🧑🎓 Higher Ed April Rebound. $184M+ VC Funding.

Impact Capital Markets #87 looks at our Higher Education stock index, major impact deals, M&A, and upcoming economic releases.

Hei 🏔️

📉 Today's Global Economic Update: The US ISM Services PMI dropped to 49.4 in April 2024 from 51.4, signaling the first contraction in services since December 2022. This raises concerns, alongside other indicators including signs of the labor market weakening, that consecutive rate hikes by the Fed may be slowing the economy.

🛰️ Deal of the Day: Privateer, a Hawaii-based space data startup, raised a $56.5M Series A to expand operations.

What's New?

🧑🎓 Higher Education. Higher education index recovers from 9% dip

💰 Funding. Space data, geothermal exploration, cell therapy + more

💼 M&A. Insurance services, earth data analytics

📅 Economics. UK GDP data, US inflation, balance of trade + more

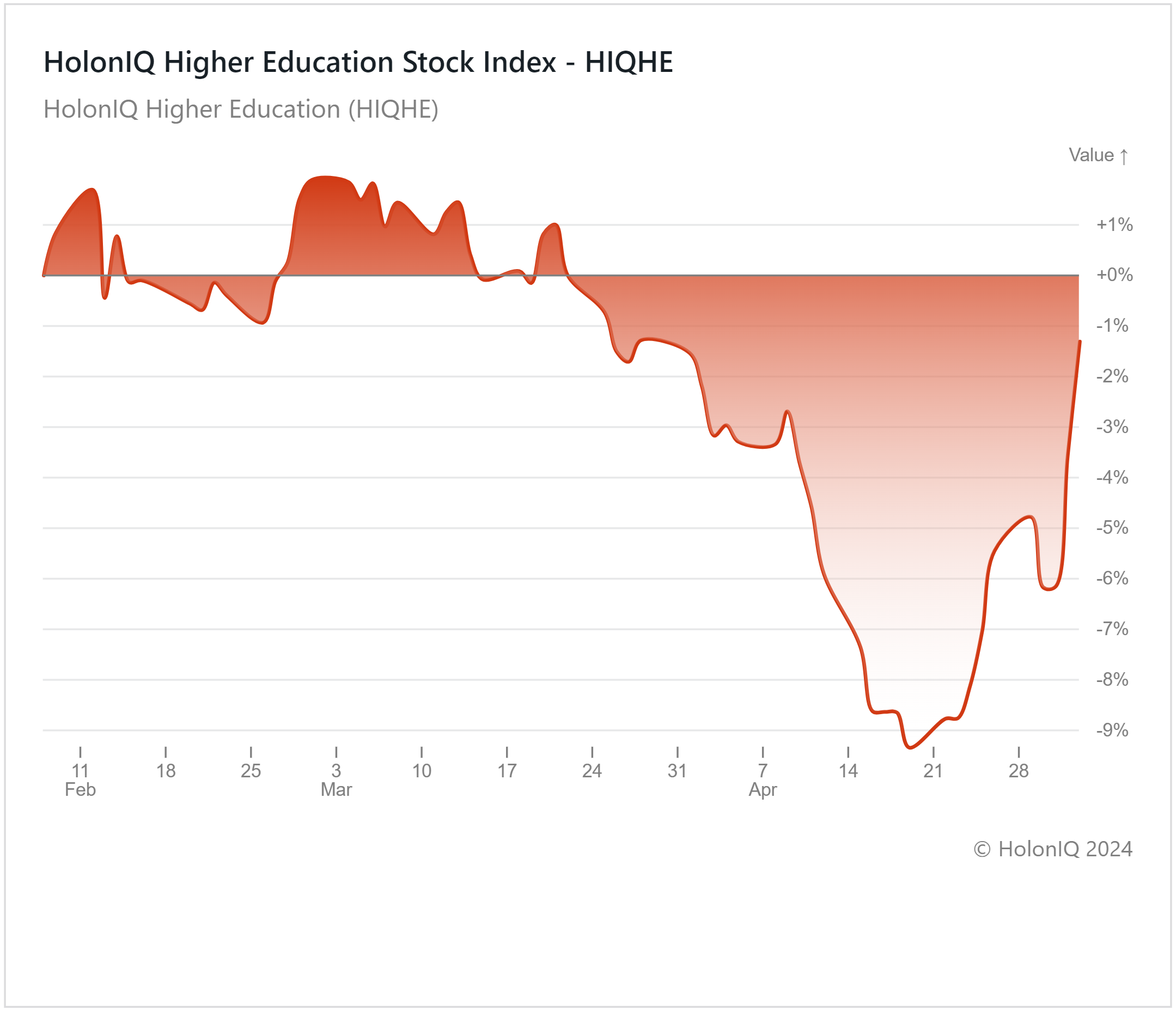

🧑🎓 Higher Education Index Recovers from 9% Dip

HolonIQ’s Higher Education index staged a recovery by December 2023 after a rough first half of 2023, although some of these gains have been eroded in 2024. Despite an overall decline this year, there were signs of improvement in late April with a partial recovery from a 9% drop.

Strategic Education ($3B MCap) demonstrated a 3M return of 24% driven by their Q1 earnings report released this April, showing revenue growth of 13.1%. IDP Education's ($3B MCap) stock price declined by 18% due to increased competition as students applying to Canadian universities now have additional test options alongside IELTS. In comparison, other major stocks within the index, such as CAE Inc. ($6B MCap) and Grand Canyon Education ($4B MCap) saw only moderate movements within the quarter. Despite labor market challenges and economic uncertainties, academic institutions are restructuring their strategies to integrate online programs & AI into their services. This shift has the potential to improve the index in the long term.

💰 Funding

🛰️ Privateer, a Hawaii-based space data startup, raised a $56.5M Series A from Aero X Ventures to expand operations.

