💧 $217M Hydrogen Mobility Funding. Cybersecurity Up 6%.

Impact Capital Markets #69 looks at our Cybersecurity stock index, major impact deals, M&A, and upcoming economic releases.

Hujambo 🦓

📉 Today's Global Economic Update: US Inflation data released yesterday revealed that in March 2024, the annual inflation rate increased to 3.5%, driven by increases in energy costs, transportation, and apparel. Meanwhile, core inflation remained steady at 3.8%, indicating continued underlying pressure on prices.

💧 Deal of the Day: HysetCo, a hydrogen mobility solutions provider, raised $217M from Hy24 to accelerate the decarbonization of urban transport.

What's New?

🔒 Cybersecurity. Cybersecurity index up 6%

💰 Funding. Hydrogen mobility, medical technology, power plants + more

💼 M&A. Medical equipment & pet health

📅 Economics. ECB Interest Rate Decision, UK GDP, inflation + more

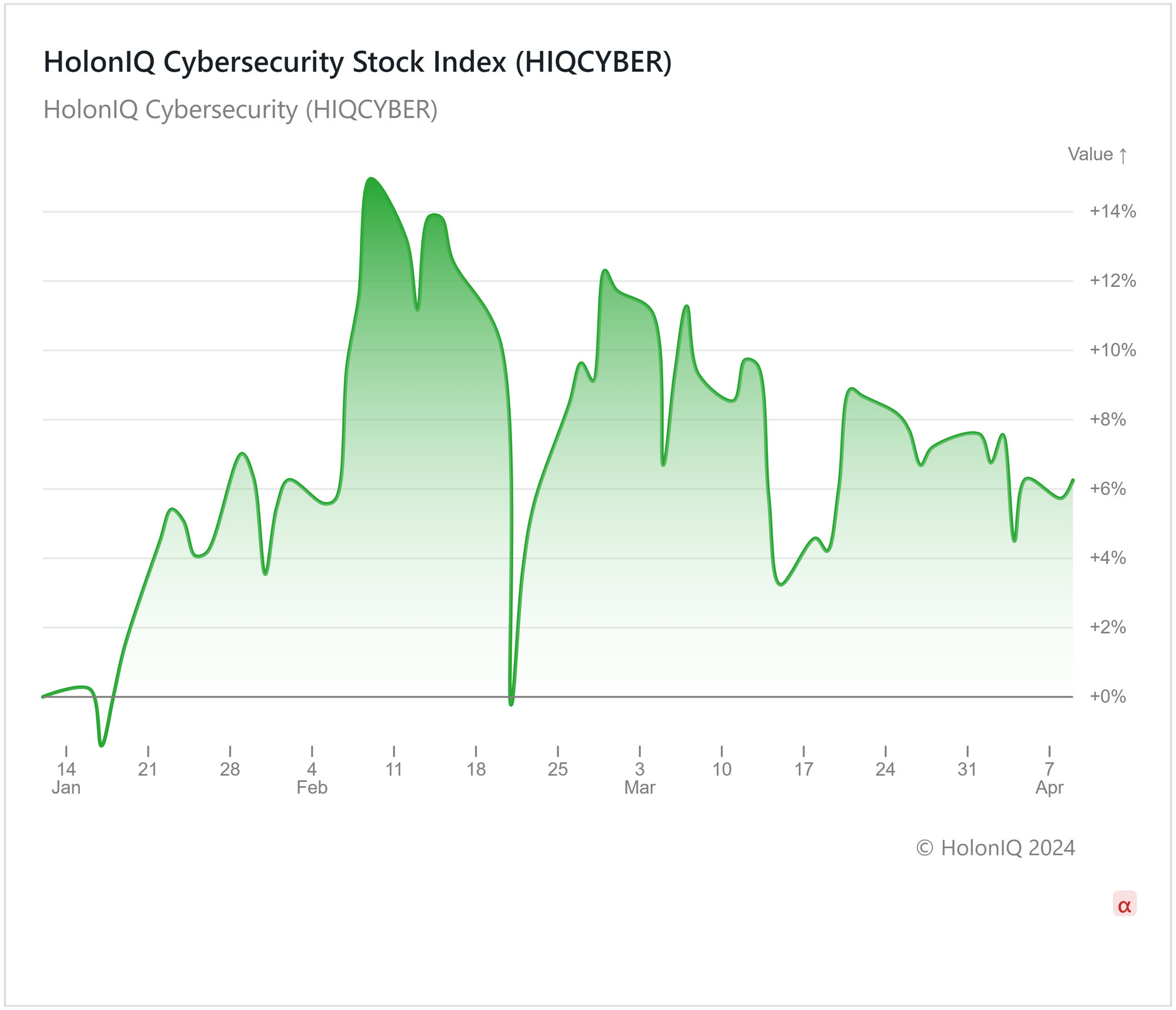

🔒 Cybersecurity Index Up 6%

HolonIQ's Cybersecurity index saw a 6% increase on the quarter, with yearly returns surpassing 70%. Notably, index returns significantly outpaced the S&P500, which rose by ~30% in the past year. Key stocks in the index, including CrowdStrike Holdings, Inc. ($75B MCap), Broadcom Inc. ($618B MCap), and Fortinet, Inc. ($52B MCap), experienced returns of 30%, 22%, and 18% respectively.

The cybersecurity market has seen a mix of factors driving recent trends, both at company level and across the industry. CrowdStrike, for instance, has demonstrated resilience during turbulent periods, displaying strong financials and growth prospects. Meanwhile, Palo Alto Networks' ($90B MCap) downward adjustment in sales forecast last quarter had a domino effect on other players like Zscaler, Inc. ($28B MCap). This adjustment prompted investors to reevaluate the sector's outlook, resulting in declines in some stocks. Despite these fluctuations, the cybersecurity industry is expected to continue its growth trajectory due to the escalating risk of cyber threats. Cybersecurity firms are positioned for long-term success as they remain pivotal in safeguarding digital infrastructure amid the ongoing wave of digitalization.

💰 Funding

💧 HysetCo, a French hydrogen mobility solutions provider, raised $217M from Hy24 to accelerate the decarbonization of urban transport.

