🧬 Evolving Genomics Landscape + South Asia Health Tech 100

Recent innovations in the genomic landscape have allowed for more cost-effective sequencing options. However, the same scalability is yet to be seen for gene therapies.

Happy Monday 👋

Recent innovations in the genomic landscape have allowed for more cost-effective sequencing options. However, the same scalability is yet to be seen for gene therapies. In the Health Tech landscape, we revisit the 2023 South Asia Health Tech 100, which highlights the region's most promising startups in the health technology sector.

This Week's Topics

🧬 Genomics. Mapping 200+ players across the genomics landscape

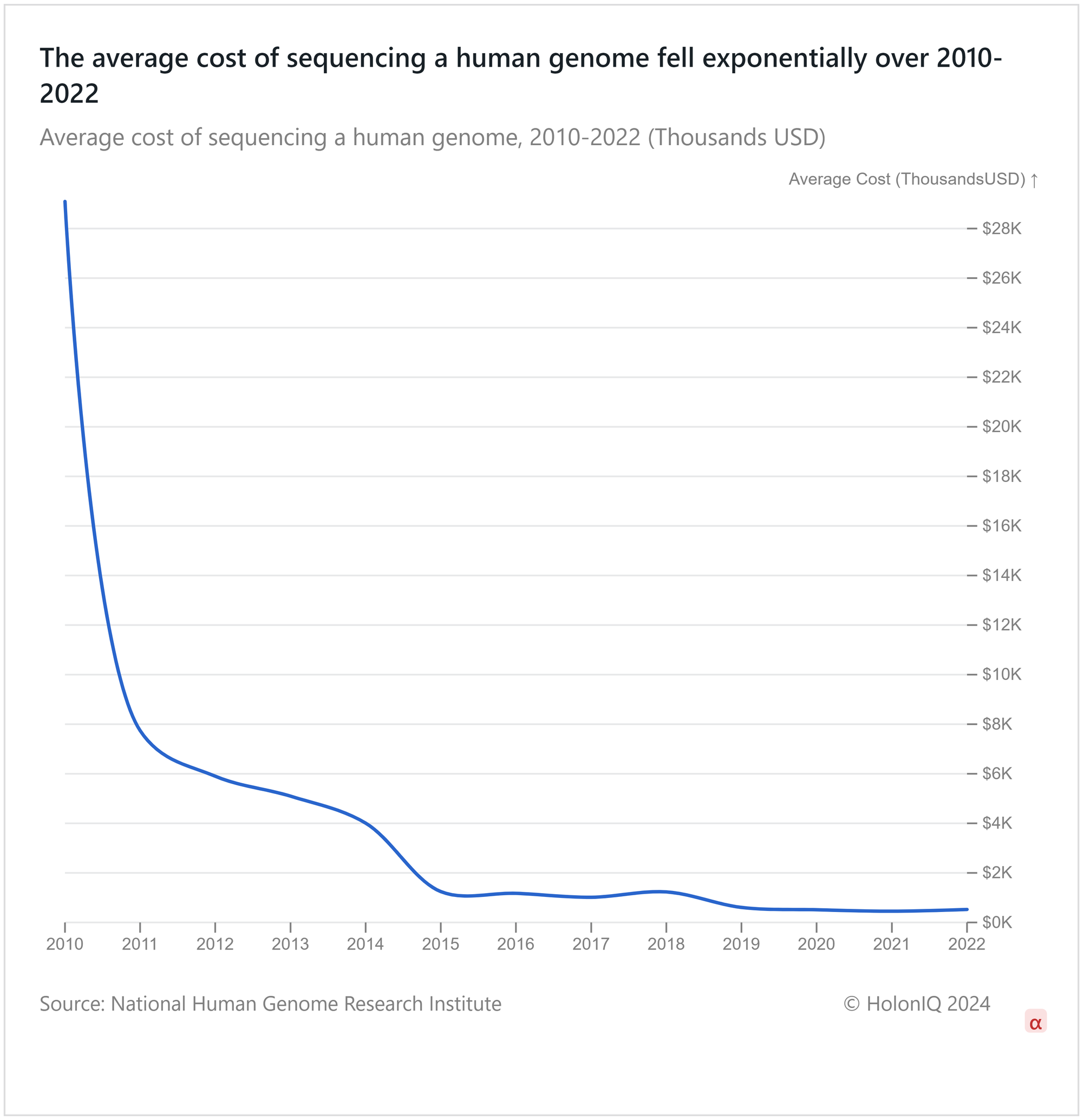

📊 Charts Spotlight. Human gene sequencing costs fell drastically since 2021

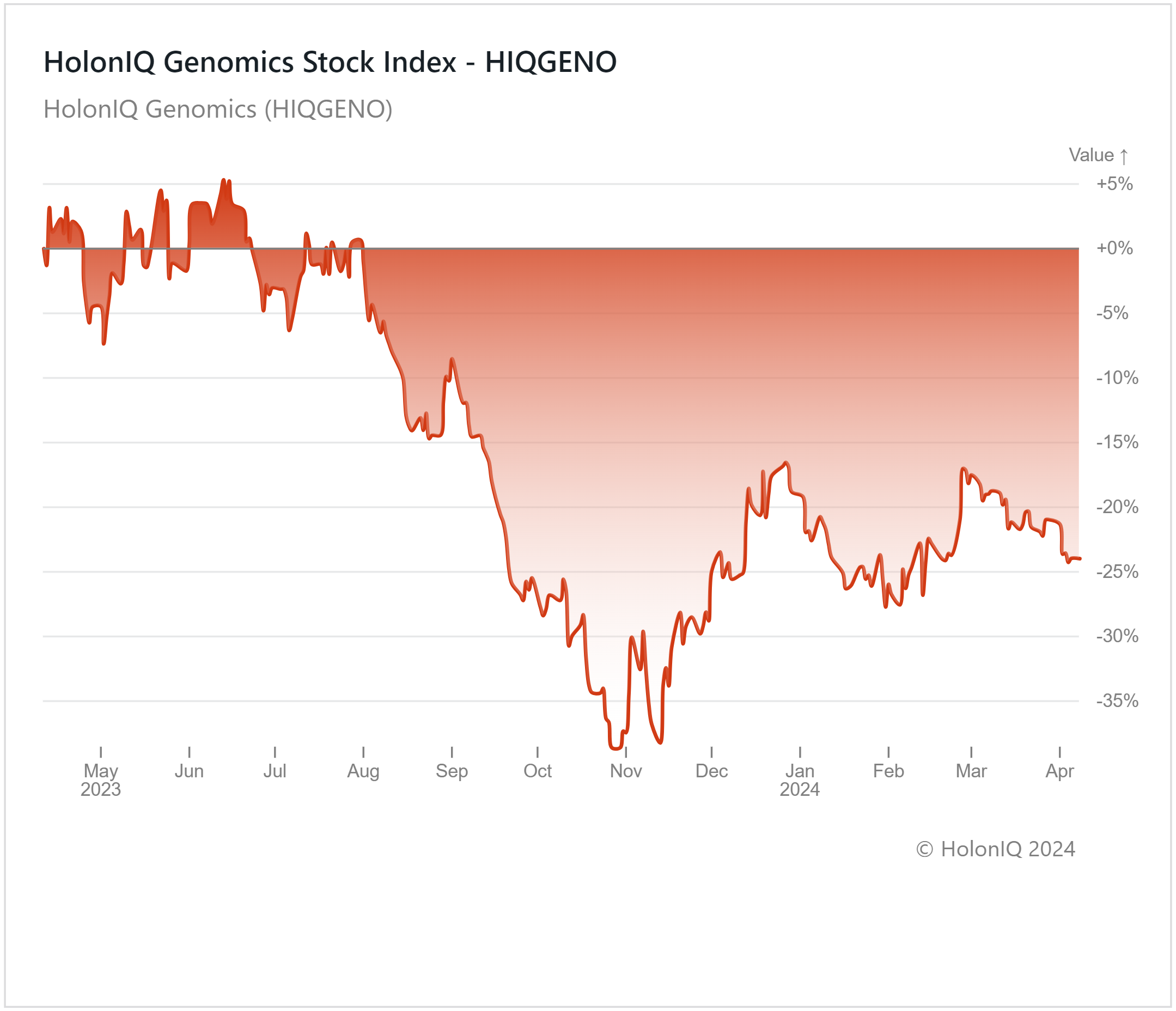

📈 Genomics Index. Down 25% over the past 12 months

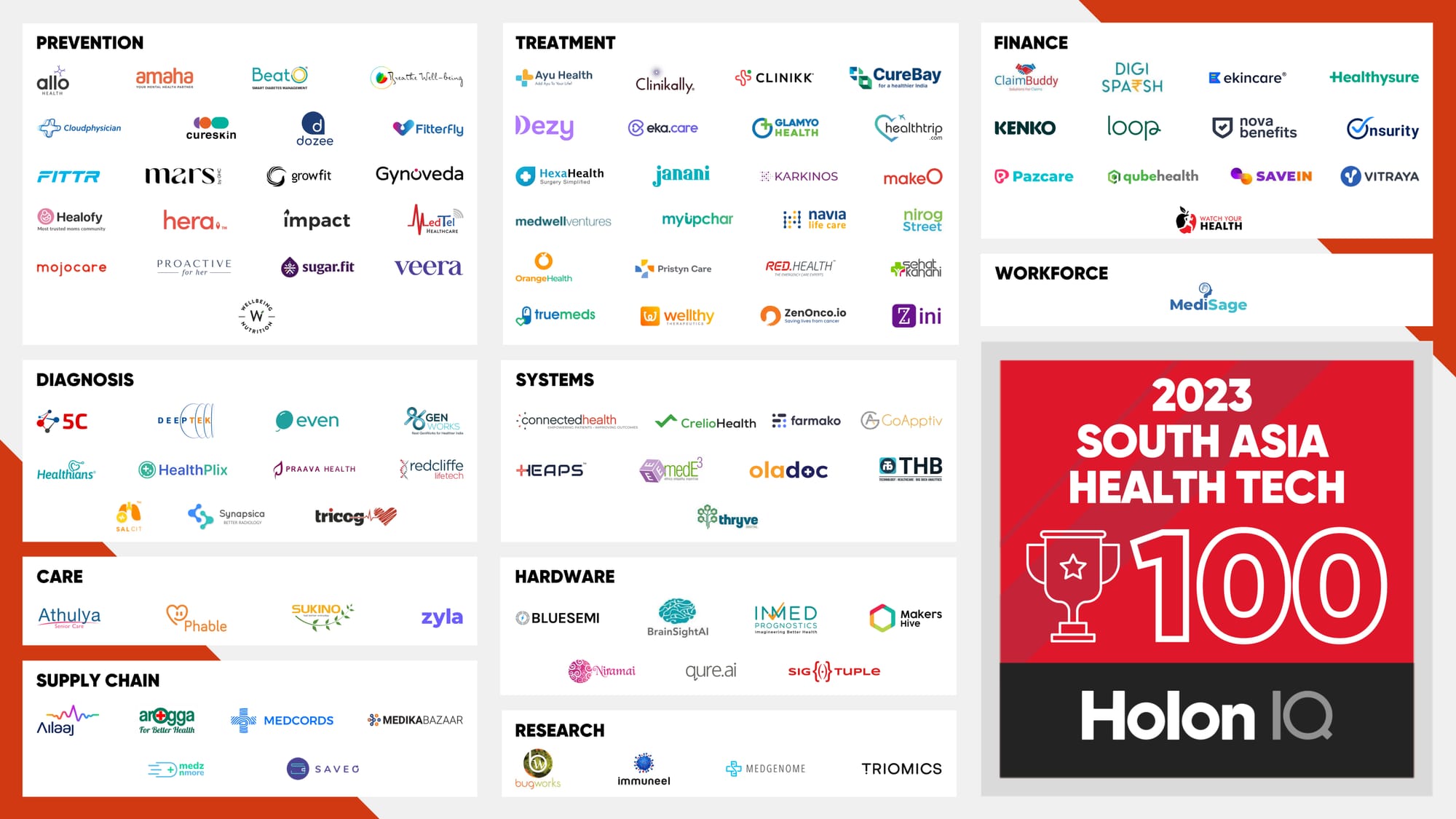

🏆 South Asia Health Tech 100. South Asia's most promising startups working in digital health, biotech, drug discovery, and analytics

📖 Annual Health Tech Outlook. 190+ pages of trends, insights, and data

💰 Health Tech Deals of the Week. Funding, M&A and IPOs

Don't forget to check out the 2024 Global Health Tech Outlook, and sign up for our Daily Newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

🧬 Genomics Landscape

Decreasing DNA sequencing costs propel health genomics, leading to a global surge in data collection initiatives. This data empowers researchers to link genes to disease risk, enabling earlier diagnoses, preventative actions, and personalized treatments. Companion diagnostics development and accelerated drug discovery are further benefits. Data sharing, healthcare professional education, and ensuring equitable access for all populations remain key challenges.

