💰 $3B Novartis Acquisition. Early Childhood Dip 35%.

Impact Capital Markets #23 looks at our Early Childhood Stock Index, major impact deals and acquisitions, and the upcoming economic releases.

Yesterday, the Reserve Bank of Australia announced it would maintain its cash rate at 4.35%, citing that inflation is still high even though costs are coming down. Policymakers stressed the importance of inflation returning to target levels and signaled a cautious approach to future rate adjustments.

Today's Topics

- 🧑🏫 Early Childhood. Early Childhood Stocks Down 35%

- 💰 Funding. Ambience raises $70M, Biopharma and Plant Meat Deals + More

- 💼 Acquisitions. Novartis' $2.9B acquisition + Orthopedic, Oilfield M&A and more

- 📅 Economics. Major Interest Rate Decisions, Euro Area GDP & Inflation Releases + More

For unlimited access to more deals and economic updates, request a demo

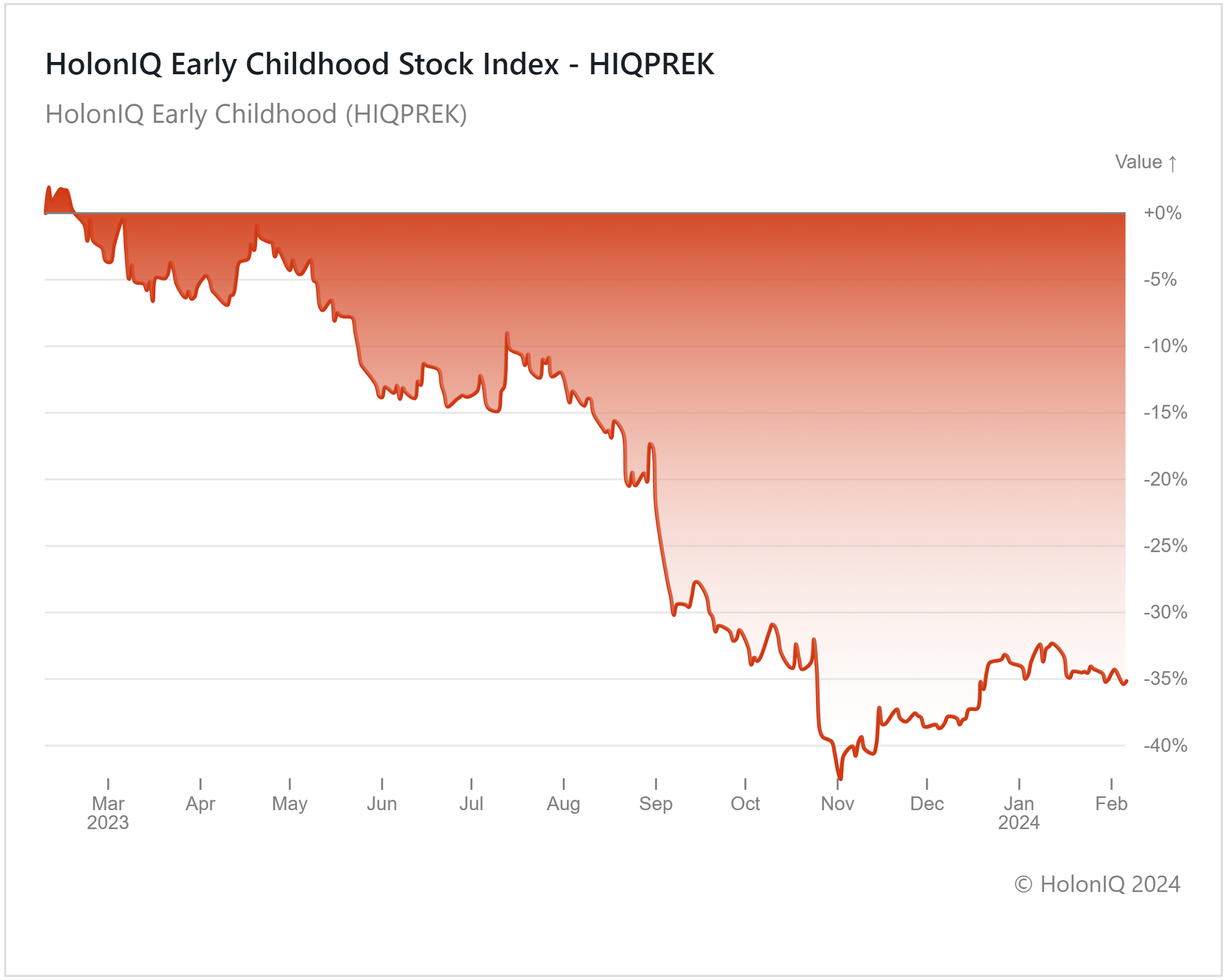

🧑🏫 Early Childhood Index Down 35%

HolonIQ Early Childhood (HIQPREK)

12-month YTD returns have declined 35%. The index has seen an overall declining trend over the past 12 months, dipping to lows exceeding 40% in November 2023 driven by poor performance in major stocks such as Youji Corporation (TSE:2152) and Dadi Early-Childhood Education Group (TPEX:8437).

