🌱 31% of Food System Emissions from Livestock + Nordic-Baltic Climate Tech 100

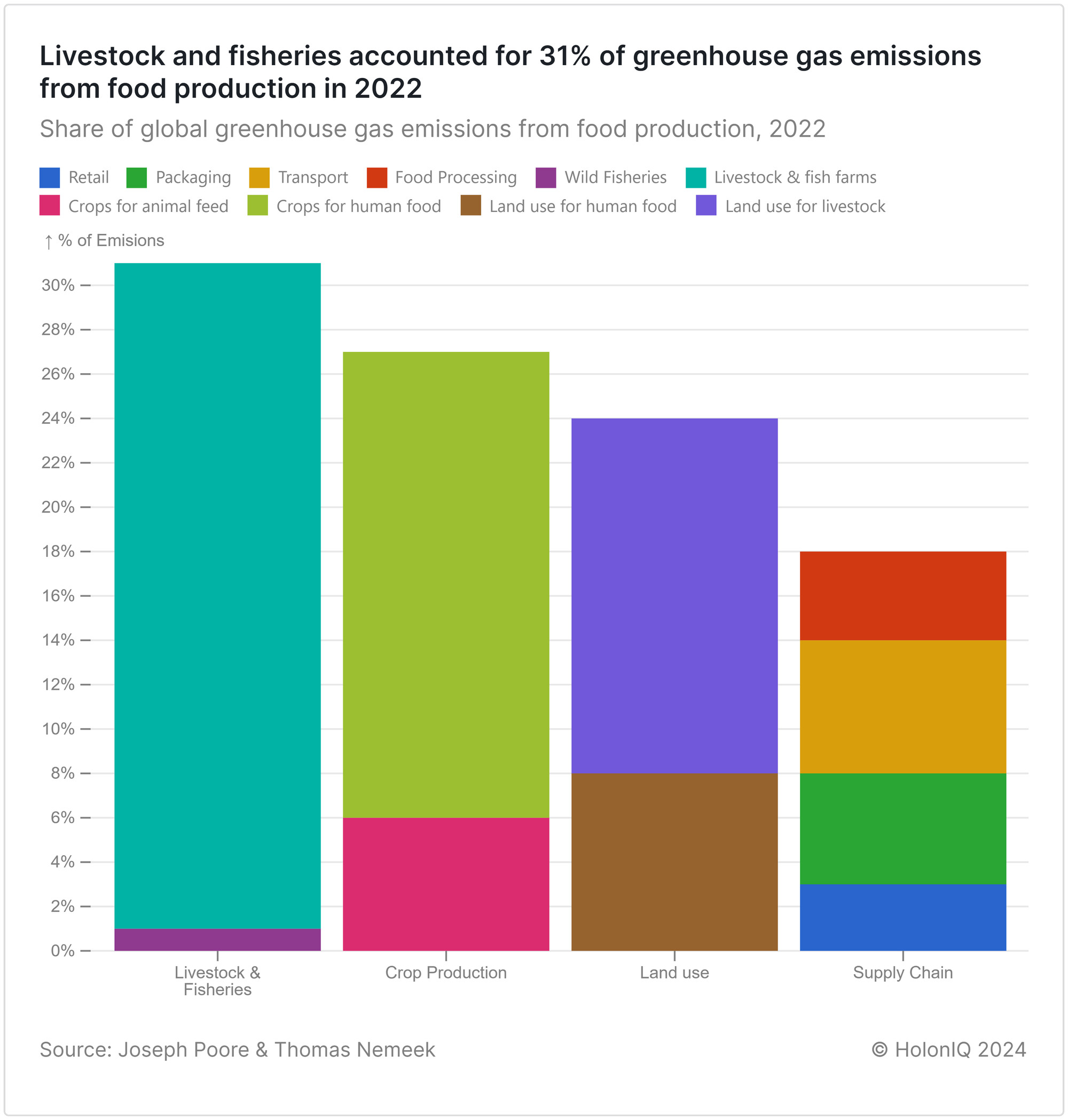

Agriculture accounts for 26% of total global emissions. The livestock and fisheries sectors are the largest contributors, responsible for 31% of agricultural emissions. Smart farming is emerging as a powerful solution to combat these impacts.

