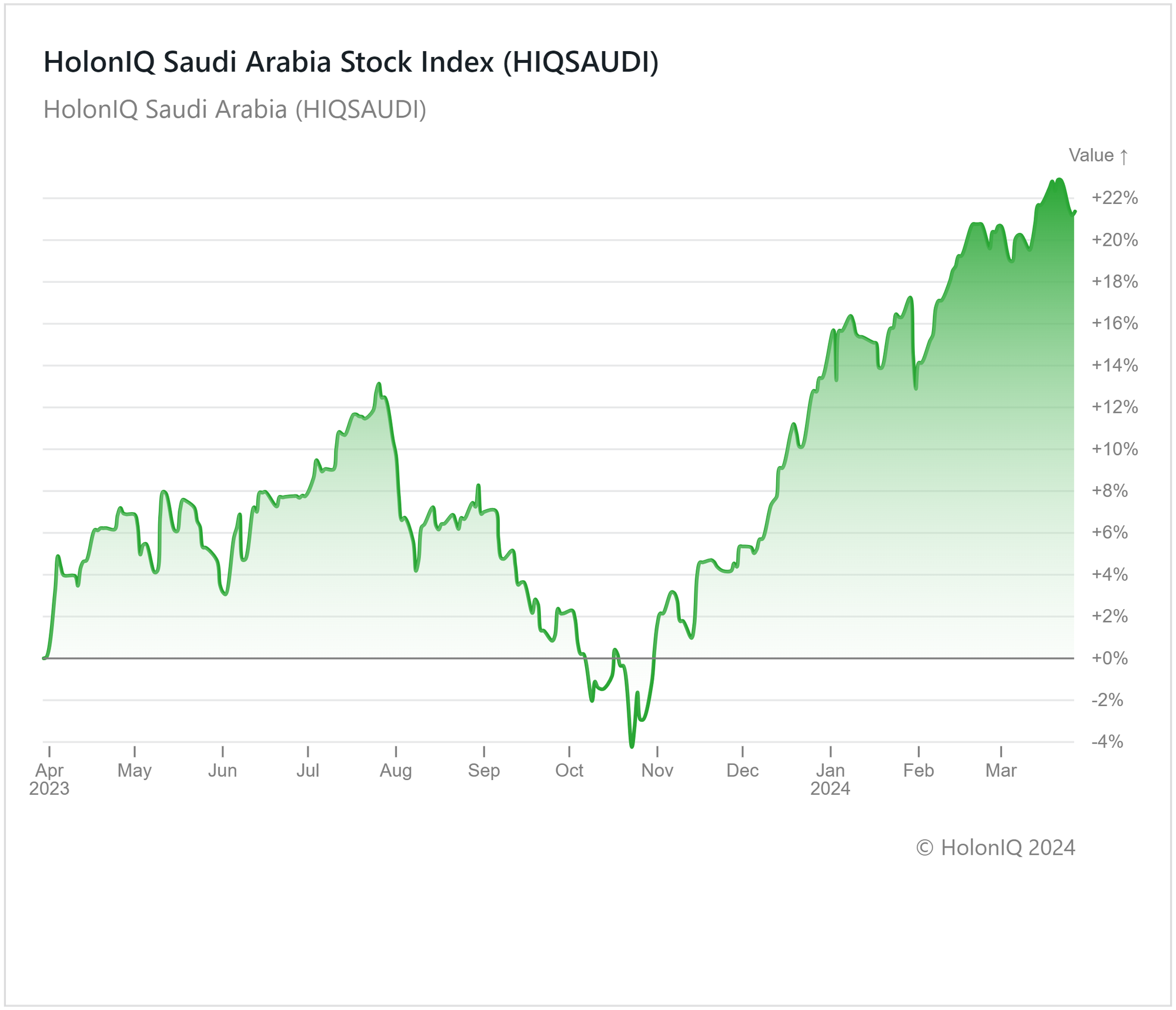

🐪 Saudi Arabia Stock Index Up 19%. $375M+ VC Funding.

