🍚 Nutrition and Supplement Regulations + Africa Health Tech 50

Governments are tightening regulations surrounding nutrition and supplements and are seeking means to improve enforcement efficiencies, evidenced by the upcoming US FDA reorganization.

Happy Monday 👋

Governments are tightening nutrition and supplement regulations and seeking means to improve enforcement, evidenced by the upcoming US FDA reorganization. In the Health Tech landscape, we revisit the 2023 Africa Health Tech 50, highlighting the region's most promising startups in the health technology sector.

This Week's Topics

🍚 Nutrition and Supplement Regulatory Landscape. More regulatory scrutiny by governments

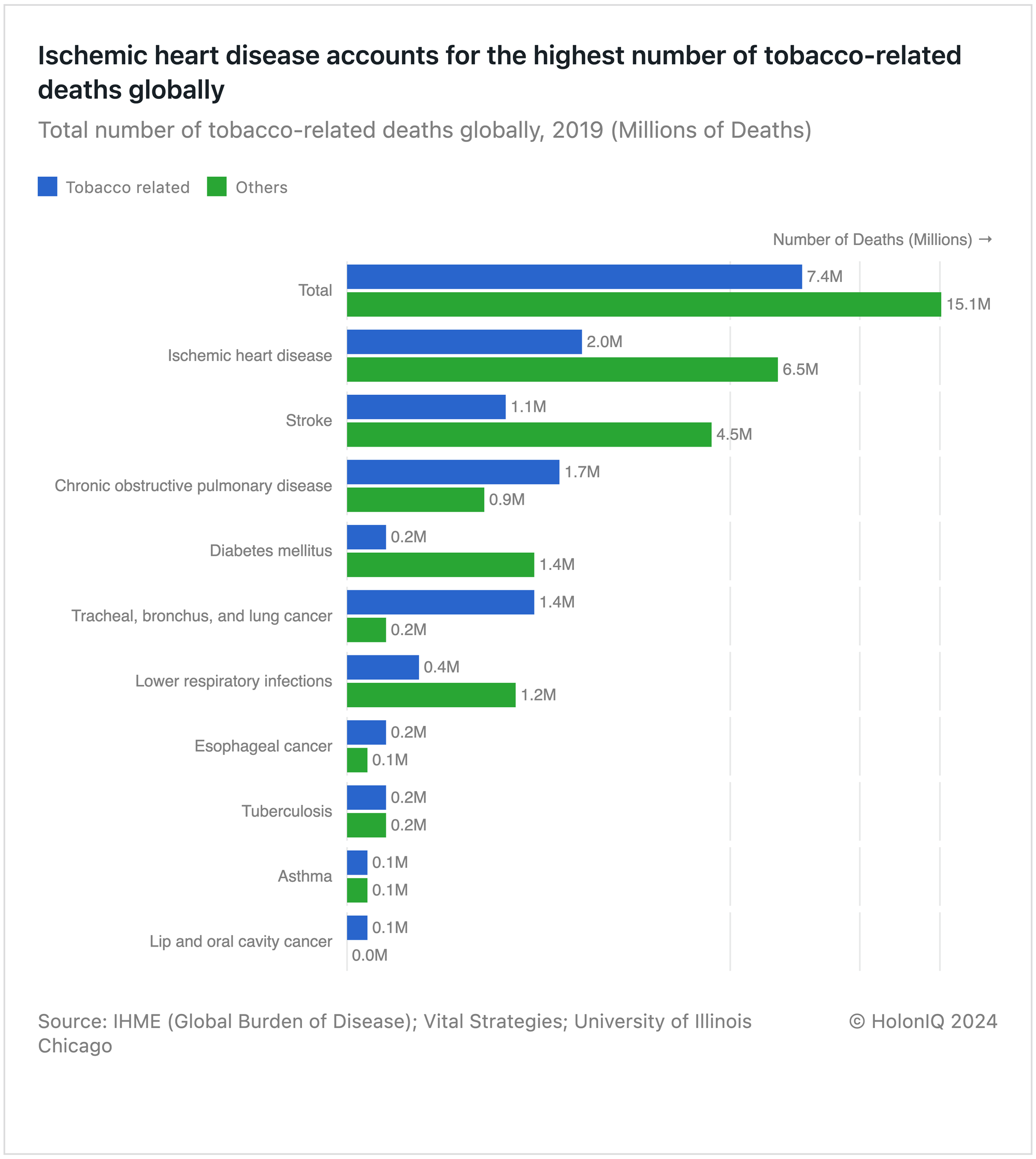

📊 Charts Spotlight. Tobacco use responsible for over 7M deaths in 2019

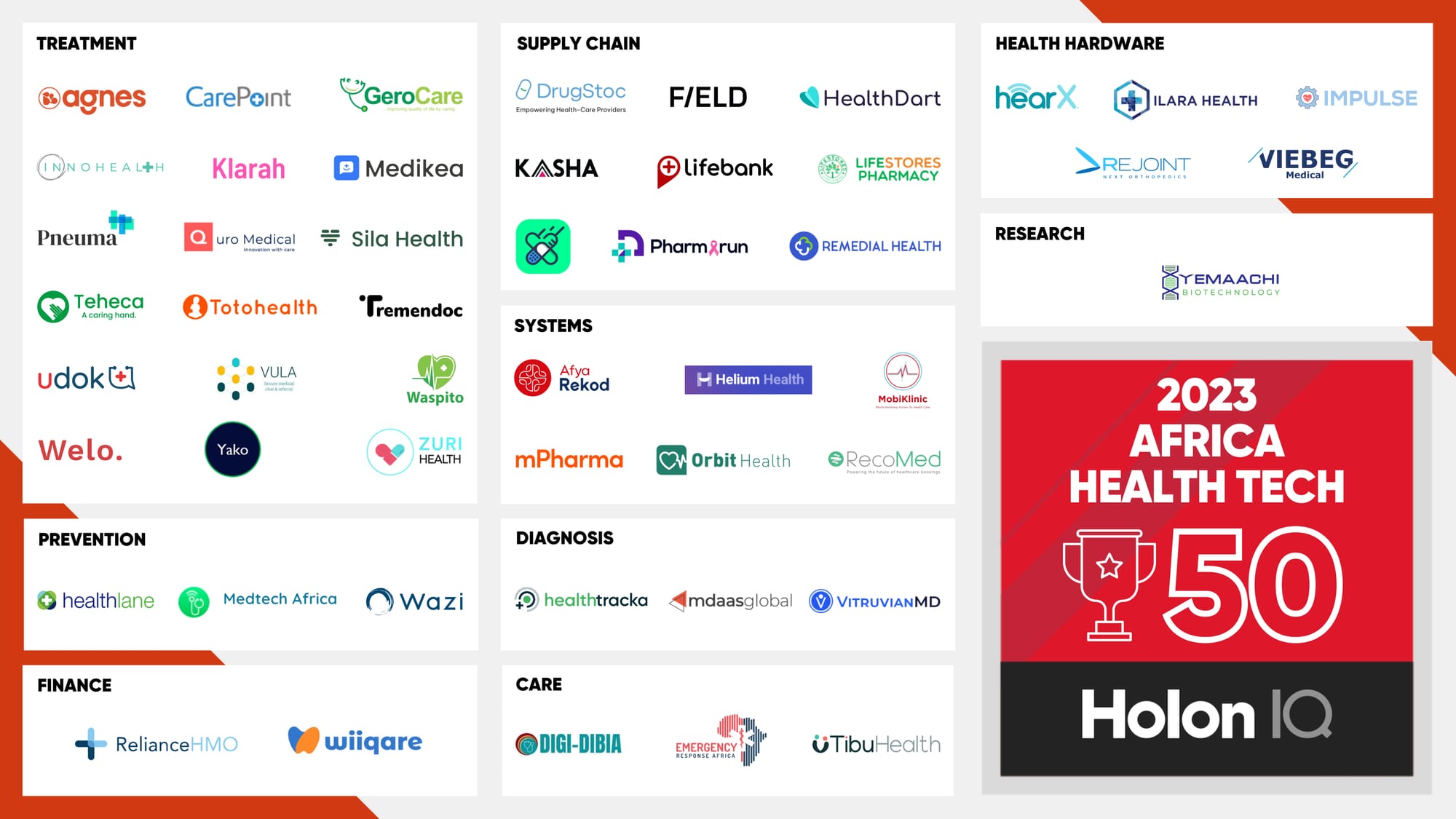

🏆 Africa Health Tech 50. Africa's most promising startups working in digital health, biotech, drug discovery, and analytics

📖 Annual Health Tech Outlook. 190+ pages of trends, insights, and data

💰 Health Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Health Tech Outlook and sign up for our Daily Newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

🍚 Nutrition and Supplement Regulatory Landscape

Historically, a lack of uniform enforcement has created regulatory grey areas within the nutrition and supplement space. To prioritize public health, regulators are tightening controls, posing challenges for existing players and raising barriers to entry. Major regulatory bodies worldwide are taking action. The FDA, for instance, is mandating lead testing for food manufacturers using international ingredients. Additionally, they are restructuring their food division to streamline responses to food-related incidents. Similar trends are emerging elsewhere, with Uruguay considering stricter regulations on dietary supplements. Heightened regulatory scrutiny is prompting even large distributors to act. In May, Amazon implemented new standards for third-party food vendors on their platform.