Happy Monday 👋

Agriculture plays a significant role in global emissions, accounting for 26% of total emissions. Within agriculture, the livestock and fisheries sectors are the largest contributors, responsible for 31% of agricultural emissions, followed by crop production at 27%. This week, we also spotlight the 2023 Nordic-Baltic Climate Tech 100, highlighting the region's most promising startups in the climate technology sector and how they are fairing in 2024.

This Week's Topics

💨 Smart & Vertical Farming. Mapping 200+ global players across key categories

📈 Aviation Index. Index down 4% as Boeing's woes impact the overall market

🏆 Nordic-Baltic Climate Tech 100. $5.3B of fundraising in 2024 to date

📊 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data💰 Climate Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Climate Tech Outlook and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

🌱 Smart and Vertical Farming Landscape

The global food system, a significant contributor to global greenhouse gas emissions (accounting for roughly 23%, with some studies suggesting up to 30% when including food retail), is undeniably a major player in climate change. To combat this impact, smart farming, which is an umbrella term used to define various farming methods and technologies, is emerging as a powerful solution. This approach integrates technology and data into agricultural practices to improve sustainability, efficiency, and, ultimately, crop yield.

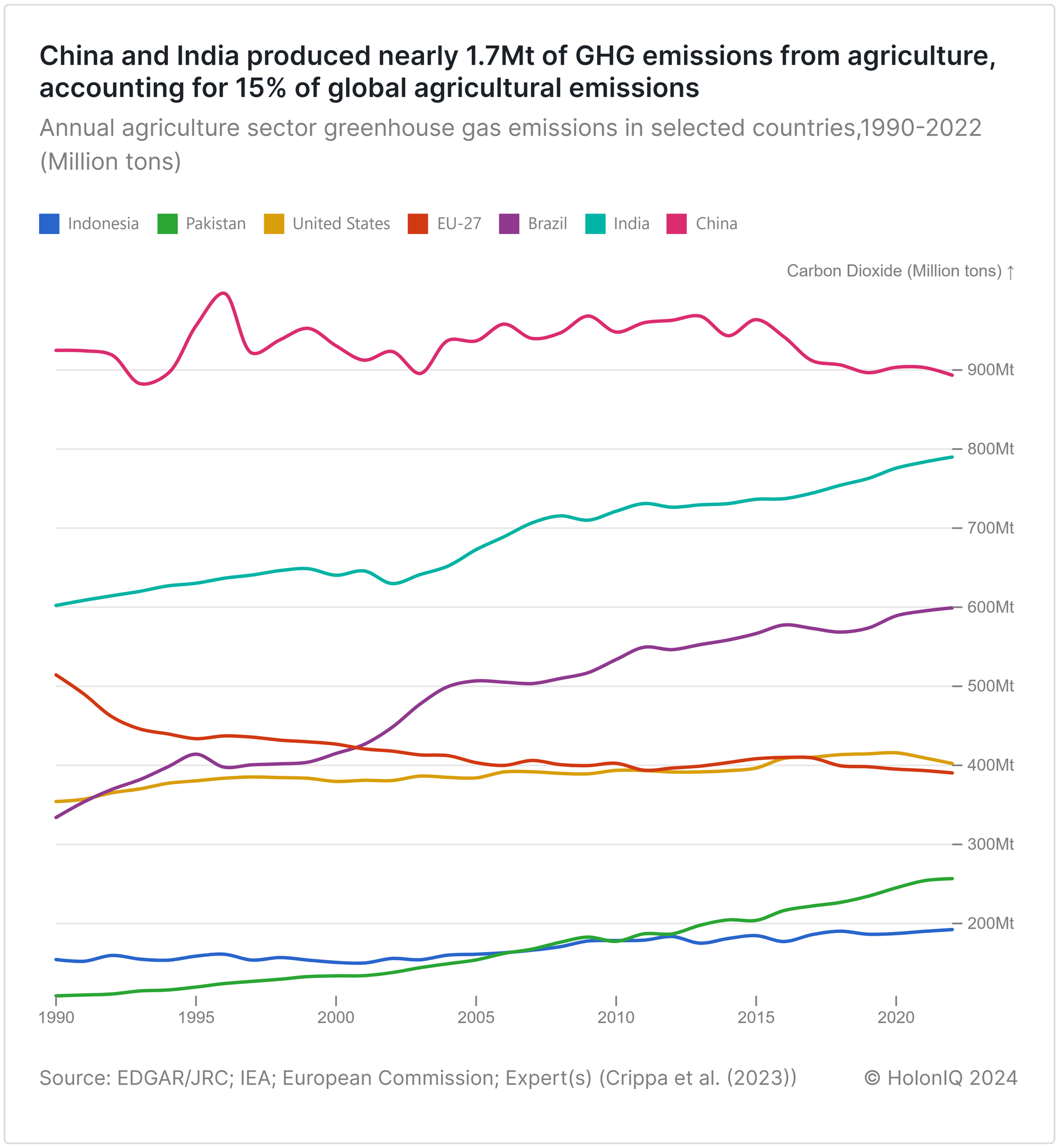

Within emissions from the food system, livestock and fisheries contribute to 31%, followed by crop production and land use at 27% and 24%, respectively. Supply chain aspects such as retail, packaging, and transportation account for 18%. Excluding GHG emissions, the global food system also causes significant damage to soil and freshwater sources. 63% of soil degradation can be attributed to agricultural practices and grazing for livestock. As global food demand rises in tandem with the global population, the incorporation of innovative farming solutions and technologies is going to be vital. At the end of 2022, China and India, the 2 most populous countries in the world, will have recorded the highest emissions from agriculture over the last 10 years, highlighting the correlation between emissions and population when it comes to agriculture.

