👵 Aged Care + Australia & New Zealand Health Tech 100

In this week's Health Newsletter, we preview the Aged Care landscape and spotlight the Australia and New Zealand Health Tech 100. Don't forget to check out the 2024 Global Health Tech Outlook, and sign up for our Daily Newsletters Chart of the Day and Impact Capital Markets.

Happy Monday 👋

Aged Care will be one of the most pressing issues around the world for decades to come. Don't forget to check out the 2024 Global Health Tech Outlook, and sign up for our Daily Newsletters Chart of the Day and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

This Week's Topics

- 👵 Aged Care Market Map. 100+ Companies Across the Aged Care Landscape

- 📊 Charts Spotlight. US Nursing Care Staff on the Decline

- 🔴 China Health Stock Index. Down 40% Over the Past 12 Months

- 🏆 Australia and New Zealand Health Tech 100. ANZ's 100 Most Promising Health Techs

- 📊 2024 Global Health Tech Outlook. 190+ Pages of Trends, Insights, and Data

- 💰 Top Deals This Week. Funding, M&A and IPOs

👵 Aged Care Landscape

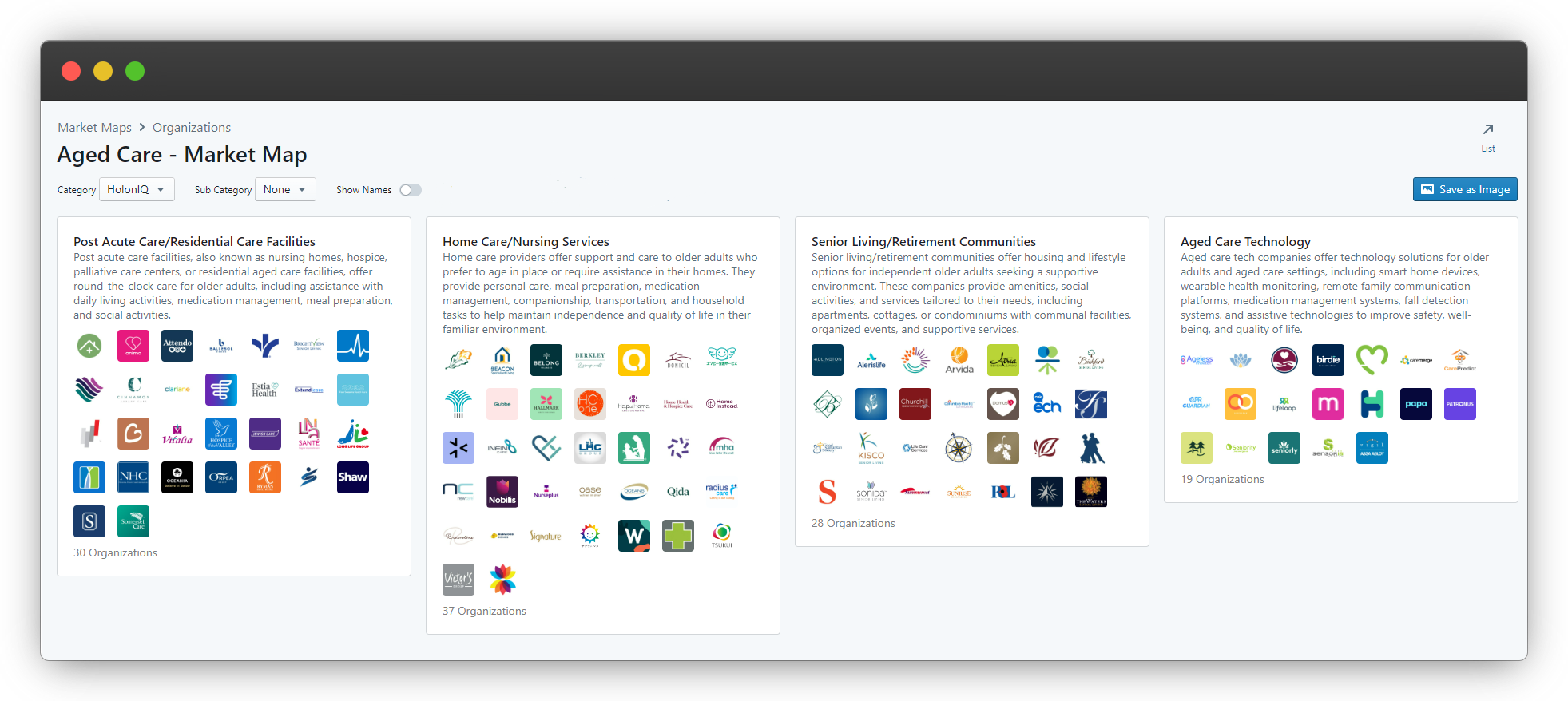

A surge in demand for aged care services is imminent due to population aging, a global phenomenon marked by a rising proportion of individuals aged 60 and above. About 1 in 6 people globally are projected to reach this age category by 2030 (a 40% increase from 2020), presenting significant challenges and opportunities for healthcare systems. Moreover, the "oldest-old" population (80+) is expected to triple by 2050, with low- and middle-income countries experiencing the most dramatic shift. Understanding these demographic changes is crucial for effectively preparing for the future of aged care.

The aged care field witnessed recent developments across diverse areas. In Canada, the government announced dental care coverage for senior citizens beginning in May 2024. China plans to collaborate with multiple firms to improve technology infrastructure, aiming for greater "elder-friendliness" by facilitating digital access to aged care services. In the corporate sector, Welltower announced a $1B acquisition of Affinity Living Communities, scheduled for later this year.

HolonIQ is tracking hundreds of global health companies in this area and through Q1 we're launching an enhanced Market Maps feature to explore landscapes dynamically on dimensions important to you. By region, revenue, age, category, and more with subcategorization on any dimension in one click. Stay tuned for the launch!

