🏥 Health Insurance Deep Dive + East Asia Health Tech 200

Happy Monday 👋

This week we are exploring Health Insurance. Don't forget to check out the 2024 Global Health Outlook, and sign up for our new Daily Newsletters - 'Chart of the Day' and 'Impact Capital Markets'. For unlimited access to over one million charts, request a demo.

This Week's Topics:

🏥 Health Insurance Landscape

📊 2024 Global Health Tech Outlook

🏆 East Asia Health Tech 200

📊 Charts, Charts and more Charts

📈 Health Tech Capital Markets

💰 Top Deals This Week

Have feedback or ideas for us? Email hello@holoniq.com — we'd love to hear from you!

🏥 Health Insurance Landscape

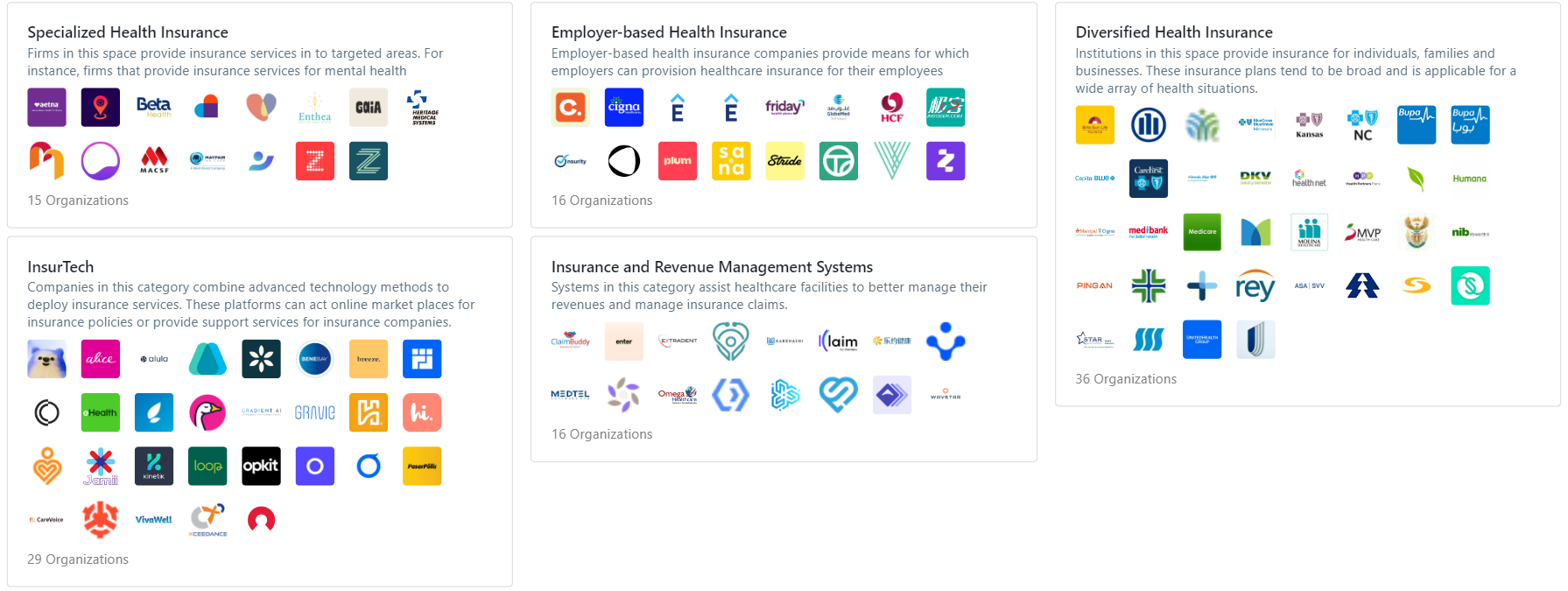

Private health insurance has become a main-stay in the health payments landscape over the past few decades. Private health insurance accounts for 10% of the overall health spending among OECD countries. In the, 40% of all insurance spending in the US originate from private health insurance. With the emergence of supportive technologies and AI, provision of health insurance enters into a realm of new opportunities. As such, our market map will outline the most significant operators in the space covering established insurance providers to pioneers in insurance innovations.