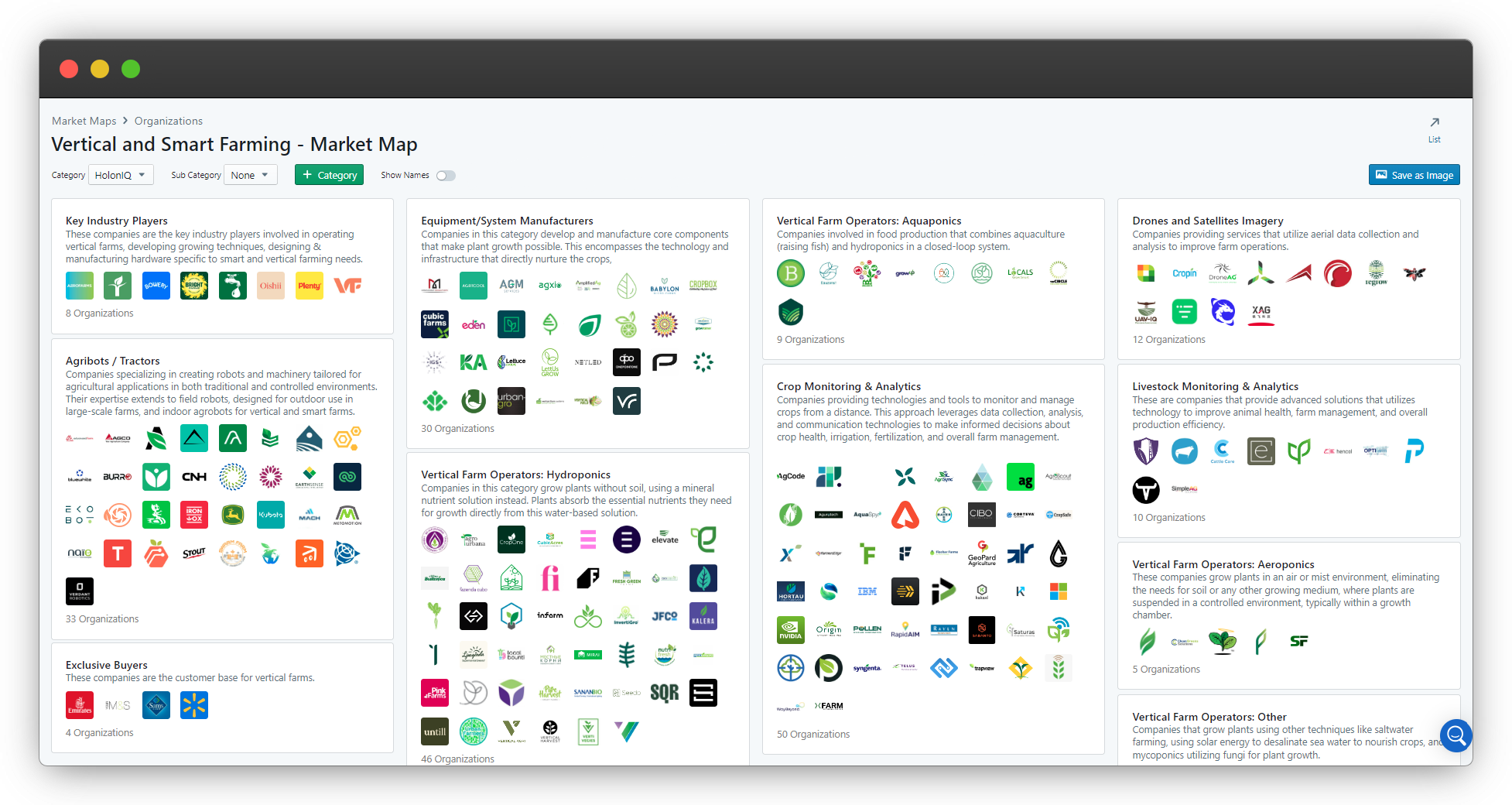

🌱 Smart and Vertical Farming - Market Map

Smart farming encompasses technologies and solutions that specifically attempt to mitigate the emissions and waste that stem from food production. Vertical Farming is a form of indoor farming where produce is grown through controlled environmental agricultural practices such as hydroponics and aeroponics in vertically stacked layers. The concept uses 90% less water and land than traditional farming. Other segments include drones and satellite imaging, livestock monitoring, crop monitoring, and agribots.

