⚕️Outcome-Based Reimbursements + SE Asia Health Tech 50

Value-based care shifts reimbursement towards outcomes, incentivizing quality, population health management, and cost reduction through financial metrics for sustainable, optimal healthcare results.

Happy Monday 👋

Value-based care shifts reimbursement towards outcomes, incentivizing quality, population health management, and cost reduction through financial metrics for sustainable, optimal healthcare results. In the Health Tech landscape, we revisit the 2023 Southeast Asia Health Tech 50, which highlights the region's most promising startups in the health technology sector.

This Week's Topics

⚕️ Value-based Care. Shifting from fee-for-service to rewarding patient outcomes

📊 Charts Spotlight. Human gene sequencing costs fell drastically since 2021

📈 Aged Care Index. Ends flat over the last three months

🏆 Southeast Asia Health Tech 50. South Asia's most promising startups working in digital health, biotech, drug discovery, and analytics

📖 Annual Health Tech Outlook. 190+ pages of trends, insights, and data

💰 Health Tech Deals of the Week. Funding, M&A and IPOs

Don't forget to check out the 2024 Global Health Tech Outlook and sign up for our Daily Newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

⚕️ Value-Based Care: Shifting from Fee-For-Service to Rewarding Patient Outcomes

Value-based care models represent a shift in healthcare reimbursement, moving away from fee-for-service structures towards rewarding providers based on patient outcomes. This approach incentivizes quality care, improved population health management, and cost reduction. These models typically involve financial metrics that track factors like hospital readmission rates, preventive care utilization, and chronic disease management. By focusing on these metrics, providers are encouraged to deliver efficient, evidence-based care that improves patient health while controlling costs. The long-term goal of value-based care is creating a sustainable healthcare system that provides optimal results for patients and payers.

A new playbook by AHIP, AMA, and NAACOS addresses best practices for value-based care arrangements in healthcare. This industry-wide effort aims to improve patient experience, population health, and cost reduction. Drawing on real-world examples, the playbook offers guidance across key areas like patient assignment, performance measurement, and incentivizing value-based practices. The collaborative approach ensures diverse perspectives and practical insights for implementing successful value-based payment and delivery models. This initiative is essential for physician success in achieving positive patient outcomes and financial optimization within the value-based care landscape.

