💰 $1B+ VC Funding Day. Gaming & ESports Down 33%.

Impact Capital Markets #53 looks at our Gaming and ESports stock index, major impact deals, M&A, and upcoming economic releases.

E kaaro 👋

📉 Today's Global Economic Update: Canada's latest inflation data revealed a drop to 2.8% in February 2024, marking its lowest rate since June 2023. This unexpected decline could influence the Bank of Canada's monetary policy decision, raising the probability of a rate cut in the near term. The inflation rate was largely driven by lower rent and mortgage interest costs in February.

🧠 Deal of the Day: Engrail Therapeutics, a neuroscience company, raised a $157M Series B to advance the company's pipeline of treatments for neurological conditions.

What's New?

- 🎮 Gaming and ESports. Gaming and ESports down 33%

- 💰 Funding. Neuroscience, insurance tech, carbon removal & more

- 💼 M&A. Clinical laboratory & oncology

- 📅 Economics. Major interest rate decisions, inflation data, retail sales + more

For unlimited access to more deals and economic updates, request a demo

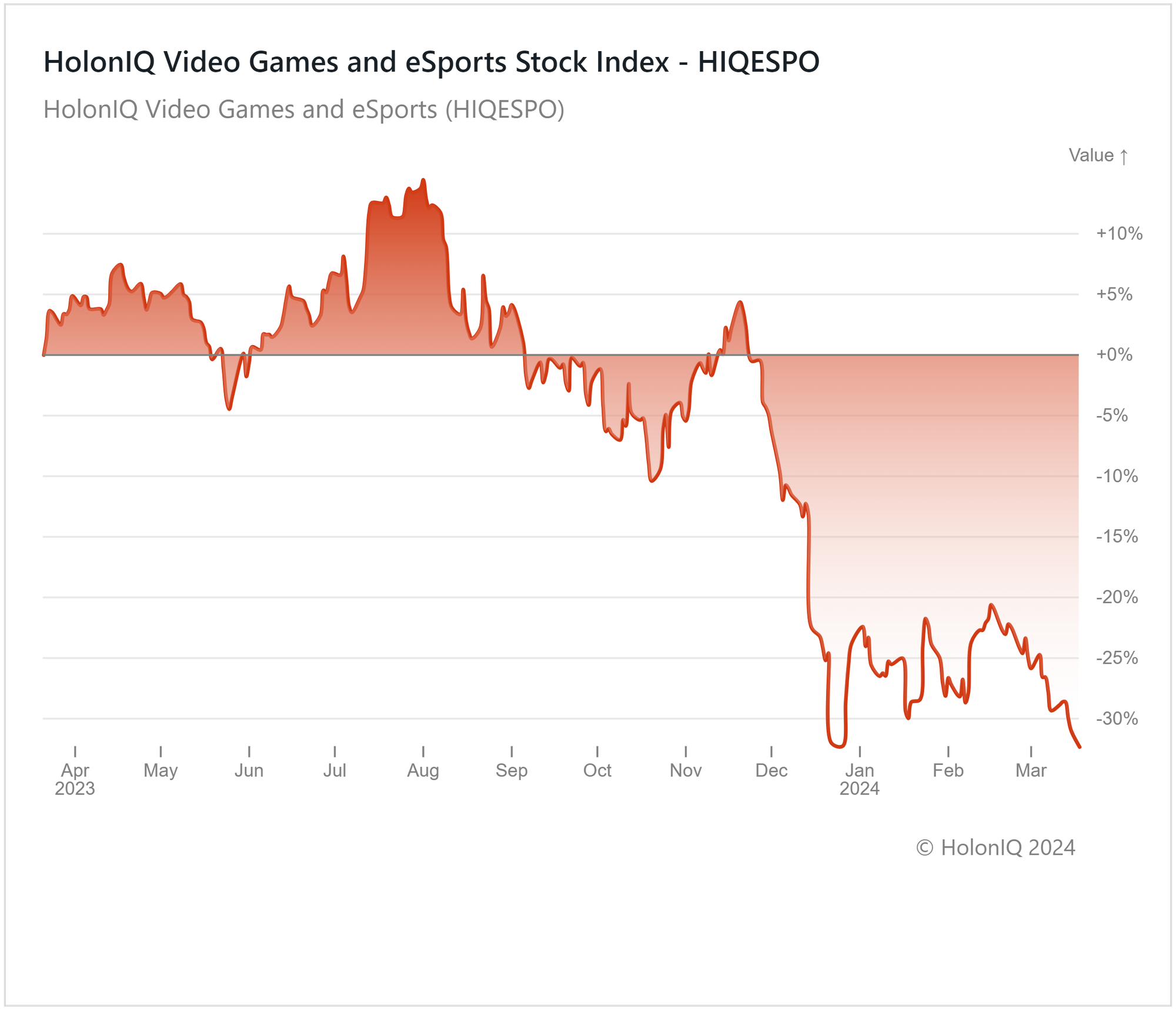

🎮 Gaming and ESports Down 33%

HolonIQ's Video Games & ESports Index has declined by 32% over the past year following a significant downturn in December 2023. The decline in video game and esports stocks over the past year can be attributed to the industry's overexpansion during the pandemic, fueled by heightened demand amid COVID-19 lockdowns. The shifts in consumer preference towards mobile-based games and live-service games have led to a decrease in interest in traditional video games after the pandemic. This has resulted in layoffs across the industry and uncertainty about future growth prospects.

The rising cost of living worldwide has also exacerbated this downturn. Falling demand for video games due to the lower disposable income of consumers, coincided with elevated costs for video game companies, diminishing their profit margins. The ESports industry's reliance on external funding and sponsorships has also created challenges in generating stable income sources for these companies. This points to the importance of reexamining business strategies to maintain adaptability in an ever-shifting market landscape.

💰 Funding

🍔 Wonder, a New York-based food delivery startup, raised $700M to support expansion and invest in R&D.