📈 Capital Markets - Aviation Stock Index

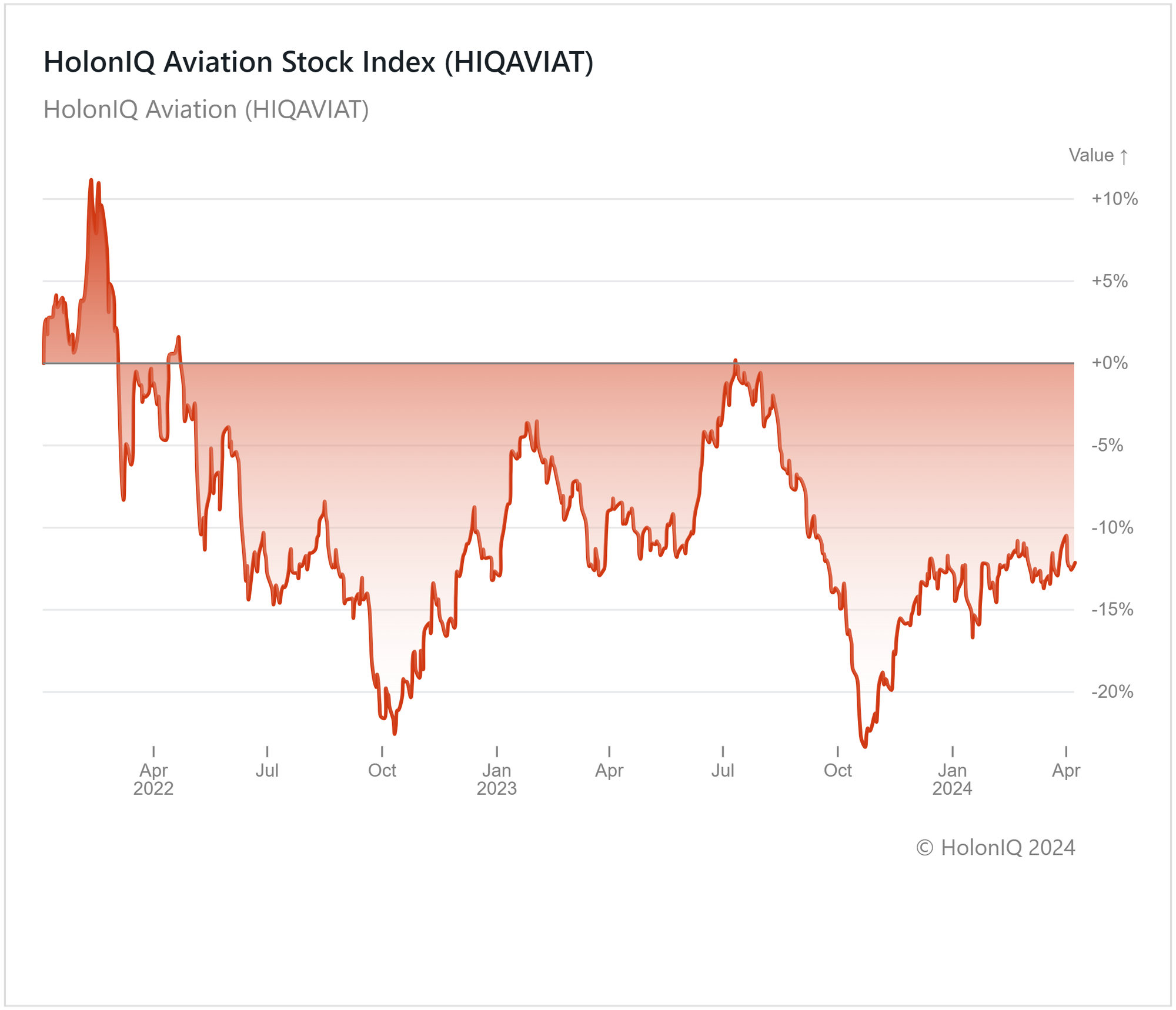

HolonIQ tracks thousands of listed climate tech companies worldwide, along with acquisitions and investment transactions. Soon, we will launch a range of stock indices to track the daily performance of over 10 different sectors across Climate Technology.

Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

The aviation index has experienced some volatility over the past three months but ended flat. While global air travel has returned to pre-pandemic levels, recent accidents and technical issues in Boeing aircraft have plagued most airlines, causing flights to be canceled. Investor confidence amidst the rising frequency of mechanical failures has dwindled, resulting in less-than-stellar stock performances. Singapore Airlines ($14B MCap) and SouthWest Airlines ($17B MCap) saw flat performance over the quarter.

Delta Airlines ($30B MCap) was a notable exception, with over 10% growth over the last quarter. The airline postponed its deliveries of Boeing 737 Max 10 aircraft, but its diverse fleet, including Airbus, Bombardier, and Embraer, likely mitigated the impact.

Fuel costs have also been on the rise for airlines, affecting their profitability ratios. This is made worse by the increased adoption of costlier sustainable aviation fuels as airlines attempt to find greener alternatives. However, global air travel volume is expected to exceed pre-Covid levels in 2024 as the Asia-Pacific region makes a full recovery. Driven by sustained demand, this could make 2024 a good year for airline profits.

🏆 Nordic-Baltic Climate Tech 100

The Nordic-Baltic Climate Tech 100 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

The Nordic-Baltic Climate Tech 100 companies have secured approximately $6B to date in 2024, up from the $500M they raised in 2023. Northvolt, a Swedish battery developer and manufacturer, secured a $5B loan, the largest green loan in Europe, as it seeks to expand its battery factory in northern Sweden. The company has raised $13B in equity over the last 2 years. Heart Aerospace, another Swedish company operating in the electric aircraft space, raised a $107M Series B. Electrification and battery energy storage are a key priority in Europe as it attempts to decouple its reliance on Chinese imports.