💊 Pharmaceutical Index Retraces Losses to Gain 4%. $504M+ VC Funding.

Impact Capital Markets #93 looks at our Pharmaceutical Index, major impact deals, M&A, and upcoming economic releases.

Hei 🏔️

📈 Today's Global Economic Update: The United Kingdom's unemployment rate reached 4.3% from January to March 2024, up slightly from 4.2% in the previous quarter. This suggests the Bank of England may cut interest rates in mid-2024, provided there are no unexpected changes in inflation.

☢️ Deal of the Day: Newcleo, an energy company, raised $94M to develop their advanced nuclear reactor technology and advance planned projects.

What's New?

💊 Pharmaceutical. Pharmaceutical index retraces losses to gain 4%

💰 Funding. Energy, biotechnology, cleaning solutions + more

💼 M&A. Cloud-based code visualization and waste removal

📅 Economics. US inflation data, retail sales, balance of trade + more

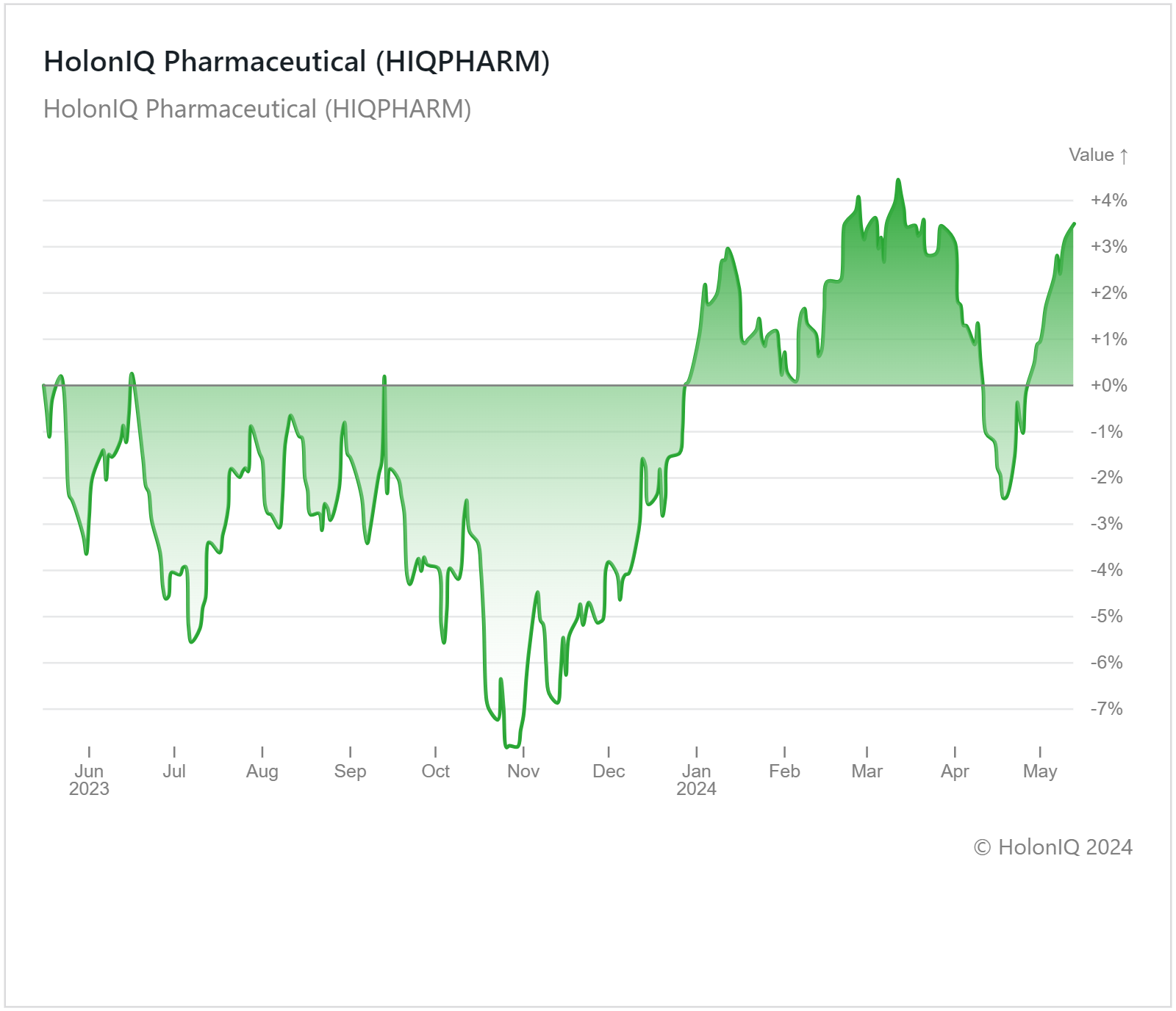

💊 Pharmaceutical Index retraces losses to gain 4%

Over the past twelve months, HolonIQ's Pharmaceutical Index has experienced a 4% gain, following months of fluctuation that saw the index dip as low as 18% in October 2023. Throughout much of 2023, pharmaceutical companies within the index faced a challenging operational landscape due to regulatory constraints, elevated interest rates, and revenue normalization following the COVID-19 pandemic. China's regulatory crackdown on the health industry also dampened investor confidence and led to lower returns for Chinese pharmaceutical stocks, exerting downward pressure on the index. However, the index indicates a turnaround, with the recent boost in weight loss drugs driving the positive outcomes of stocks within the index. Novo Nordisk ($447B MCap) reported a 28% increase in net profit in the 1Q 2024, as sales of its weight loss drug, Wegovy, more than doubled. Its stock price increased by 57% over the past year. Eli Lilly And Co ($726 MCap) also saw a 76% return, with strong sales of its drugs, Mounjaro, and Zepbound driving a 26% increase in revenue in Q1 2024.

Expectations are high for continued growth in the pharmaceutical sector, driven by improving macroeconomic conditions and the prospect of AI integration reshaping the industry. However, as legislation to control prescription drug costs marches on, this could squeeze pharmaceutical firms' profits. Likewise, tensions between the US and China could threaten the supply chains of several pharmaceutical companies, as Chinese firms constitute the largest makers of active pharmaceutical ingredients and are major suppliers of drugs to the EU and US.

💰 Funding

☢️ Newcleo, a UK-based energy company, raised $94M to develop their advanced nuclear reactor technology.

🧠 SmarterDx, a New York-based clinical AI platform designed to help hospitals realize revenue integrity, raised a $50M Series B from Transformation Capital to accelerate product innovation and identify new opportunities.

