💰$90M Food Delivery Funding. Hydropower Stock Volatility.

Impact Capital Markets #22 looks at our Hydropower Stock Index, major impact deals and acquisitions, and the upcoming economic releases.

Yesterday's trade data revealed a mixed picture: Australia's surplus contracted as exports slowed, while Germany's surplus reached EUR 22.2 billion, its highest since November 2017, with exports outpacing imports

Today's Topics

- 🌊 Hydropower. Hydropower Stock Recovers from an 8% drop

- 💰 Funding. $235M+ Funding in Robot delivery, Cardiology, Agtech + More

- 💼 Acquisitions. Clinical Surveillance, Saas Energy, Chronic Care + More

- 📅 Economics. Major Interest Rate Decisions, Balance of Trade, GDP & Inflation Releases + More

For unlimited access to more deals and economic updates, request a demo

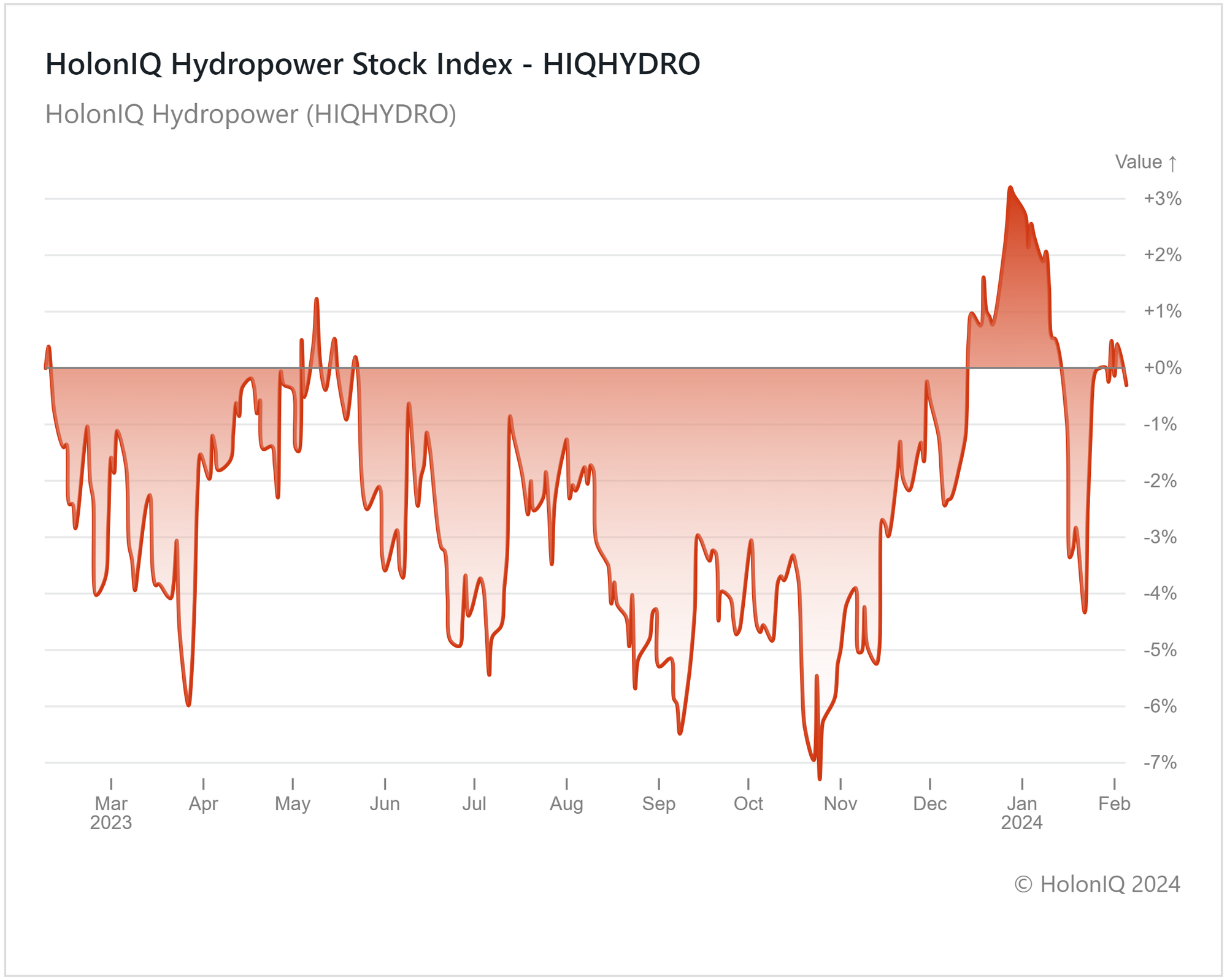

🌊 Hydropower Stock Volatility

HolonIQ Hydropower (HIQHYDRO).

