🏗️ Infrastructure Up 23%. $140M+ VC Funding.

Impact Capital Markets #51 looks at our Infrastructure stock index, major impact deals, M&A, and upcoming economic releases.

Talofa 🏝️

📉 Today's Global Economic Update: China's retail sales data for January to February 2024 shows a 5.5% YoY growth, marking the 13th consecutive month of expansion. This growth reflects persistent consumer confidence despite economic setbacks stemming from weakness in the property sector.

🧬 Deal of the Day: Relation Therapeutics, a UK-based biotechnology company, raised a $35M Seed to advance its pipeline of drugs treating osteoporosis.

What's New?

- 🏗️ Infrastructure. Infrastructure index up 23%

- 💰 Funding. Biotechnology, energy efficiency, green technology & more

- 💼 M&A. Virtuos acquires Beyond-FX

- 📅 Economics. Major interest rate decisions, retail sales data, inflation + more

For unlimited access to more deals and economic updates, request a demo

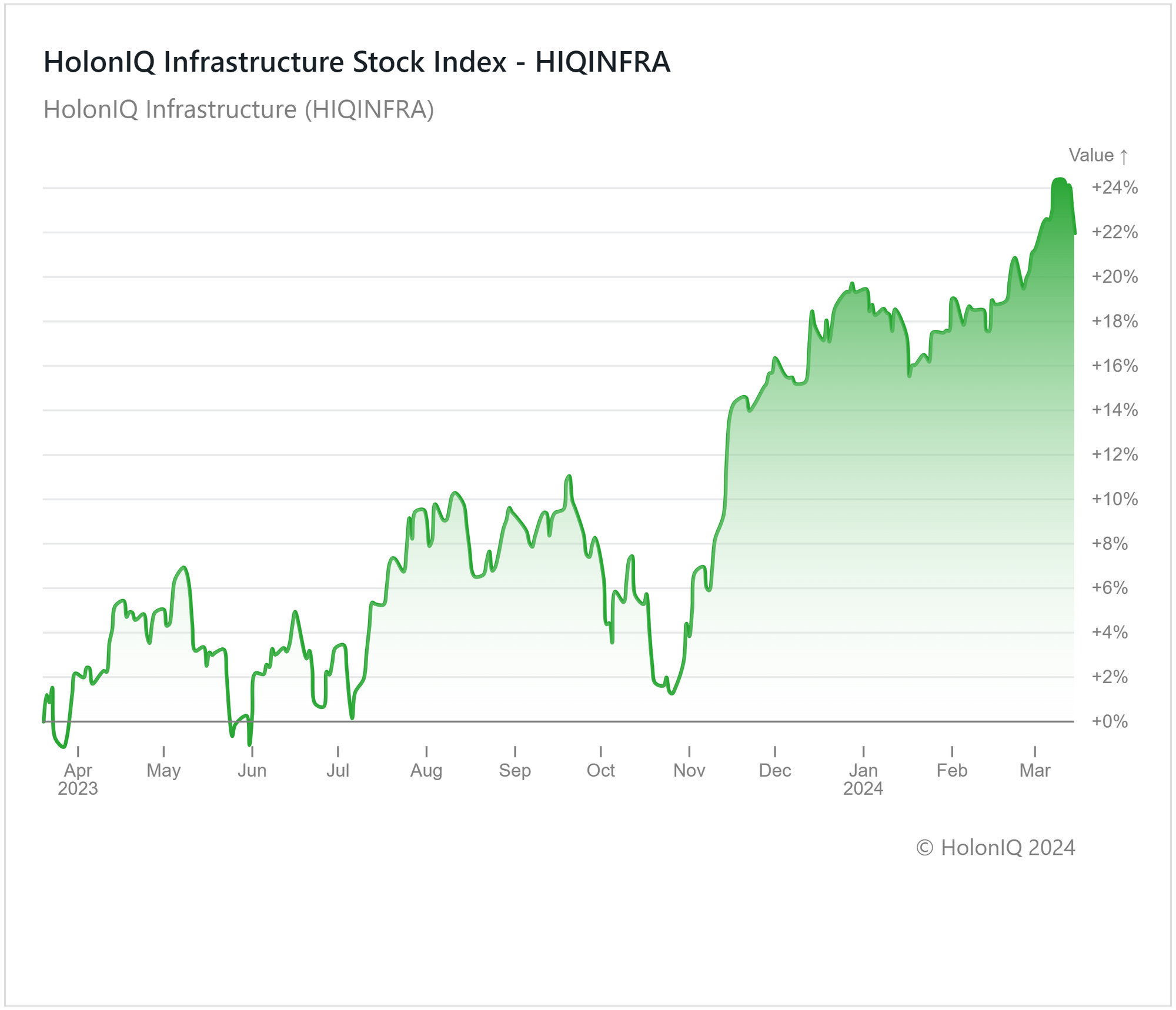

🏗️ Infrastructure Index Up 23%

HolonIQ's Infrastructure Index grew 23% over the past year, driven by companies operating railways. Major stocks in the index, including Union Pacific Corp ($149B MCap), Canadian Pacific Kansas City ($84B MCap), and CSX Corp ($72B MCap), demonstrated gains of 29%, 10%, and 27%, respectively.

Looking ahead, infrastructure investments are increasingly attractive for investors seeking stability and growth. Global disruptions in recent years have emphasized the need to strengthen supply chains, enhance energy independence, and upgrade essential facilities like healthcare and transport which add to a future pipeline of projects. The sector will benefit from the the expected interest rate decline which will add to the positive investor sentiment. In response, many countries are prioritizing infrastructure projects, creating a favorable environment for investment. With government funding often insufficient and private capital increasingly sought to drive these projects, long term prospects for infrastructure investments look positive. This was part of the rationale behind the $12.5B acquisition of Global Infrastructure Partners by BlackRock earlier in the year.

💰 Funding

