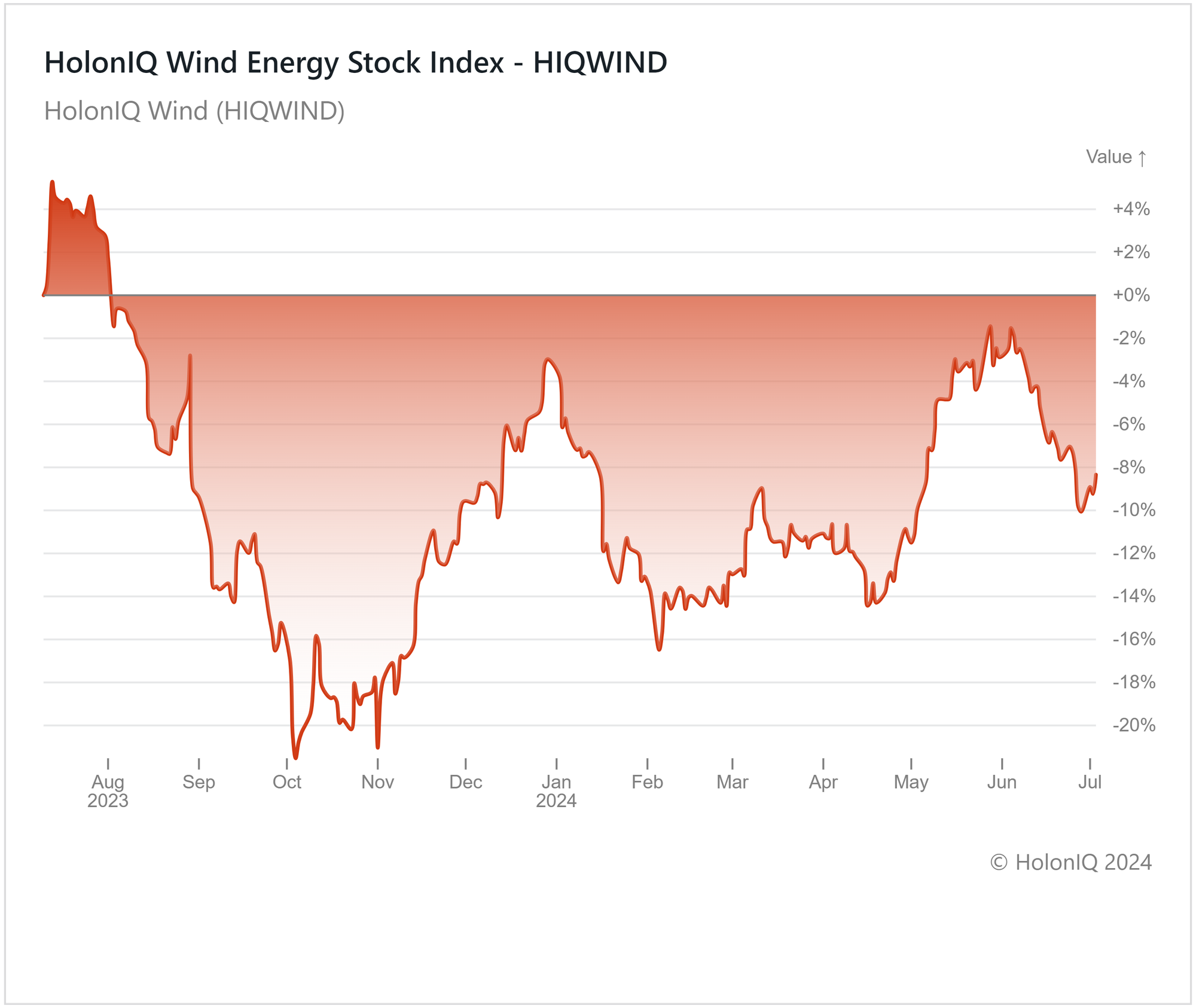

🍃 Wind Index Declines 8% YOY. $420M+ VC Funding.

