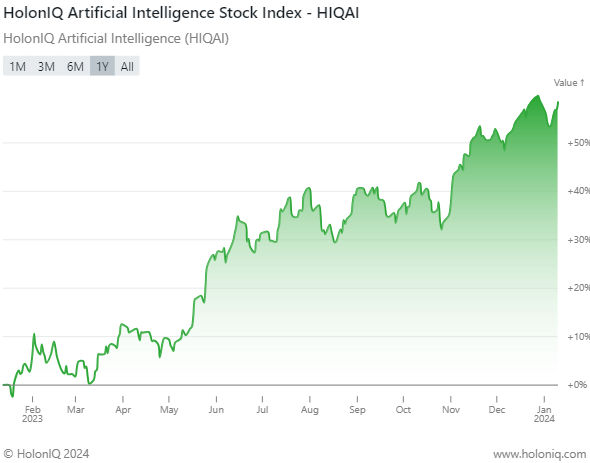

- 🤖 AI. Artificial Intelligence index jumps up nearly 60% in a year

- 💰 Funding. $250M+ for Mobility, Neurology, and More

- 💼 Acquisitions. Clinical Solutions, Curriculum & Plastic Injection

- 📅 Economics. Trade, GDP and Inflation data coming up

Have feedback or ideas for us? Email hello@holoniq.com — we'd love to hear from you!

🧠 AI Stocks up 60%

HolonIQ Artificial Intelligence Index: The index has been on an upward trend since at least the beginning of the period shown and has increased by 9.81% overall. In the most recent month shown, the index increased by almost 5%. The strong performance of the HIQAI in recent months is likely due to a number of factors, including the increasing ubiquity of AI in our everyday lives and the increasing investment in AI by both governments and businesses. Significant highlights include Google's announcement of LaMDA 3, sparking debate about sentience and consciousness in AI models. In March, OpenAI's GPT-3 launched ChatGPT, offering conversational AI interactions to the public and raising concerns about fake news and misinformation. Meta unveils Make-A-Video, transforming text prompts into short videos and pushing the boundaries of creative AI tools in the month of July. All things considered, 2023 saw a major advancement in AI capabilities, but it also brought attention to the urgent need for ethical concerns, responsible research, and explicit restrictions.

💰 Funding

🚗 FINN, a Germany-based mobility solution provider, raised a $109M Series C from Planet First Partners, to accelerate growth in the electric car sector.

🏥 Harbor Health, an Austin, Texas-based primary and specialty clinic group, raised a $95.5M Series A from General Catalyst, to speed up growth in primary care and create plan designs supporting co-created care journeys.

🏥 Artisight, a Chicago, Illinois-based provider of an AI-powered smart hospital platform for virtual care, raised a $42M Series B from NVIDIA, to double its headcount.

🧠 Rune Labs, a California-based precision neurology software and data company, raised $12M from Nexus NeuroTech. The funds are likely to further develop its precision neurology software and data analytics capabilities.

🎓 ConveGenius, a India-based edtech company, raised a $7M Series A from UBS Optimus Foundation and Mount Judi Ventures. The fund will be used for the development of advanced generative AI capabilities and facilitate international market expansion.

💼 Acquisitions

🩺 MedRisk, a Pennsylvania-based company which specializes in managed physical rehabilitation in workers’ compensation, acquired Medata, a California-based provider of cost management and clinical solutions in the United States. The amount of the deal was not disclosed.

🖥️ MadCap Software, a California-based technical writing software company, acquired Xyleme, a Colorado based provider of learning content management solutions that enable single-source publishing of educational materials.

💊 SHL Medical, a Switzerland- based provider of advanced drug delivery solutions, acquired Superior Tooling, a North Carolina-based manufacturing company of plastic injection molds and injection blow molds.

📅 Economic Calendar

Anticipate key economic indicators focusing on Balance of Trade, GDP, and Inflation.

Friday, January 12th 2024

🇨🇳 China - Inflation Rate YoY, December

🇨🇳 China - Balance of Trade, December

🇬🇧 UK - GDP MoM, November

🇺🇸 US - PPI MoM, December

Monday January 15th 2024

🇩🇪 Germany - Full Year GDP Growth, 2023

Tuesday January 16th 2024

🇦🇺 Australia - Westpac Consumer Confidence Change, January

🇬🇧 UK - Unemployment Rate, November

🇩🇪 Germany - ZEW Economic Sentiment Index, January

🇨🇦 Canada - Inflation Rate YoY, December

Wednesday January 17th 2024

🇨🇳 China - GDP Growth Rate YoY, Q4

🇨🇳 China - Industrial Production YoY, December

🇬🇧 UK - Inflation Rate YoY, December

🇺🇸 US - Retail Sales MoM, December

Thursday January 18th 2024

🇺🇸 US - Building Permits Prel, December

🇯🇵 Japan - Inflation Rate YoY, December

🇬🇧 UK - Retail Sales MoM, December

🇺🇸 US - Michigan Consumer Sentiment Prel, January

Friday January 19 2024

🇯🇵 Japan - Inflation Rate YoY, December

🇬🇧 UK - Retail Sales MoM, December

🇺🇸 US - Michigan Consumer Sentiment Prel, January