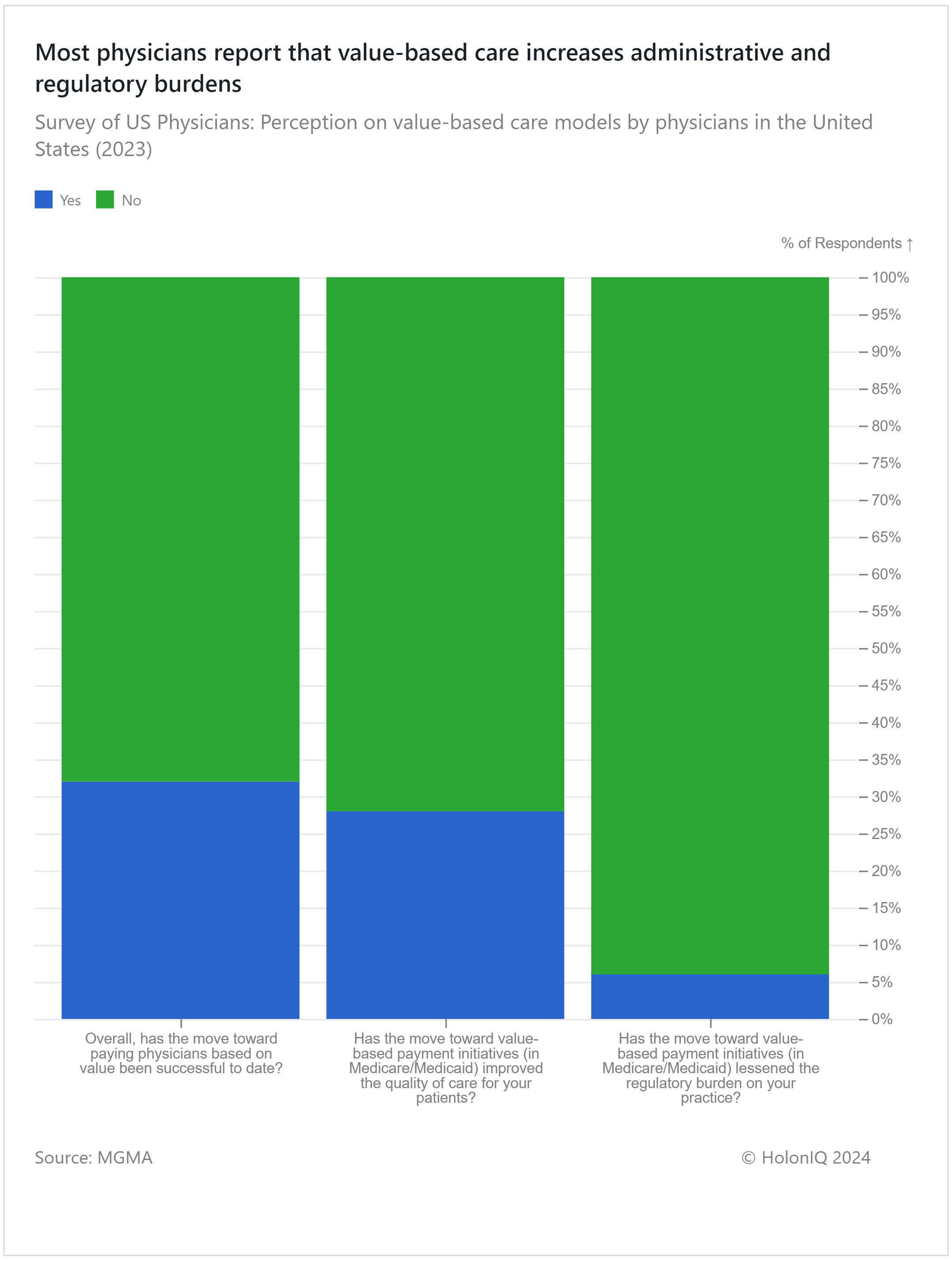

📊 Charts Spotlight - Physicians Report That Value-based Models Increase Burdens

Subscribe to HolonIQ's 'Chart of the Day,' a daily newsletter that helps explain the global impact of the economy, from climate tech to education and healthcare.

While value-based care intends to improve healthcare quality and efficiency, it bloats administrative burdens for healthcare providers. Value-based care necessitates substantial data collection and reporting on numerous parameters, which is time-consuming and costly, necessitating more personnel or software. The absence of consistent rules among insurers adds another degree of difficulty. Physicians experience delays owing to previous permission requirements, which impede patient treatment. Detailed documentation requirements to qualify for value-based compensation divert time away from patient care. While the program seeks long-term advantages, some physicians believe the existing system does not provide adequate financial compensation, making the administrative burden exceed the positives. Efforts are ongoing to reduce legislation and reporting and to make value-based care less difficult for physicians while still fulfilling its objectives.

