💊 Pharma Up 3%. $650M+ Funding Across Impact Sectors.

Impact Capital Markets #13 looks at our Pharmaceutical Stock Index, major impact deals and acquisitions, and the upcoming big economic releases. For unlimited access to more deals and economic updates, request a demo.

Today's Topics

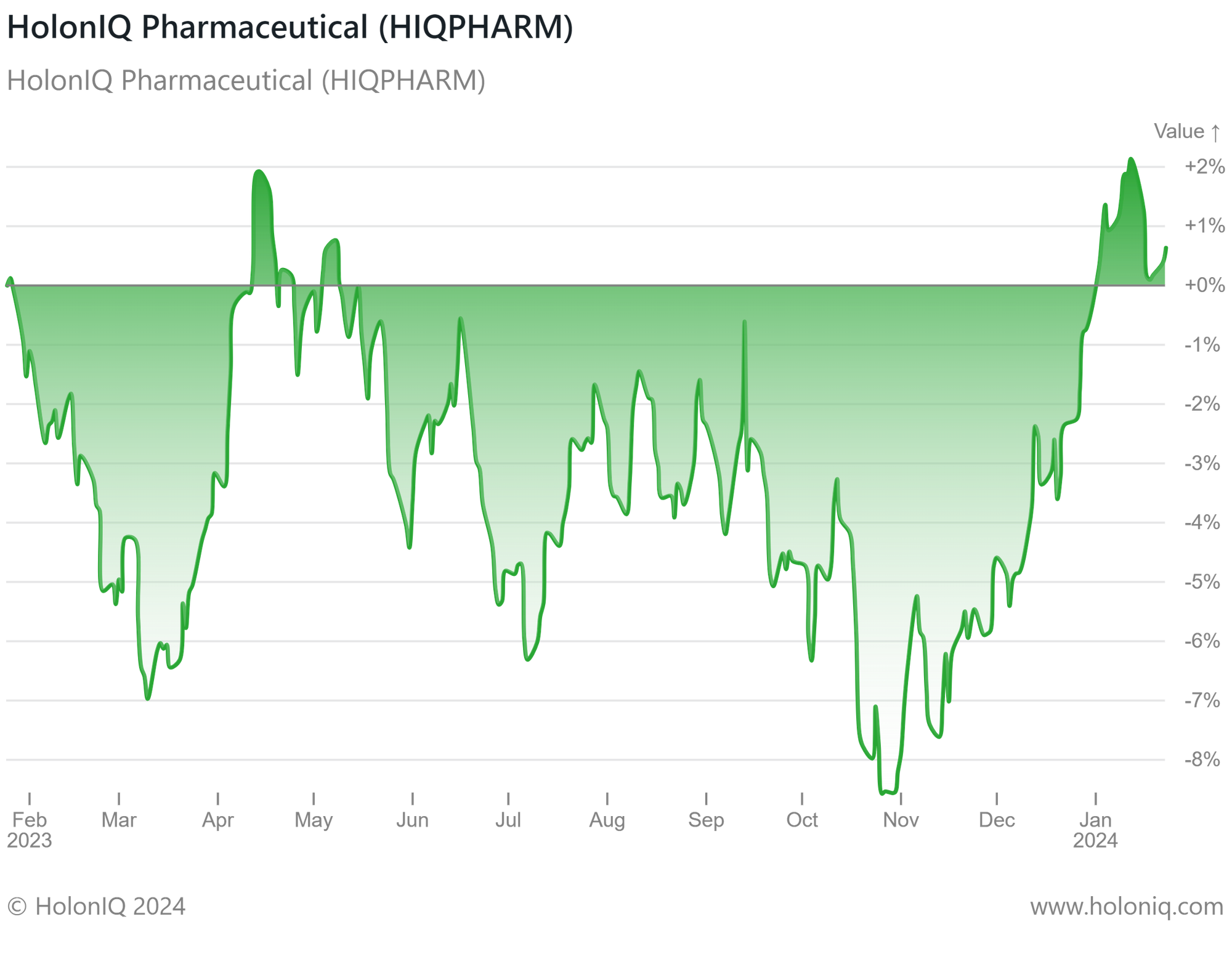

- 💊 Pharma. Pharma up 3% YoY after patchy 12 months.

