🛵 Micro-Mobility + Africa Climate Tech 50

Micro-mobility solutions are on the rise primarily led by the rising cost of fuel and growing consumer awareness of the climate crisis. The 2023 Africa Climate Tech 50 highlights the most promising startups working in the clean technology sector.

Happy Monday 👋

Electric micro-mobility solutions are on the rise, primarily driven by the rising cost of fuel and growing consumer awareness of the climate crisis. This week we also focus on the 2023 Africa Climate Tech 50, which highlights the most promising startups working in the climate technology sector.

This Week's Topics

- 🛵 Micro-Mobility Market Map. Mapping 130+ global players across the landscape

- 📊 Charts Spotlight. Sales volume of electric bicycles in the EU

- 📈 Micro-Mobility Stock Index. Stocks decline amidst delistings and high-interest rates

- 🏆 Africa Climate Tech 50. Africa's most promising startups working in clean energy, zero-emission mobility, and sustainability

- 📊 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data

- 💰 Climate Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Climate Tech Outlook, and sign up for our Daily Newsletters, Chart of the Day and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

🛵 Micro-Mobility Landscape

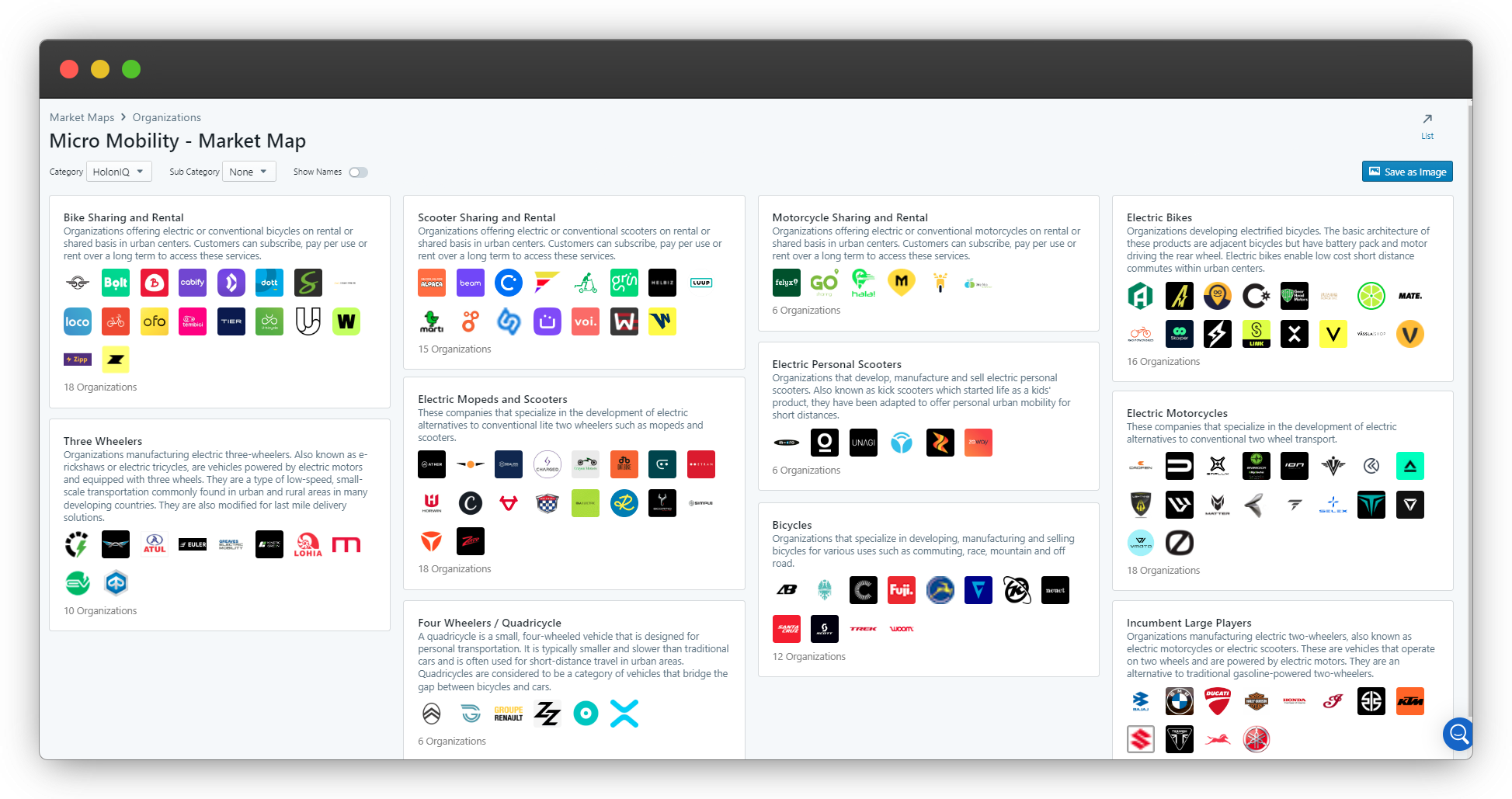

Over the last 2 years, micro-mobility has seen a surge driven by the increasing adoption of electric bikes, motorbikes, & scooters, which is set to transform the personal mobility sector. There are ~600 million motorcycles in the world, with APAC accounting for at least 60% of that. For example, Thailand is colloquially known as the land of 100 million scooters. Global 2-wheeler sales, including scooters, in 2022 were reported to be ~60.4 million, representing the second-highest level ever.

