💊 $135M Non-Opioid Funding Boost. Higher Ed Recovers.

Impact Capital Markets #29 looks at our Higher Ed Stock Index, major impact deals and acquisitions, and the upcoming economic releases.

Sawasdee 👋

📉 Today's Global Economic Update: Japan's GDP contracted by 0.1% QoQ in Q4 2023, following a 0.8% fall in Q3, signaling its first recession in five years. Private consumption and capital expenditure also remained muted, with government expenditure edging down.

💊 Deal of the Day: Latigo Biotherapeutics raised a $135M Series A for pioneering non-opioid pain treatments.

What's New?

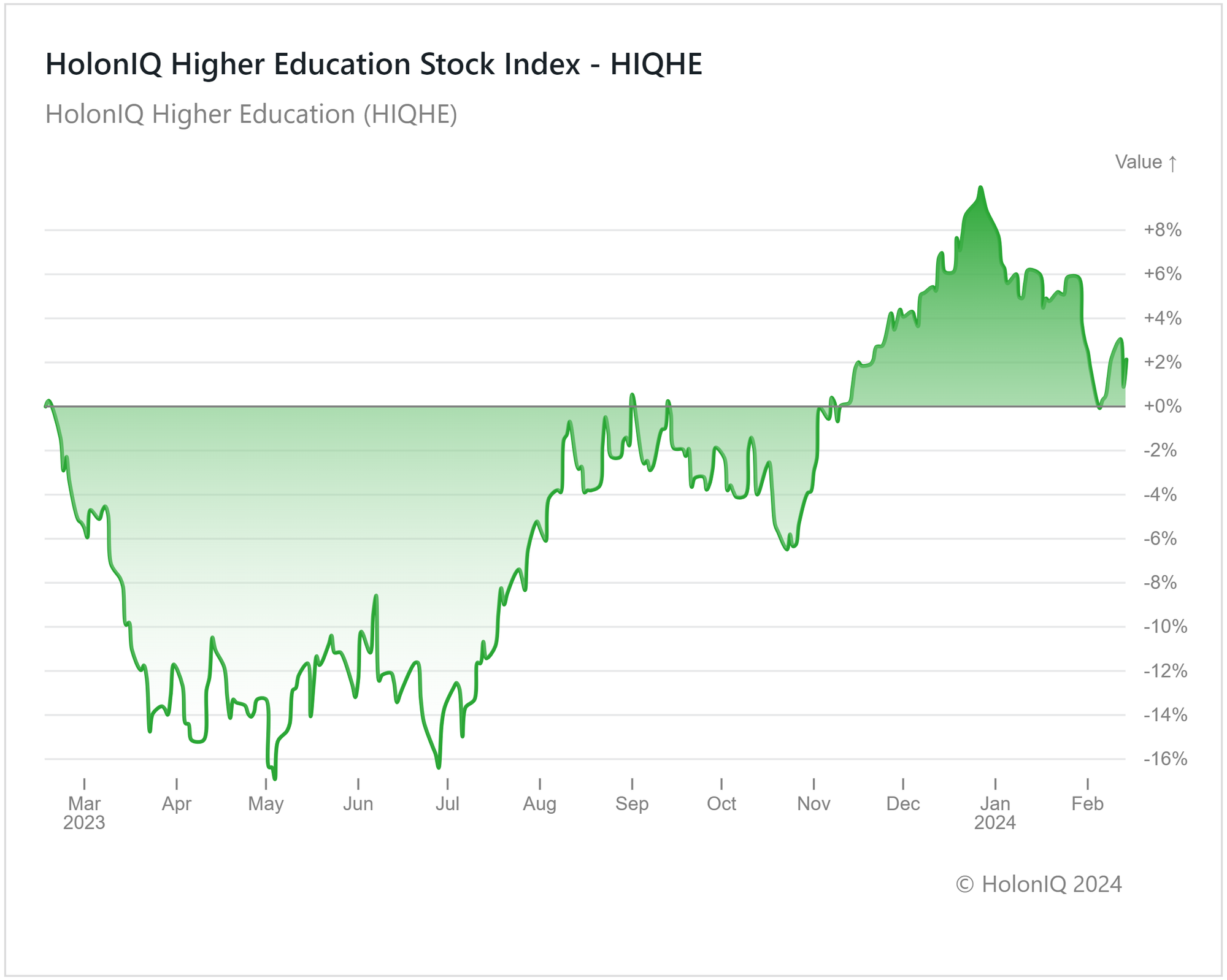

- 🎓 Higher Ed. Higher Ed Index Reverses 16% Loss, Ends Flat YoY

- 💰 Funding. Latigo Raises $130M, EV, Cancer Therapeutics, Agriculture Deals + More

