🚗 $250M Autonomous Mobility Funding. Hydrogen Stocks Down 30%.

Impact Capital Markets #48 looks at our Hydrogen index stock index, major impact deals, M&A, and upcoming economic releases.

Ciao 🍕

📉 Today's Global Economic Update: Yesterday's US Inflation Data revealed a headline inflation rate of 3.2% in February 2024, up from 3.1% in January, with transportation services and energy commodities seeing the steepest rise. Core inflation eased slightly to 3.8%, indicating some stability in underlying prices despite overall price pressures.

🚗 Deal of the Day: Applied Intuition, an autonomous vehicle software supplier, raised a $250M Series E to invest in generative AI.

What's New?

- 💧 Hydrogen. Hydrogen index down 30%

- 💰 Funding. Autonomous vehicles, climate tech, biotech & more

- 💼 M&A. Energy, environmental services, digital therapeutics & more

- 📅 Economics. Major interest rate decisions, retail sales, inflation data + more

For unlimited access to more deals and economic updates, request a demo

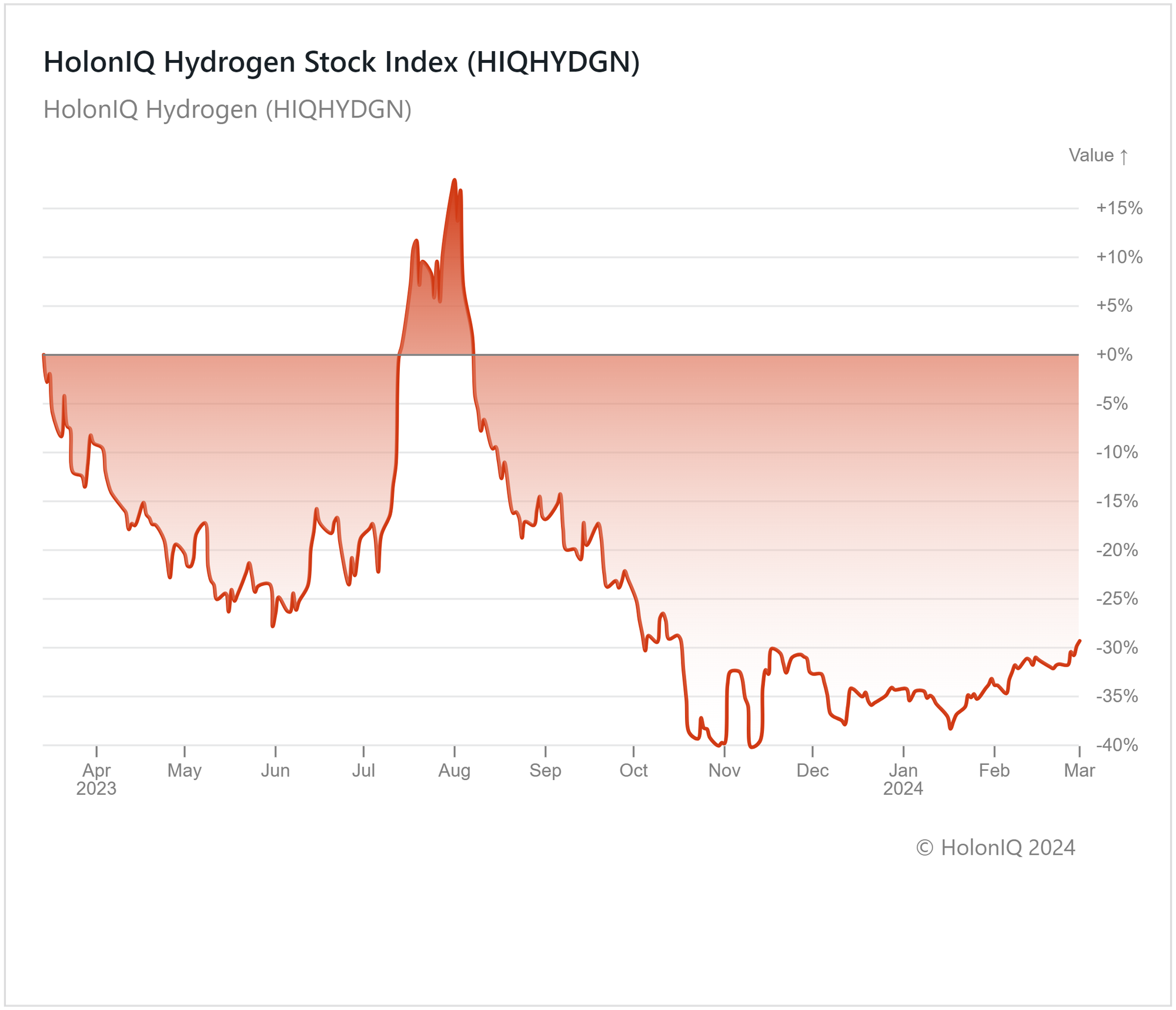

💧 Hydrogen Index Down 30%

HolonIQ's Hydrogen Index has declined by 30% over the past year despite a spike in August. Major stocks like Plug Power ($2B MCap), Bloom Energy Corp ($2B MCap), and Doosan Fuel Cell ($1B MCap) experienced substantial declines of 71%, 48%, and 42%, respectively.

