🏆 Meet 100 Global Climate Tech Investors, in person

Meet 100 Global Climate Tech Investors. Applications are now open for the Indo Pacific Climate Tech 100.

Hello 👋

This week we opened applications for an ambitious climate tech initiative to help accelerate clean energy investment and climate impact in one of the world's largest and fastest-growing regions, the Indo-Pacific.

In partnership with over 100 of the region's top investors, philanthropies and financial institutions, the Indo-Pacific Climate Tech 100 will connect top Climate Tech startups with leading global investors for in-person meetings and presentations on June 5-6, 2024, in Singapore at the IPEF Clean Economy Investor Forum.

HolonIQ, in support of the Indo-Pacific Partnership for Prosperity, co-chaired by the CEOs of KKR and Tata, is accepting applications from companies based in the 14 IPEF partner countries. Over the month of April 2024, companies that submit applications will be evaluated by regional and industry experts on five dimensions. The top 100 companies will be announced in early May 2024 with select winners invited to meet with investors and government agencies in person at the IPEF Clean Economy Investor Forum, June 5-6, 2024 in Singapore.

This Week's Topics

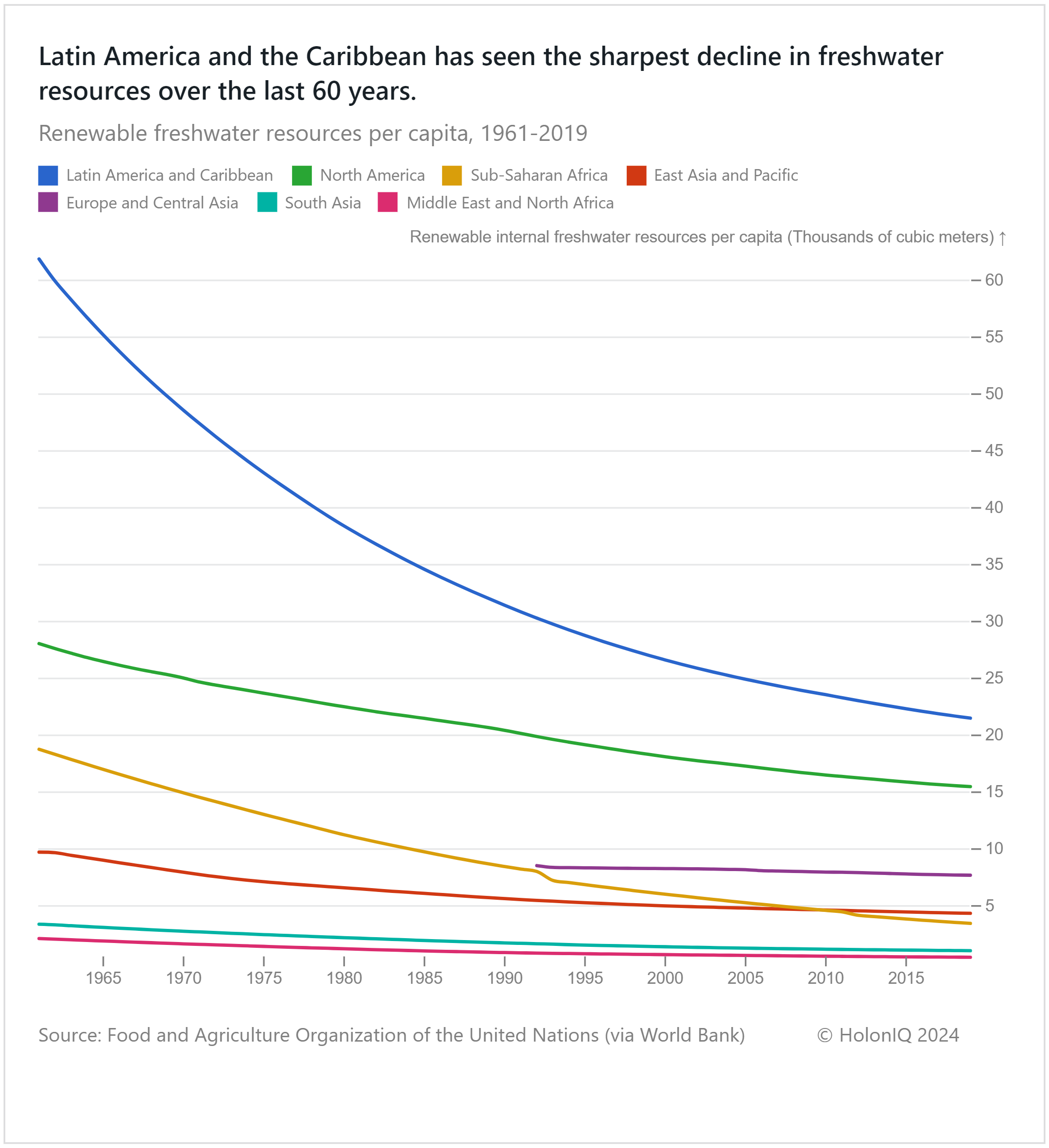

📊 Charts Spotlight. The LAC and African regions have seen the sharpest decline in freshwater resources

📈 Mining Index. Mining stock index gains 12% YoY

🏆 Africa Climate Tech 50. $13M of fundraising in 2024 to date

📊 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data

💰 Climate Tech Deals of the Week. Funding

Don't forget to check out the 2024 Global Climate Tech Outlook, and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

📊 Charts Spotlight - The LAC and African Regions Have Seen The Sharpest Decline of Freshwater Resources

Subscribe to the HolonIQ newsletter 'Chart of the Day', a daily newsletter that helps explain the global impact of the economy, from climate tech to education and healthcare.