HolonIQ Market Map - Aged Care

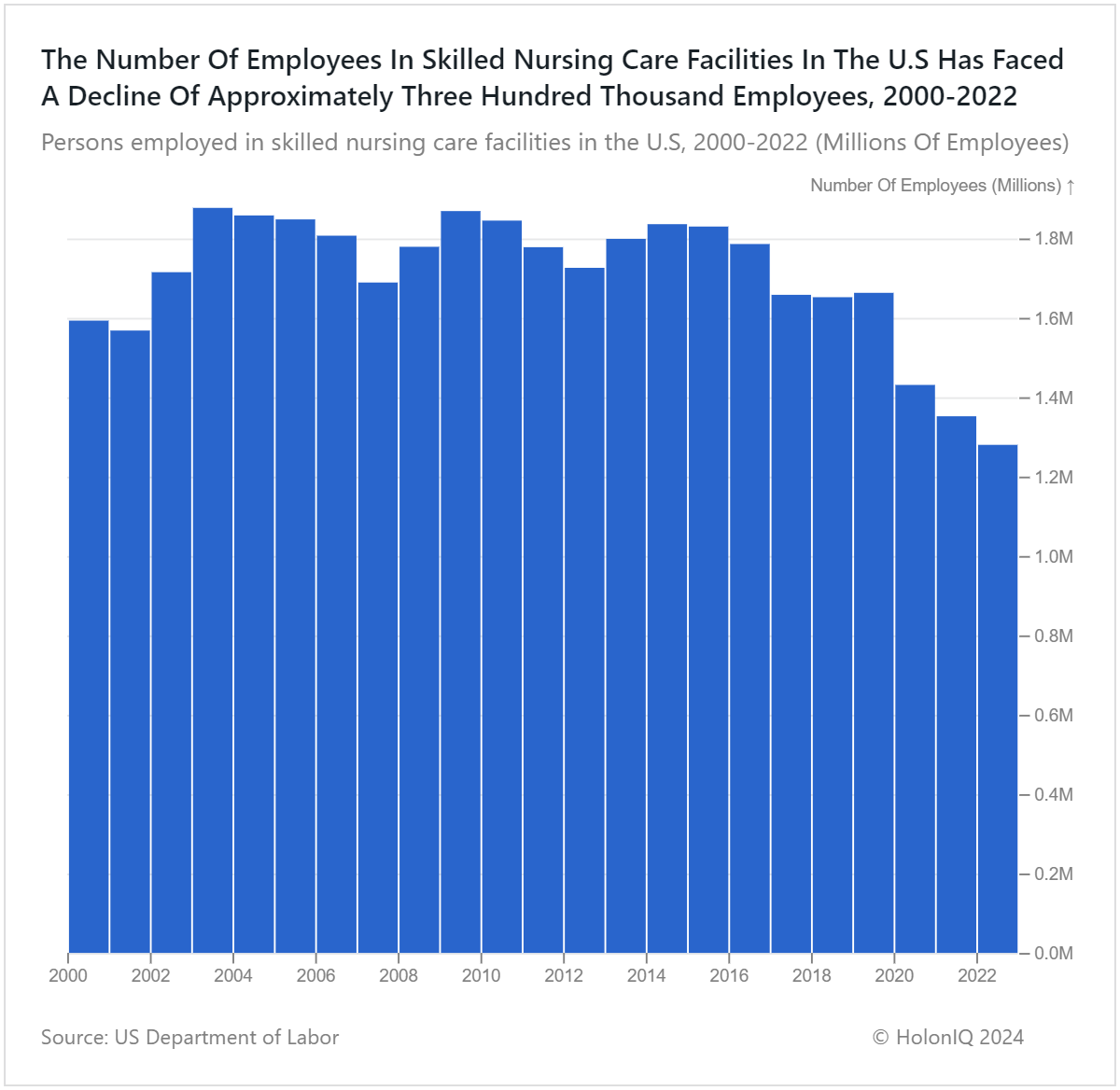

📊 Charts Spotlight - US Nursing Care Staff on the Decline

Subscribe to HolonIQ's 'Chart of the Day,' a daily newsletter that helps explain the global impact economy - from climate tech to education and healthcare.

Healthcare worker shortages have been a critical concern across the US, and staffing requirements and concerns have been a key discussion in the nursing home space. Staff counts in US nursing homes have been on a general downward trend since 2010, a trend that has been persistent since the COVID-19 pandemic. Stress and burnout have fueled declines in worker counts in long-term care settings. Persistent decreases in staffing count signal an exacerbation of labor shortages, given that the US has an aging population. With the Biden Administration seeking to implement staffing requirements in nursing homes, this may strain an already thin labor pool from which nursing homes can source their staff.

📈 China Health Stock Index

HolonIQ tracks thousands of listed health companies around the world and several acquisitions and investments each year. Soon, we will launch a range of stock indices to track the daily performance of over 10 different sectors across Health Technology.

Our new Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

The HolonIQ China Health Index has fallen 42% over the last 12 months. Recent anti-corruption measures that targeted the Chinese health sector have prompted short-term investor aversion to healthcare stocks, contributing to a decline in the index's performance. Demographic challenges have also raised concerns, with continuous population declines and a low birth rate increasing worries.

However, certain efforts taken suggest some potential for the reversal of this trend. China is harnessing digital technology to drive healthcare innovation, particularly in smart medicine, to address the needs of an aging population. Initiatives focused on improving critical care in pregnancies highlight a commitment to maternal health. Comprehensive plans targeting heart and brain diseases also outline long-term public health strategies. Despite current headwinds, these proactive measures demonstrate China's commitment to addressing healthcare challenges.

