🩺 Health Insurance Rebounds, $650M+ Funding

Impact Capital Markets #8

For over 5 years, HolonIQ has been tracking and analyzing Impact Capital Markets, Foundations and Philanthropies, Venture and Growth Capital, Private Equity and Public Markets.

Now, with more than 50 stock indices being tracked, we're kicking off 2024 with a new daily newsletter for data-driven global leaders looking to understand trends in strategic industries.

Today's Topics

- 🩺 Health Insurance. Health Insurance rebounds in 2H 2023

- 💰 Funding. $740M+ Funding in Energy & Health

- 💼 Acquisitions. Hospitals, Bio Tech, Oil and gases

- 📅 Economics. Consumer, GDP and Inflation data + Japan, Canada Interest rates next week.

Have feedback or ideas for us? Email hello@holoniq.com — we'd love to hear from you!

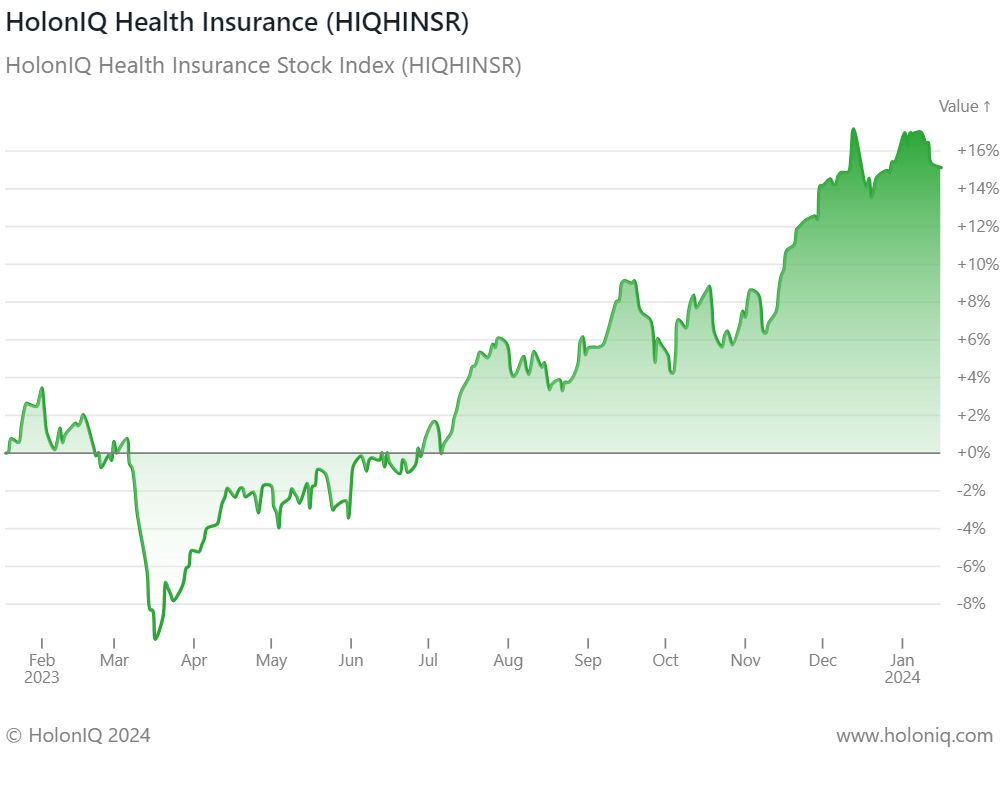

🩺 Health Insurance rebounds in 2H 2023 after 1H Downturn

HolonIQ Health Insurance Index (HIQHINSR). The index saw yearly returns turn negative in 1H 2023, but staged a recovery in the second half of the year, with Year-on-Year returns increasing to ~15% in January 2024.UnitedHealth Group, Inc.(Market Cap: US$ 482B), the American health insurance giant, faced several challenges throughout the year, which included several lawsuits over issues including claim denials and coverage. CVS Health Corporation (Market Cap: US$ 98.5B), another prominent player in the health insurance market in the US, also announced a layoff of more than 200 workers and announced its plans to concentrate only on its primary care and urgent care services. In other developments, CVS invested in Carbon Health, a primary and urgent care startup, to improve the startup’s expansion into new markets. On a positive note, in 2H 2023, Cigna Corporation (Market Cap: US$ 89B), created a new AI digital health platform to provide a more personalized experience for its users.

