💰 $1.1B EV Funding. Pharmaceuticals Gains 8%.

Impact Capital Markets #41 looks at our Pharmaceuticals stock index, major impact deals, M&A, and upcoming economic releases.

Mālō e lelei 🌴

📉 Today's Global Economic Update: Euro Area Inflation Data released last Friday revealed a YoY decline to 2.6% in February 2024, down from 2.8% in January. The decrease was primarily driven by price stabilization in the energy sector, which saw a 3.7% fall in energy prices from -6.7% in January.

🚗 Deal of the Day: iM Motors, a China-based electric vehicles manufacturer, raised a $1.1B Series B to develop new models and expand market channels.

What's New?

- 💊 Pharmaceuticals. Pharmaceuticals Index gains 8%

- 💰 Funding. iM Motors raises $1.1B + biopharmaceutical & mental health deals

- 💼 M&A. Solar energy, waste management, wind power & pest control

- 📅 Economics. Major balance of trade data, unemployment data, US inflation data + more

For unlimited access to more deals and economic updates, request a demo

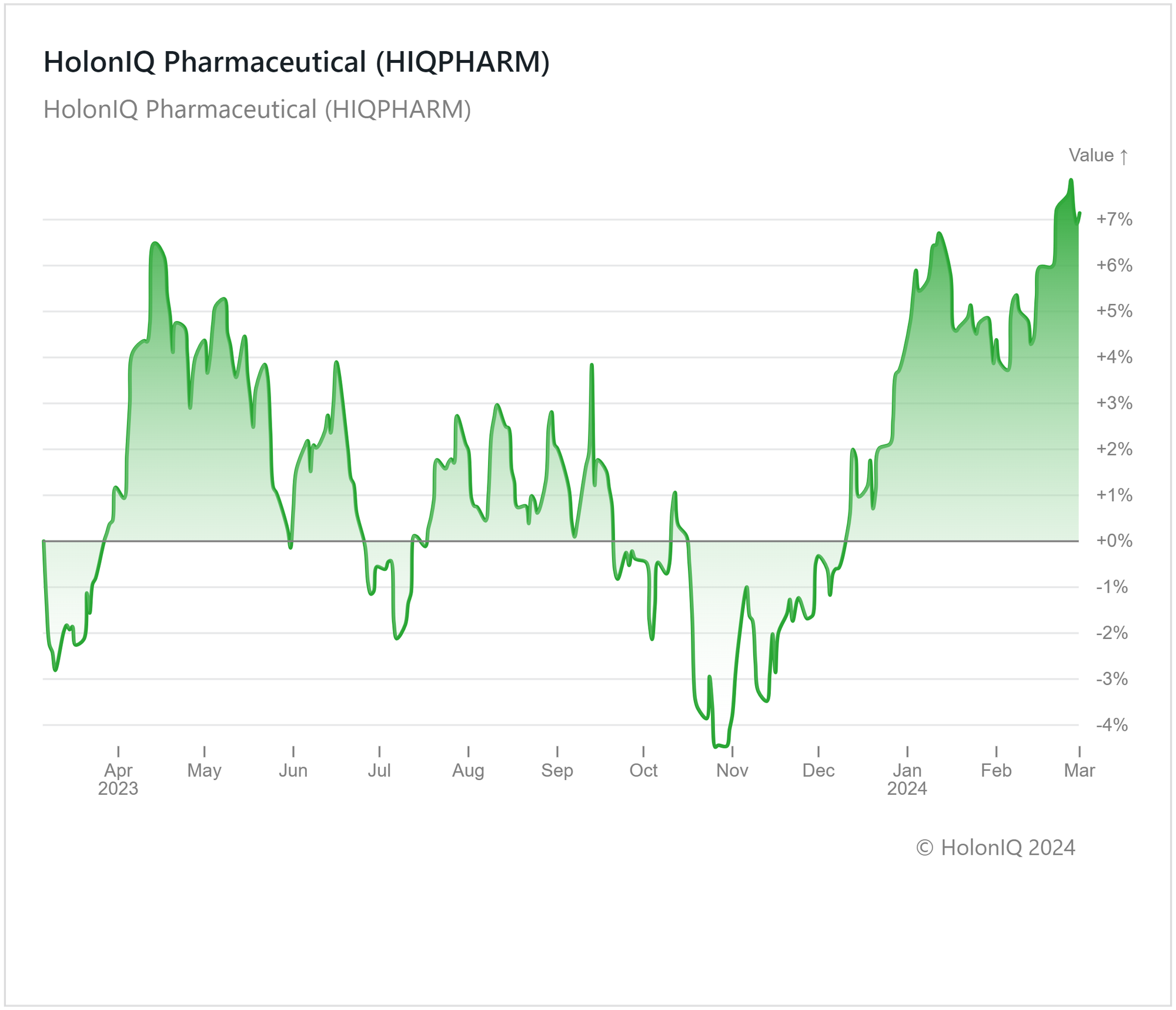

💊 Pharmaceuticals Index Gains 8%

HolonIQ’s Pharmaceuticals Index has experienced an 8% increase over the past year. Major stocks in the index have risen, with Eli Lilly & Co. ($743B MCap) increasing 145%, Novo Nordisk ($420B MCap) rising 69% and Merck & Co. ($322B MCap) gaining 14%.

The pharmaceutical industry has seen many opportunities over the last year, with the weight-loss market buoyed by the success of GLP-1 medications like Ozempic and Rybelsus, offering breakthroughs. Eli Lilly & Co and Novo Nordisk are two companies benefiting from this, with the success of products such as Mounjari and Zepbound resulting in significant boosts to their share values.

However, the industry has also encountered challenges, with inflation driving up costs and affecting consumer demand, particularly affecting smaller sponsor-owned firms operating within tight margins. Mounting regulatory pressures concerning drug pricing and reimbursement policies, such as the Inflation Reduction Act and potential Medicare pricing changes, could also present hurdles for industry players in the near future.

💰 Funding

🚗 iM Motors, a Chinese electric vehicles manufacturer, raised a $1.1B Series B from Bank of China Financial Assets Investment. The funding will be used

