⚕️ Health Tech Restructuring + North America Health Tech 200

Restructuring efforts in major health tech firms continue. We revisit the 2023 North America Health Tech 200, highlighting the region's most promising startups in the health technology sector.

Happy Monday 👋

Restructuring efforts in major health tech firms have been a recurring theme, with Pfizer and Bristol Myers Squibb both committing to restructures worth $1.5B. In the Health Tech market, we revisit the 2023 North America Health Tech 200, highlighting the region's most promising startups in the health technology sector.

This Week's Topics

⚕️ Health Tech Restructuring. Attempts to streamline operations among major health tech firms

🏆 North America Health Tech 200. North America's most promising startups working in digital health, biotech, drug discovery, and analytics

📖 Annual Health Tech Outlook. 190+ pages of trends, insights, and data

💰 Health Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Health Tech Outlook and sign up for our Daily Newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

⚕️ Health Tech Restructuring

Companies like BioMarin, Galapagos, Bayer, Novartis, Genentech, Sanofi, Pfizer, Kenvue, and Bristol Myers Squibb have all announced substantial job cuts aimed at streamlining operations and focusing on core areas. BioMarin has laid off 170 employees and reduced its R&D pipeline by half. Galapagos implemented 100 layoffs, aligning with its renewed focus on innovation. Bayer cut 1,500 jobs to streamline operations. Novartis plans to lay off 680 employees, with further reductions possible, as part of a broader restructuring program. Genentech and Sanofi are laying off hundreds of workers in their Bay Area offices. Pfizer has initiated a cost reduction program targeting $1.5 billion in savings by 2027. Kenvue, formerly part of Johnson & Johnson, plans to cut 4% of its global workforce, affecting around 880 employees. Bristol Myers Squibb is cutting 6% of its workforce, or approximately 2,200 jobs, to save $1.5B by the end of 2024.

