🚢 Shipping Index Up 25%. $200M VC Funding.

Impact Capital Markets #49 looks at our Shipping stock index, major impact deals, M&A, and upcoming economic releases.

Aloha 🏝️

📉 Today's Global Economic Update: The UK Monthly GDP data released yesterday revealed a 0.2% Month-on-Month expansion in January 2024, marking a turnaround from the previous month's decline. Notable contributions were from the services and construction sectors, offsetting a decline in industrial output.

⚕️ Deal of the Day: Healthcare technology company, Zephyr AI, raised a $111M Series A to improve its analytical speed and expand operations.

What's New?

- 🚢 Shipping. Shipping index up 25%+

- 💰 Funding. Health tech, plant-based food, EVs & more

- 💼 M&A. Daasity acquires Red Fox Analytics

- 📅 Economics. Major interest rate decisions, inflation data + more

For unlimited access to more deals and economic updates, request a demo

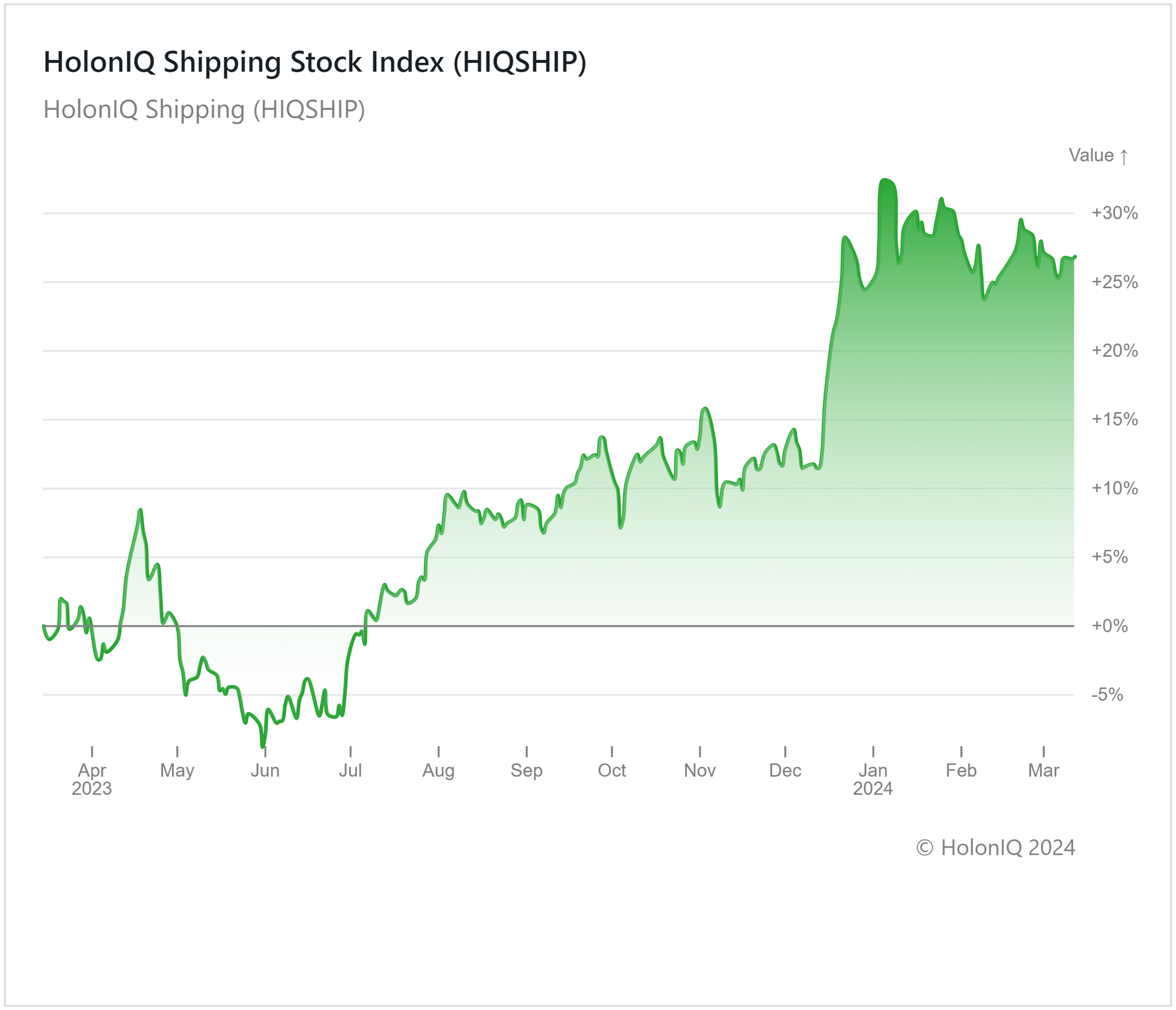

🚢 Shipping Index Up 25%+

The HolonIQ Shipping Index has increased by over 25% in the past year, rebounding from declines observed in 2Q 2023. Major stocks like Nippon Yusen ($15B MCap) and Mitsui O.S.K. Lines ($12B MCap) experienced increases of 17% and 22%. Some key stocks, including Hapag-Lloyd ($26B MCap) and A.P. Møller-Mærsk ($25B MCap), which saw declines of 54% and 40% respectively, bucked this trend, pulling index returns down. The shipping industry has seen a gradual recovery from the COVID-related downturn, with supply chain disruptions easing as port congestion and transport bottlenecks cleared out. Despite the subsequent drop in freight rates, optimism about a recovery in Chinese exports also improved sentiment.

More recently, the emergence of conflicts along Middle Eastern and European trade routes has started to undermine this trend, potentially triggering a reversal. Almost all major shipments coming through the Red Sea have had to be rerouted, which has led to higher costs for freight carriers, impacting profitability. 2024 is also expected to be characterized by further challenges, with the strengthening of emission control regulations leading to increasing costs for shipping companies, forcing them to rethink strategies to maintain profitability.

💰 Funding

⚕️ Zephyr AI, a Virginia-based healthcare technology company, raised a $111M Series A to improve its analytical speed and expand operations.

🧬 X-Therma, a California-based biotechnology firm, raised a $22.4M Series B from Starling Locke Capital & LOREA AG to advance the development of key products in X-Therma's pipeline.

