🚗 $1.1B+ Autonomous Mobility Funding. Waste & Recycling Index Up 5%.

Impact Capital Markets #88 looks at our Waste and Recycling stock index, major impact deals, M&A, and upcoming economic releases.

Ahoj 🍺

📉 Today's Global Economic Update: In March 2024, Germany's trade surplus increased to EUR 22.3B ($24.01B), with exports rising by 0.9% to EUR 134.1B ($144.4B), surpassing market expectations, while imports unexpectedly increased by 0.3% to EUR 111.9B ($120.5B), driven by higher purchases from the EU.

🚗 Deal of the Day: Wayve, an autonomous driving technology company, raised a $1.1B Series C to improve product development.

What's New?

♻️ Waste and Recycling. Waste & recycling index rises 5%

💰 Funding. Autonomous driving, biopharma, radiology + more

💼 M&A. Freepik acquires Magnific

📅 Economics. UK GDP data, US inflation, balance of trade + more

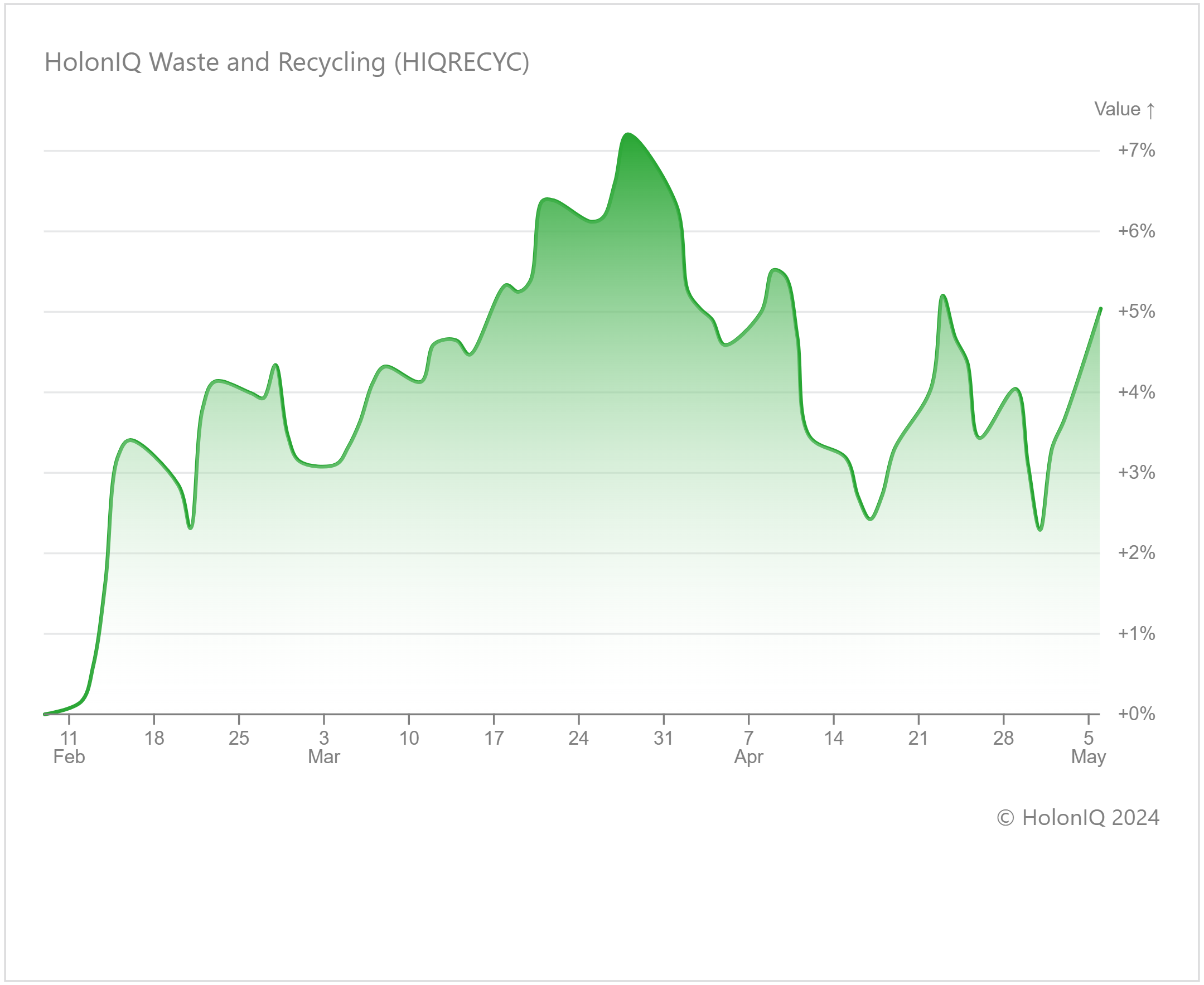

♻️ Waste & Recycling Industry Rises 5%

HolonIQ’s Waste and Recycling index has steadily risen over the past 6 months, showing a 5% increase over the last 3 months, reaching a high of 7% at the end of March. The global waste and recycling industry is undergoing a significant transformation due to various factors. With the world's population growing and urbanization accelerating, the demand for waste management services is on the rise. Countries like Vietnam and China are actively adopting circular economy models to reduce landfill waste and promote sustainability.

This growth is evident in key stocks within the index, with companies like Waste Management ($84B MCap), Republic Services ($59B MCap), and Waste Connections ($43B MCap) showing significant increases of 11%, 8%, and 6%, respectively, over the past 3 months. For instance, Waste Management reported strong financial results, with nearly 15% growth in total company operating EBITDA in the first quarter and a substantial expansion in margins. Despite some challenges including global trade restrictions on recycled materials, the outlook for the waste and recycling industry remains optimistic. Advancements in technology, evolving legislation, and a growing demand for recycled content are expected to fuel rapid growth in the coming years.

