🚂 Rail Index Up 70%. $140M+ VC Funding.

Impact Capital Markets #52 looks at our Rail stock index, major impact deals, M&A, and upcoming economic releases.

Merhaba ☕

📉 Today's Global Economic Update: The Bank of Japan (BoJ) raised its short-term interest rate from -0.1% to a range of 0%-0.1%, marking its first hike since 2007, in a move that was widely expected by markets. Policymakers have indicated that there are no immediate plans for further rate hikes, but further effects of this decision on the currency and bond markets can be expected in the coming months.

💉 Deal of the Day: Carlsmed, a medical technology provider, raised a $52.2M Series C to speed up the development of its platform tailored to assist in spine fusion surgeries.

What's New?

- 🚂 Rail. Rail index climbs 70%

- 💰 Funding. Cleantech, medical devices, digital health & more

- 💼 M&A. Carbon capture, digital data provider & more

- 📅 Economics. Major interest rate decisions, retail sales data, inflation + more

For unlimited access to more deals and economic updates, request a demo

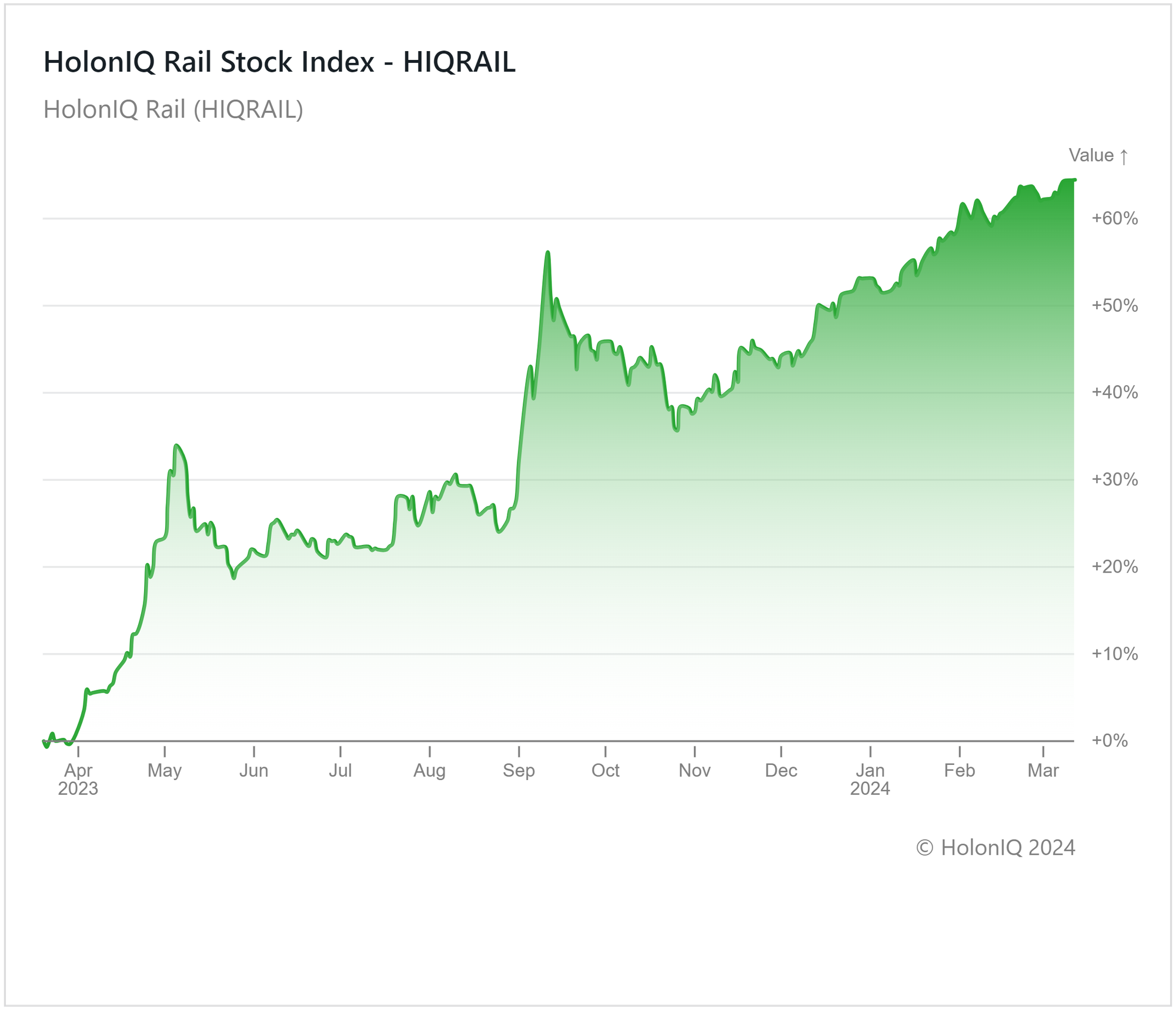

🚂 Rail Index Climbs 70%

HolonIQ's Rail Index has seen strong growth, increasing by 70% over the past year. Major stocks, including Union Pacific Corp. ($149B MCap), Canadian Pacific Kansas City ($84B MCap), and Canadian National Railway Co. ($83B MCap) have experienced notable gains, with increases of 29%, 16%, and 13%, respectively.

Railway stocks are on the rise as governments globally increase their investments in railway infrastructure. This increased spending has led to funds being channeled towards sustainable transportation solutions, driven by environmental considerations. New technologies like high-speed rail networks and innovative train designs are boosting rail efficiency, driving up demand for railway stocks. A growing inflow of foreign investment into the sector, specifically in developing countries, is also opening up new paths for growth and expansion. Against the backdrop of escalating urbanization and the growing need for efficient transportation solutions, railway stocks are gaining traction as a promising investment prospect on a global scale.

💰 Funding

💉 Carlsmed, a California-based medical technology provider, raised a $52.2M Series C from U.S. Venture Partners & B Capital to speed up the development of its platform tailored to assist in spine fusion surgeries.

