💰 $107M Boost for 'Project 3 Mobility'. Agtech & Smart Farming Slide 18%.

Impact Capital Markets #24 looks at our Agtech and Smart Farming Stock Index, major impact deals and acquisitions, and the upcoming economic releases.

Hi there 👋

📉 Today's Global Economic Roundup: China's latest inflation rate data reveals a 0.8% year-on-year decline in consumer prices for January 2024, marking the longest decline since October 2009. Notably, food prices have dropped at a record pace of 5.9%.

🚗 Deal of the Day: Project 3 Mobility secures $107M to revolutionize urban autonomous mobility.

What's New?

- 🥬 Agtech and Smart Farming. Agtech & Smart Farming Stocks Down 18%

- 💰 Funding. $135M+ Funding in Mobility, Grid Solutions, Green Chemistry + More

- 💼 Acquisitions. M&As in EdTech, Utility, Cannabinoid medications + More

- 📅 Economics. Major Interest Rate Decisions, GDP & Inflation Releases + More

For unlimited access to more deals and economic updates, request a demo

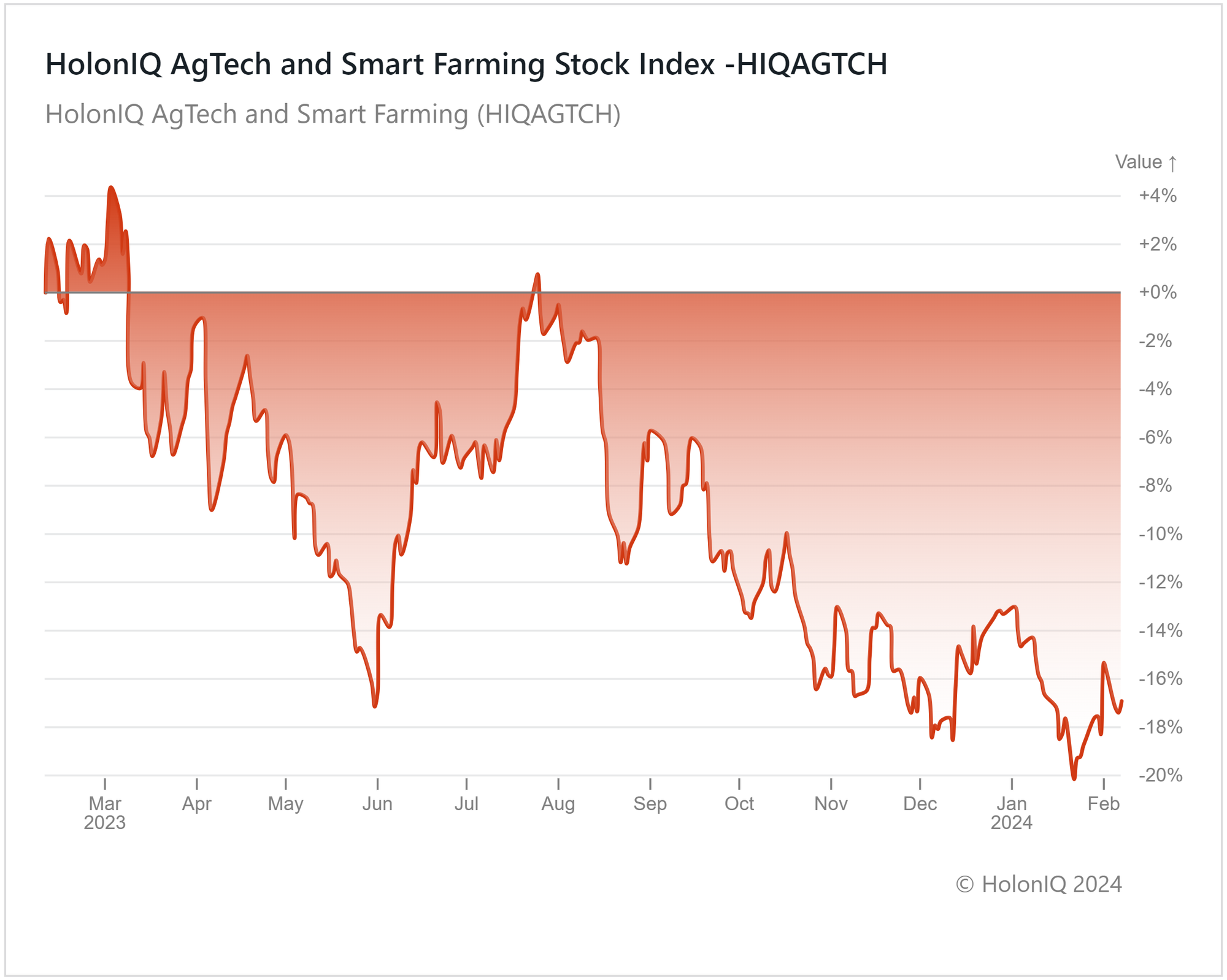

🥬Agtech and Smart Farming Index Down 18%

HolonIQ AgTech and Smart Farming (HIQAGTCH)