to develop new models and expand market channels.

💊 FogPharma, a Massachusetts-based clinical-stage biopharmaceutical company, raised a $145M Series E from Nextech Invest for ongoing clinical developments.

🧠 Matter Neuroscience, a NYC-based well-being monitoring company, raised $26M from Polaris Partners. The funding will be used to develop solutions to improve mental health.

💼 M&A

☀️ 1komma5°, a German solar tech developer, acquired Arkana Energy Group, an Australian solar energy company that offers solar solutions for commercial and residential sectors.

🔄 Univar Solutions, an Illinois-based chemical distributor, acquired Valley Solvents & Chemicals Company, a Texas-based distributor of industrial solvents & chemicals.

🌬️ AFRY, a Swedish engineering services company, Carelin Oy, entered into an agreement to acquire a Finnish company that offers services to the wind power industry.

🐜 Senske Lawn & Tree Care, a Washington-based consumer services company focusing on pest control and grounds maintenance, acquired Turf Doctor, a Maine-based lawn care and pest control company.

📅 Economic Calendar

Major Balance of Trade, Unemployment Data, US Inflation Data + More

Tuesday, March 5th 2024

🇺🇸 US ISM Services PMI, February

Wednesday, March 6th 2024

🇦🇺 Australia GDP Growth Data, Q4

🇩🇪 Germany Balance of Trade, January

🇨🇦 Canada BoC Interest Rate Decision

🇨🇦 Canada Ivey PMI, February

🇺🇸 US JOLTs Job Openings, January

Thursday, March 7th 2024

🇦🇺 Australia Balance of Trade, January

🇨🇳 China Balance of Trade, Jan-Feb

🇪🇦 Euro Area Deposit Facility Data

🇪🇦 Euro Area ECB Interest Rate Decision

🇨🇦 Canada Balance of Trade, January

🇪🇦 Euro Area ECB Press Conference

Friday, March 8th 2024

🇨🇦 Canada Unemployment Data, February

🇺🇸 US Non-Farm Payrolls, February

🇺🇸 US Unemployment Data, February

Tuesday, March 12th 2024

🇦🇺 Australia NAB Business Confidence, February

🇬🇧 UK Unemployment Data, January

🇺🇸 US Core Inflation Data, February

🇺🇸 US Inflation Data, February

Wednesday, March 13th 2024

Thursday, March 14th 2024

🇺🇸 US PPI Data, February

🇺🇸 US Retail Sales Data, February

Friday, March 15th 2024

🇺🇸 US Michigan Consumer Sentiment (Preliminary), March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com