🔬 Fertility Tech + Puerto Rico Impact 50

Declining birth rates result from a complex combination of factors, with rising infertility rates in developed nations being a key contributor.

Declining birth rates are driven by a complex interplay of factors. While female education, contraception, and economic prosperity play a role, rising infertility rates, particularly in developed nations, are a significant contributor. Assisted Fertility Technology (ART) offers options for those facing infertility, however social, political and legal barriers remain in some locations. Legal restrictions in Alabama classifying embryos as human, while Canada's relaxed policies on egg and sperm donation exemplify contrasting approaches. This week we also feature the Puerto Rico Impact 50, identifying the most promising startups and scale-ups from Puerto Rico across health, climate & education.

This Week's Topics

🔬 Fertility tech. Exploring the complexities of fertility tech

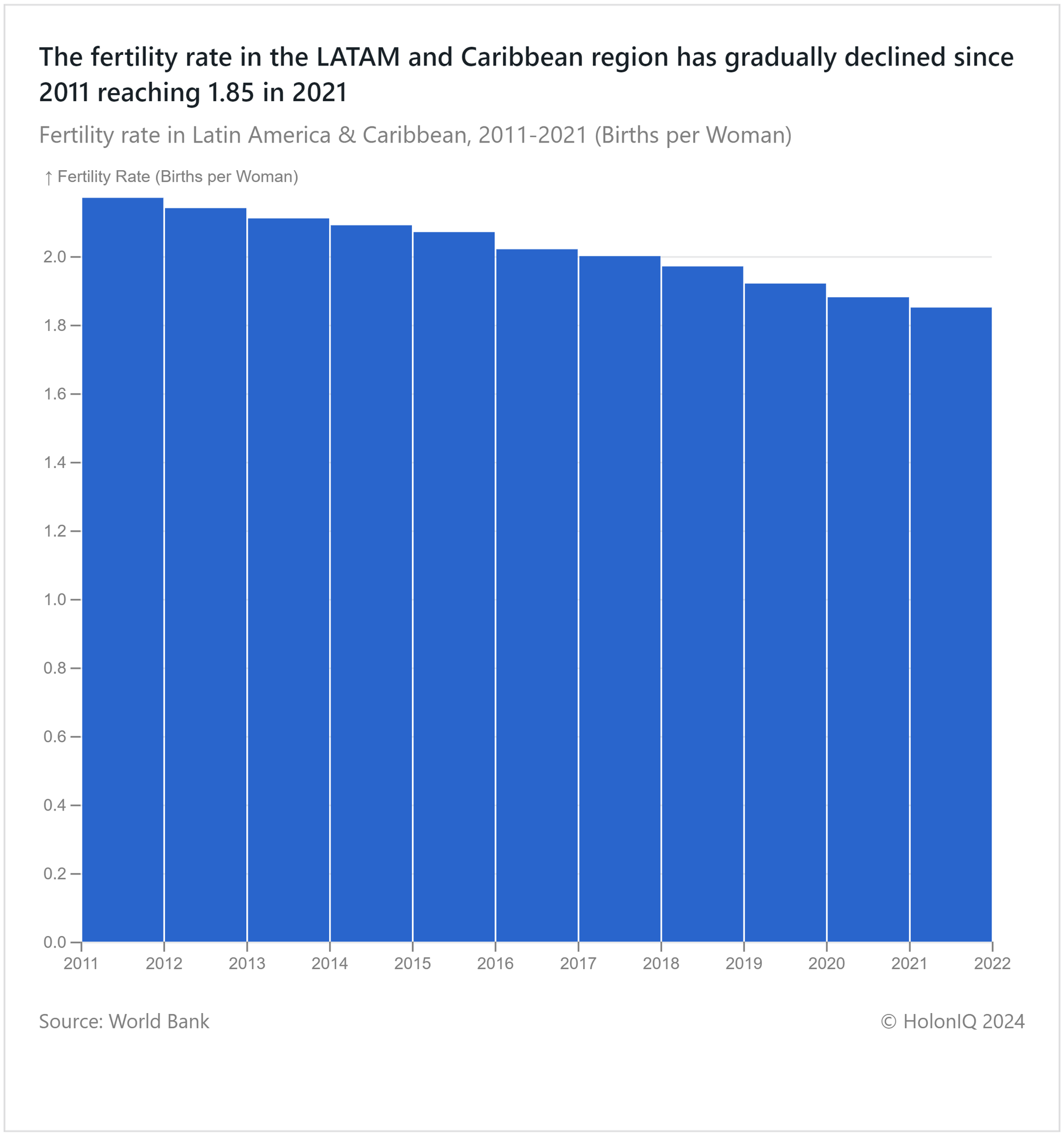

📊 Charts Spotlight. Fertility rates in LATAM and the Caribbean on a decline

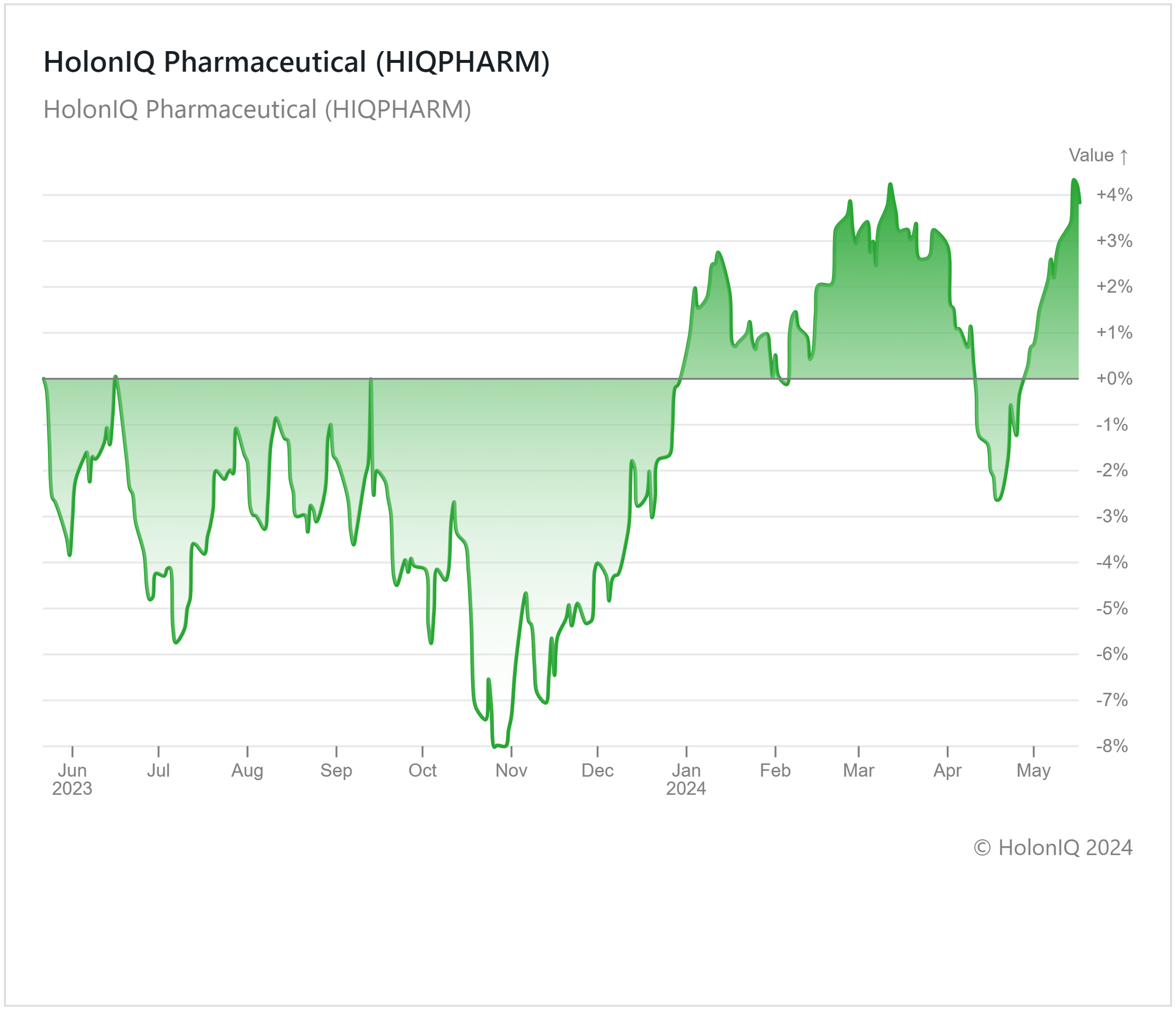

📈 Pharmaceutical Index. Pharmaceutical Index retraces losses to end at 5%

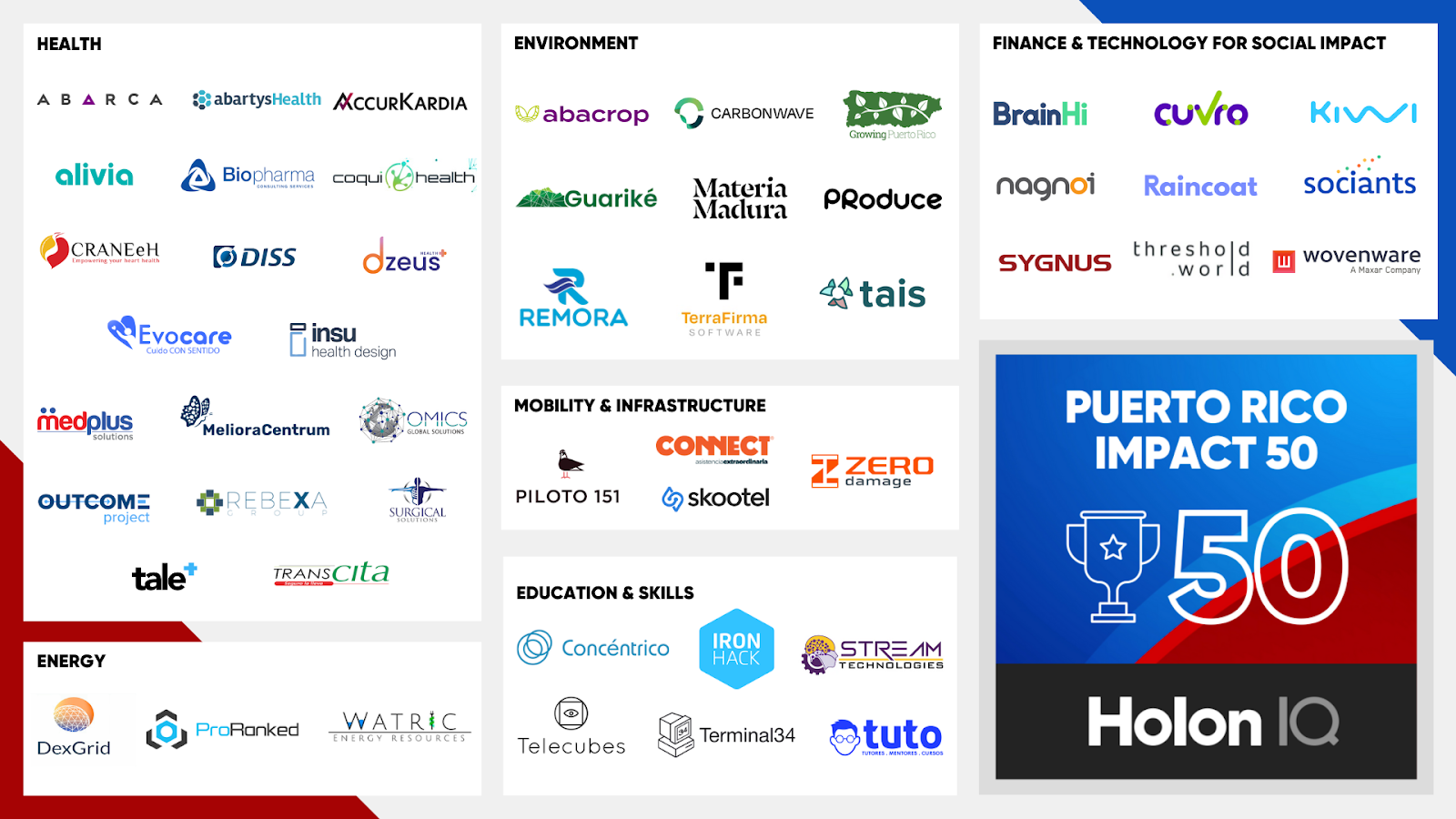

🏆 Puerto Rico 50. The most promising startups and scale-ups from Puerto Rico across health, climate & education.

