🩺Health Insurance Index Rises 21%. $485M+ VC Funding.

Impact Capital Markets #118 looks at our Health Insurance Stock Index, major impact deals, M&A, and upcoming economic releases.

Mingalabar 🏞️

Today's Global Economic Update: The UK's inflation rate fell to the Bank of England's (BoE) target level of 2% in May for the first time in 3 years. Despite this, the BoE is not expected to cut interest rates at Thursday's monetary policy meeting with the cut likely to come in August or September instead.

🚚 Deal of the Day: Waabi, a Canadian autonomous truck startup, raised a $200M Series B to develop and launch autonomous trucks powered by generative AI.

What's New?

🩺 Health Insurance. Health insurance index rises 21%

💰 Funding. Autonomous trucks, biotech, mental health services + more

💼 M&A. Shell acquires pavilion energy

📅 Economics. BoE Interest Rate, balance of trade, inflation, + more

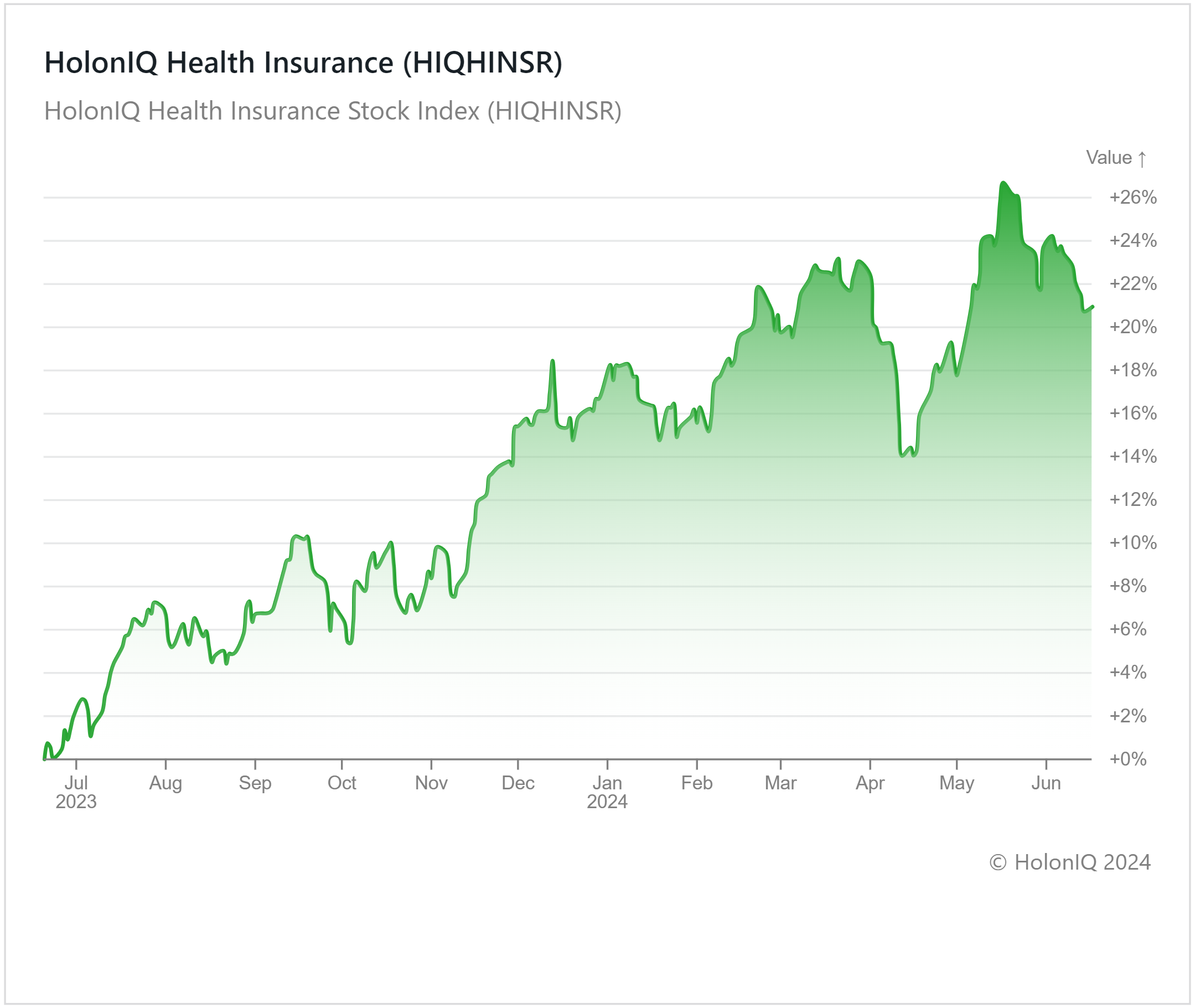

🩺Health Insurance Index Rises 21%

HolonIQ's Health Insurance Index has risen 21% over the past twelve months, driven primarily by strong performances from US-based constituents. Elevance Health ($124B MCap) increased by 20% and UnitedHealth Group ($442B MCap) by 2%. The US dominates the health insurance market, generating about two-thirds of global premium income, with healthcare spending rising by 7.5% in 2023, outpacing GDP growth due to higher expenditures on Medicaid and private health insurance. The insured population in the US also reached a record high of 93%. However, high medical costs, uncertainties around claims processing due to cyberattacks, and the government's decision not to increase payments for private Medicare plans in Q2 2024 have presented challenges.

