💊 Pharmaceutical Index Stalls. $360M+ VC Funding.

Impact Capital Markets #70 looks at our Pharmaceutical index stock index, major impact deals, M&A, and upcoming economic releases.

Zdravo 🍷

📉 Today's Global Economic Update: At the European Central Bank's (ECB) policy meeting yesterday, policymakers signaled a potential rate cut in June while opting to keep rates unchanged in April. The decision follows a steeper-than-expected fall in Eurozone inflation in March, which closed in on the ECB's 2% inflation target.

💉 Deal of the Day: Nectero Medical, a clinical-stage biotechnology company, raised a $96M Series D to support the submission of a New Drug Application (NDA) with the U.S.

What's New?

💊 Pharmaceutical. Pharmaceutical index 3M returns flatline

💰 Funding. HR, biotech, solar energy + more

💼 M&A. Network, advertising & packaging

📅 Economics. China GDP, Japan inflation + more

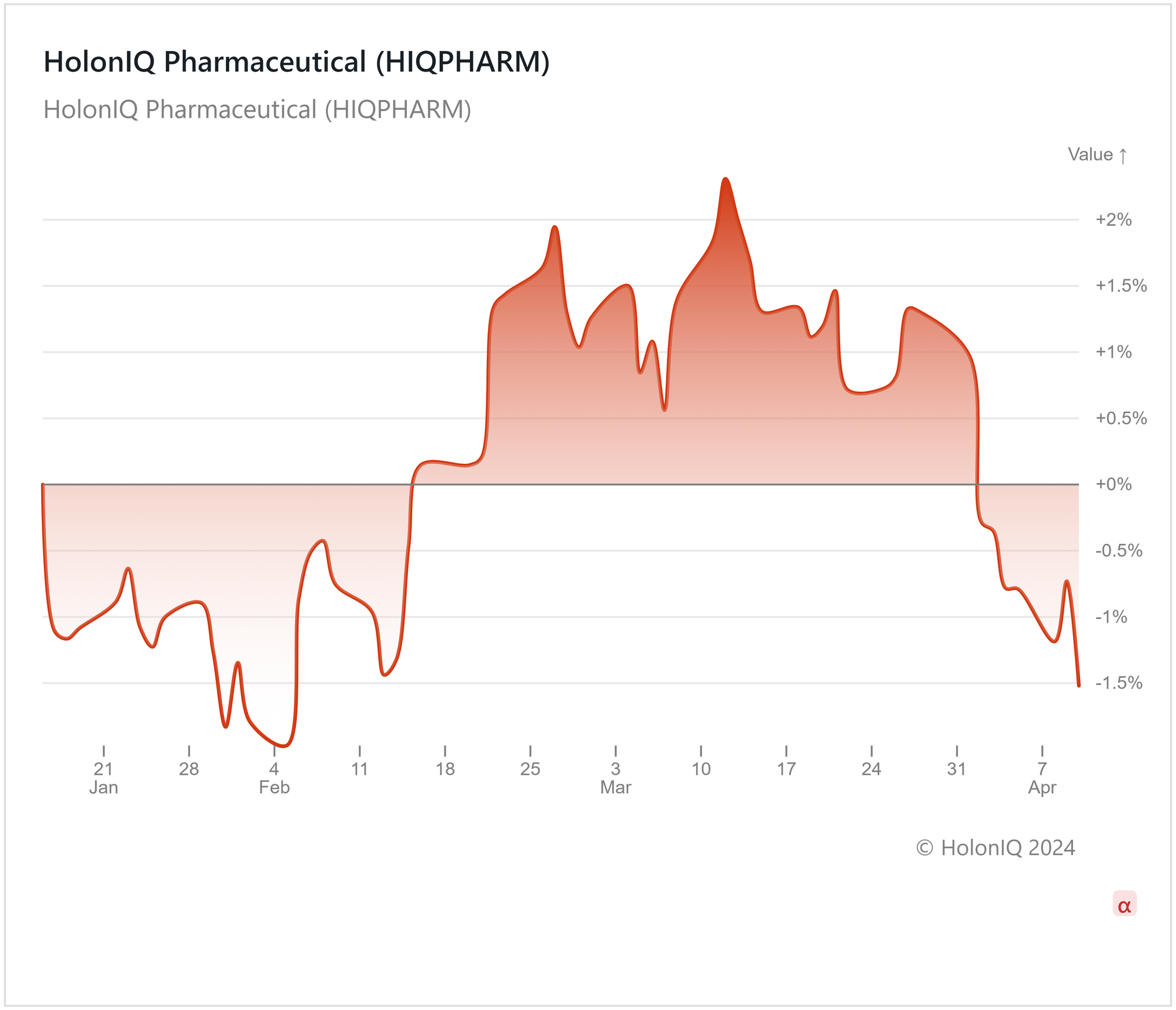

💊 Pharmaceutical Index 3M Returns Flatline

HolonIQ’s Pharmaceutical index has seen limited movement over the past 3 months. Key stocks in the index displayed mixed performance with Eli Lilly & Co. ($724B MCap) gaining 18% and Johnson & Johnson ($359B MCap) falling by 7%. This stagnation aligns with the broader trend in the index, which has been moderating since November. While Eli-Lily and Novo Nordisk have seen some impressive growth in diabetes management drugs, cheaper alternatives are seeking entrance to the market. Hangzhou Jiuyuan Gene Engineering developed a biosimilar with similar properties to Ozempic, Novo Nordisk's weight loss drug, and is currently seeking approval in China. The entrance of such alternatives will pose a challenge to drug offerings by these major pharmaceutical firms.

In a development that could have ongoing impacts on the index, Swiss Pharma giant Novartis ($208B MCap) announced a layoff in April, which saw 680 employees being released, while the company also paused its clinical trial for a cancer drug citing concerns surrounding experimental impurities. As Novartis becomes more efficient through the restructuring process, it could potentially pull the index in a positive direction. Recent acquisition activities by AstraZeneca and Bristol Myers Squibb may provide an impetus for some positive momentum to the index as well.