The insurance landscape witnessed several interesting developments over the past month. For instance, Humana was removed as a provider of Medicare Advantage plans by ChristianaCare, the largest healthcare provider in Delaware. In tandem with coverage expansions for bariatric surgeries and sickle cell treatments, our team at HolonIQ decides to focus on this landscape.

HolonIQ is tracking hundreds of health companies in this area around the world and through Q1 we're launching an enhanced Market Maps feature to explore landscapes dynamically on dimensions important to you. By region, revenue, age, category and more with sub categorization on any dimension in one click. Stay tuned for the launch!

HolonIQ Market Map - Health Insurance

📊 2024 Global Health Tech Outlook

2024 is a fresh start and the stage is set for the next wave of Health Technology. Just a few weeks ago, we launched the 2024 Global Health Tech Outlook, HolonIQ's annual analysis of the health landscape, presenting over 190 pages of detailed market data, investment & analysis, strategic shifts and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report. You may also be interested in our Global Economic Outlook, Global Climate Tech Outlook or Global Education Outlook.

We have a jam packed agenda for 2024 including a major new market sizing release and many more exciting new initiatives. Stay tuned or Connect with HolonIQ to learn more about how we support forward thinking institutions, governments and organizations worldwide as they navigate the challenges and opportunities ahead. Purchase the Outlook or Download the Extract.