💰Funding

⚡ Electra, a France-based EV charging company, raised $333M Series B from PGGM Investments and will likely use the funds to expedite the expansion of its charging infrastructure in Europe.

💡 Aira, a Sweden-based clean energy-tech company , raised $158.2M Series B from Altor to continue market expansion across Italy, Germany, and the UK.

🔋 Ineratec, a Germany-based e-Fuel company, raised over $129M Series B from Piva Capital to start the mass production of its industrial-scale Power-to-X plants worldwide and advance the production of e-Fuels made from recycled CO2 and renewable energy.

🔬 Noctrix Health, a California-based medical device company, raised a $40M Series C from Sectoral Asset Management to advance the Nidra™ Tonic Motor Activation (TOMAC) therapy towards its anticipated launch in the US market.

🚗 Trojan Energy, a UK-based electric vehicle charging company, raised $33M from Scottish National Investment Bank to facilitate its ambitious growth plans.

🛏️ Onera Health, a Netherlands-based company which specializes in sleep diagnostic and monitoring solutions, raised $32M Series C from Gimv and EQT life science to accelerate manufacturing and deployment plans to meet the customer demand for its self-applied, no-wire end-to-end solution.

💊 Disco Pharmaceuticals, a German-based company that specializes in large-scale surfaceome unlocking of cancer cells, raised $21.8M Seed from Sofinnova Partners to advance its cancer target-hunting platform.

📦Acquisitions

🏥 PureHealth, a Abu Dhabi-based healthcare platform, acquired Circle Health Group, a UK-based large independent hospital operator for about $1.2B.

💉 Integer Holdings Corporation, a Massachusetts-based medical device outsource manufacture, acquired Pulse Technologies, a Pennsylvania-based company that manufacture medical device components and assemblies for $140M.

🧬 Parse Biosciences, a Washington-based biotechnology startup company, acquired Biomage, a UK-based company which specializes in single-cell analysis.

💻 AEGIS Hedging Solutions, a Texas-based company that leads in hedging services and software for commodity markets, acquired Ancova Energy, an Oklahoma-based company that provides oil and gas marketing services and software.

🦿 Ossur, Iceland-based provider of mobility solutions, acquired Fior & Gentz, a Germany-based maker of lower limb neuro orthotic components.

🖥️ Innovaccer, a California-based maker of digital tools for providers, has acquired Cured, a Indiana-based digital marketing and customer relationship management [CRM] platform.

💧 Atlas-SSI, a Minnesota-based leader in water screening solutions that protect mission-critical assets and water ecosystems, acquired ABASCO, a Texas-based prominent provider of containment barriers and service.

📅 Economic Calendar

Anticipate key economic indicators focusing on Balance of Trade, GDP, and Inflation. Japan, Canada Interest rate decisions next week.

Wednesday January 17th 2024

🇨🇳 China - GDP Growth Rate YoY, Q4

🇨🇳 China - Industrial Production YoY, December

🇬🇧 UK - Inflation Rate YoY, December🇺🇸

🇺🇸 US - Retail Sales MoM, December

Thursday January 18th 2024

🇺🇸 US - Building Permits Prel, December

🇯🇵 Japan - Inflation Rate YoY, December

🇬🇧 UK - Retail Sales MoM, December

🇺🇸 US - Michigan Consumer Sentiment (Preliminary), January

Friday January 19th 2024

🇯🇵 Japan - Inflation Rate YoY, December

🇬🇧 UK - Retail Sales MoM, December

🇺🇸 US - Michigan Consumer Sentiment (Preliminary), January

Tuesday January 23th 2024

🇦🇺 Australia - NAB Business Confidence, December

🇯🇵 Japan - BoJ Interest Rate Decision

Wednesday January 24th 2024

🇯🇵 Japan - Balance of trade, December

🇩🇪 Germany - HCOB Manufacturing PMI (Preliminary), January

🇨🇦 Canada - BoC Interest Rate Decision

Thursday January 25th 2024

🇩🇪 Germany - Ifo Business Climate, January

🇺🇸 US - Durable Goods Orders MoM, December

🇺🇸 US - GDP Data, Q4

Friday January 26th 2024

🇩🇪 Germany - GfK Consumer Confidence , February

🇺🇸 US - Personal Income and Expenditure Data, December