12-month Indexed returns (returns on the index relative to the level on February 07, 2023) have been on a downward trend but made a turnaround in October and increased to 3% YoY in January 2024. Index performance declined due to a number of factors, including the fact that China began to rely on coal due to drought-induced depletion of hydropower resources.

Despite challenges, significant strides are being made globally towards advancing sustainable energy solutions and diversifying energy portfolios. Recent developments globally include the US DOE’s allocation of almost $600M to enhance water power technologies across America, Colombia’s integration of 18 solar and small hydroelectric plants into the grid during the second and third quarters of 2023, and Spanish multinational electric utility Iberdrola (MarketCap: US$ 73B) powering up the Portuguese hydro project in January 2024. The rising interest rates across the world are pushing up project financing, which is making new projects more costly, but as economies stabilize and countries ramp up renewable energy capacities to achieve net-zero goals, this sector may see a resurgence.

💰 Funding

🤖 Starship Technologies, a California-based delivery robot company, raised $90M to scale up its self-driving delivery robot fleet, aiming to meet growing market demand.

🫀 Procyrion, a Texas-based cardio-renal medical device company, raised a $57.7M Series E from Fannin Innovation Studio. These funds will help to advance a crucial research study exploring a device called Aortix.

🌱 ProducePay, a California-based AgTech finance platform, raised a $38M Series D from Syngenta Ventures to support the company’s expansion into Europe, Asia, Africa, and Australia.

🌦️ Jua, a Swiss-based AI Weather Power Trading Platform, raised a $16M Seed from Green Generation Fund & 468 Capital to develop an AI model for weather prediction.

🔬 Vektor Medical, a California-based company specializing in AI-based arrhythmia analysis technology, raised a $16M Series A from TVM Capital Life Science and Solas BioVentures to revolutionize arrhythmia care.

🏠 Keus, an Indian smart home automation company, raised $12M OAKS Asset Management to open new experience centers in major cities and solidify market leadership in Hyderabad.

🩺 Neurescue, a Danish medical device startup developing cardiovascular devices, raised a $7.2M Series A from West Hill Capital. This funding will be used to further develop and scale its NEURESCUE device, a pioneering solution for improved treatment of cardiac arrest.

💼 Acquisitions

💻 Inovalon, a Bowie, Maryland-based provider of cloud-based software solutions empowering data-driven healthcare, acquired VigiLanz, a Minnesota-based clinical surveillance SaaS company.

⚡ Franklin Energy, a Wisconsin-based energy solutions company, acquired Snugg Home, a Colorado-based leading SaaS energy efficiency company.

🩺 Thyrocare, an Indian diagnostic and preventive healthcare service provider, acquired Think Health Diagnostics, a Chennai-based home healthcare aggregator platform that combines a variety of health services.

🏥 Hamilton Beach Health, a Virginia-based digital health solutions provider, acquired HealthBeacon, an Irish chronic care device developer.

🌍 Novo Holdings, a Danish investment company, acquired Catalent, a New Jersey-based provider of enhanced global treatment solutions.

📅 Economic Calendar

Major Balance of Trade, Interest Rate Decision, China Inflation Data + More

Tuesday February 6th 2024

🇨🇦 Canada - Ivey PMI s.a , January

Wednesday February 7th 2024

🇨🇦 Canada - Balance of Trade , December

Thursday February 8th 2024

🇨🇳 China - Inflation Data, January

Friday February 9th 2024

🇨🇦 Canada - Unemployment Data, January

Tuesday , February 13th 2024

🇦🇺 Australia Westpac Consumer Confidence Change, February

🇬🇧 UK Unemployment Rate, December

🇩🇪 Germany ZEW Economic Sentiment Index, February

🇺🇸 US Core Inflation Data , January

🇺🇸 US Inflation Data , January

Wednesday February 14th 2024

🇦🇺 Australia NAB Business Confidence, January

🇬🇧 UK Inflation Rate, January

Thursday February 15th 2024

🇯🇵 Japan GDP Data , Q4

🇬🇧 UK GDP Data , Q4

🇬🇧 UK GDP Data, December

🇺🇸 US Retail Sales Data , January

Friday February 16th 2024

🇬🇧 UK Retail Sales Data, January

🇺🇸 US Building Permits Prel, January

🇺🇸 US PPI MoM, January

🇺🇸 US Michigan Consumer Sentiment Prel, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com