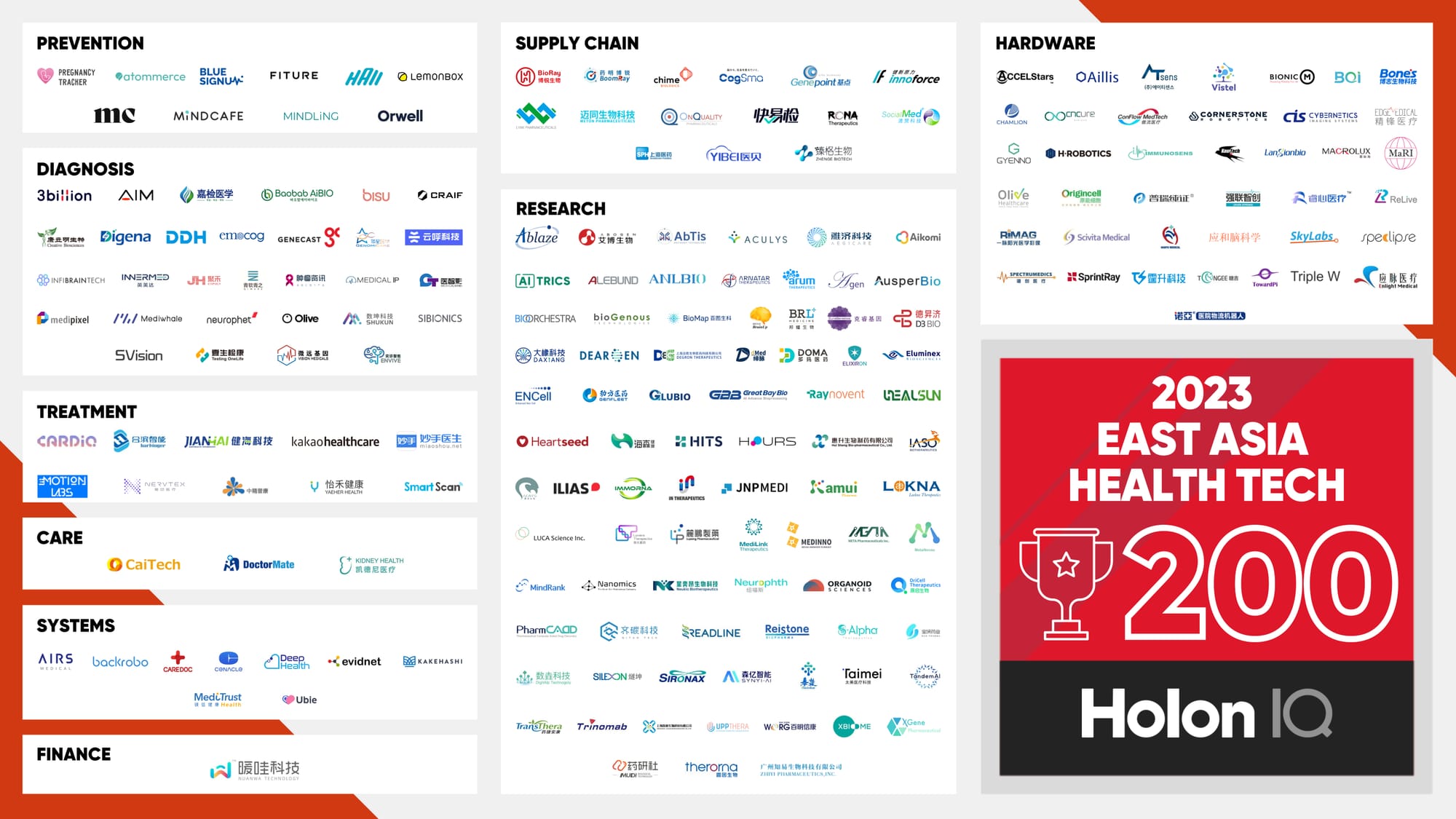

🏆 East Asia Health Tech 200

The East Health Tech 200 is HolonIQ’s annual list of the most promising startups working in digital health, biotech, drug discovery and analytics.

Some of the cohort members stood out among all others over the last few months. Neurophet gathered impressive momentum by partnering with the South Korean-based Konkuk University Hospital in January 2023. Furthermore, Neurophet successfully raised $15M in a Series C funds and is set to launch its IPO in 2024. Other cohort members such as SiBionics and BioRay were able to obtain regulatory approvals for their solutions from Europe and the US, respectively, in November 2023.

📊 Charts, Charts and more Charts.

Subscribe to HolonIQ's newsletter 'Chart of the Day,' providing a daily chart that helps explain the global impact economy - from education to healthcare and climate technology.

