💰 $470M+ VC Funding Day. Publishers Index Ends Flat.

Impact Capital Markets #75 looks at our Publishers stock index, major impact deals, M&A, and upcoming economic releases.

Ciao 🍕

📉 Today's Global Economic Update: Japan's Inflation Data released yesterday revealed a decrease in inflation to 2.7% from February's 2.8%, aligning with expectations. Prices for goods and services slowed, while energy prices declined less due to subsidy reductions. Core inflation fell slightly below forecasts at 2.6%, and monthly consumer prices increased by 0.2%, the highest since October.

🔬 Deal of the Day: Metsera, a clinical-stage biopharmaceutical company launched with $290M in Series A and seed financing.

What's New?

📖 Publishers. Publishers index ends flat

💰 Funding. Biopharma, EV charging, geothermal energy + more

💼 M&A. Health tech & laboratory analytics

📅 Economics. US GDP, Japan inflation & interest rate decision + more

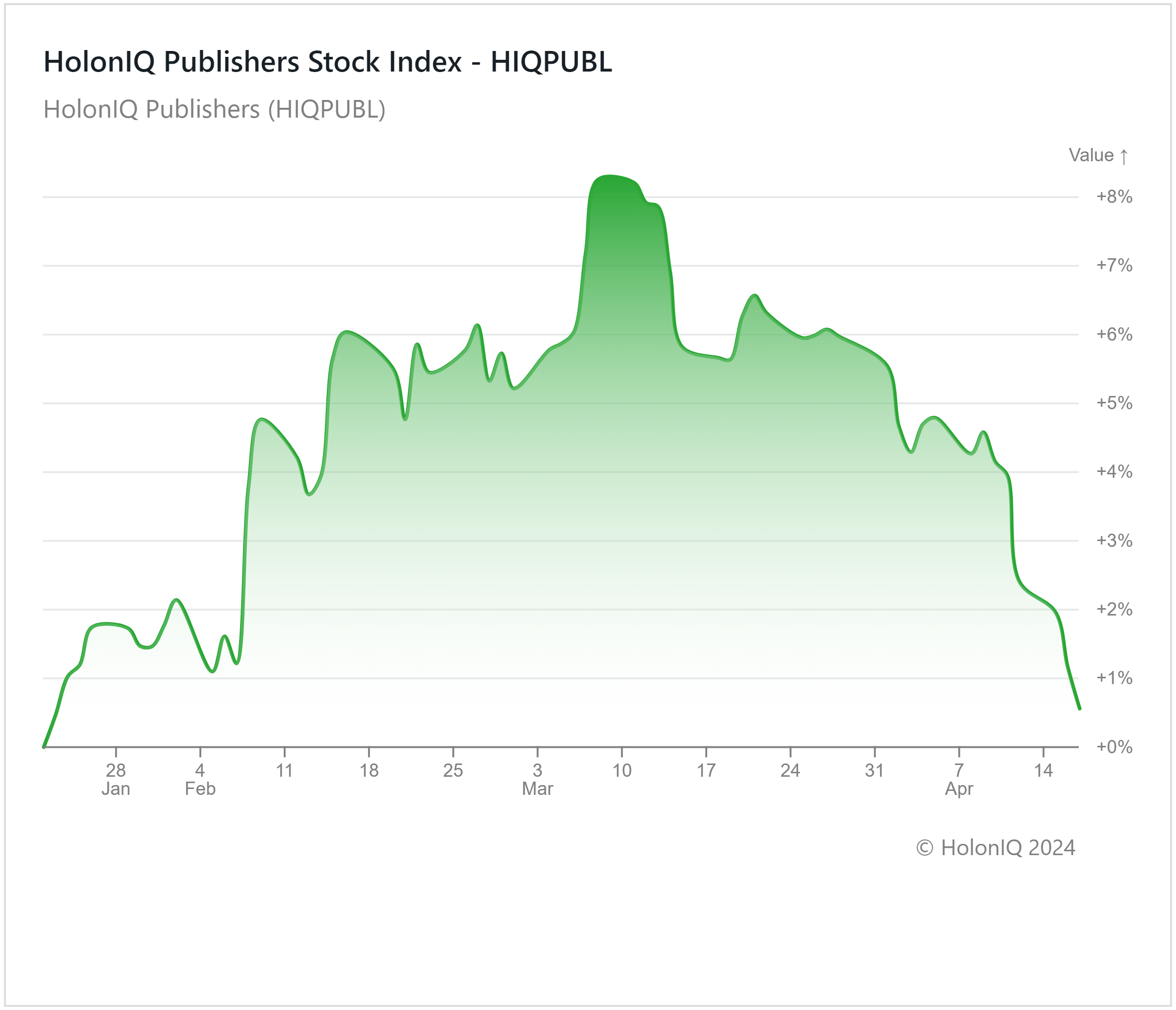

📖 Publishers Index Ends Flat

HolonIQ’s publisher index retraced gains seen earlier in the quarter, now showing a gain of less than 1%. Significant stocks within the index, including News Corp. ($14B MCap), Informa Plc ($13B MCap), and Pearson Plc ($8B MCap), reported quarterly returns of 1%, 6%, and 5%, respectively. Yearly index gains have also been partially reversed during the quarter, currently settling at ~9%.

The widespread adoption of generative AI can have a significant impact on the publisher index. Publishers like News Corp have reportedly engaged in discussions with OpenAI to potentially license their content, amidst legal concerns surrounding the utilization of third-party content for training artificial intelligence systems. Last month, News Corp completed a share buyback in March while Pearson unveiled intentions to repurchase shares worth over $200M, and Informa expanded their stock buyback to $1.5B, which could be a positive sign for shareholders. With the market adapting to the new valuations, publishing companies are also enhancing their AI study tools, suggesting prospective growth for the index ahead.