💰 Funding

💉 Nectero Medical, a Delaware-based clinical-stage biotechnology company, raised a $96M Series D from Norwest Venture Partners to accelerate the execution of its Phase II/III trials and to support the submission of a New Drug Application (NDA) with the U.S.

👥 Factorial, a Spanish human resources company, raised $80M from General Catalyst to support growth efforts and to invest in product development and engineering.

🌞 Arcadia, a Washington-based climate software and data company, raised $50M from Macquarie Asset Management to grow its community solar program.

🔋 Apricus Generation, a Florida-based solar energy holding company, raised a $28M Series A to team up with developers and guide solar and battery projects.

📚 Abre, an Ohio-based K-12 data solution company, raised a $24M Series A from PeakSpan Capital to support innovation in focus areas.

🧪 DeepCure, a Massachusetts-based AI drug discovery company, raised a $24M Series A from IAG Capital Partners to progress its immunology and inflammation pipeline.

💼 M&A

🎯 JobCannon, a Ukraine-based recruitment startup, acquired Adsme, an advertising and marketing startup in Ukraine.

📦 Zeus Packaging Group, an Irish packaging company, acquired Weedon Group, a UK-based independent integrated corrugated manufacturer.

🌐 Postman, a California-based API collaboration company, acquired Orbit, a community growth platform provider in California.

📅 Economic Calendar

China GDP, Japan Inflation + More

Friday, April 12th 2024

🇺🇸 US United States Michigan Consumer Sentiment (Preliminary), April

Monday, April 15th 2024

🇺🇸 US Retail Sales Data, March

🇨🇳 China GDP Growth Data, Q1

🇨🇳 China Industrial Production Data, March

🇨🇳 China Retail Sales Data, March

Tuesday, April 16th 2024

🇬🇧 UK Employment Data, February

🇩🇪 Germany ZEW Economic Sentiment Index, April

🇨🇦 Canada Inflation Data, March

🇺🇸 US Building Permits (Preliminary), March

🇯🇵 Japan Balance of Trade Data, March

Wednesday, April 17th 2024

Thursday, April 18th 2024

🇯🇵 Japan Inflation Data, March

Friday, April 19th 2024

🇬🇧 UK Retail Sales Data, March

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com