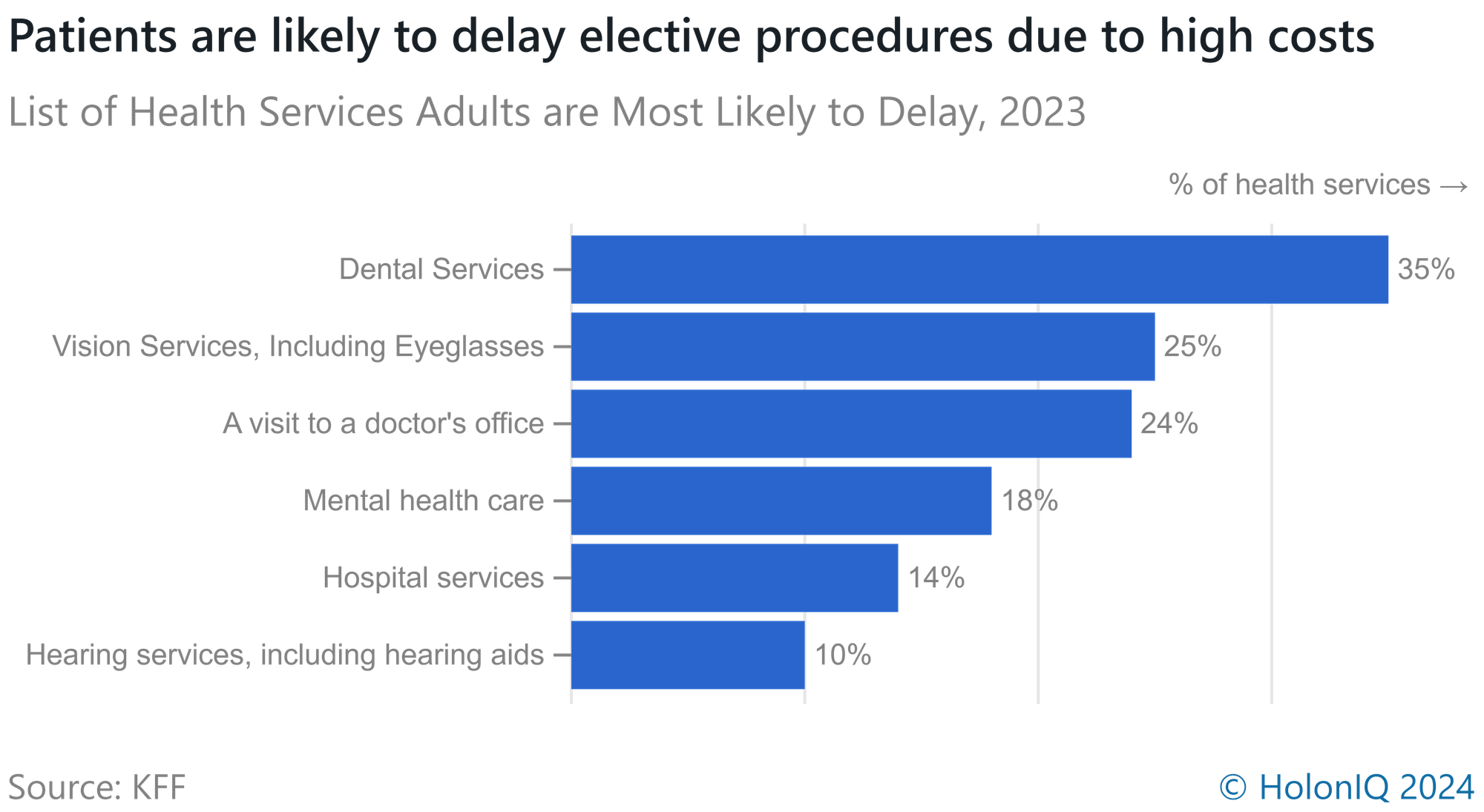

Most adults delay or postponed elective medical care due high medical costs. In may instances, many Americans live quite a distance away from a hospital. Americans who live in rural areas live around 10.6 miles away from the nearest hospital on average. These individuals are highly worried about relevant transportation costs required as well. Another limiting factor is that some of these services may not be covered by their health insurance scheme, which makes them hesitate to obtain relevant care. Seeking care for uninsured maladies may leave a significant dent to their finances, hence they are likely to postpone these types of care.

