🫀 Pulse-Field Ablation + MENA Health Tech 50

A novel approach for treating atrial fibrillation, pulsed-field ablation employs electrical pulses to target and impair heart cells, presenting various potential benefits compared to conventional thermal ablation methods.

Happy Monday 👋

Pulsed-field ablation (PFA) is a new method for treating atrial fibrillation (AF). This technique utilizes electrical pulses to damage heart cells and offers several potential advantages over traditional thermal ablation techniques. In the Health Tech landscape, we revisit the 2023 MENA Health Tech 50, highlighting the region's most promising startups in the health technology sector.

This Week's Topics

🫀 Pulse-Field Ablation. Exploring the latest technology in heart treatments

📊 Charts Spotlight. Managing drug dispensing is the most common shortage management strategy among pharmacies

📈 China Biotech Index. Continuation of a downward trend since 2023

🏆 MENA 50. MENA's most promising startups working in digital health, biotech, drug discovery, and analytics

📖 Annual Health Tech Outlook. 190+ pages of trends, insights, and data

💰 Health Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Health Tech Outlook and sign up for our Daily Newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

🫀 Pulse-Field Ablation

Pulsed-field ablation (PFA) is a new method for treating atrial fibrillation (AF). This technique utilizes electrical pulses to damage heart cells and offers several potential advantages over traditional thermal ablation techniques. PFA may carry a lower risk to surrounding tissues, reduce procedure times, and demonstrate good initial efficacy. However, further investigation is needed to determine optimal settings and assess long-term durability.

Major MedTech companies are beginning to enter this field. In December 2023, Medtronic became the first MedTech firm to secure FDA approval for its PFA system, PulseSelect. In February, the company completed the first commercial cases through the system and received regulations from Japan for commercial operations in May. J&J filed for approval for its Varipulse system, where the clinical trial data showed that 80% of patients who received treatment at the one-year mark did not experience atrial arrhythmia recurrence.