🌬️ Mission Zero Technologies, a UK-based cleantech startup offering direct air carbon capture services, raised a $27.6M Series A from 2150 to develop technology that will increase the volume of CO₂ captured.

🔬 Spineart, a Swiss medical device company, raised $22.6M in Convertible Financing to open a new R&D and Training Center in Texas.

🧬 Pandorum Technologies, an Indian biotechnology company, raised $11M to expand operations and improve its R&D efforts.

🩺 UpHill, a Portuguese digital health startup, raised a $7.6M Series A from Explorer Investments to scale its operations internationally.

💼 M&A

🌿 TotalEnergies, a French energy and petroleum company, acquired Talos Low Carbon Solutions, a Texas-based carbon capture and storage (CCS) business.

📊 Sensor Tower, a California-based digital economy data provider, acquired data.ai, a California-based market intelligence platform.

👓 Oakley Capital, a UK-based private equity investor, acquired a majority stake in Horizons Optical, a manufacturer of eyeglasses based in Spain.

📅 Economic Calendar

Major Interest Rate Decisions, Retail Sales Data, Inflation + More

Tuesday, March 19th 2024

🇩🇪 Germany ZEW Economic Sentiment Index, March

🇺🇸 US Building Permits (Preliminary), February

🇨🇦 Canada Inflation Data, February

Wednesday, March 20th 2024

🇬🇧 UK Inflation Data, February

🇺🇸 US Fed Interest Rate Decision

🇺🇸 US FOMC Economic Projections

Thursday, March 21st 2024

🇺🇸 US Fed Press Conference

🇯🇵 Japan Balance of Trade Data, February

🇩🇪 Germany HCOB Manufacturing PMI (Flash), March

🇬🇧 UK BoE Interest Rate Decision

Friday, March 22nd 2024

🇯🇵 Japan Inflation Data, February

🇬🇧 UK Retail Sales Data, February

🇩🇪 Germany Ifo Business Climate Index, March

Tuesday, March 26th 2024

🇦🇺 Australia Westpac Consumer Sentiment Index, March

🇩🇪 Germany GfK Consumer Confidence Index, April

🇺🇸 US Durable Goods Orders Data, February

Thursday, March 28th 2024

🇺🇸 US Core PCE Price Index Data, February

🇺🇸 US GDP Growth Data, Q4

Friday, March 29th 2024

🇫🇷 France Inflation Data (Preliminary), March

🇮🇹 Italy Inflation Data (Preliminary), March

🇺🇸 US Personal Income & Spending Data, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com