📈 Health Tech Capital Markets

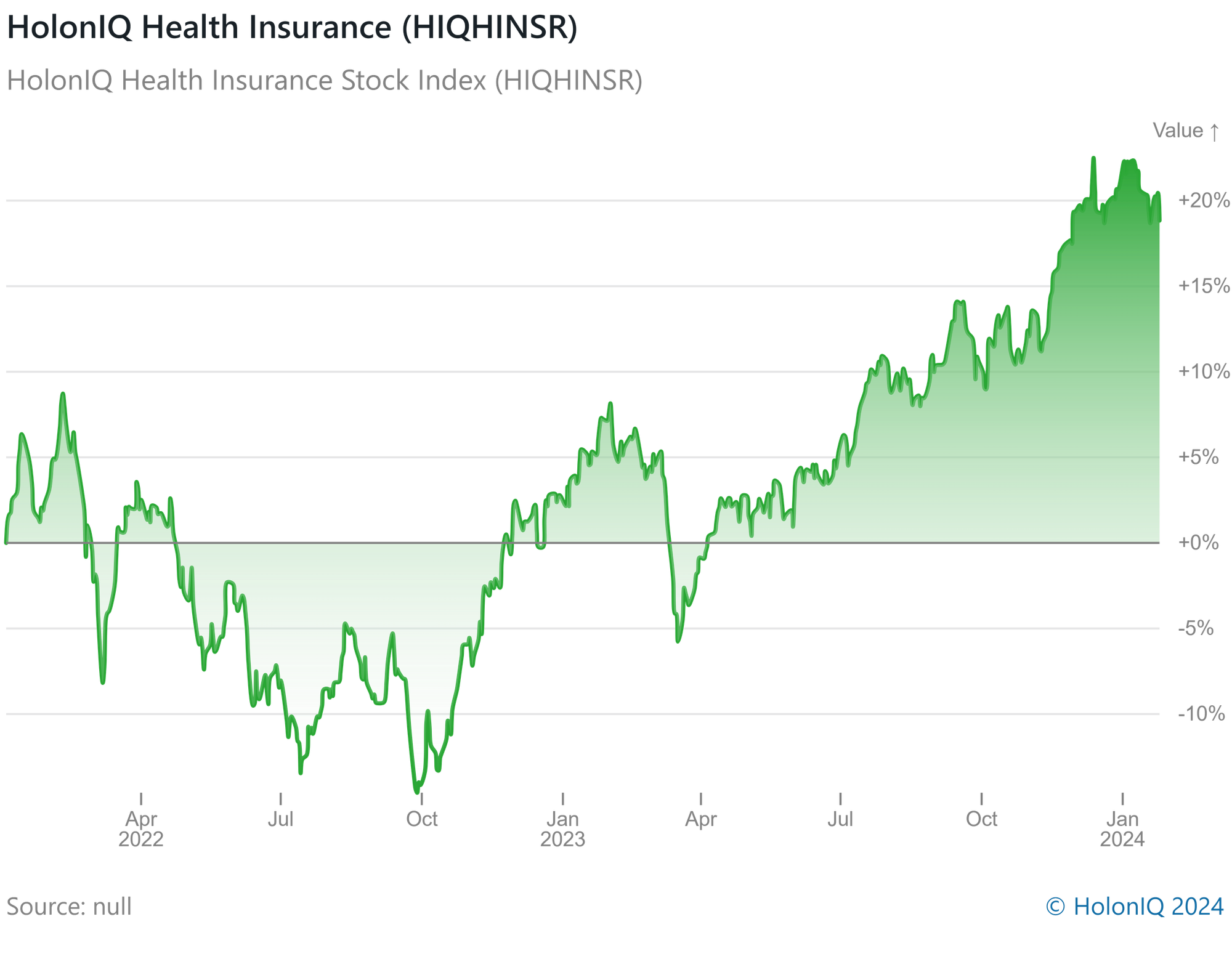

HolonIQ tracks over multiple listed companies in health around the world and thousands of acquisitions and investments each year. Soon we will launch a range of Stock Indices to track the daily performance of over 10 indices across Health Technology.

Our new Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

💰 Top Deals This Week

Funding

🎗️ Accent Therapeutics: has secured $75M in a Series C funding round led by Mirae Asset Capital Life Science. The funds will be used to advance lead programs, including a DHX9 inhibitor and KIF18A inhibitor, which are potential cancer therapies.

🥦 Bloom Nutrition: has raised $90M in a financing round led by Nutrabolt,. The funds will be used to accelerate Bloom's business, including demand-generation activities, product innovation, and internal capabilities.

Acquisitions:

💔 Sanofi: acquired Inhibrx's experimental drug, INBRX-101, which is in clinical trials, for to $2.2 billion, aiming to strengthen its rare disease portfolio.

👁️ Sandoz: is set to buy the Cimerly ophthalmology franchise from Coherus Biosciences for $170M, as Coherus Biosciences intends to focus on oncology. The deal is set to occur in the first half of 2024

🧬 Natera: acquired reproductive health assets from Invitae for $10M, with potential milestone payments and litigation credits of up to $42.5M. The sale will reduce operating expenses by $44M, excluding one-time severance payments.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com