🚢 Shipping Index Rises 65%. $45M+ VC Funding.

Impact Capital Markets #106 looks at our Shipping Stock Index, major impact deals, M&A, and upcoming economic releases.

Kamusta 🏝️

📈 Today's Global Economic Update: India's GDP data released last Friday revealed a 7.8% increase for the quarter ending March 2024, surpassing the forecasted 6.7% and confirming its status as the world’s fastest-growing major economy.

🤖 Deal of the Day: Valar Labs, a California-based histology AI company, raised a $22M Series A to expand operations and R&D efforts.

What's New?

🚢 Shipping. Shipping index rises 65%

💰 Funding. Payment solutions and histology AI

💼 M&A. Delivery management and SAP consulting

📅 Economics. US employment data, Euro Area Interest rate + more

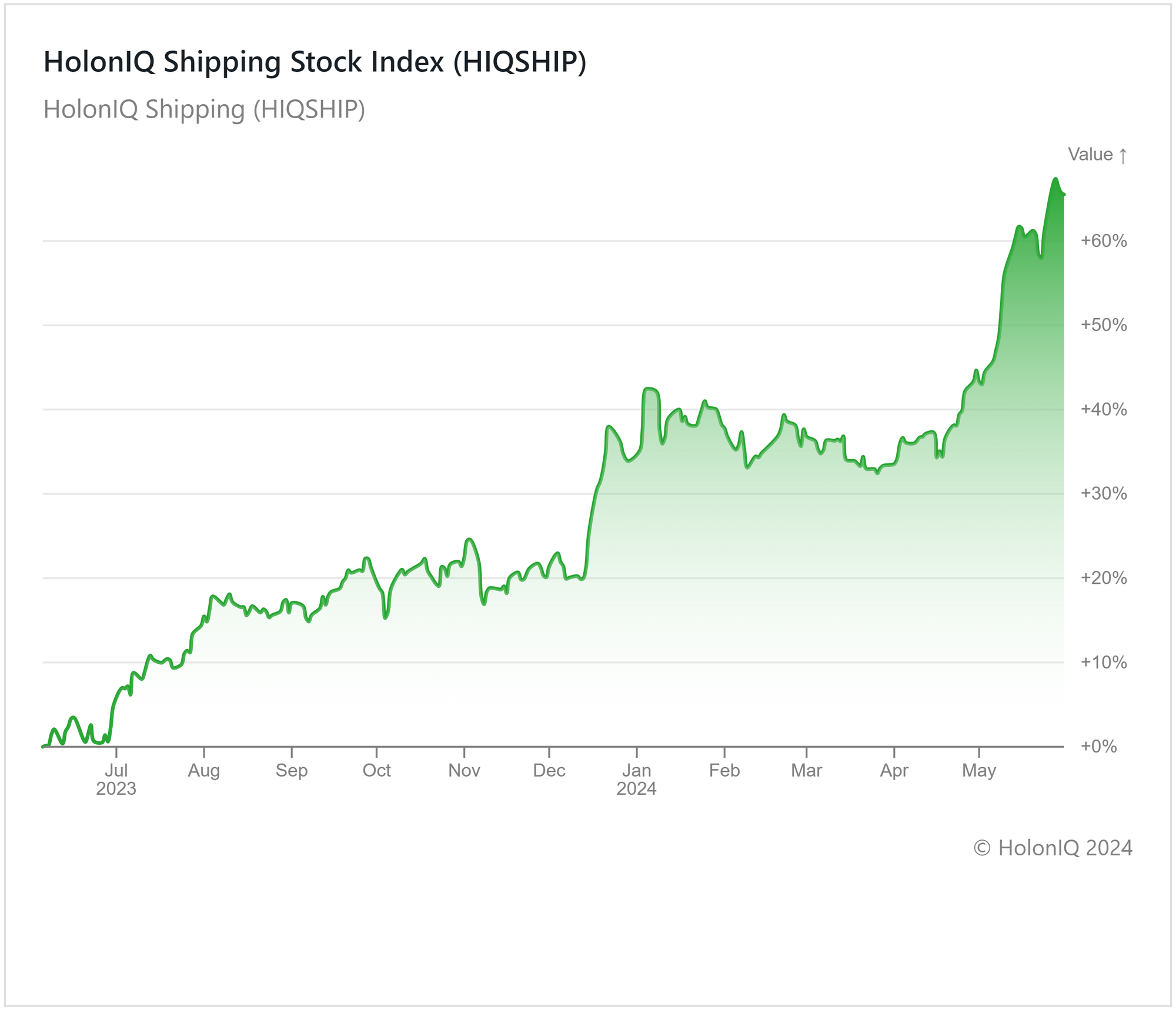

🚢 Shipping Index Rises 65%

HolonIQ’s shipping index has experienced a 21% increase over the past three months, with Year-on-Year returns exceeding 65%. Militant attacks in the Red Sea have forced ships to reroute to longer routes, driving up freight rates substantially and increasing the value of shipping stocks. The resolution of supply chain issues following COVID-19, technological advancements, and port industry improvements have also positively impacted stocks in the index. Hapag-Lloyd ($34B MCap) increased 29% over the past three months. COSCO Shipping ($31B MCap) and Evergreen Marine ($14B MCap) have also seen quarterly earnings rise by 29%, 41%, and 18%, respectively.

The return to normality as conditions of the war wane adds an element of uncertainty to stocks in the index, especially with earning results for some stocks being less than reported. Compared to last year's quarter, Hapag-Lloyd's group EBIT and group profit decreased in 1Q 2024. However, Evergreen Marine has seen Q1 2024 net profit triple that of a year ago. Looking ahead, the global economic outlook, along with geopolitics, will have a significant impact on the performance of the index.