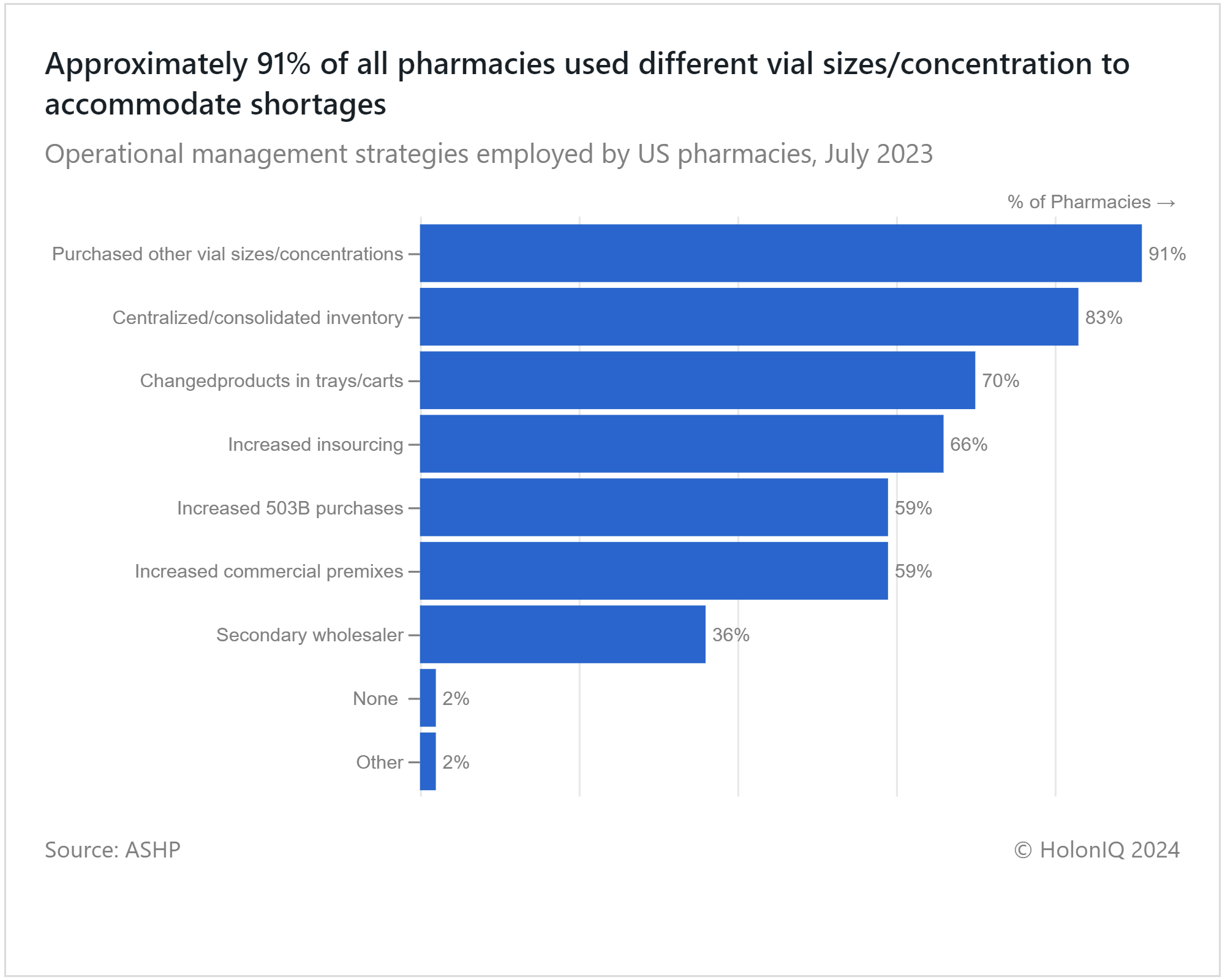

📊 Charts Spotlight - Managing Drug Dispensing is the Most Common Shortage Management Strategy

Subscribe to HolonIQ's 'Chart of the Day,' a daily newsletter that helps explain the global impact economy, from climate tech to education and healthcare.

Drug shortages pose significant risks to healthcare, impacting patient safety and medical procedures. A survey by the ASHP revealed that 57% of respondents faced shortages of chemotherapy drugs, followed by corticosteroid and hormonal drugs (28%), oral liquids (22%), and crash cart drugs (18%). Operational strategies are being considered, including finding alternative sources, utilizing different preparation methods, and compounding. Addressing these shortages may necessitate healthcare providers to alter their purchasing practices, such as using different vial sizes and concentrations. This approach offers flexibility in medication administration and dosage adjustments, reducing the risk of treatment interruptions and patient harm which could be why the graph indicates 91% employment. Moreover, organizations may have shifted inventories of shortage drugs to centralized locations or patient care areas, enhancing oversight and monitoring.