Impact Capital Markets #131 looks at our Wind Index, major impact deals, M&A, and upcoming economic releases.

📈 Today's Global Economic Update: German exports fell 3.6% in May, exceeding the 1.9% decline forecast, due to weak demand from China, the U.S., and European countries.

🌐 Deal of the Day: Quantexa, a UK-based decision intelligence platform, raised a $129M Series E to support its global expansion.

What's New?

🍃 Wind. Wind Index declines 8% YoY

💰 Funding. Decision Intelligence, technology, biotech + more

💼 M&A. Life sciences and biotech

📅 Economics. US inflation, UK GDP, balance of trade + more

🍃 Wind Index declines 8% YoY

HolonIQ’s Wind index showed signs of recovery in May due to improving demand conditions but saw a subsequent decline due to political factors, with the index contracting by 8% on a yearly basis. With a growing global focus on achieving green energy targets, ample funding and development for wind energy generation exists. The recent European election has caused mixed investor sentiment, leading to declining shares of European wind turbine makers and wind energy companies. Hundreds of gigawatts of wind energy projects are awaiting permits to connect to Europe’s power grid. The political changes in the EU might create pressure on funding for these wind projects. The upcoming US election and the economic conflict between China and its allies against Europe and the US have added to investor uncertainty. Despite this, China, the largest wind energy producer in the world, is set to add 70 gigawatts of wind power capacity by the end of the year. Iberdrola ($82B MCap), acquired Avangrid by purchasing shares worth $2.6 billion. Avangrid received full federal approval for the construction of offshore wind projects. With rising funding and developments amid mixed geopolitical factors, the Wind Index is expected to grow, but is likely to see volatile periods ahead.

💰 Funding

🌐 Quantexa, a UK-based decision intelligence platform, raised a $129M Series E from GIC to support its global expansion.

🧬 Myricx Bio, a UK-based biotech company, raised a $114M Series A from Novo Holdings and Abingworth to advance its antibody-drug conjugate (ADC) payload platform.

💻 Axelera AI, a Dutch AI-based technology company, raised a $68M Series B to support its global expansion and enhance its AI hardware acceleration technology.

🌾 Arya.ag, an Indian agritech startup, raised a $29M Series D from Quona Capital and Asia Impact to enhance its supply chain solutions and accelerate its agritech innovations.

🏗️ Phaidra, a Washington-based AI-based infrastructure company, raised $12M from Index Ventures for R&D efforts.

💼 M&A

🦠 AddLife, a Swedish life sciences company, acquired BonsaiLab, a Spanish biotech company.

🧪 Iktos, a French biotech company, acquired Synsight, a French molecular diagnostics company.

📅 Economic Calendar

US Inflation, UK GDP, Balance of Trade + More

Monday, July 8th 2024

🇩🇪 Germany Balance of Trade, May

🇦🇺 Australia Westpac Consumer Confidence Change, July

🇦🇺 Australia WNAB Business Confidence Index, June

Tuesday, July 9th 2024

Thursday, July 11th 2024

🇬🇧 UK GDP Data, May

🇺🇸 US Core Inflation Data, June

🇺🇸 US Inflation Data, June

Friday, July 12th 2024

🇺🇸 US PPI Data, June

🇺🇸 US Michigan Consumer Sentiment (Preliminary), July

🇨🇳 China Balance of Trade, June

Tuesday, July 16th 2024

🇩🇪 ZEW Economic Sentiment Index, July

🇨🇦 Inflation Data, June

🇺🇸 Retail Sales, June

Wednesday, July 17th 2024

🇬🇧 Inflation Data, June

🇺🇸 Building Permits (Preliminary), June

🇯🇵 Balance of Trade, June

Thursday, July 18th 2024

🇬🇧 Employment Data, May

🇪🇦 Deposit Facility Data

🇪🇦 ECB Interest Rate Decision

🇯🇵 Inflation Data, June

Friday, July 19th 2024

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com