🫁 $1.4B UK Pharma Acquisition. EV Charging Falls 65%.

Impact Capital Markets #30 looks at our EV Charging Stock Index, major impact deals, acquisitions, and upcoming economic releases.

Cześć 🍲

📉 Today's Global Economic Update: UK GDP data released yesterday reveals a 0.2% YoY contraction in Q4 2023, the first decline since 2021. The services sector leads the downturn, while industrial output shows marginal growth. GDP growth for the full year registered a 0.1% YoY increase.

🫁 Deal of the Day: GlaxoSmithKline acquired Aiolos Bio, a specialist in respiratory treatments for $1.4B.

Today's Topics

- 🔌 EV Charging. EV Charging Index Declines 65%

- 💰 Funding. Freenome Raises $254M, BioConjugates, Sustainability Deals + More

- 💼 M&A. $1.4B GlaxoSmithKline's Acquisition, HR platform, Dairy & Electro-Technology M&A Deals

- 📅 Economics. Major Employment Data, Inflation Data, UK GDB Data + More

For unlimited access to more deals and economic updates, request a demo

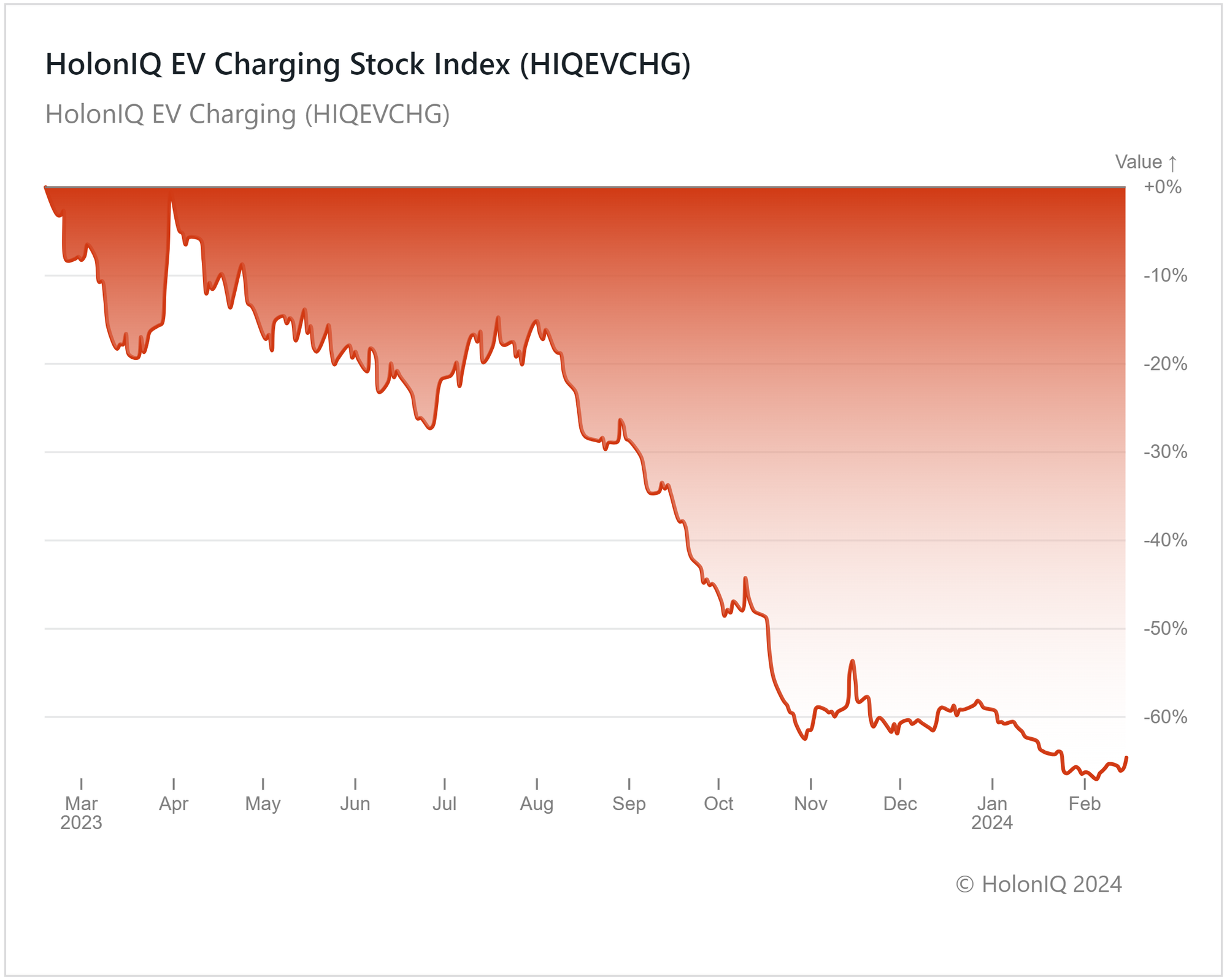

🔌 EV Charging Index Declines 65%

Holon IQ’s EV Charging index fell by 65% over the last year as major stocks in the index registered significant declines. ChargePoint Holdings (MCap: $970M) is down 82% YoY, while Tesla (MCap: $628B) and BYD (MCap: $72B) fell 0.8% and 15% respectively, pushing the index down. An exception was ABB Ltd. (MCap: $82B), which rose by 25% in the last year.

The downturn in the EV charging market is primarily linked to developments in China, the largest EV market globally. China’s property market slump has led to a deterioration in economic conditions, driving down the demand for EVs. In Europe, the energy price fluctuations caused by the Russia-Ukraine conflict have increased EV charging costs, suppressing demand. However, things could be taking a turn for the EV industry in 2024, with January seeing record EV sales numbers globally. As EVs on the road continue to rise, EV charging has seen significant developments over the last few months, with the deployment of new charging infrastructure accelerating. With EV output in China picking up pace and governments around the world implementing policies to incentivize EV adoption, the outlook for the EV charging sector is improving.

💰 Funding

🩸 Freenome, a California-based biotechnology company developing blood tests for early cancer detection, raised $254M from Roche to further develop cancer detection tests using its multiomics platform.

🧬 Firefly Bio, a California-based biopharmaceutical company specializing in Degrader Antibody Conjugates (DACs), raised a $94M Series A from Versant Ventures & MPM Capital. The funding will be used to advance its platform technology to develop DACs that treat cancer.