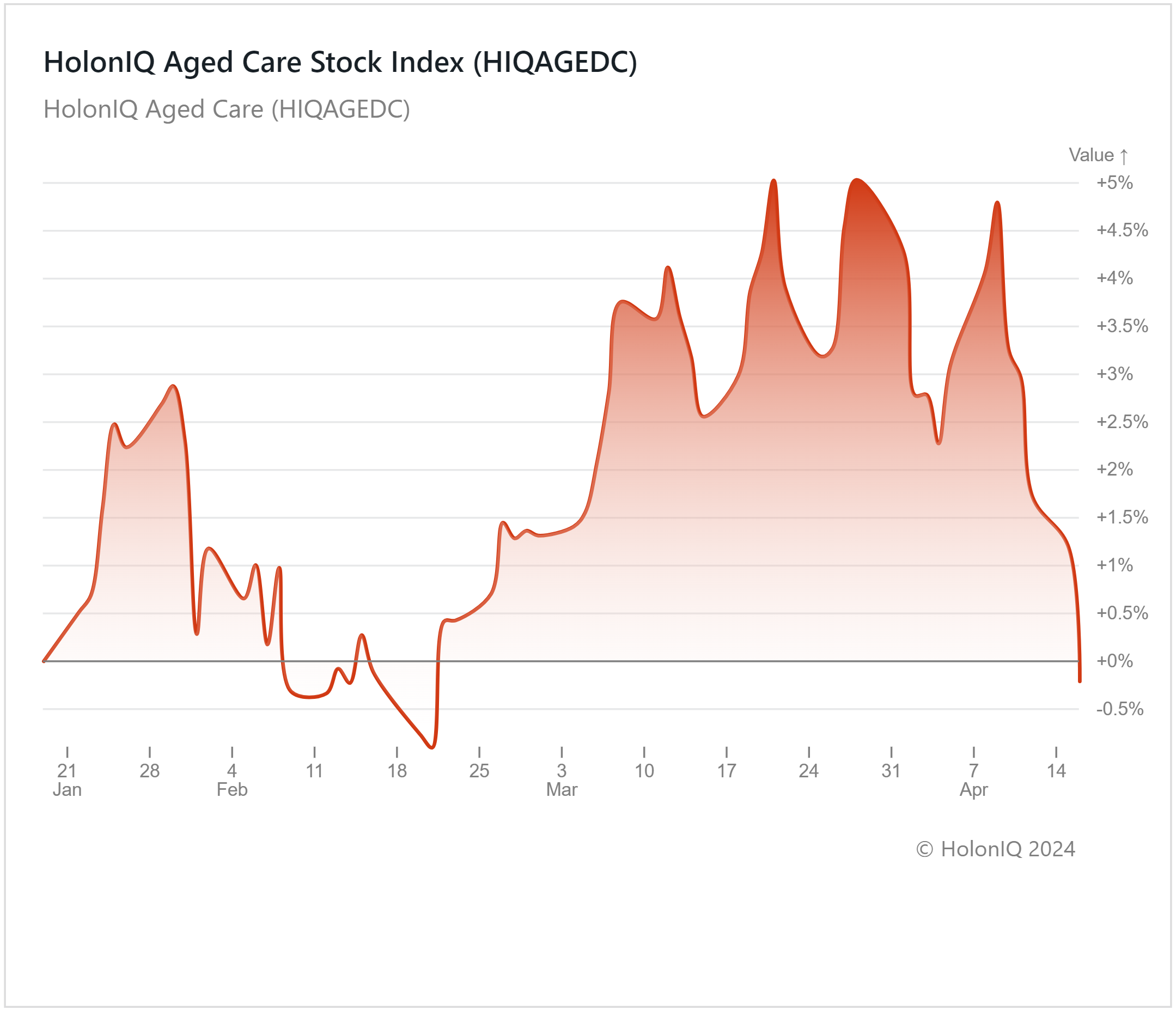

📈 Capital Markets - Aged Care Index Ends Flat

HolonIQ tracks thousands of listed health companies worldwide, as well as acquisitions and investment transactions. Soon, we will launch a range of stock indices to track the daily performance of over ten sectors across Health Technology.

Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

HolonIQ's Aged Care index stagnated after a March high of 5%, mirroring its performance from three months prior. Key stocks like Welltower OP LLC rose 4%, while Sonova Holding AG and Ventas, Inc. fell 3% and 14%, respectively. The sector confronts a pressing challenge: a globally aging population. By 2030, 1 in 6 people is projected to be over 60, signifying a substantial forthcoming demand for aged care services. The sector exhibited promising performance in March due to year-on-year enrollment improvements. Further growth for the index might be aided by key player expansions in 2024, such as Encompass' planned six new facilities. However, persistent challenges—staffing shortages, funding limitations, and regulatory hurdles—impede industry progress. Enrollment rate improvements may decelerate or stagnate, potentially slowing future index performance.