An 18% fall in the last year was seen as global supply disturbances and the Russia-Ukraine conflict weighed on investor sentiment. The index, reflecting the cyclical nature of agriculture, has also acted as a barometer of economic worries in 2023. The short-lived recovery around mid-2023 can be linked to encouraging economic data releases from the US, a major catalyst for global growth. This, coupled with an outlook for falling steel and iron ore prices (vital for agricultural machinery companies), helped improve industry sentiment, but worries about 2024's economic prospects took root again in the third quarter.

Two firms that were once considered pioneers in the industry, AeroFarms, and Future Crops, were forced to shut down operations in 2023. Major stocks in the index such as Deere & Co. witnessed a year of declining volumes. Corteva Inc. another major stock, also reported lower revenues in 4Q23, and saw its prices sink 13%. A rebound in global food demand and prices will likely help agribusiness stocks bounce back. However, the UN’s FAO Food Price Index saw a decline for the sixth consecutive month in January 2024, so whether a rise in price is on the cards for 2024 remains a question.

💰 Funding

🚗 Project 3 Mobility, a Croatian autonomous mobility innovation company, raised a $107M Series A from TASARU Mobility Investments to develop all elements of the project further and deliver P3's urban autonomous mobility ecosystem.

🔌 Amperesand, a Singapore-based grid infrastructure solution provider, raised a $12.5M Seed from Xora Innovation and Material Impact to commercialize silicon-carbide solid-state transformer tech from Nanyang Technological University.

⚗️ DUDE CHEM, a Germany-based green chemical manufacturing company, raised a $7M Seed from Vorwerk Ventures and b2venture to grow the team, and relaunch items to secure chain for a top EU drug maker.

🚗 Guided Energy, a Parisian startup focusing on the optimization of EV fleet management, raised a $5.2M Seed from Sequoia and Dynamo Ventures to accelerate growth.

🏥 Subscribili, a Texas-based healthcare startup that enables subscription-based healthcare systems, raised $4.3M from Darby Group Companies to revolutionize the dental care industry.

💼 Acquisitions

🎓Savvas Learning Company, a New Jersey-based next-generation K-12 learning solutions leader, acquired Outlier, a New York-based online education platform that offers intro-level college courses online at a relatively affordable price.

📚 95 Percent Group LLC, an Illinois-based education management company, acquired Morpheme Magic, a company that helps learners build morphological awareness.

⚡️ Qualus Corporation, an Ohio-based company that specializes in power services and innovators at the forefront of the energy transition, acquired Enkompass Power and Energy Corporation, a Canadian electrical engineering and technical services firm.

💡 Apogee Interactive, a Georgia-based company that provides energy education and consumer engagement apps for utilities, acquired EnergyX Solutions, an Ontario-based creator of artificial-intelligence-powered software for utilities.

⚡️Swell Energy, a California-based energy management and grid solutions provider, acquired ReNuEnergy Solutions, a North Carolina-based company that offers customized residential and commercial solar and energy storage solutions.

💊 Curaleaf International, a Massachusetts-based vertically integrated medical and wellness cannabis producer, acquired Can4Med, a Poland-based pharmaceutical wholesaler specializing in cannabinoid medications.

📅 Economic Calendar

Major Interest Rate Decision, Employment Data, GDP Data + More

Friday February 9th 2024

🇨🇦 Canada - Unemployment Data, January

Tuesday , February 13th 2024

🇦🇺 Australia Westpac Consumer Confidence Change, February

🇬🇧 UK Unemployment Rate, December

🇩🇪 Germany ZEW Economic Sentiment Index, February

🇺🇸 US Core Inflation Data , January

🇺🇸 US Inflation Data , January

Wednesday February 14th 2024

🇦🇺 Australia NAB Business Confidence, January

🇬🇧 UK Inflation Rate, January

Thursday February 15th 2024

🇯🇵 Japan GDP Data , Q4

🇬🇧 UK GDP Data , Q4

🇬🇧 UK GDP Data, December

🇺🇸 US Retail Sales Data , January

Friday February 16th 2024

🇬🇧 UK Retail Sales Data, January

🇺🇸 US Building Permits Prel, January

🇺🇸 US PPI MoM, January

🇺🇸 US Michigan Consumer Sentiment Prel, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com