🧬 Relation Therapeutics, a UK-based biotechnology company, raised a $35M Seed from DCVC and NVentures to advance its pipeline of drugs treating osteoporosis.

💡 Sealed, a New York-based residential energy efficiency startup, raised $30M from Keyframe Capital to expand operations.

🌱 Locus Fermentation Solutions, an Ohio-based green tech company that produces biological alternatives to chemicals, raised $30M to scale its operations.

🔋 Pure Lithium, a Massachusetts-based lithium metal battery technology company, raised a 15M Series A from Oxy Low Carbon Ventures to facilitate its development.

🖥️ Clique, a California-based infrastructure company providing data computing support for blockchains, raised a $8M Series A from Polychain Capital to build a coordination network.

💪 Bone Health Technologies, a California-based health technology company, raised $5M to support the development of its Osteoboost wearable, a wearable belt device to treat low bone density.

💼 M&A

🎬 Virtuos, a Singaporean video game development company, acquired Beyond-FX, a California-based visual effects studio.

📅 Economic Calendar

Major Interest Rate Decisions, Retail Sales Data, Inflation + More

Tuesday, March 19th 2024

🇯🇵 Japan BoJ Interest Rate Decision

🇦🇺 Australia RBA Interest Rate Decision

🇩🇪 Germany ZEW Economic Sentiment Index, March

🇺🇸 US Building Permits Data (Preliminary), February

🇨🇦 Canada Inflation Data, February

Wednesday, March 20th 2024

🇬🇧 UK Inflation Data, February

🇺🇸 US Fed Interest Rate Decision

🇺🇸 US FOMC Economic Projections

Thursday, March 21st 2024

🇺🇸 US Fed Press Conference

🇯🇵 Japan Balance of Trade, February

🇩🇪 Germany HCOB Manufacturing PMI (Flash), March

🇬🇧 UK BoE Interest Rate Decision

Friday, March 22nd 2024

🇯🇵 Japan Inflation Data, February

🇬🇧 UK Retail Sales Data, February

🇩🇪 Germany Ifo Business Climate Index, March

Tuesday, March 26th 2024

🇦🇺 Australia Westpac Consumer Sentiment Index, March

🇩🇪 Germany GfK Consumer Confidence Index, April

🇺🇸 US Durable Goods Orders Data, February

Thursday, March 28th 2024

🇺🇸 US Core PCE Price Index Data, February

🇺🇸 US GDP Growth Data, Q4

Friday, March 29th 2024

🇫🇷 France Inflation Data (Preliminary), March

🇮🇹 Italy Inflation Data (Preliminary), March

🇺🇸 US Personal Income & Spending Data, February

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com