🌌 LeoLabs, a California-based space safety, security, and sustainability company, raised $29M to scale up its insight delivery by investing in advanced end-user applications and partner integrations.

💉 Capitainer, a Sweden-based self-collection dried blood spot system for patients, raised a $28.4M Series A from We Venture Capital to expand and innovate their self-sampling solutions.

👶 Upwards, a California-based national childcare network and care benefits company, raised a $21M Series A from Alpha Edison to advance expansion and enhance customer experience.

🌎 Sage Geosystems, a Texas-based provider of Geopressured Geothermal System (GGS) technologies, raised a $17M Series A from Chesapeake Energy Corporation to fund the construction of a 3MW commercial Geopressured Geothermal System (GGS) facility.

🔗 Metalbook, an India-based B2B platform focused on the global metal supply chain, raised a $15M Series A from Rigel Capital to enhance technological infrastructure and extend its network of worldwide processing centers.

⚡ Fever, the Swedish Powertech company building an API-centric platform for virtual power plants, raised a $10.7M Seed from General Catalyst to accelerate growth and broaden collaborations in Europe.

💼 M&A

🫁 GlaxoSmithKline, a UK-based developer and marketer of health and wellness products, acquired Aiolos Bio, a California-based clinical-stage biopharmaceutical company focused on respiratory and inflammatory conditions, for $1.4B.

👥 HiBob, a leading HR platform in the UK, acquired Pento, a payroll automation firm for $40.2M.

🐄 First Milk, a UK-based dairy product manufacturer, acquired BV Dairy, a manufacturer of specialist chilled dairy products.

💧 Ovivo, a Canadian water and wastewater treatment equipment provider, acquired E2metrix, a technology company specializing in advanced electro-technologies.

📅 Economic Calendar

Major Employment Data, Inflation Data, UK GDB Data + More

Friday, February 16th 2024

🇺🇸 US Building Permits Prel, January

🇺🇸 US PPI MoM, January

🇺🇸 US Michigan Consumer Sentiment Prel, February

Tuesday, February 20th 2024

🇦🇺 Australia RBA Meeting Minutes

🇨🇦 Canada Inflation Data, January

Wednesday, February 21st 2024

🇯🇵 Japan Balance of Trade, January

Thursday, February 22nd 2024

🇺🇸 US FOMC Minutes

🇩🇪 Germany HCOB Manufacturing PMI Flash, February

Friday, February 23rd 2024

🇩🇪 Germany Ifo Business Climate, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com