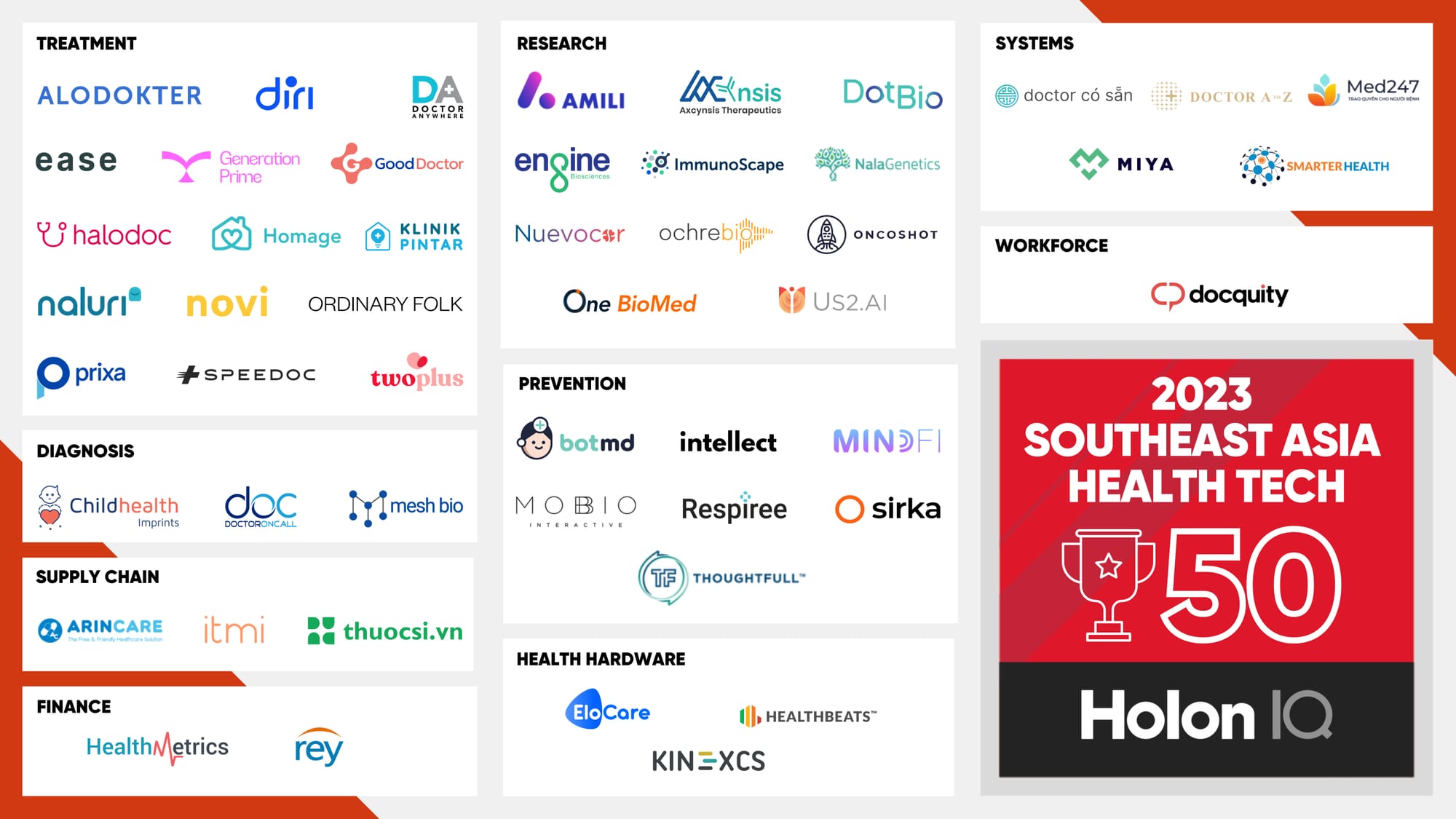

🏆 Southeast Asia Health Tech 50

The 2023 Southeast Asia Health Tech 50 is HolonIQ’s annual list of the most promising startups working in digital health, biotech, drug discovery, and analytics in the region.

Over the past two months, a few cohort members expanded their operations through collaborations with other entities. MiyaHealth (a Singaporean health payment platform) announced that the company will expand its operations to Indonesia and the Philippines in March 2024. Alodokter (an Indonesian digital health company) initiated a collaboration with Takeda (a Japanese pharmaceutical firm) in March 2024 aimed at combating dengue spread in Indonesia.

📊 2024 Global Health Tech Outlook

HolonIQ's annual analysis of the evolving Health Tech landscape offers over 190 pages of in-depth insights on market data, investments, strategic shifts, and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report.

💰 Health Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the health industry across all regions of the world. Subscribe to our daily Impact Capital Markets newsletter to peruse the top deals for each day.

Funding

🫁 Nectero Medical, a US-based developer of new therapies for aortic aneurysms, which build up in the aorta, raised $96M Series D funding led by Northwest Venture Partners to accelerate the Phase II/III of its new drug application to treat abdominal aortic aneurysms.

🧠 Two Chairs, a US-based individual and group mental health therapy service provider, secured $72M Series C funding to expand into additional states and finalize additional healthcare partnerships.

🏥 Kontakt.io, a US-based scalable solution provider for real-time operational adaptation and efficiency improvement, raised $47.5M Series C funding to improve and expand its artificial intelligence (AI) solution.

🔬 Evergreen Theragnostics, a US-based platform offering radiopharmaceutical development services, raised $26M in venture funding to expand its operations and research and development sector.

M&A

🦠 Century Therapeutics, a US-based biotechnology company that develops cell therapies for cancer treatment, has acquired Clade Therapeutics for $45M to expand its cancer and autoimmune therapies pipeline.

🏭 Warburg Pincus, a US-based private equity firm, has acquired a stake in Appasamy Associates for $383M to support and drive the Company’s manufacturing of ophthalmic equipment and lenses.

📦 Palex, a Spanish distributor of medical specialty products for the health market in Spain and internationally, has acquired Werfen for $106M to support sales of its Medical Devices and Scientific Instrumentation Distribution businesses in Spain and Portugal.

💳 Frazier Healthcare Partners, a US-based private equity firm, has acquired RevSpring undisclosed amount, to use Frazier's investment and expertise to boost RevSpring's success in communication and payments.

IPOs/Other Offerings

💊 NFL Biosciences, a France-based biotech company developing natural drugs for addiction, announced that it raised $3.3M in a follow-on offering.

🧠 Biohaven, a US-based biotech company developing treatments for neurological and immunological diseases, announced that it plans to raise $200M in a follow-on offering.

🧠 Eliem Therapeutics, a US-based biotech company that treats nervous system disorders, raised $120M in PIPE funding to focus on developing a lead program, TNT119, an antibody for several autoimmune diseases.

🦠 Century Therapeutics, a US-based biotechnology company that develops cell therapies for cancer treatment, raised $60M in PIPE funding to support its ongoing clinical trials of its lead candidate CNTY-101.

🩺 Cullinan Therapeutics, a US-based developer that specializes in cancer treatments and therapies, raised $280M in PIPE funding to support treatment development for cancer and autoimmune diseases.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com