💼 $2.1B Californian O&G Acquisition. Aviation's 7% Decline.

Impact Capital Markets #25 looks at our Aviation Stocks Index, major impact deals and acquisitions, and upcoming economic releases.

Bonjour 👋

📉 Today's Global Economic Roundup: Last Wednesday, Canada reported a trade deficit of CAD 300 million for December 2023, significantly missing projections for a CAD 1.1 billion surplus. This unexpected shift, the first deficit since July, hints at potential economic challenges ahead.

⛽ Deal of the Day: California Resources Corporation acquires Aera Energy, a major oil and gas producer in California, for $2.1B.

What's New?

- 🛬 Aviation. Aviation Stocks Index Down 7%

- 💰 Funding. Unlearn Raises $50M, Mobility, Pharmaceutical, Mental Health Deals + More

- 💼 M&A. $2.1B California Resources Corp's Acquisition, Radiology, Solar Power M&A + More

- 📅 Economics. Major Interest Rate Decisions, Euro Area GDP & Inflation Releases + More

For unlimited access to more deals and economic updates, request a demo

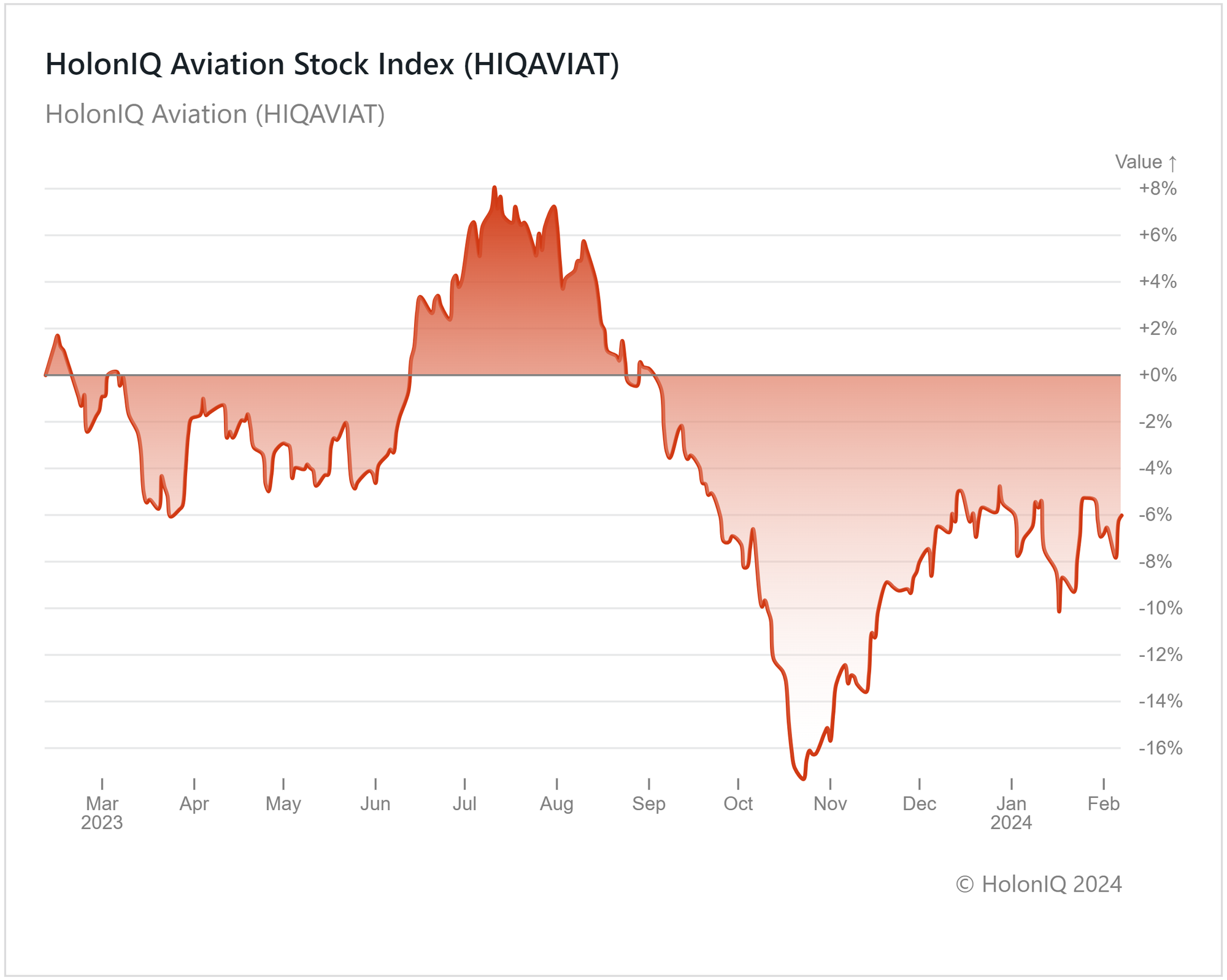

🛬 Aviation Index Down 7%

HolonIQ Aviation (HIQAVIAT)