- 💰 Funding. $650M+ Funding in Battery Storage, EV charging, Biotherapeutics, Climate Tech, & More.

- 💼 Acquisitions. Sanofi $1.7B acquisition + More in Drug Discovery, Online Education, BioTech, Sustainability

- 📅 Economics. Major Interest Rate Decisions in next 2 weeks. Euro Area GDP & Inflation Releases + More

Have feedback or ideas for us? Email hello@holoniq.com — we'd love to hear from you!

💊 Pharma Up 3% YoY After Patchy 12 Months

HolonIQ Pharmaceutical (HIQPHARM). 12-month indexed returns (returns on the index relative to the level on January 25, 2023) have been negative for most of the last 12 months. However, an improvement was seen towards the latter part of this period, with returns increasing to almost 3% in January 2024.

Among developments related to major pharmaceutical companies, prominent market leader Eli Lilly and Company (Market Cap: US$ 599B) announced in early July 2023 that their drug, ‘Donanemab’, slows the progression of Alzheimer's disease by a significant rate of 60% in its earliest stages. Johnson & Johnson (Market Cap: US$391B), top-ranked among biotech and pharmaceutical companies in the world, reported a cancer drug developed to maintain control over a prevalent form of metastatic lung tumor for an extended duration. This could also offer Johnson & Johnson a chance to compete with AstraZeneca (LON: AZN) in the cancer drug market.

Leveraging the rise of AI, pharma companies are starting to create therapies tailored to individual patient’s genetics, develop more effective drugs and treatments, and maintain data on their medical backgrounds.

💰 Funding

🔋 Instagrid, a Germany-based provider of portable battery storage, raised $95M Series C from Teachers’ Venture Growth. The funds will facilitate entry into the North American market, boost production, and expand its range of mobile power solutions for decarbonizing off-grid power.

🔌 Monta, a Danish EV charging company, raised a $87M Series B from Energize Capital, GreenPoint Partners, and Denmark’s state-backed Export and Investment Fund. The funds will be used to expand its EV charging management business across Europe and the US.

💊 Calluna Pharma, a Norwegian biotherapeutics company, raised a $81.7M Series A. The funds will advance clinical programs, research, operations, manufacturing, regulatory processes, and business development for its therapeutic pipeline over the next 2.5 years.

💉 Accent Therapeutics, a Massachusetts-based biopharmaceutical, raised a $75M Series C from Mirae Asset Capital Life Science to support the early clinical development of Accent's lead programs.

💊 SmithRx, a California-based pharmacy benefits management (PBM) company, raised a $60M Series C from Venrock to continue reducing the costs of pharmacy benefits for small and midsized self-insured businesses.

🧫 Elephas, a Wisconsin-based biotech company, raised $55M Series C from Venture Investors Health Fund and the State of Wisconsin Investment Board. The company intends to use the funds to expand operations and its business reach.

🌍 AiDash, a California-based climate tech company, raised $50M Series C from Lightrock to increase its headcount, establish its head quarters in Europe, and scale to meet growing international demand.

⚡ Welligence Energy Analytics, a Texas-based energy data & intelligence firm specializing in global oil and gas markets, raised $41M from Elephant. The funding will be used to further enhance its current products and geographical data coverage and expand into new energy research verticals.

🌾 Bluewhite, an Israel-based agricultural Robot-as-a-Service (RaaS) company, raised a $39M Series C from Insight Partners to further scale its agricultural autonomous tractor and farming solutions, and expand into new markets worldwide.

🏥 Turquoise Health, a California-based healthcare pricing platform, raised a $30M Series B from Adams Street Partners to support transparent pricing workflows across its customer base of over 160 healthcare organizations.

🧬 S2 Genomics, a California-based genomics technology firm, raised $16M Series A from BroadOak Capital Partners and Research Corporation Technologies (RCT). The funding will speed up S2 Genomics' adoption of its singular platform, enabling efficient tissue dissociation for single-cell analysis.