The drop is driven by stocks in East Asian countries where birth rates are falling. The problem of falling student numbers have put pressure on the pre-school industry with reports of preschool closures, staff retrenchments and intensifying competition rising in Hong Kong, China and Japan. Major stocks in the region are facing the consequences and have seen their revenues dwindling, pushing the Early Childhood Index down.

Meanwhile, major stocks such as Bright Horizon Family Solutions in the US have been performing well with steady growth in earnings due to initiatives such as partnering with corporates to provide employer-provided childcare. In regions such as Australia and the US, where governments are increasing financial assistance to early childhood education and corporations are increasingly providing early childcare as a benefit for its employees, it is expected that the sector will see strong growth in the years to come.

💰 Funding

💉 Ambience Healthcare, a California-based comprehensive AI operating system for healthcare organizations, raised a $70M Series B from OpenAI Startup Fund & Kleiner Perkins for product development and AI advancements.

💊 Attralus, a California-based clinical-stage biopharmaceutical company developing transformative medicines, raised a $56M Series B from Alpha Wave Ventures to advance the Phase 1/2 development of Attralus’ lead PAR therapeutic product.

🍔 Heura Foods, a Spanish plant-based meat company, raised a $43M Series B. The funds will fuel innovation, expand the patent portfolio, and drive global expansion.

🚗 River, an India-based electric vehicle (EV) start-up, raised a $40M Series B nationwide from Yamaha Motor to scale the distribution and service network nationwide and invest further in R&D.

🌍 Avnos, a California-based company developing novel Hybrid Direct Air Capture (HDAC) technology for carbon dioxide removal, raised a $36M Series A from NextEra Energy to expand HDAC™ technology.

🎓 Colossyan, a UK-based AI video for workplace learning company, raised a $22M Series A from Lakestar to support its expansion plans, with a focus on hiring talent across various key roles.

⛴️ Sea Machines Robotics, a Massachusetts-based marine autonomy company, raised a $12M Series A Technology Ventures from Emerald Technology Ventures. The funding will likely enhance Sea Machines' autonomous technology, expand market presence, and ensure regulatory compliance.

🧠 Elemind Technologies, a Massachusetts-based neurotechnology company, raised $12M to further develop its first product ahead of its reveal in the coming months.

🏍️ OTO Capital, an Indian digital commerce and lending platform for two-wheelers, raised $10M from GMO VenturePartners. The funding will strategically expand OTO’s presence to over 30 cities, support the transition to electric vehicles, and strengthen the existing partnerships.

😴 Stellar Sleep, a Massachusetts-based sleep psychology app, raised a $6M Seed from Initialized Capital. The funding will scale the content enhancement of the app.

💼 Acquisitions

💊 Novartis, a Swiss pharmaceutical company, acquired MorphoSys, a German biopharmaceutical company for a total of $2.9B in cash.

🔬 Bruker, a Massachusetts-based manufacturer of analytical and medical instruments, acquired Spectral Instruments Imaging, an Arizona-based company specializing in preclinical in-vivo optical imaging systems.

💊 Somafina, a Georgia-based nutraceutical manufacturer, acquired UST Corporation, a Utah-based contract manufacturer of vitamins, minerals, and supplements.

🦴 Orthopedic Care Partners, a Florida-based orthopedic practice management platform, acquired The Orthopedic Partners, a Utah-based premier orthopedic practice.

🏋️♂️ SVEXA, a Delaware-based exercise intelligence layer, acquired Kollektiv, a Danish fitness tech mobile app for endurance training communities.

⛽ DNOW, a Texas-based supplier of energy and industrial products and packaged, has entered into an agreement to acquire Whitco Supply, a Louisiana-based oilfield supply company.

📅 Economic Calendar

Major Balance of Trade, Interest Rate Decision, China Inflation Data + More

Wednesday February 7th 2024

🇨🇦 Canada - Balance of Trade , December

Thursday February 8th 2024

🇨🇳 China - Inflation Data, January

Friday February 9th 2024

🇨🇦 Canada - Unemployment Data, January

Tuesday , February 13th 2024

🇦🇺 Australia Westpac Consumer Confidence Change, February

🇬🇧 UK Unemployment Rate, December

🇩🇪 Germany ZEW Economic Sentiment Index, February

🇺🇸 US Core Inflation Data , January

🇺🇸 US Inflation Data , January

Wednesday February 14th 2024

🇦🇺 Australia NAB Business Confidence, January

🇬🇧 UK Inflation Rate, January

Thursday February 15th 2024

🇯🇵 Japan GDP Data , Q4

🇬🇧 UK GDP Data , Q4

🇬🇧 UK GDP Data, December

🇺🇸 US Retail Sales Data , January

Friday February 16th 2024

🇬🇧 UK Retail Sales Data, January

🇺🇸 US Building Permits Prel, January

🇺🇸 US PPI MoM, January

🇺🇸 US Michigan Consumer Sentiment Prel, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com