In comparison, Chinese health insurance stocks underperformed, with China Life Insurance ($104B MCap) and Ping An Insurance Group ($96B MCap) declining by 18% and 13%, respectively. Rising premiums and the economic downturn have led millions to drop out of China’s state-sponsored insurance scheme, making these costs unaffordable for many. Despite these challenges, private insurers continue to innovate and customize policies to meet market demands. Growing awareness of preventative healthcare and an aging population with increasing healthcare needs are expected to drive sustained demand in the global health insurance market.

💰 Funding

🚚 Waabi, a Canadian autonomous truck startup, raised a $200M Series B from Uber and Khosla Ventures to develop and launch autonomous trucks powered by generative AI.

💊 Marea Therapeutics, a California-based biotech company, raised a $190M Series B to develop treatments targeting cholesterol.

🌼 Marigold Health, a Boston-based company focused on peer recovery, raised a $11M Series A from Rock Health Capital and Innospark Ventures to expand operations.

🧬 Leman Biotech, a Swiss tumor immunotherapy developer, raised a $6.9M Seed to advance drugs and accelerate solid tumor clinical trials.

💼 M&A

⛽ Shell, a UK-based oil & gas company signed a definitive agreement to acquire Pavilion Energy, a Singaporean integrated energy services provider.

📅 Economic Calendar

BoE Interest Rate, UK Retail Sales, Balance of Trade, Inflation, + More

Thursday, June 20th 2024

🇬🇧 UK BoE Interest Rate Decision

🇺🇸 US Building Permits (Preliminary), May

🇯🇵 Japan Inflation Data, May

Friday, June 21st 2024

🇬🇧 UK Retail Sales Data, May

🇩🇪 Germany HCOB Manufacturing PMI (Flash), June

Monday, June 24th 2024

🇩🇪 Germany Ifo Business Climate, June

Tuesday, June 25th 2024

🇦🇺 Australia Westpac Consumer Confidence Change, June

🇨🇦 Canada Inflation Rate, May

Wednesday, June 26th 2024

🇩🇪 Germany GfK Consumer Confidence, July

Thursday, June 27th 2024

🇺🇸 US Durable Goods Orders, May

🇺🇸 US GDP Growth Rate, Q1

Friday, June 21st 2024

🇫🇷 France Inflation Rate (Preliminary), June

🇮🇹 Italy Inflation Rate (Preliminary), June

🇺🇸 US Core PCE Price Index, May

🇺🇸 US Personal Income & Spending, May

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com