🦠 PhageLab, a Chile-based biotechnology company, raised $11M. The funding will enable PhageLab to advance its pipeline of phage-based solutions and establish a commercial position in Brazil.

❤️ CardioSignal, a Finland-based health tech company, raised a $10M Series A from DigiTx Partners. The funds will support additional clinical validation of CardioSignal’s breakthrough technology and the expansion of its commercial efforts.

☀️ Brite Solar, a Greek-founded energy solutions company, raised a $9.4M Series A from New Energy Partners. The funds will be used for the further development and installation of the solar glass production line, as well as for expanding their operations in Patras.

💼 Acquisitions

🧬 Sanofi, a French healthcare company announced that it has entered into a definitive agreement to acquire Inhibrx, a California-based clinical-stage biotechnology company for an approximate total value of $1.7B.

🧪 Oncodesign Services (ODS), a France-based Contract Research Organization specializing in drug discovery and preclinical services, acquired ZoBio, a Dutch CRO expert in biophysics-based small molecule drug discovery.

🎓 Intelvio, a healthcare education company based in Utah, has acquired Classward, an online provider of continuing education for aspiring and current EMS professionals based in Oregon.

⚗️ Monomoy Capital Partners, a New York-based private investment firm, acquired EnviroTech Services, a Colorado-based chemical company dealing in de-icing, anti-icing, dust control, soil stabilization, and erosion control.

🚛 Fin Sustainable Logistics, a UK-based transportation company specializing in zero-emission and sustainable parcel delivery, has acquired Urb-it, a Swedish-based sustainable delivery company that recently faced bankruptcy.

🌍 EVORA Global, a UK-based provider of tech-enabled sustainability solutions, acquired Metry, a Sweden-based platform for environmental data collection.

☀️ TotalEnergies, a French energy company has signed an agreement to acquire Kyon Energy, a Germany-based renewable energy semiconductor manufacturing firm.

⚡ Kraken, a UK-based tech firm, acquired Kwest, a Berlin-based tech start-up whose software platform enables energy installation businesses to streamline and automate operational processes.

📅 Economic Calendar

Major Interest Rate Decisions in next 2 weeks. Euro Area GDP & Inflation Releases + More

Wednesday January 24th 2024

🇯🇵 Japan - Balance of trade, December

🇩🇪 Germany - HCOB Manufacturing PMI (Preliminary), January

🇨🇦 Canada - BoC Interest Rate Decision

Thursday January 25th 2024

🇩🇪 Germany - Ifo Business Climate, January

🇪🇦 Euro Area - ECB Interest Rate Decision

🇺🇸 US - Durable Goods Orders MoM, December

🇺🇸 US - GDP Data, Q4

Friday January 26th 2024

🇩🇪 Germany - GfK Consumer Confidence , February

🇺🇸 US - Personal Income and Expenditure Data, December

Tuesday January 30th 2024

🇫🇷 France - GDP Data, Q4

🇮🇹 Italy - GDP Data, Q4

🇪🇦 Euro Area - GDP Data, Q4

🇺🇸 US - Employment Data, December

Wednesday January 31st 2024

🇦🇺 Australia - Inflation Data, Q4

🇨🇳 Canada - NBS Manufacturing PMI, January

🇯🇵 Japan - Consumer Confidence, January

🇫🇷 France - Inflation Data, January

🇩🇪 Germany - GDP Data, Q4

🇩🇪 Germany - Inflation Data, January

Thursday February 1st 2024

🇺🇸 US - Fed Interest Rate Decision

🇺🇸 US - Fed Press Conference

🇨🇳 Canada - Caixin Manufacturing PMI, January

🇪🇦 Euro Area - Inflation Data, January

🇮🇹 Italy - Inflation Data, January

🇬🇧 UK - BoE Interest Rate Decision

🇺🇸 US - ISM Manufacturing PMI, January

Friday February 2nd 2024

🇺🇸 US - Non Farm Payrolls, January

🇺🇸 US - Employment Data January

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com