🌋 Zanskar Geothermal & Minerals, a Utah-based geothermal exploration company, raised a $30M Series B from Obvious Ventures to speed up technology development.

💉 OverT Bio, a New York-based cell therapy company, raised a $16M Seed from ARTIS Ventures and Wing VC to advance product development.

🩺 Opmed.ai, a Massachusetts-based healthcare AI platform provider, raised a $15M Series A from NFX and Grove Ventures to expand operations.

🌾 Superplum, an Indian agritech company, raised a $15M Series A from Erik Ragatz to streamline its supply chain.

❤️ inHEART, a French cloud-based cardiac imaging provider, raised a $11M Series A from Vesalius Biocapital Partners and Elaia to enhance product development.

🩸 Nectin Therapeutics, an Israel-based biotech company, raised $10M from GIBF Fund to advance product development.

💼 M&A

🛡️ USI Insurance Services, a New York-based insurance brokerage and consulting firm acquired Hignojos Insurance Agency, a Texas-based insurance and benefits services company.

🌍 Privateer, a Hawaii-based space data startup acquired Orbital Insight, a California-based earth data analytics company.

📅 Economic Calendar

UK GDP Data, US Inflation, Balance of Trade + More

Tuesday, May 7th 2024

🇦🇺 Australia RBA Interest Decision

🇩🇪 Germany Balance of Trade Data, March

🇨🇦 Canada Ivey PMI s.a, April

Wednesday, May 8th 2024

🇨🇳 China Balance of Trade Data, April

Thursday, May 9th 2024

Friday, May 10th 2024

🇬🇧 UK GDP Data, Q1

🇨🇦 Canada Employment Data, April

🇺🇸 US Michigan Consumer Sentiment (Preliminary), May

🇨🇳 China Inflation Data, April

Tuesday, May 14th 2024

🇬🇧 UK Employment Data, March

🇩🇪 Germany ZEW Economic Sentiment Index, May

🇺🇸 US PPI, April

Wednesday, May 15th 2024

🇺🇸 US Core Inflation Data, April

🇺🇸 US Inflation Data, April

🇺🇸 US Retail Sales Data, April

Thursday, May 16th 2024

🇺🇸 US Building Permits (Preliminary), April

🇯🇵 Japan GDP Data (Preliminary), Q1

🇨🇳 China Industrial Production Data, April

🇨🇳 China Retail Sales Data, April

Friday, May 17th 2024

🇯🇵 Japan Inflation Data, April

🇯🇵 Japan Balance of Trade Data, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com