📊 Charts Spotlight - Tobacco Use Responsible for Over 7M Deaths in 2019

Subscribe to HolonIQ's 'Chart of the Day,' a daily newsletter that helps explain the global impact of the economy, from climate tech to education and healthcare.

Tobacco use is a major preventable cause of premature death globally, resulting in over 7M deaths in 2019. Nearly 60% of these deaths occur in Southeast Asia and the Western Pacific. Tobacco use is closely linked to ischemic heart disease and chronic obstructive pulmonary disease, causing over 1.5M deaths. It also contributes to asthma, stroke, and lung cancer. This leads to disability and premature death, accounting for one in three deaths from these major diseases caused by smoking. Smoking and smokeless tobacco use are costly, with India alone facing costs exceeding 1% of its GDP. The UK aims to be smoke-free by 2030, but the rise in the proportion of people giving up smoking has been offset by an increase in smoking among 18- to 24-year-olds. Australia implemented measures to limit smoking and vaping, with the 2023–24 budget including $737M to fund measures to protect Australians. In the US, the Department of Health and Human Services introduced a new framework to accelerate smoking cessation and address related disparities.

🏆 Africa Health Tech 50

The 2023 Africa Health Tech 50 is HolonIQ’s annual list of the region's most promising startups in digital health, biotech, drug discovery, and analytics.

Remedial Health (a Nigerian digital pharmacy network) has introduced an updated version of its customer-facing app. The update includes digital point-of-service (POS) for payment collection and other infrastructure necessary to allow its network pharmacies to provide digital payment methods. One of the 50 trends in the health industry that HolonIQ recognizes is the surrounding e-prescription solutions. Advancements in providing easier access to digital payment methods are a step toward adapting e-prescription systems.

📊 2024 Global Health Tech Outlook

HolonIQ's annual analysis of the evolving Health Tech landscape offers over 190 pages of in-depth insights on market data, investments, strategic shifts, and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report.

💰 Health Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the health industry across all regions of the world. Subscribe to our daily Impact Capital Markets newsletter to catch up on the top deals each day.

Funding

💊 Adcendo, a Denmark-based biotechnology firm committed to developing novel anti-cancer medications, secured $106M in Series A funding from Dawn Biopharma to fund its antibody-drug conjugate (ADC) pipeline assets.

🧬 Vilya, a US-based drug discovery platform for precision medicine, secured $71M in Series A funding led by Dawn Biopharma to accelerate the progress of its drug design and development platform.

💉 restor3d, a US-based medical device company specializing in enhancing the reconstruction and repair of the human body using 3D-printed implants, closed $55M in a Series A funding led by private investors including Summers Value Partners to finance its expansion.

🧬 Grey Wolf Therapeutics, a UK-based biotechnology firm that develops immunotherapy, raised $50M in a Series B funding led by ICG’s Life Sciences team to expand the reach of the company's current Phase 1/2 clinical trial of its primary immuno-oncology candidate.

M&A

🔬 Sanofi, a France-based pharmaceutical company, acquired Inhibrx, a clinical-stage biotechnology company dedicated to developing a pipeline of innovative biologic therapeutic candidates.

✨ Johnson & Johnson, a US-based MedTech firm, acquired Shockwave Medical, a medical device company that develops and markets intravascular lithotripsy technology for treating calcified plaque in patients.

💰 GTCR, a US-based private equity firm, is set to acquire Surmodics, a medical device coating and in-vitro diagnostics manufacturer.

IPOs/Other Public Offerings

🩺 ENDRA Life Sciences, a US-based developer in medical imaging firm, announced that it raised $8M in an IPO.

🧪 Summit Therapeutics, a US-based biopharmaceutical company specializing in infectious diseases, announced that it raised $200M in a follow-on offering.

🫀 Bio-Path Holdings, a US-based operator in clinical and preclinical stage company focused on nanoparticle drug development for oncology, announced that it raised $4M in a follow-on offering.

💊 KindlyMD, a US-based mental health service provider,. announced that it raised $6.8M in an IPO.

Fund Formation

💰 Brandon Capital, an Australia-based fund management business specializing in investments in life science ventures, raised $460M in a funding round to invest in local and global biotechnology, medical device, and health technology companies.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com