Impact Capital Markets #60 looks at HolonIQ's Saudi Arabia stock index, major impact deals, M&A, and upcoming economic releases.

Xin chào 🍜

📉 Today's Global Economic Update: US GDP Growth Data revealed an expansion of 3.4% in Q4 2023, slightly higher than the previously reported 3.2%. The growth was driven by strong consumer spending and non-residential business investments.

💡 Deal of the Day: Lightshift Energy, a utility-scale energy storage development company, raised a $100M Series B to accelerate sales.

What's New?

- 🐪 Saudi Arabia. Saudi Arabia stock index up 19%

- 💰 Funding. Utility, cybersecurity, telehealth & more

- 💼 M&A. Optometry education & childcare

- 📅 Economics. Inflation, US personal income & spending, employment data + more

🐪 Saudi Arabia Stock Index Up 19%

Despite a slowdown in Saudi Arabia's GDP in 2023 due to observed oil supply cuts, HolonIQ's Saudi Arabia index has increased by 19%. Major stocks within the index also increased. ACWA Power Co ($66B MCap) displayed an increase of 143%, while Saudi National Bank ($65B MCap) and Al Rajhi Bank ($89B MCap) saw a 21% and 16% rise, respectively.

Investor confidence in Saudi Arabia has been strengthened by the introduction of business-friendly policies and regulatory reforms that align with global standards. The expansion of the stock exchange to encompass a broader array of sectors, coupled with initiatives aimed at enhancing foreign ownership limits, has attracted substantial interest from international investors. Saudi Arabia's 'Vision 30' program, which aims to promote economic diversification of the local economy beyond the oil sector, will further enhance Saudi Arabia's business-friendly environment, providing a positive outlook for stocks in our index.

💰 Funding

💡 Lightshift Energy, a Virginia-based company specializing in battery storage technology, raised a $100M Series B from Greenbacker Group to accelerate sales.

🔒 Coro, a NYC-based cybersecurity platform, raised a $100M Series D from One Peak to accelerate global expansion.

🩺 Pelago, a New York-based telehealth company, raised a $58M Series C from

Atomico to advance its clinical research efforts.

💊 Aeovian Pharmaceuticals, a California-based biopharmaceutical company, raised a $50M Series A from Hevolution to support clinical trials of its products.

🏥 Surge, a French company specializing in immune system analysis, raised a $8M Seed from Eurazeo to enable the opening of SurgeLab, its laboratory dedicated to researching immune biomarkers.

💼 M&A

🎓 Axcel Learning, an NYC-based professional education company, acquired KMK Optometry, a Nebraska-based optometry education center.

🧒 Wonderschool, a California-based provider of a childcare platform, acquired EarlyDay, a Florida-based early childhood career marketplace.

📅 Economic Calendar

Inflation, US Personal Income & Spending, Employment Data + More

Friday, March 29th 2024

🇫🇷 France Inflation Data (Preliminary), March

🇮🇹 Italy Inflation Data (Preliminary), March

🇺🇸 US Personal Income & Spending Data, February

Monday, April 1st 2024

🇯🇵 Japan Tankan Large Manufacturers Index, Q1

🇨🇳 China Caixin Manufacturing PMI, March

🇺🇸 US ISM Manufacturing PMI, March

Tuesday, April 2nd 2024

🇦🇺 Australia RBA Meeting Minutes

🇩🇪 Germany Inflation Data (Preliminary), March

🇺🇸 US JOLTs Job Openings, February

Wednesday, April 3rd 2024

🇪🇦 Euro Area Inflation Data, March

🇺🇸 US ISM Services PMI, March

Friday, April 5th 2024

🇦🇺 Australia Balance of Trade Data, February

🇨🇦 Canada Balance of Trade Data, February

🇨🇦 Canada Employment Data, March

🇺🇸 US Employment Data, March

🇨🇦 Canada Ivey PMI, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com