💰 Funding

🔬 Metsera, a New York-based clinical-stage biopharmaceutical company launched with $290M in Series A and seed financing.

🚗 SWTCH Energy, a Canadian electric vehicle charging solutions company, raised a $27.2M Series B from Blue Earth Capital to accelerate charging in multi-tenant buildings.

🩺 Pathios Therapeutics, a UK-based biotech company, raised $25M Series B from Bristol Myers Squibb to support its novel cancer immunotherapy.

🚀 Orbex, a UK-based spaceflight company, raised a $20.7M Series D to accelerate the advancement of its rocket designed for launching small satellites.

🌋 GA Drilling, a Texas-based geothermal drilling company, raised $15M to accelerate the delivery of geothermal tech to replace fossil fuels.

🛡️ Allen Control Systems, a Texas-based defense technology company, raised a $12M Seed from Craft Ventures to expand operations.

🧬 Outrun Therapeutics, a UK-based biotechnology company, raised a $10M Seed from M Ventures and MP Healthcare Venture Management to expand operations and its R&D efforts.

💼 M&A

💻 DrFirst, a Maryland-based health tech company, acquired Myndshft Technologies, an Arizona-based healthcare IT solutions provider.

🔬 Analytical Instrument Management, a Colorado-based lab equipment supplier, acquired PSI Labs, a Michigan-based full-service analytical laboratory.

📅 Economic Calendar

US GDP Data, Japan Inflation & Interest Rate Decision + More

Friday, April 19th 2024

🇬🇧 UK Retail Sales Data, March

Tuesday, April 23rd 2024

🇩🇪 Germany HCOB Manufacturing PMI (Flash), April

🇦🇺 Australia Inflation Data, Q1

Wednesday, April 24th 2024

🇩🇪 Germany Ifo Business Climate Index, April

🇺🇸 US Durable Goods Orders Data, March

Thursday, April 25th 2024

🇩🇪 Germany GfK Consumer Confidence Index, May

🇺🇸 US GDP Growth Data, Q1

🇯🇵 Japan BoJ Interest Rate Decision

Friday, April 26th 2024

🇺🇸 US Core PCE Price Index, March

🇺🇸 US Personal Income & Spending, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com