🧹 Gausium, a Chinese company providing self-operating cleaning solutions, raised a $50M Series D to expand operations.

🧬 Elegen, a California-based biotechnology company, raised a $35M Series B from Triatomic Capital to accelerate the development of their DNA synthesis technology.

🔬 Brixton Biosciences, a Massachusetts-based clinical-stage life sciences company, raised a $33M Series B from Schooner Capital to pursue clinical studies for the treatment of chronic knee pain.

👥 Gorgias, a California-based customer experience platform, raised $29M from SaaStr and Alven to enhance e-commerce customer support and continue refining its technology.

⚡️ Enspired, an Austrian AI energy trading company, raised a $27.5M Series B from Zouk Capital to expand into new markets.

👩💼 Sona, a UK-based intelligent workforce management platform, raised a $27.5M Series A from Felicis to broaden its market reach and enhance its AI capabilities.

💼 Sesame, a Spanish HR management startup, raised $24.8M from PSG and GP Bullhound to invest in product development and promote global growth.

🚚 Glydways, a California-based autonomous transport and clean energy tech firm, raised $20M to develop their on-demand Personal Rapid Transit (PRT) technology.

🏭 Ndustrial, a North Carolina-based real-time industrial intelligence platform, raised a $18.5M Series B from ABB and GS Energy to boost its growth.

💊 Truveris, a Delaware-based company specializing in pharmacy cost control, raised a $15M Series E from Canaan Partners and New Leaf Venture Partners to expand nationwide.

💼 M&A

💻 GitKraken, an Arizona-based provider of productivity and collaboration tools for developers, acquired CodeSee, a California-based platform to assist in understanding code.

🗑️ Belfor Franchise Group, a Michigan-based franchise company of service oriented brands, acquired JUNKCO+, a Kentucky-based waste removal and demolition company.

📅 Economic Calendar

US Inflation Data, Retail Sales, Balance of Trade + More

Wednesday, May 15th 2024

🇺🇸 US Core Inflation Data, April

🇺🇸 US Inflation Data, April

🇺🇸 US Retail Sales Data, April

Thursday, May 16th 2024

🇺🇸 US Building Permits (Preliminary), April

🇯🇵 Japan GDP Data (Preliminary), Q1

🇨🇳 China Industrial Production Data, April

🇨🇳 China Retail Sales Data, April

Friday, May 17th 2024

🇯🇵 Japan Inflation Data, April

🇯🇵 Japan Balance of Trade Data, April

Monday, May 20th 2024

🇦🇺 Australia Westpac Consumer Confidence Index, May

🇦🇺 Australia RBA Meeting Minutes

Tuesday, May 21st 2024

🇨🇦 Canada Inflation Data, April

🇯🇵 Japan Balance of Trade, April

Wednesday, May 22nd 2024

🇬🇧 UK Inflation Data, April

🇺🇸 US FOMC Minutes

Thursday, May 23rd 2024

🇩🇪 Germany HCOB Manufacturing PMI (Flash), May

🇯🇵 Japan Inflation Data, April

Friday, May 24th 2024

🇬🇧 UK Retail Sales Data, April

🇺🇸 US Durable Goods Orders Data, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com