The number of people without access to clean drinking water is forecast to reach 5 billion by 2050. This is caused by a decline in freshwater and groundwater levels as a result of unsustainable irrigation practices and climate change. Over the last 60 years, freshwater resources around the world have seen a sharp decrease, with LAC, North America, and Sub-Saharan Africa seeing the steepest declines. To make matters worse, the African and LAC regions are more susceptible to the impacts of climate change in comparison to developed countries. Approximately 319 million people in Sub-Saharan Africa lack access to clean drinking water. In Sub-Saharan Africa, around 522 million people experience severe water scarcity for at least one month per year.

However, Integrated Water Resources Management (IWRM) projects are taking shape in regions and countries that are experiencing a lack of access to clean water. Cambodia, where 20% of the population lacks access to clean water, is set to deploy an $80M IWRM project to improve dry season irrigation water availability and cope with wet season flooding. Africa, where only 31% of the population has access to clean drinking water, is seeing the emergence of a few IWRM projects in the region. Lake Togo in West Africa, which is facing strong pressures due to demographic growth and concentration, is set to have an IWRM project kick-off led by GRET, an international development NGO. Ethiopia, Albania, the UAE, and Saudi Arabia have all deployed similar projects to ensure the region's water security. While these projects will significantly enhance the region's water security, the scale of these projects needs to increase exponentially over the next decade to alleviate the water issues the region is facing now.

📈 Capital Markets - Mining Stock Index

HolonIQ tracks thousands of listed climate tech companies worldwide, along with acquisitions and investment transactions. Soon, we will launch a range of stock indices to track the daily performance of over 10 different sectors across Climate Technology.

Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

HolonIQ Mining Index rebounded to a 12% gain during the 1st quarter of 2024, following a period of declines throughout much of 2023. While many index constituents saw declines, with BHP ($145B MCap) falling 8%, Vale SA ($61B MCap) decreasing 25%, and Glencore ($57B MCap) registering a -23% return, China Shenhua Energy ($101B MCap) significantly boosted the index with a 31% increase. Fortescue ($52B MCap) also registered 12% growth.

With the monetary tightening cycle coming to an end, 2024 has a relatively brighter outlook. Continued stimulus in China and industrial recovery in developing markets could lead to higher demand. The rapid adoption of clean energy technologies like solar energy and batteries, and thus the increased demand for critical minerals, are tailwinds for the mining industry. Likewise, with gold outperforming most commodities in 2023, increased investment in gold is likely to persist.

However, balancing development with environmental conservation poses a significant hurdle for the industry, especially amidst increasing climate concerns and the emergence of regulatory complexities. Despite rising demand, high levels of capital are also required for mining critical minerals, posing a significant challenge to firms within the mining industry.

🏆 Africa Climate Tech 50

The Africa Climate Tech 50 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

Africa's top climate tech startups raised approximately $70M worth of funds in 2023, with storage and solar start-ups accounting for most of the funding. This is a sharp difference between the amount of funding that North America and Europe raised in 2023, which was in the high billions. In 2024, these companies have raised approximately $13M to date to enhance the clean energy transition and scale up its agricultural sector in the region. Kenyan startup Apollo Agriculture, an agri-fintech startup dedicated to helping small-scale farmers across Africa increase their profits and farm more sustainably, secured a $10M investment to enable increased earnings for farmers, faster adoption of sustainable practices, and increased food security across Africa.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🤖 Viam, a NYC-based tech platform for smart machinery, raised a $45M Series B from Union Square Ventures and Battery Ventures for commercial innovation and platform advancement.

🚀 TCab Tech, a Shanghai-based company creating a zero-emission airborne ridesharing app for the public, raised a $20M Series A to launch the air-taxi app within the Middle East region.

🚌 Ember, a UK-based company specializing in electric bus networks, raised a $13.9M Series A to speed up the rollout of its electric bus service and improve its online services platform.

🌱 Circular, a California-based platform developed to simplify sustainable sourcing of post-consumer recycled (PCR) plastic, raised $10.5M to expand its team.

♻️ Wase, a UK-based clean fuel start-up, raised $9.2M from Extantia Capital to scale its waste-to-energy technology.

⛏️ Aberdeen Minerals, a UK-based mineral exploration company, raised $6.9M from Central Asia Metals to fund its battery mineral exploration programs.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com