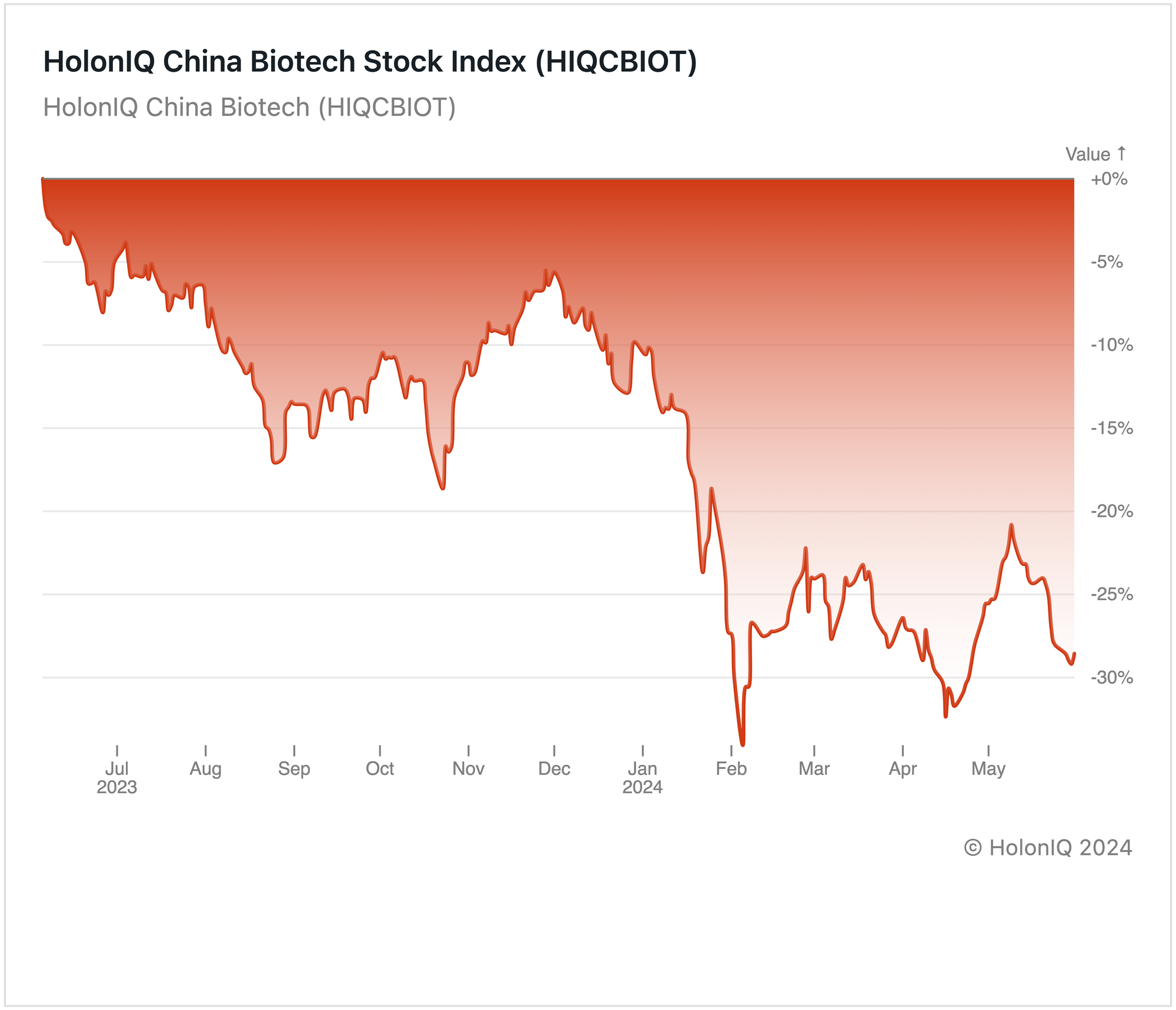

📈 Capital Markets - China Biotech Index on a Downward Trend

HolonIQ tracks hundreds of listed health companies worldwide, as well as acquisitions and investment transactions. Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

Since Q2 2022, the China Biotech index has experienced a persistent downward trend, currently around -30% over the past year. Although there was a slight deceleration in the downtrend during Q4 2023, it resumed at the beginning of the year, reaching its lowest point in February, dropping to around 35%. This decline in Chinese biotech companies, exemplified by firms like WuXi AppTec Co ($17B MCap) is primarily attributed to the US extending its crackdown on Chinese firms to the biotechnology sector. A proposed bill prohibits federally funded medical providers from contracting with certain Chinese biotech firms due to "national security" concerns. The immediate financial repercussions of these measures are evident in the stock market, with significant drops in the share prices of affected companies.

Moreover, there has been a substantial reduction in funding for biotech, especially from US venture capital funds, which have slashed investment in Chinese biotech groups by over half in the past two years. Additionally, growth is slowing as demand for Covid-19 vaccines decreases, impacting companies that experienced a surge during the pandemic, as seen in key stocks in the index like Imeik Technology Development Co Ltd ($9B MCap), Shanghai Fosun Pharmaceutical Co Ltd. ($8B MCap), and China Resources Sanjiu Medical & Pharmaceutical Co., Ltd. ($8.5B MCap) showed a year-over-year decline of 39%, 37%, 9% respectively.

Nevertheless, the resilience of the Chinese biotech sector shines through despite these challenges, laying the groundwork for future growth. Through strategic partnerships and proactive navigation of global dynamics, these firms are well-positioned for success, making significant global contributions to healthcare and scientific advancements.