📖 Annual Health Tech Outlook. 190+ pages of trends, insights, and data

💰 Health Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Health Tech Outlook and sign up for our Daily Newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

🔬 Fertility Tech

Fertility rates have dipped continuously since 1960, driven by increased educational opportunities for women, better contraceptive accessibility, lower childhood mortality, economic prosperity, and higher prevalence of infertility issues, which have developed nations at a more disproportionate rate. Between 1990-2015, infertility rates increased from 3.5% to 16.7% for developed nations, while developing nations witnessed a shift from 6.9% to 9.3% over the period. As such, infertility rates have a higher influence on the shrinking birth rate.

Fertility technology, also known as Assistive Reproductive Technology (ART), offers valuable options for those struggling with infertility. ART encompasses a range of procedures, including in-vitro fertilization (IVF) and, while ART offers hope for many, it intersects with complex social, legal and political factors. Reproductive rights are central to the discussion around fertility tech. For example, Alabama's recent ruling classifying embryos as human adds legal hurdles. Conversely, Health Canada's policy changes to simplify egg and sperm donation streamline operations. These contrasting examples highlight the dynamic legal landscape surrounding ART. Beyond legal issues, traditions and cultural norms influence the adoption of fertility tech. Social stigma surrounding infertility or these treatments can prevent individuals from seeking essential care.

📊 Charts Spotlight - Fertility Rates in LATAM and the Caribbean on a Decline

Subscribe to HolonIQ's 'Chart of the Day,' a daily newsletter that helps explain the global impact economy, from climate tech to education and healthcare.

In 2021, Latin America and Caribbean countries experienced a gradual decline in fertility rates, dropping to 1.85 from the previous 2.2, which is already considered low for sustaining a stable population. Brazil, Costa Rica, and Colombia witnessed rapid declines in fertility rates, attributed to various factors such as the introduction of new contraception methods and evolving family values in Brazil, phased fertility transitions in Costa Rica, and widespread private family planning programs in Colombia. These declining birth rates pose challenges to the sustainability of social services and pension systems, necessitating a shift towards increased productivity and re-evaluation of retirement age policies. However, Argentina and Uruguay implemented awareness programs and contraceptive initiatives, resulting in substantial drops in pregnancies among young women. Similarly, Chile saw a significant decrease in teen pregnancies. Governments have responded by initiating policies aimed at reducing stress for working parents, including tax deductions for dependents and paid maternity leave, to boost fertility rates.

📈 Capital Markets - Pharmaceutical Index Retraces Losses to End at 5%

HolonIQ tracks hundreds of listed health companies worldwide, as well as acquisitions and investment transactions. Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

Over the past twelve months, the HolonIQ Pharmaceutical Index has experienced a 5% increase, following months of fluctuation that saw the index dip as low as -18% in October 2023. Throughout much of 2023, pharmaceutical companies in the index faced a challenging operational landscape due to elevated interest rates, inflation surpassing expectations, regulatory constraints, and the normalization of revenue following the COVID-19 pandemic. China's regulatory crackdown on the health industry also dampened investor confidence and led to lower returns for Chinese pharma stocks, exerting a downward pressure on the index.