- 💼 M&A. Deals in Oil, Solar Power, and Job Portal

- 📅 Economics. Major Retail Sales Data, Inflation Data, Balance of Trade Data, UK GDB Data + More

For unlimited access to more deals and economic updates, request a demo

🎓 Higher Ed index recovers from 16% decline to end flat YoY

The Higher Education index recovered from a 16% decline in 2H23 to end flat in February 2024, with strong performances from several stocks within the group. A notable exception was IDP Education (MCap: $3.6B), an international student placement and English testing provider whose stock fell 35% YoY. This drag on the index stemmed from concerns about rising competition in Canada and India. Still, the company announced impressive results for 1H FY2024 (Jul23 - Dec23), driven by increased student placement revenue, which could dampen some pessimism toward the stock.

While IDP Education fell, other major players performed well. Online learning platform Coursera (MCap: $2B) returned 9% over 12 months and recently reported earnings growth of 19% for CY2023. Grand Canyon Education (MCap: $4B) also reported revenue gains of 14%, buoyed by its successful diversification into new areas like pre-apprenticeship programs.

Despite labor market challenges and economic uncertainty, academic institutions are restructuring their strategies to integrate online programs into their services, while competency-based learning and apprenticeship models are also gaining momentum. With global competition increasing, the higher education landscape is shifting, but if firms adapt to these changes, these trends can unlock fresh growth opportunities.

💰 Funding

💊 Latigo Biotherapeutics, a California-based non-opioid pain-focused biotech, raised a $135M Series A to support the continued advancement of its portfolio of novel pain therapeutics.

🧬 NextPoint Therapeutics, a Massachusetts-based clinical-stage biotechnology company, raised a $42.5M Series B from Catalio Capital Management to advance the company’s two immuno-oncology clinical programs, NPX267 and NPX887.

🏍️ Roam, an EV startup based in Kenya, raised a $24M Series A from Equator to scale the production of electric motorcycles and buses.

🌱 Hippo Harvest, a California-based controlled environment agriculture (CEA) startup, raised a $21M Series B from Standard Investments to expand its product offerings into new categories of leafy greens.

🩺 Vessi Medical, a bladder-specific cryotherapy technology company in Israel, raised a $16.5M Series A from ALIVE Israel HealthTech Fund & Agriline to treat Non-Muscle Invasive Bladder Cancer.

🦗 FreezeM, an Israeli startup that revolutionizes insect farming with a breeding service, raised a $14.2M Series A to build a hub of breeding facilities to supply insect farmers in different regions.

💼 M&A

⛽ Sanoat Energetika Guruhi, Uzbekistan's largest privately held oil and gas company, acquired CGC Lubricants, an Italian producer of high-quality automotive and industrial oils and lubricants.

☀️ SolarSquare Energy, an India-based solar panel installation company, acquired PV Diagnostics, a utility-scale solar power company in India.

🎓 The National Association for Community College Entrepreneurship (NACCE), a North Carolina-based nonprofit organization that offers leadership education, acquired SkillPointe, a Georgia-based online resource for job seekers and students.

📅 Economic Calendar

Major Retail Sales Data, Inflation Data, Balance of Trade Data, UK GDB Data + More

Thursday February 15th 2024

🇬🇧 UK GDP Data, December

🇺🇸 US Retail Sales Data , January

Friday February 16th 2024

🇬🇧 UK Retail Sales Data, January

🇺🇸 US Building Permits Prel, January

🇺🇸 US PPI MoM, January

🇺🇸 US Michigan Consumer Sentiment Prel, February

Tuesday February 20th 2024

🇦🇺 Australia RBA Meeting Minutes

🇨🇦 Canada Inflation Data, January

Wednesday February 21st 2024

🇯🇵 Japan Balance of Trade, January

Thursday February 22nd 2024

🇺🇸 US FOMC Minutes

🇩🇪 Germany HCOB Manufacturing PMI Flash, February

Friday February 23rd 2024

🇩🇪 Germany Ifo Business Climate, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com