📖 Publishers Index Rises 21%. $25M+ VC Funding.

Impact Capital Markets #126 looks at our Publishers Stock Index, major impact deals, M&A, and upcoming economic releases.

Bawo 🍁

📈 Today's Global Economic Update: The annual inflation rate in France decreased to 2.1% in June 2024, the lowest since August 2021, from 2.3% in May, driven by lower increases in food and energy prices. The data comes as financial markets have seen volatility due to the ongoing French elections.

🧬 Deal of the Day: Waypoint Bio, a New York-based cell therapy company, raised a $14.5M Seed to advance product development.

What's New?

📖 Publishers. Publishers index rises 21%

💰 Funding. Cell therapy, healthcare workflow management, and bio startups

💼 M&A. Elara caring acquires caregivers home health

📅 Economics. US inflation, Euro Area inflation, balance of trade + more

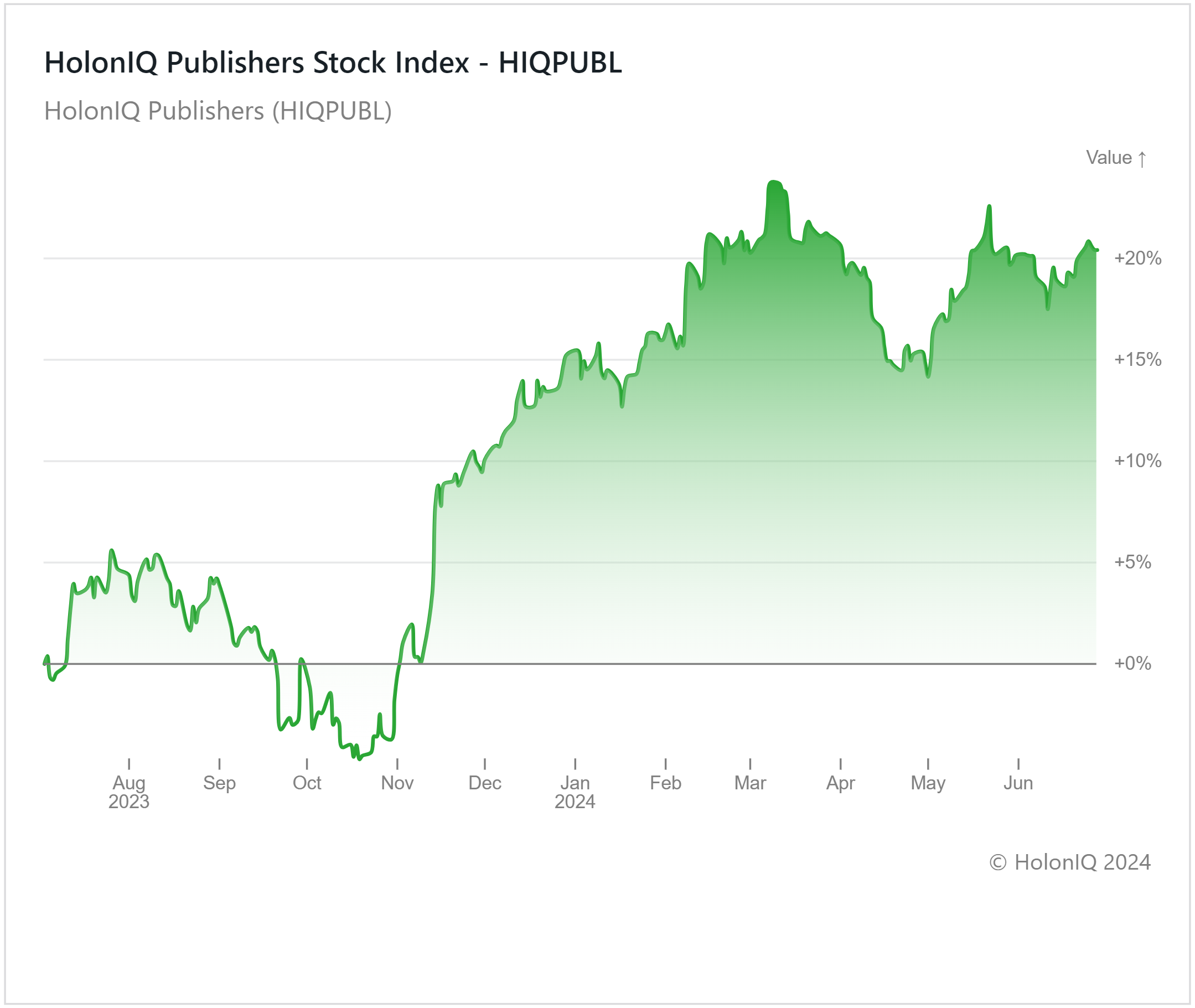

📖 Publishers Index Rises 21%

HolonIQ’s Publisher index has experienced a 21% rise over the past year. The industry's recovery from COVID-era challenges driven by the shift towards digitalization, has increased sales of ebooks and online subscriptions. AI adaptations by firms have significantly impacted the index, with investors expressing mixed views about these changes. Pearson ($8B MCap) announced that it will expand its generative AI study tools into their ebooks & learning platforms for university students internationally. Informa’s ($14B MCap) stock prices increased alongside a deal with Microsoft to provide data access to improve the tech company's AI capabilities. Both Pearson & Informa expanded its share buyback programs supported by strong financial performance.