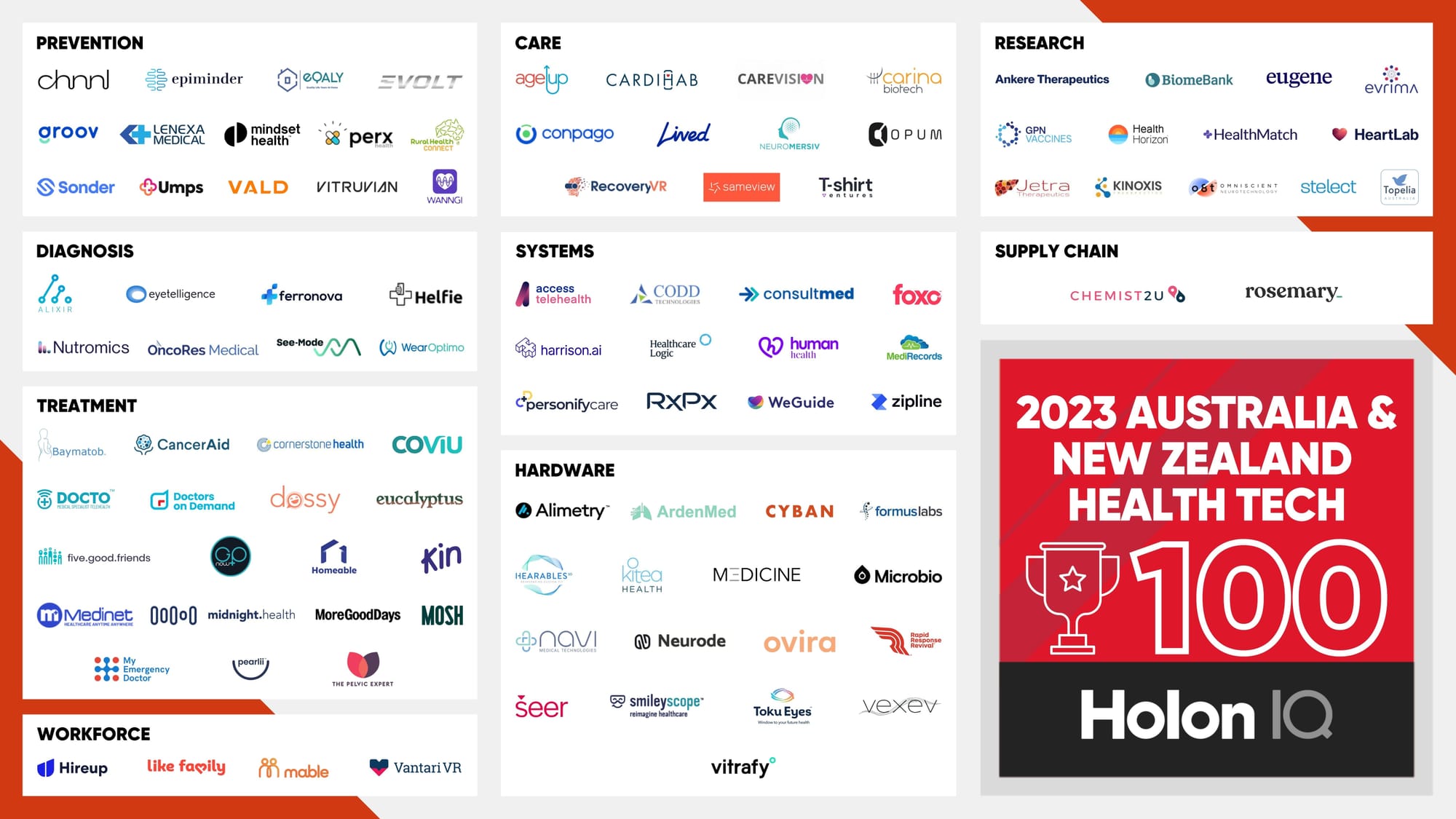

🏆 Australia and New Zealand Health Tech 100

The Australia and New Zealand Health Tech 100 is HolonIQ’s annual list of the most promising startups working in digital health, biotech, drug discovery, and analytics in the region.

The cohort has seen positive funding news over the past several weeks. Sonder (an Australian workplace wellbeing firm) raised $16M in Series B funding in January 2024. Vantari (an Australian VR clinician training platform) raised $7M through a pre-Series A round in December 2023.

📊 2024 Global Health Tech Outlook

2024 is a fresh start and the stage is set for the next wave of Health Technology. Just a few weeks ago, we launched the 2024 Global Health Tech Outlook, HolonIQ's annual analysis of the health landscape, presenting over 190 pages of detailed market data, investment & analysis, strategic shifts, and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report. You may also be interested in our Global Economic Outlook, Global Climate Tech Outlook, or Global Education Outlook.

We have a jam-packed agenda for 2024 including a major new market sizing release and many more exciting new initiatives. Stay tuned or Connect with HolonIQ to learn more about how we support forward-thinking institutions, governments, and organizations globally as they navigate the challenges and opportunities ahead. Purchase the Outlook or Download the Extract.