Collaborations to improve patient outcomes are booming in health genomics. Thermo Fisher and Bayer's partnership targets faster, decentralized cancer testing to minimize treatment delays—a critical issue with studies showing a 10% monthly mortality rise for delayed treatment. In infectious diseases, India's infexnTM test provides rapid (24-hour) identification, aiding the fight against antimicrobial resistance, a major national concern. The surge in genomic data necessitates improved storage solutions. The DNA Data Storage Alliance addresses this by introducing Sector Zero and Sector One specifications, which standardize the physical structure and data retrieval, paving the way for wider DNA storage adoption.

🧬 Genomics - HolonIQ Platform Market Map

📊 Charts Spotlight - Human Gene Sequencing Costs Fell Drastically Since 2010

Subscribe to HolonIQ's 'Chart of the Day,' a daily newsletter that helps explain the global impact economy, from climate tech to education and healthcare.

The first successful attempt at genomic sequencing was conducted back in 2001. Due to the limited expertise and equipment, genomic sequencing costs were in the millions in the early 2000s. As the scalability of genomic sequencing improved over time, costs associated with sequencing decreased drastically since then. In 2022, the average cost of genomic sequencing fell to $524. It is likely that a similar phenomenon may occur in gene therapies. Currently, gene therapies exceed millions of dollars, and it is likely that these procedures will become more affordable over time. Concurrent efforts by governments and health insurance providers to improve coverage will expand accessibility. The Center for Medicare and Medicaid released a new pilot program that would provide a payment scheme for expensive sickle-cell gene therapies.

📈 Capital Markets - Genomics Index

HolonIQ tracks thousands of listed health companies around the world, as well as acquisitions and investment transactions. Soon, we will launch a range of stock indices to track the daily performance of over ten different sectors across Health Technology.

Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

The HolonIQ Genomics index fell by around 25% year-over-year in the broader portfolio. Major constituents QIAGEN, Illumina, and BioMarin all saw notable drops. Pandemic disruptions and recession fears impacted market performance. However, new treatment approvals since November, including Orchard Therapeutics' Lenmeldy gene therapy, signal a more positive outlook, with advancements in cell therapy and DNA storage standardization by The DNA Data Storage Alliance offering further promise. FDA approvals like Lenmeldy bode well, but high costs currently limit patient access. Expanded coverage for these treatments could ease access barriers and solidify genomics' role in healthcare.

🏆 South Asia Health Tech 100

The South Asia Health Tech 100 is HolonIQ’s annual list of the most promising startups working in digital health, biotech, drug discovery, and analytics in the region.

A couple of cohort members have seen funding activity over the past month. Cureskin (an Indian AI platform for dermatology) secured $20M in Series B funding to expand its operations. Sugar.fit (an Indian mobile health app for diabetes management) obtained a $5M Series A to enhance its research, technology, and product offerings.

📊 2024 Global Health Tech Outlook

HolonIQ's annual analysis of the evolving Health Tech landscape offers over 190 pages of in-depth insights on market data, investments, strategic shifts, and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report.

💰 Health Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the health industry across all regions of the world. Subscribe to our daily Impact Capital Markets newsletter to peruse the top deals for each day.

Funding

🎗️ D3 Bio, a Chinese biotech company that specializes in cancer therapeutics, closed a $62M Series A led by Medicxi to accelerate the development of its products, particularly a new generation of small molecule inhibitors.

💖 Grow Therapy, a US-based mental health technology company, raised a $88M Series C led by Sequoia Capital to expand operations and its R&D activities.

M&A

🩹 Merck, a US pharmaceutical conglomerate, has acquired Abceutics for $208M to enhance ADC safety and potentially optimize therapy efficacy.

🫀 Johnson & Johnson has acquired Shockwave Medical for $13.1B, to enhance Johnson & Johnson’s heart care device offerings.

🧬 Vertex Pharmaceuticals, a US-based biotechnology company, plans to acquire Alpine Immune Sciences for $4.9B to claim ownership of treatment rights for IgA nephropathy, a kidney disease therapeutic currently undergoing clinical trials.

IPOs/Follow-on Offerings

💊 Contineum Therapeutics, a US-based company innovating oral therapies for critical conditions, announced that it raised a $110M follow-on offering.

👂 Sensorion, a French company creating treatments for inner ear conditions, announced that it raised $16M in a follow-on offering.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com