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🔋 Alsym Energy, a US-based battery energy company, raised a $78M Series C. The funds are expected to help the company expand prototyping and pilot lines for its batteries.

🔋 Torus, a US-based energy storage company, secured $67M to deepen its energy solutions portfolio in the commercial and large-scale utility sectors.

🌱 ION Clean Energy, a Colorado-based firm developing carbon dioxide capture technologies, raised $45M from Chevron New Energies & Carbon Direct Capital to expand operations.

🌱 Windfall Bio, a California-based agricultural technology company, raised a $28M Series A from Prelude Ventures to expand pilot deployments across methane-intensive industries.

🚗 Exoes, a French company providing advanced engineering services to the car manufacturing industry and fluid manufacturers, raised $37M in funding.

M&A

📦 Nefab Group, a Swedish industrial packaging provider, acquired Irving-based Plastiform and its subsidiary Precision Formed Plastics to strengthen its global market position and commitment to saving resources in supply chains.

🔌 SolarEdge Technologies, an Israeli smart energy technology company, acquired Wevo Energy, an EV charging optimization software startup.

🪨 Holcim, a Swiss global building materials and aggregates firm, has entered into a definitive agreement to acquire Tensolite, an Argentinian manufacturing company that produces prestressed concrete items.

🪨 Korea Zinc, the world's largest lead and zinc smelter based in South Korea, acquired Kataman Metals from Brown Gibbons Lang & Company (BGL). The acquisition aims to accelerate Korea Zinc's recycling and resource circulation business.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com