12-month returns for the HolonIQ Aviation Index are down 7%. Major stocks across the board performed differently over the past year. Singapore Airlines and RyanAir returned 15% and 44% respectively; while South West, Air China and United Airlines Holdings saw falls exceeding 10%.

With all COVID restrictions being lifted, demand for passenger air travel was revived. However, due to a mix of supply chain, infrastructure and labor shortages, several airlines that had downsized during the pandemic were unable to respond quickly enough. The closure of Russian Airspace as a result of the Russia Ukraine conflict also hindered European Connectivity.

Recovery remained uneven between regions with the US flight traffic exceeding 2019 levels, while Asia Pacific showed strong but delayed recovery. With Chinese air travel picking up in 2H23, and business travel gradually increasing, it is expected that further recovery in the sector will continue. However, higher ticket prices could hamper some of this. Supply chain shortages could also continue to remain a challenge, as aircraft manufacturers grapple with meeting orders and labor shortages persist both on ground and in the air.

💰 Funding

🩺 Unlearn, a California-based AI company creating digital twins of clinical trial participants that enable research, raised a $50M Series C from Altimeter Capital to advance AI to eliminate trial and error in medicine.

🚗 SingAuto, a Singapore-based company that specializes in energy-efficient refrigerated car innovation, raised a $45M Series A to construct its production line, develop software as well as trial vehicles, and refine its products.

🤖 Aizon, a California-based Artificial Intelligence (AI) SaaS AI-enhanced pharmaceutical manufacturing company, raised a $20M Series C from NewVale Capital to accelerate its development pipeline, and better serve its customers.

💭 Headlight, a California-based mental health firm, raised a $18M Series A from Matrix Partners China & EPIC Ventures to support their mission of simplifying patients' mental health journey.

💻 Pixee Medical, a French manufacturing company that produces computer-assisted surgery solutions, raised $15M from Relyens to accelerate its expansion in the US and develop its next generation of innovative products.

♻️ Feynman Dynamics, a Chinese startup specializing in carbon capture and conversion technology, raised a $14.1M Seed from Tianjin Venture Capital to bolster its large-scale production capacity for its carbon capture technology.

💼 M&A

⛽ California Resources Corporation, an oil and natural gas company with a focus on energy transition within the sector, has acquired Aera Energy, also a significant oil and gas producer responsible for nearly 25 percent of California's production, for $2.1B.

🩺 Premier Radiology Services, a Florida-based radiology telecare solution, acquired National Rad, a Florida-based subspecialty diagnostic radiology practice, providing outstanding diagnostic radiology and consulting services.

☀️ Virtusa, a Massachusetts-based provider of next-gen information technology (IT) consulting and outsourcing services, acquired Bright, a Maine-based solar-power subscription business that aims to offer homeowners with renewable energy.

🔬 Spectrum Science, a New York-based healthcare marketing and strategic services firm, acquired Continuum Clinical, an Illinois-based global clinical trial recruitment and engagement solutions provider.

📅 Economic Calendar

Major Balance of Trade, Interest Rate Decision, China Inflation Data + More

Friday February 9th 2024

🇨🇦 Canada - Unemployment Data, January

Tuesday , February 13th 2024

AU Westpac Consumer Confidence Change, February

GB Unemployment Rate, December

DE ZEW Economic Sentiment Index, February

US Core Inflation Data , January

US Inflation Data , January

Wednesday February 14th 2024

AU NAB Business Confidence, January

GB Inflation Rate, January

Thursday February 15th 2024

JP GDP Data , Q4

GB GDP Data , Q4

GB GDP Data, December

US Retail Sales Data , January

Friday February 16th 2024

GB Retail Sales Data, January

US Building Permits Prel, January

US PPI MoM, January

US Michigan Consumer Sentiment Prel, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com