However, the index is experiencing a turnaround, with the recent boost in weight loss drugs propelling the positive outcomes of key stocks within the index. Novo Nordisk ($447B MCap) reported a 28% increase in net profit in the 1Q 2024, as sales of its weight loss drug Wegovy more than doubled. Its stock price increased by 57% over the past year. Eli Lilly And Co ($726 MCap) also saw a 76% increase after strong sales of its drugs, Mounjaro and Zepbound drove a 26% increase in revenue in Q1 2024.

Expectations are high for continued growth in the pharmaceutical sector, driven by improving macroeconomic conditions and the prospect of AI integration reshaping the industry. However, as legislation to control prescription drug costs marches on, this could create challenges for pharmaceutical firms. Likewise, as US legislators take aim at Chinese-owned companies over national security concerns, the supply chains of several pharmaceutical companies are at threat of being disrupted. These Chinese firms constitute the largest makers of active pharmaceutical ingredients and antibiotics and are major suppliers of drugs to the EU and US.

🏆 Puerto Rico Impact 50

HolonIQ launched its inaugural Puerto Rico Impact 50 list as part of Puerto Rico Impact Week, identifying high-potential Puerto Rican startups and scale-ups driving positive change in education, health, and climate.

The Puerto Rico Impact 50 reflects a strong emphasis on health innovation. Health Tech solutions make up 38% of the list, with finance & technology, along with environment solutions next. Puerto Rico is well known for its biotech, pharmaceuticals and life sciences industry, particularly in manufacturing and medical device production. So it's no surprise to see a strong contingent of health tech solutions from in this year's list.

📊 2024 Global Health Tech Outlook

HolonIQ's annual analysis of the evolving Health Tech landscape offers over 190 pages of in-depth insights on market data, investments, strategic shifts, and trends in healthcare services, pharmaceuticals, biotechnology, and medical hardware. Download the extract or purchase the full report.

💰 Health Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the health industry across all regions of the world. Subscribe to our daily Impact Capital Markets newsletter to peruse the top deals for each day.

Funding

🏥 SmarterDx, a US-based clinical AI company that develops automated pre-bill review tech to help hospitals maintain revenue integrity, raised $50M in a Series B funding led by Transformation Capital.

📑 Chapter, a US-based tech-enabled Medicare advisor providing consultation on the appropriate medical services, raised $50M in a Series C funding led by XYZ Venture Capital to accelerate product development and hiring initiatives.

👶 ByHeart, a US-based infant nutrition company with FDA-registered infant formula, raised $95M in a Venture funding to keep pushing their US commercial launch and the development of its innovation pipeline.

🔬 Ajax Therapeutics, a US-based biotechnology company developing treatments that target signals in the body linked to blood cancer, raised $95M in Series C funding to support its ongoing clinical trials.

🧬 Lycia Therapeutics, a US-based biotechnology company focusing on creating technology that uses lysosome-targeting hybrids, raised $106.6M in Series C funding to advance lead programs treating autoimmune and inflammatory diseases into clinical stages.

M&A

💊 OnKure, a US-based clinical-stage biopharmaceutical, merged with Reneo Pharmaceuticals, an operator of a pharmaceutical company that used to develop therapies for rare metabolic diseases.

📑 Navacord, a Canada-based insurance brokerage firm that offers risk management and consulting solutions, acquired SecuriGlobe, a travel protection and health insurance distributor in Canada.

Fund Formation

💼 Sands Capital, a US-based investment manager that seeks to invest in technology and life sciences businesses, raised $555M in a funding round to invest in therapeutic, diagnostic, and device companies.

💰 NewVale Capital, a US-based growth equity fund that invests in established, revenue-generating pharmaceutical services companies, raised $167M in a funding round to aid the growth of established pharmaceutical service companies crucial in delivering medicines to patients.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com