⚛️US ~2x China's Nuclear Energy Consumption. Universities. Chip Sales Down 20%.

Chart of the Day #137 looks at Universities, Nuclear Energy and Semiconductors

Zdravo 🍷

Japanese semiconductor giants are planning to invest approximately $31B by 2029 to strengthen the production of power devices and image sensors. South Africa's nuclear regulator has approved a 20-year extension for one of the two units at the country's sole nuclear power station, amidst concerns over the nation's fragile electricity supply.

Today's Topics

🎓 Universities. India leads globally with over 5K universities

⚛️ Nuclear Energy. The US consumes nearly twice as much nuclear energy as China

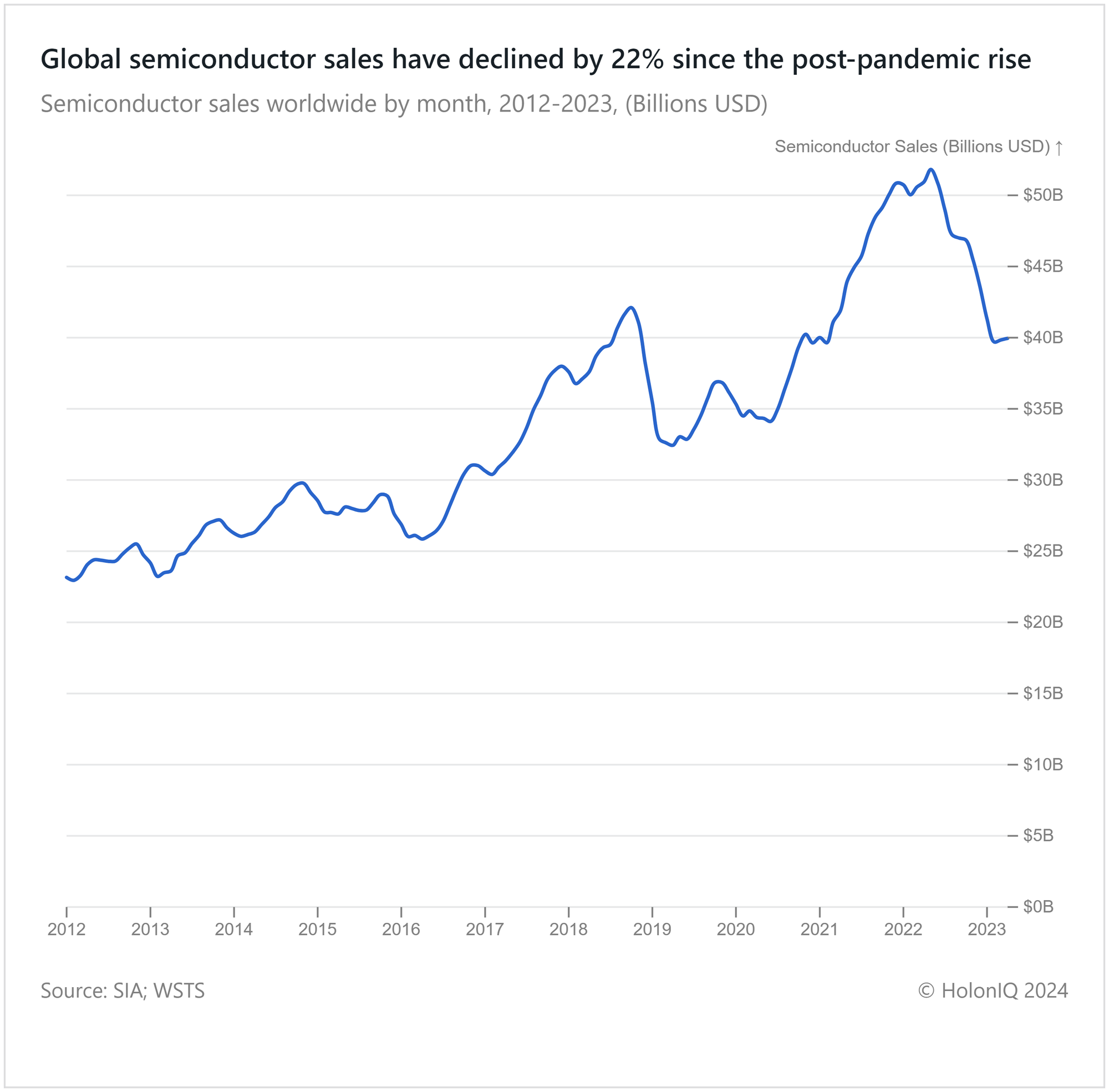

💻 Semiconductors. 20%+ drop in global semiconductor sales post-pandemic

For unlimited access to over one million charts, request a demo.

🎓India Leads Globally with Over 5K Universities

India leads the world with over 5,000 universities ranked among the top 10,000 globally in 2023. This reflects the country's large population and high demand for higher education. Indonesia and the US also have over 3,000 universities each, driven by similar population and education demands. In comparison, China, despite being the second most populous country, has less than half the number of top-ranked universities as India. India's substantial lead underscores its significant investment in educational infrastructure and supportive government policies.

⚛️ The US Consumes Nearly Twice as Much Nuclear Energy as China

The United States consumes almost twice as much nuclear energy as China and more than three times as much as Russia. The extensive infrastructure, with over 90 nuclear reactors, supports a significant portion of the US electricity needs, reducing reliance on fossil fuels and lowering carbon emissions. Substantial investments in nuclear technology and a long-standing commitment to energy security also contribute to its high consumption levels.

💻 20%+ Drop in Global Semiconductor Post-Pandemic

Global semiconductor sales, after peaking in 2022 during the post-pandemic surge, have since dropped by 22%. This decline reflects easing supply chain disruptions and falling demand amid economic uncertainties. Prior to this, the industry experienced steady growth driven by technological advancements and increased demand for electronic devices. The pandemic-induced increase in sales appears to have been temporary, while current sales volumes remain ~10% above the level seen just before the pandemic.

Like getting this newsletter? For unlimited access to over one million charts, request a demo.

Thank you for reading. Have a great week ahead!Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com