AI poses significant challenges for smaller publishing companies and individual publishers, with content creators increasingly worried about copyright protection. The incorporation of AI into Google's search features, Microsoft's Copilot, and OpenAI offers users direct answers to queries rather than directing them to original content. As a result, paid subscription numbers are declining, significantly affecting publishing company sales. Given the mixed market sentiment and the rising demand for study materials fueled by advancements in EdTech, the index is expected to grow, though it's likely to experience periods of volatile movements.

💰 Funding

🧬 Waypoint Bio, a New York-based cell therapy company, raised a $14.5M Seed from Hummingbird Ventures to advance product development.

🩺 Synthpop, a New York-based AI-driven healthcare workflow platform, raised a $5.6M Seed to hire additional engineers and enhance software development.

💡 Helical, a Luxembourg-based AI-for-bio startup, raised $2.4M to build an open-source platform for large language models trained on DNA and RNA data.

💼 M&A

🏠 Elara Caring, a Texas-based multi-state home health provider, acquired Caregivers Home Health, a Virginia-based home health services company.

📅 Economic Calendar

US Inflation, Euro Area Inflation, Balance of Trade + More

Monday, July 1st 2024

🇩🇪 Germany Inflation Data (Preliminary), June

🇺🇸 US ISM Manufacturing PMI, June

Tuesday, July 2nd 2024

🇪🇦 Euro Area Inflation Data, June

🇺🇸 US JOLTs Job Openings Data, May

Wednesday, July 3rd 2024

🇨🇦 Canada Balance of Trade, May

🇺🇸 US ISM Services PMI, June

🇦🇺 Australia Balance of Trade, May

Friday, July 5th 2024

🇨🇦 Canada Employment Data, June

🇺🇸 US Employment Data, June

🇨🇦 Canada Ivey PMI s.a, June

Monday, July 8th 2024

🇩🇪 Germany Balance of Trade, May

🇦🇺 Australia Westpac Consumer Confidence Change, July

🇦🇺 Australia WNAB Business Confidence Index, June

Tuesday, July 9th 2024

Thursday, July 11th 2024

🇬🇧 UK GDP Data, May

🇺🇸 US Core Inflation Data, June

🇺🇸 US Inflation Data, June

Friday, July 5th 2024

🇺🇸 US PPI Data, June

🇺🇸 US Michigan Consumer Sentiment (Preliminary), July

🇨🇳 China Balance of Trade, June

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com