🌱 ProteinDistillery, a German plant-based food company, raised a $16.4M Seed to launch a protein competence center in Southern Germany, integrating a network of knowledge partners and companies in the field.

🚚 Packfleet, a UK-based carbon-neutral courier company, raised a $10M Series A from General Catalyst and Voyager Ventures to enhance its presence in the London delivery market.

🌿 Murphy’s Naturals, a North Carolina-based outdoor lifestyle company, raised a $8M Series B from Point King Capital to support its R&D efforts.

🔌 Necture, a start-up providing a platform to manage car fleets and charging infrastructure, raised a $7M Series A from Smart Energy Innovation Fund to support Necture's expansion plans in the corporate fleet market.

🌍 Furno, a California-based climate technology company, raised a $6.5M Seed from Energy Capital Ventures to upgrade its technological capabilities.

🚗 Telo, a California-based electric mobility company, raised a $5.4M Seed from Ali Partovi. The funds will be used to validate the safety of its EVs.

🛴 Joyride, a Canadian micro-mobility platform operator, raised a $5.2M Series A from Yamaha Motors to improve its technology.

💉 Sugar.fit, an Indian health tech startup, raised a $5M Series A from Eduardo Saverin & B Capital to accelerate research and development in diabetes management.

💼 M&A

📊 Daasity, a California-based data and analytics platform catering to consumer brands, acquired Red Fox Analytics, a Colorado-based data analytics provider for consumer packaged goods brands.

📅 Economic Calendar

Major interest rate decisions, Inflation Data + More

Thursday, March 14th 2024

🇺🇸 US PPI Data, February

🇺🇸 US Retail Sales Data, February

Friday, March 15th 2024

🇺🇸 US Michigan Consumer Sentiment Data (Preliminary), March

Monday, March 18th 2024

🇨🇳 China Industrial Production Data, Jan-Feb

🇨🇳 China Retail Sales Data, Jan-Feb

Tuesday, March 19th 2024

🇯🇵 Japan BoJ Interest Rate Decision

🇦🇺 Australia RBA Interest Rate Decision

🇩🇪 Germany ZEW Economic Sentiment Index, March

🇺🇸 US Building Permits Data (Preliminary), February

🇨🇦 Canada Inflation Data, February

Wednesday, March 20th 2024

🇬🇧 UK Inflation Data, February

🇺🇸 US Fed Interest Rate Decision

🇺🇸 US FOMC Economic Projections

Thursday, March 21st 2024

🇺🇸 US Fed Press Conference

🇯🇵 Japan Balance of Trade Data, February

🇩🇪 Germany HCOB Manufacturing PMI (Flash), March

🇬🇧 UK BoE Interest Rate Decision

Friday, March 22nd 2024

🇯🇵 Japan Inflation Data, February

🇬🇧 UK Retail Sales Data, February

🇩🇪 Germany Ifo Business Climate Index, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com