💻 Semiconductors up 50%. $900M+ Funding.

Impact Capital Markets #9

For over 5 years, HolonIQ has been tracking and analyzing Impact Capital Markets, Foundations and Philanthropies, Venture and Growth Capital, Private Equity and Public Markets.

Now, with more than 50 stock indices being tracked, we're kicking off 2024 with a new daily newsletter for data-driven global leaders looking to understand trends in strategic industries.

Today's Topics

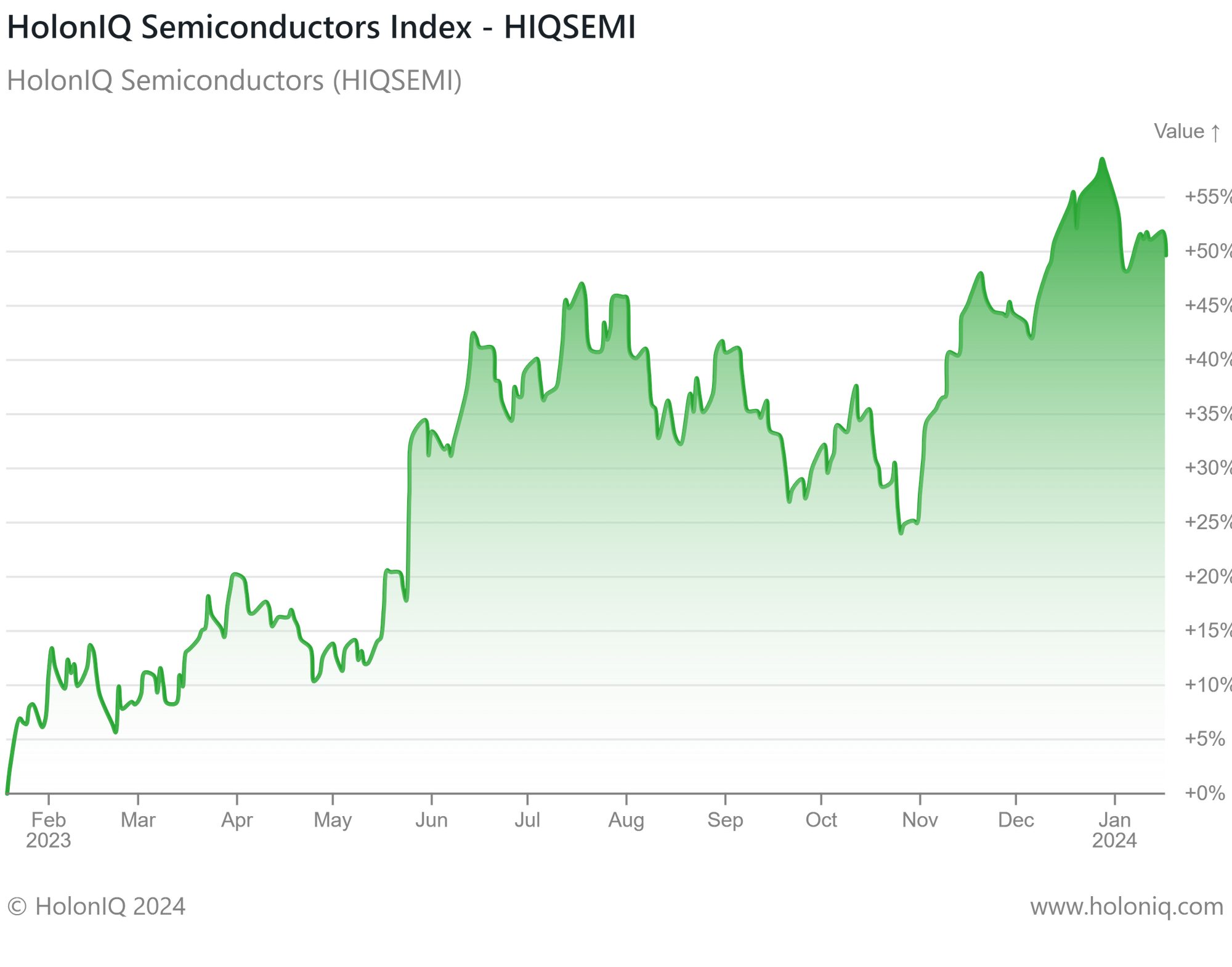

- 💻 Semiconductors. Upward Trend in 12-Month Indexed Returns

- 💰 Funding. $900M+ Funding Boost for Quantum Computing, Waste Management and More

- 💼 Acquisitions. Electric Health Record, Pharma & Education Admin

- 📅 Economics. Consumer, GDP and Inflation data + Japan, Canada Interest rates next week.

Have feedback or ideas for us? Email hello@holoniq.com — we'd love to hear from you!