💰 Funding

🚗 Wayve, a UK-based autonomous driving technology company, raised a $1.1B Series C from SoftBank Group to enhance product development.

💉 Zenas BioPharma, a Massachusetts-based biopharmaceutical company, raised a $200M Series C to advance its clinical programs.

🏥 Rad AI, a California-based radiology automation startup, raised a $50M Series B from Khosla Ventures to hire a team to launch its new product.

💊 Prologue Medicines, a Massachusetts-based therapeutics company, raised a $50M Series A from Flagship Pioneering to develop a pipeline of medicines for a wide range of diseases.

🧬 Memo Therapeutics AG, a Swiss biotech company raised a $22M Series C to accelerate the development of its main therapeutic candidate.

🧪 NSG BioLabs, a Singaporean biotech incubator has raised $15.4M from Celadon Partners to expand across Singapore and Southeast Asia.

📚 Futura, an Italian Edtech company raised a $15M Series A from Eurazeo

to diversify and scale operations across Europe.

💼 M&A

🖼️ Freepik, a Spanish tech company, acquired Magnific, a Spanish AI image tool provider.

📅 Economic Calendar

UK GDP Data, US Inflation, Balance of Trade + more

Wednesday, May 8th 2024

🇨🇳 China Balance of Trade Data, April

Thursday, May 9th 2024

Friday, May 10th 2024

🇬🇧 UK GDP Data, Q1

🇨🇦 Canada Employment Data, April

🇺🇸 US Michigan Consumer Sentiment (Preliminary), May

🇨🇳 China Inflation Data, April

Tuesday, May 14th 2024

🇬🇧 UK Employment Data, March

🇩🇪 Germany ZEW Economic Sentiment Index, May

🇺🇸 US PPI, April

Wednesday, May 15th 2024

🇺🇸 US Core Inflation Data, April

🇺🇸 US Inflation Data, April

🇺🇸 US Retail Sales Data, April

Thursday, May 16th 2024

🇺🇸 US Building Permits (Preliminary), April

🇯🇵 Japan GDP Data (Preliminary), Q1

🇨🇳 China Industrial Production Data, April

🇨🇳 China Retail Sales Data, April

Friday, May 17th 2024

🇯🇵 Japan Inflation Data, April

🇯🇵 Japan Balance of Trade Data, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com