💰 Funding

🤖 Valar Labs, a California-based histology AI company, raised a $22M Series A from DCVC and Andreessen Horowitz to expand operations and its R&D efforts.

💳 Forward, a Texas-based payment solutions provider, raised a $16M Seed from Commerce Ventures, Elefund, and Fiserv to meet the demands of software partners.

💼 M&A

📦 Scurri, an Irish delivery management platform, acquired HelloDone, a UK-based AI provider to retailers and brands.

🚀 Applexus Technologies, a Washington-based SAP consulting provider, acquired Absoft, a UK-based SAP implementation company.

📅 Economic Calendar

US Employment Data, Euro Area Interest Rate, Balance of Trade + More

Monday, June 3rd 2024

🇺🇸 US ISM Manufacturing PMI, May

Tuesday, June 4th 2024

🇺🇸 US JOLTs Job Openings, April

🇦🇺 Australia GDP Growth Data, Q1

Wednesday, June 5th 2024

🇨🇦 Canada BoC Interest Rate Decision

🇺🇸 US ISM Services PMI, May

🇦🇺 Australia Balance of Trade Data, April

Thursday, June 6th 2024

🇪🇦 Euro Area Deposit Facility Data

🇪🇦 Euro Area ECB Interest Rate Decision

🇪🇦 Euro Area ECB Press Conference

🇨🇦 Canada Ivey PMI s.a, May

🇨🇳 China Balance of Trade Data, May

Friday, June 7th 2024

🇩🇪 Germany Balance of Trade Data, April

🇨🇦 Canada Balance of Trade Data, April

🇨🇦 Canada Employment Data, May

🇺🇸 US Employment Data, May

Monday, June 10th 2024

🇦🇺 NAB Business Confidence, May

Tuesday, June 11th 2024

🇬🇧 UK Employment Data, April

🇨🇳 China Inflation Data, May

Wednesday, June 12th 2024

🇬🇧 UK GDP, April

🇺🇸 US Core Inflation Data, May

🇺🇸 US Inflation Data, May

🇺🇸 US Fed Interest Rate Decision

🇺🇸 US FOMC Economic Projections

🇺🇸 US Fed Press Conference

Thursday, June 13th 2024

🇺🇸 US PPI, May

Friday, June 14th 2024

🇯🇵 Japan BoJ Interest Rate Decision

🇺🇸 Michigan Consumer Sentiment (Preliminary), June

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com