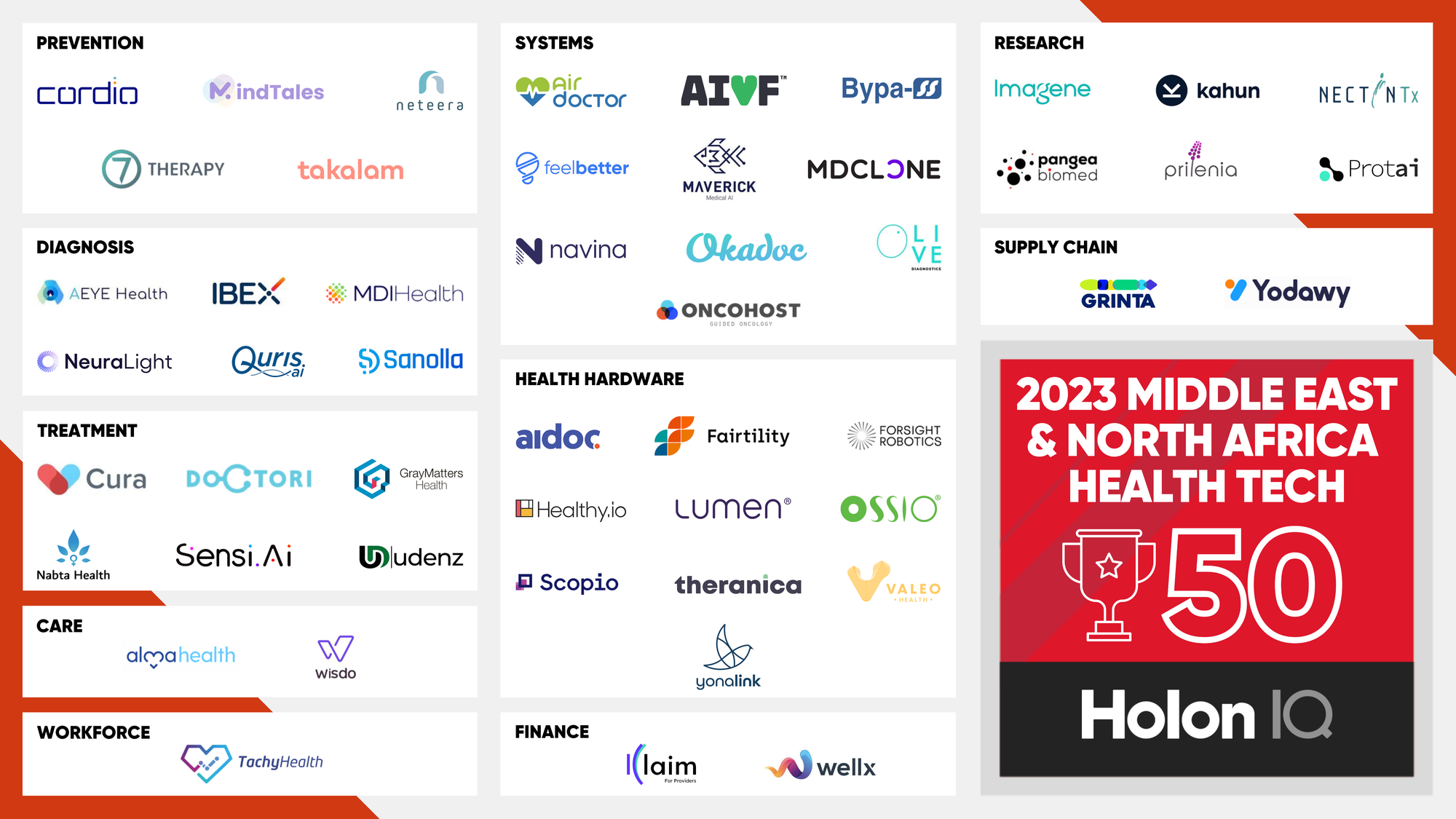

🏆 MENA Health Tech 50

The 2023 MENA Health Tech 50 is HolonIQ’s annual list of the region's most promising startups in digital health, biotech, drug discovery, and analytics.

One of the cohort members secured vital regulatory approval in April. AEYE Health (an Israeli AI-based diagnostic firm) received FDA clearance for its AI system that diagnoses diabetic retinopathy from retinal images captured by a handheld camera. This portable solution is suited for point-of-care screening, potentially addressing a leading cause of blindness.

📊 2024 Global Health Tech Outlook

HolonIQ's annual analysis of the evolving Health Tech landscape offers over 190 pages of in-depth insights on market data, investments, strategic shifts, and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report.

💰 Health Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the health industry across all regions of the world. Subscribe to our daily Impact Capital Markets newsletter to catch up on the top deals each day.

M&A

🎗️ Nordson, a US-based firm that produces equipment for testing and inspection, acquired Atrion Medical for $800M, a producer of medical devices and components that produces a wide range of items for specific niche markets.

🧠 Merck, a US-based biopharmaceutical company, plans to acquire Eyebio for $3B, a biotech firm that specializes in developing therapeutics for ophthalmology.

IPOs/Other Public Offerings

🩺 Waystar, a healthcare payment processor, is looking to raise around $1B through an IPO.

🔬 Rapport Therapeutics, a biotech company developing small molecule therapies, for central nervous systems disorders has filed to raise up to $100M through an IPO.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com