The increased utilization of Liquified Natural Gas (LNG) in numerous countries has led to declining demand for hydrogen as an energy source. LNG, despite being a fossil fuel, is considered less harmful than coal and oil. Moreover, obstacles in project financing arising from supply chain bottlenecks, high-interest rate environments, and inflation have also added to the decline in hydrogen stock prices. Despite challenges, the sector shows promise for recovery through advancements in technology and the potential easing of inflation. Green Hydrogen continues to be a top priority for most countries, especially in decarbonizing heavy industries such as chemical production, cement, concrete, and steel.

💰 Funding

🚗 Applied Intuition, a California-based autonomous vehicle software supplier, raised a $250M Series E to invest in generative AI.

🌍 CarbonCapture, a California-based climate tech company, raised a $80M Series A from Prime Movers Lab for technology development.

🤖 Bear Robotics, a California-based manufacturer of self-driving robots, raised a $60M Series C from LG Electronics to expand into new territories such as smart warehousing and supply chain automation.

💔 Empathy, a New York-based grief assistance platform, raised a $47M Series B from Index Ventures to fund expansions to its platform.

🏥 CodeMatrix, a Boston-based healthcare-focused AI solutions provider, raised a $40M Series B from Transformation Capital to invest further in technology.

☀️ Holu Hou Energy, a Hawaii-based solar energy storage company, raised $35M from Irradiant Partners to support Hawaii's largest solar and energy storage project pipeline.

🌋 Quaise Energy, a Massachusetts-based terawatt-scale geothermal company, raised a $21M Series A from Prelude Ventures & Safar Partners to strengthen its supply chain.

🛴 VOI Technology, a Swedish micro-mobility company, raised $25M to expand its fleet of e-scooters and e-bikes.

👶 Siolta Therapeutics, a California-based biotech company, raised a $12M Series C from SymBiosis & Khosla Ventures to support the clinical development of its product aimed at preventing atopic diseases in newborns.

🧬 Tierra Biosciences, a California-based biotechnology company, raised a $11M Series A from Material Impact to improve Tierra's predictive AI technology.

💼 M&A

💡 Hillmann Consulting, a New Jersey-based environmental services company, acquired Abraxas Energy Consulting, a California-based energy efficiency solutions provider.

🌲 True Environmental, a New York-based environmental services firm, acquired Sundance Consulting, an Idaho-based full-service environmental consulting firm.

🩺 Mahana Therapeutics, a California-based digital therapeutics developer, acquired Cara Care, a German digital health platform.

📊 Frazier Life Sciences, a California-based venture capital firm, acquired RevSpring, a Michigan-based payment solutions company servicing healthcare and financial services firms.

📅 Economic Calendar

Major Interest Rate Decisions, Retail Sales, Inflation Data + More

Thursday, March 14th 2024

🇺🇸 US Inflation Data, February

🇺🇸 US Retail Sales Data, February

Friday, March 15th 2024

🇺🇸 US Michigan Consumer Sentiment (Preliminary), March

Monday, March 18th 2024

🇨🇳 China Industrial Production, Jan-Feb

🇨🇳 China Retail Sales Data, Jan-Feb

Tuesday, March 19th 2024

🇯🇵 Japan BoJ Interest Rate Decision

🇦🇺 Australia RBA Interest Rate Decision

🇩🇪 Germany ZEW Economic Sentiment Index, March

🇺🇸 US Building Permits Data (Preliminary), February

🇨🇦 Canada Inflation Data, February

Wednesday, March 20th 2024

🇬🇧 UK Inflation Data, February

🇺🇸 US Fed Interest Rate Decision

🇺🇸 US FOMC Economic Projections

Thursday, March 21st 2024

🇺🇸 US Fed Press Conference

🇯🇵 Japan Balance of Trade Data, February

🇩🇪 Germany HCOB Manufacturing PMI (Flash), March

🇬🇧 UK BoE Interest Rate Decision

Friday, March 22nd 2024

🇯🇵 Japan Inflation Data, February

🇬🇧 UK Retail Sales Data, February

🇩🇪 Germany Ifo Business Climate Index, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com