💻 Semiconductor Index Trends Upwards Over 12M

HolonIQ Semiconductors Index (HIQSEMI). Indexed returns (returns on the index relative to the level on 17th Jan 2023) has been on a general upward trend over the last 12 months, increasing to 50% in January 2024. NVIDIA Corp. (MarketCap: US$1.4B) was a prominent contributor to the upward trend of returns as it partnered with various industry players to enhance shareholder value. This included developing a platform for generative AI and 5G/6G apps with SoftBank Group and leveraging artificial intelligence to expedite the design and development of new drugs with Roche Holdings. The company was also involved in creating 3D holographic augmented reality, artificial intelligence, and robotics focused education experiences for K-12 students with Integem, a leading provider of Holographic AR technology and education.

In other developments, the world's leading chip manufacturer, Taiwanese semiconductor manufacturer (MarketCap: US$478B), made an announcement in early August 2023 announcing the construction and management of a microchip plant in collaboration with European companies Bosch, Infineon, and NXP, in which each of these companies will have a 10% stake in the plant.

💰Funding

💻 Quantinuum, a Cambridge-based quantum computing company, has raised $300M at a pre-money valuation of $5 billion. JP Morgan Chase led the round, and the funds will be used to accelerate progress toward achieving universal fault-tolerant quantum computers.

📱 Everphone, a German-based company that lends and refurbishes mobile phones for businesses, raised a $294M Series D from Citigroup. The funds will be used to achieve decisive growth, integrating an additional one million device users into its circular Device-as-a-Service model.

💊 Comanche Biopharma, a Massachusetts-based biopharmaceutical company, raised a $75M Series B from New Enterprise Associates to advance its mission of developing and globally making available the first treatment targeting a root cause of preeclampsia.

🧪 Cleveland Diagnostics, an Ohio-based clinical-stage biotechnology company, raised $75M from Novo Holdings to enhance commercial operations, invest in expanded infrastructure and research and development, and extend the reach of its novel prostate cancer test.

🏥 Forta, a California-based healthcare service provider, raised a $55M Series A from What If Ventures and Insight Partners. The funding will be used to expand its family-powered autism therapy practice, provide AI-enabled applied behavior analysis (ABA) therapy, and develop its suite of clinical algorithms.

💊 Ratio Therapeutics, a Massachusetts-based clinical phase pharmaceutical company, raised a $50M Series B from Schusterman and Duquesne to expand the applications of the company's proprietary technology platforms.

⚡ Lightship, a California-based all-electric RV company, raised a $34M Series B from Prelude Ventures and Obvious Ventures. The funds will accelerate production, develop manufacturing systems, create jobs, and scale up operations.

🌳 SeeTree, an Israel-based tree intelligence platform, raised a $17.5M Series C from HSBC Asset Management and European Bank for Reconstruction and Development (EBRD) to expand the crop types that work with its intelligence platform.

🌱 The Mediterranean Food Lab, an Israel-based developer of plant-based food flavors, raised a $17M Series A from Gullspång Re:food to scale up novel solid-state fermentation technology that can transform the sensory experience of eating plant-based foods.

🎓 Elice, a South Korea-based digital education company, raised $14.9M from Vertex Venture Holdings to build an extensive infrastructure for AI education and research.

💼 Acquisitions

📑 PointClickCare, an Ontario-based healthcare technology platform, acquired American HealthTech, a Mississippi-based provider of electronic health record (EHR) solutions.

💊 BioTE, a Texas-based medical company, announced a definitive agreement to acquire Asteria Health, a UK-based pharmaceutical compounding solution company.

🏥 Pyx Health, a Arizona-based health platform solving loneliness, acquired InquisitHealth, a New Jersey-based health management firm.

🗣️ The StudyLingua group, a Switzerland-based company that provides Education Administration Programs, acquired Aventure Linguistique, a French-Swiss based language travel agency.

📅 Economic Calendar

Anticipate key economic indicators focusing on Balance of Trade, GDP, and Inflation. Japan, Canada Interest rate decisions next week.

Thursday January 18th 2024

🇺🇸 US - Building Permits Prel, December

🇯🇵 Japan - Inflation Rate YoY, December

🇬🇧 UK - Retail Sales MoM, December

🇺🇸 US - Michigan Consumer Sentiment (Preliminary), January

Friday January 19th 2024

🇯🇵 Japan - Inflation Rate YoY, December

🇬🇧 UK - Retail Sales MoM, December

🇺🇸 US - Michigan Consumer Sentiment (Preliminary), January

Tuesday January 23th 2024

🇦🇺 Australia - NAB Business Confidence, December

🇯🇵 Japan - BoJ Interest Rate Decision

Wednesday January 24th 2024

🇯🇵 Japan - Balance of trade, December

🇩🇪 Germany - HCOB Manufacturing PMI (Preliminary), January

🇨🇦 Canada - BoC Interest Rate Decision

Thursday January 25th 2024

🇩🇪 Germany - Ifo Business Climate, January

🇺🇸 US - Durable Goods Orders MoM, December

🇺🇸 US - GDP Data, Q4

Friday January 26th 2024

🇩🇪 Germany - GfK Consumer Confidence , February

🇺🇸 US - Personal Income and Expenditure Data, December