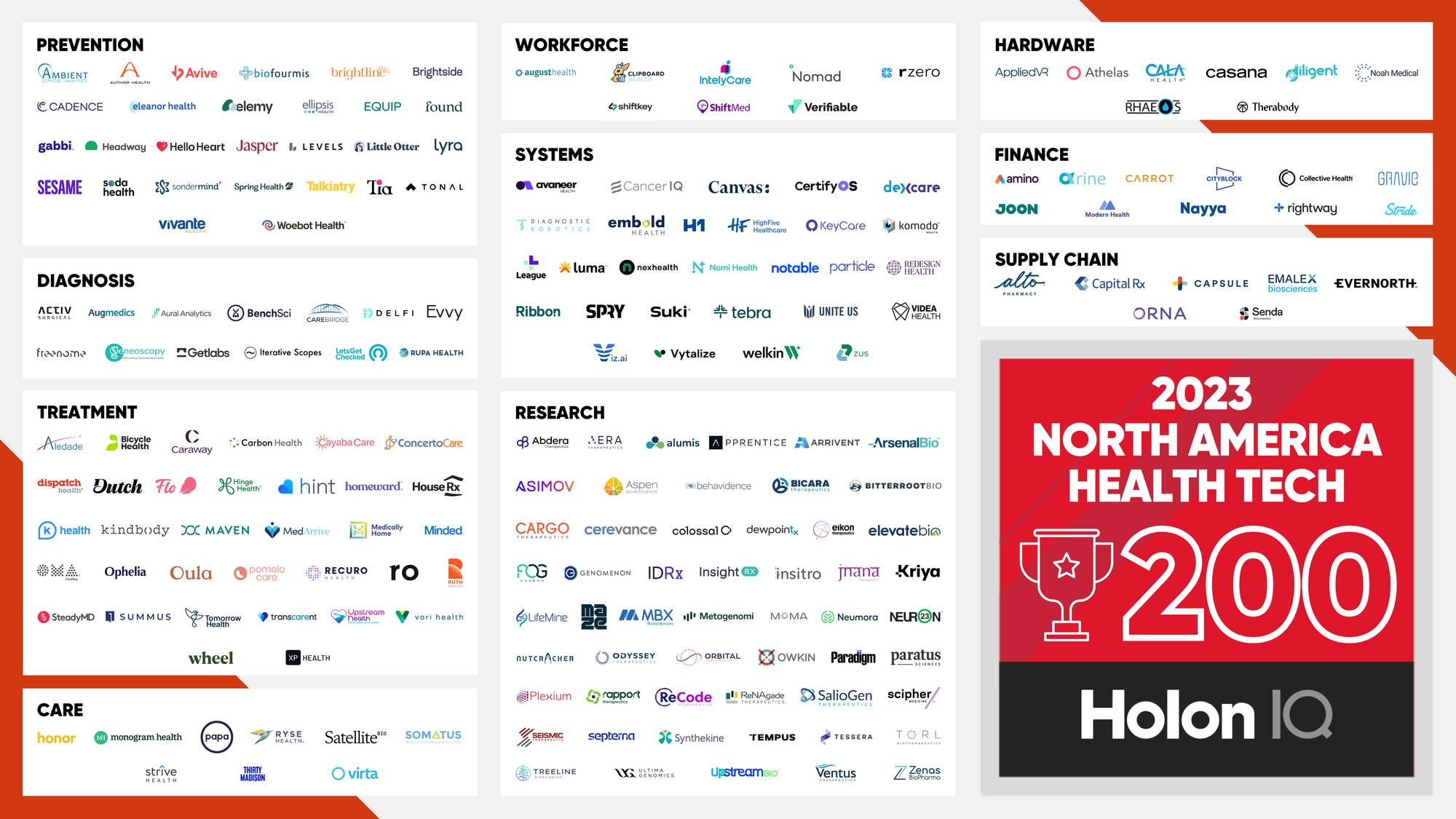

🏆 North America Health Tech 200

The 2023 North America Health Tech 200 is HolonIQ’s annual list of the region's most promising startups in digital health, biotech, drug discovery, and analytics.

Several cohort members entered into collaborations to offer more personalized services for patients. OSF Healthcare partnered with DELFI Diagnostics to utilize a blood test for early lung cancer detection, potentially increasing screening rates. FogPharma and Artbio combined their expertise to develop targeted cancer drugs that minimize side effects. Sturdy Health implemented Notable's AI platform to personalize patient engagement through features like appointment reminders and self-scheduling. One of HolonIQ’s health trends is personalized medicine and these partnerships enable patients to receive more personalized health services, particularly for cancer.

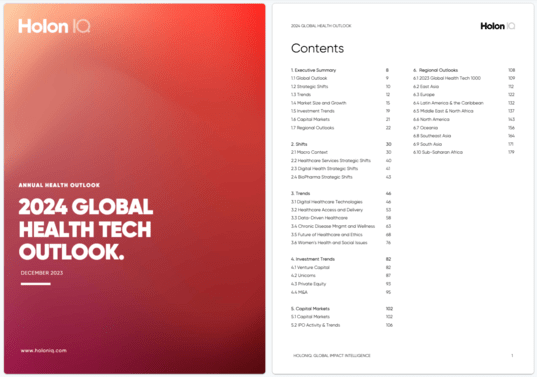

📊 2024 Global Health Tech Outlook

HolonIQ's annual analysis of the evolving Health Tech landscape offers over 190 pages of in-depth insights on market data, investments, strategic shifts, and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report.

💰 Health Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the health industry across all regions of the world. Subscribe to our daily Impact Capital Markets newsletter to catch up on the top deals each day.

Funding

💊 Alzheon, a US-based developer in a drug discovery platform using small molecules to create treatments for Alzheimer's and other neurodegenerative disease, raised $100M in a Series E funding to finance the completion of a Phase III trial and the regulatory submissions for its leading Alzheimer's disease drug candidate.

🔬 Kardium, a Canada-based medical solutions company offering an advanced system for treating atrial fibrillation (AF), raised $104M in Private Equity funding led by Fidelity Management & Research Company to finalize its PULSAR clinical study of the system and to obtain regulatory approvals.

✨ Bright Peak Therapeutics, a Switzerland-based firm that develops engineered cytokines for immuno-oncology applications, secured $90M in Series C funding led by Johnson & Johnson to progress its leading cancer immunotherapy program, BPT567, into clinical trials.

💉 Amber Therapeutics, a UK-based developer of a bioelectronic platform designed to create innovative, closed-loop bioelectrical therapies, raised $100M in a Series A funding led by New Enterprise Associates to support its neuromodulation therapy.

M&A

🩺 Addus HomeCare, a US-based provider of personal home care and support services, acquired Gentiva Health Services for $350M, another healthcare services provider specializing in home care and hospice services.

🧬 GlaxoSmithKline, a UK-based healthcare conglomerate, acquired Elsie Biotechnologies for $50M, a biopharmaceutical company specializing in gene therapies.

IPOs/Other Public Offerings

🧠 Rapport Therapeutics, a US-based developer that aims to revolutionize the treatment of neurological disorders using precision medicine, announced that it raised $154M in an IPO.

💊 QuantumPharm, a UK-based manufacturer and supplier specializing in unlicensed medicines and difficult-to-source products, announced that it raised $126.8M in an IPO in Hong Kong.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com