The driving factor behind the electrification of two-wheelers is advancements in battery technology and design. Electric two-wheelers are now a competitive alternative to their gasoline-powered counterparts, thanks to innovative battery designs that have reduced the size and weight, enabling newer batteries to fit within a typical motorcycle. Battery swapping technology has added to the convenience of long-range mobility, comparable to petrol power and low maintenance, and has enhanced the overall user experience. Rising fuel costs, especially following the pandemic, added tailwinds to the sales of electric 2-wheelers, especially across Asia & certain regions of Europe. Policy initiatives are also facilitating the electrification of two-wheelers. Governments worldwide are implementing regulations to promote electric vehicle adoption, along with incentives like tax breaks & subsidies, as well as non-financial perks like preferential parking & discounts on congestion charges.

🛵 Micro-Mobility - Market Map

📊 Charts Spotlight - Sales Volume Of Electric Bicycles In The EU

Subscribe to the HolonIQ newsletter 'Chart of the Day', a daily newsletter that helps explain the global impact economy, from climate tech to education and healthcare.

Europe has a long-established cycling culture, and many European cities have been designed with pedestrians and cyclists in mind. This existing infrastructure seamlessly integrates e-bikes, making them a natural extension of existing cycling habits. The pandemic's positive effect on cycling adoption paved the way for further adoption of electric bikes and scooters, while the high oil prices as a result of the conflict in Europe added incentive for electrification. Additionally, startups focusing on micro-mobility rental and sharing have made electrified options convenient to access through integrations with other transport methods without the hassle of ownership, especially for those living in urban areas.