💉 TORL BioTherapeutics, a California-based clinical-stage biopharmaceutical firm, raised a $158M Series B from Deep Track Capital to continue the clinical development of its first-in-class Antibody-Drug Conjugate (ADC).

🏨 Guesty, a California-based property management software platform, raised a $130M Series F from Kohlberg Kravis Roberts to develop its platform.

🔬 Elucent Medical, a Minnesota-based medical technology company, raised a $42.5M Series C from Vensana Capital & RC Capital. The funding will be used to

advance its 'EnVisio' and 'SmartClip' technologies for cancer surgery.

📊 Onum, a Spanish data observability platform, raised a $28M Series A from Dawn Capital to make key strategic hires and expand into the US market.

🚗 Yoshi Mobility, a Tennessee-based tech-enabled mobile car care company, raised a $26M Series C from General Motors Ventures and Bridgestone Americas. The funding will be used to scale core operations and expand into preventative maintenance, virtual inspections, and EV charging.

🏭 Proxima Fusion, a German-based stellarator fusion power plant developer, raised $21.6M Seed to expand its team.

📚 Spines, a Florida-based AI publishing platform, raised a $6.5M Seed from Aleph to enhance brand awareness & optimize publishing for authors.

💼 M&A

💉 Behrman Capital, a New York-based private equity company, acquired Vista Apex, a Wisconsin-based medical equipment manufacturing company.

🐾 Alvar Pet, a Finnish pet food brand, acquired Verkkokauppa Kivuton, an e-commerce platform and pet health product supplier in Finland.

📅 Economic Calendar

ECB Interest Rate Decision, UK GDP, Inflation + More

Thursday, April 11th 2024

🇪🇦 Euro Area ECB Interest Rate Decision

🇺🇸 US Producer Price Index, March

Friday, April 12th 2024

🇬🇧 UK GDP Data, February

🇺🇸 US United States Michigan Consumer Sentiment (Preliminary), April

Monday, April 15th 2024

🇺🇸 US Retail Sales Data, March

Tuesday, April 16th 2024

🇨🇳 China GDP Growth Data, Q1

🇨🇳 China Industrial Production Data, March

🇨🇳 China Retail Sales Data, March

🇬🇧 UK Employment Data, February

🇩🇪 Germany ZEW Economic Sentiment Index, April

🇨🇦 Canada Inflation Data, March

🇺🇸 US Building Permits (Preliminary), March

Wednesday, April 17th 2024

🇯🇵 Japan Balance of Trade Data, March

🇬🇧 UK Inflation Data, March

Friday, April 19th 2024

🇬🇧 UK Retail Sales Data, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com