💰 Health Tech Top Deals of the Week

HolonIQ actively monitors and tracks deals in the Health industry, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

💼 M&A

🩹 Gilead, has acquired CymaBay Therapeutics for $4.3B, focusing on the primary biliary cholangitis medication Seladelpar. The acquisition is expected to be completed by the end of Q1 2024.

🏥 Welltower, is partnering with Affinity Living Communities to acquire 25 active adult communities in the Pacific Northwest for $969M. The acquisition is set to be completed later in the year.

📈 IPOs

🧬 Metagenomi, a biotech firm that provides gene editing tools, closed its initial public offering of 6M shares at $15.00 per share, raising $94M.

🔬 Sana Biotechnology, a cell-engineering solutions company, raised $165M in a public offering, with Morgan Stanley, JP Morgan, and Goldman Sachs acting as joint book-running managers. The company plans to utilize the funds for clinical trials.

❌ Closures

🧬 Synlogic Therapeutics, a Nasdaq-listed biotech firm, is to cease operations and lay off almost all its staff after discontinuing a major drug trial.

⚕️ Roivant, has discontinued the development of its only asset, a former Eisai drug dubbed RVT-2001 that was being studied in a mid-stage trial for patients with myelodysplastic syndromes (MDS).

🧪 LianBio, has announced it will begin winding down operations and sell its remaining pipeline assets.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com