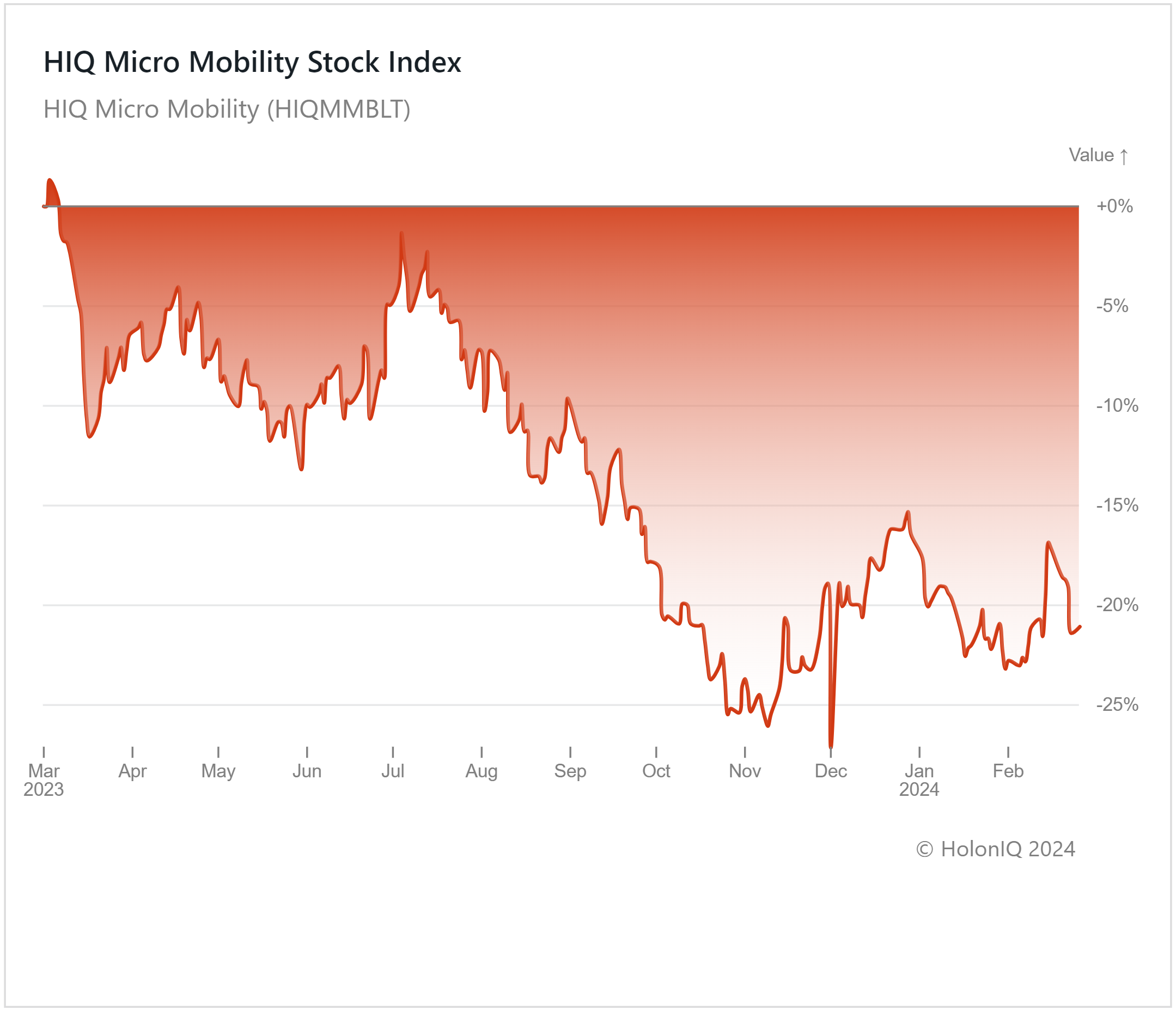

📈 Capital Markets - Micro-Mobility Index

HolonIQ tracks thousands of listed climate tech companies worldwide and several acquisitions and investments each year. Soon, we will launch a range of stock indices to track the daily performance of over 10 different sectors across Climate Technology.

Our new Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

HolonIQ's Micro-Mobility Index fell by over 20% in the past year as most of the stocks on the index registered significant declines. Shimano Inc ($12B MCap), one of the larger constituents in the index, saw revenue and stock prices drop in 2023. Although the overall micro-mobility market has grown from pre-pandemic levels, the decline is due to a cooling off of demand post-pandemic and supply chain issues affecting batteries and other components. Other manufacturers, such as Harley Davidson ($5B MCap) witnessed a 24% decrease in stock value over the last year as a result of high interest rates that have made auto loans more expensive.

The bankruptcy of Bird and the delisting of Micromobility.com haven't helped investor confidence, and the bearish sentiment is likely to continue until future demand is fully understood.

🏆 Africa Climate Tech 50

The Africa Climate Tech 50 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

Given that the African region faces significant challenges in accessing international finance, the region secured the least in terms of VC funding in the Climate Tech landscape. However, the Africa Climate Tech 50 list, although not evenly distributed, included almost all sub-sectors, mirroring the Nordic region where the sole exception was the absence of startups in the Biosphere subsector. Renewables followed by Circular Economy and Food Systems represented 70% of the list. South Africa and Kenya were found to be leading the African Climate Tech landscape.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🚗 IM Motors, a China-based electric vehicle company raised a $1.1B Series B to finance new smart car models and technologies. State-owned carmaker SAIC owns the company.

🌋 Fervo Energy, a Texas-based geothermal development company, raised $244M from Devon Energy to enhance growth and integrate new technologies.

☀️ ENVIRIA, a German decentralized energy solutions provider, raised a $200M Series B from BlackRock for the expansion of solar projects across Germany.

🔋 Antora Energy, a US-based startup raised $150M to scale up manufacturing of a novel thermal battery technology claimed to be suitable for decarbonizing industrial processes.

🌱 Oishii Farm, a New Jersey-based vertical farming company, raised a $134M Series B from Japanese telecommunications firm NTT to expand its distribution to new markets.

🛴 Yulu, an Indian startup providing shared two-wheeler electric vehicle services, raised $19.25M from Magna International & Bajaj Auto Finance to strengthen its market leadership.

M&A

🥛 Harwood Private Equity, an investor in the UK lower mid-market, acquired Crest Foods, an Oklahoma-based company that develops stabilizer formulations and recipes for dairy products.

🍓 Driscoll's, a California-based global provider of fresh strawberries and other berries, acquired Costa Group, Australia’s largest producer of fresh fruit and vegetables.

♻️ Cycle0, a UK-based biomethane producer, acquired Biogasclean, a Danish supplier of biological desulfurization and methanation systems.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com