🧠 Engrail Therapeutics, a California-based neuroscience company, raised a $157M Series B to advance the company's pipeline of treatments for neurological conditions.

🛡️ Coterie, an Ohio-based insurance tech company, raised $27M from Hiscox to expand its business reach.

🌳 Novocarbo, a German carbon removal company, raised $27M from SWEN Capital Partners to expand its network of carbon removal parks in Europe.

⛴️ Candela, a Swedish maritime transportation provider, raised $26.6M from Groupe Beneteau to expand its sales team and develop its technology.

📦 Ingrid, a Swedish sustainable e-commerce delivery service, raised a $23M Series A from Verdane & Schibsted to expand operations across Nordic markets.

🐟 Poseidon Ocean Systems, a Canadian aquaculture engineering and technology provider, raised a $20.7M Series B from Ecosystem Integrity Fund to expand manufacturing capacity.

💉 Anima, a California-based healthcare software company, raised a $20M Series A from Molten Ventures to scale operations.

🧬 Cure51, a French biotechnology company, raised $16.3M from Sofinnova Partners to build a dataset aimed at understanding prolonged survival in certain cancer patients.

💼 M&A

🧪 US BioTek Laboratories, which specializes in food allergy and food sensitivity testing, acquired RealTime Laboratories, a Texas-based clinical mycotoxin testing laboratory.

🩺 AstraZeneca has entered into a definitive agreement to acquire Fusion Pharmaceuticals, a Canadian oncology company developing radioactive drugs for cancer treatment.

📅 Economic Calendar

Major Interest Rate Decisions, Retail Sales Data, Inflation + More

Wednesday, March 20th 2024

🇺🇸 US Fed Interest Rate Decision

🇺🇸 US FOMC Economic Projections

Thursday, March 21st 2024

🇺🇸 US Fed Press Conference

🇯🇵 Japan Balance of Trade Data, February

🇩🇪 Germany HCOB Manufacturing PMI (Flash), March

🇬🇧 UK BoE Interest Rate Decision

Friday, March 22nd 2024

🇯🇵 Japan Inflation Data, February

🇬🇧 UK Retail Sales Data, February

🇩🇪 Germany Ifo Business Climate Index, March

Tuesday, March 26th 2024

🇦🇺 Australia Westpac Consumer Sentiment Index, March

🇩🇪 Germany GfK Consumer Confidence Index, April

🇺🇸 US Durable Goods Orders Data, February

Thursday, March 28th 2024

🇺🇸 US Core PCE Price Index Data, February

🇺🇸 US GDP Growth Data, Q4

Friday, March 29th 2024

🇫🇷 France Inflation Data (Preliminary), March

🇮🇹 Italy Inflation Data (Preliminary), March

🇺🇸 US Personal Income & Spending Data, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com