📚 Evolution of Publishers + South Asia EdTech 100

Established publishing giants maintain market dominance with varied offerings, as e-books challenge traditional print in education. Emerging contenders enter niche sectors alongside longstanding academic and trade publishers.

Happy Monday 👋

Major publishing houses dominate the market with diverse catalogs, and digital formats are slowly disrupting traditional print in education. New players emerge in niche markets alongside established academic and trade publishers. Technology integration creates space for advanced applications for content, simulated learning, and AI is now shaping the evolving learning content landscape. This week, we revisited 100 of South Asia's most promising EdTech startups.

This Week's Topics

🏫 Publishers. Transitioning from paper to digital & static to active content

📊 Chart Spotlight. Career development tops strategy for talent retention

📈 Publishers Index. Retraces gains to end flat over the last three months

🍎 Back to School Summit. 10-11th September in New York City

🏆 South Asia EdTech 100. The most promising learning, teaching, and upskilling startups in the region

📖 Annual Education Outlook. 180+ pages of trends, insight, and data

💰 Education Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Education Outlook and sign up for our new Daily Newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

📚 Publishers Landscape

Major publishing houses still dominate the educational content market with extensive catalogs spanning fiction, non-fiction, educational instructional and assessment materials, and more. These companies leverage their vast resources, multi-year contracts, and distribution networks to shape industry trends and drive market dynamics. Over the past decade, there has been a significant shift from traditional print materials to digital formats, and publishers with digital content are offering interactive experiences with formats such as videos, simulations, and augmented reality to make learning more engaging.

Publishers are also leveraging artificial intelligence to personalize the experience for students, generating relevant content within their platforms, adapting pathways to student progress, building AI chatbots to assist learning, and more. Publishers are also recommending or integrating their suite of supplementary resources, allowing students and educators to easily access or buy materials directly connected to what their students are studying. This focus on innovation keeps pace with how students prefer to learn and helps digital publishers stand out in a crowded market.

While smaller independents and point-solutions populate specialized niches, educational publishers continue to carve out their territories, catering to large audiences and diverse needs, acquiring or developing digital capabilities to stay current and relevant. HolonIQ tracks the global education publisher and digital content market, identifying the key market segments and mapping innovations as they occur.

📚 Publishers - Market Map

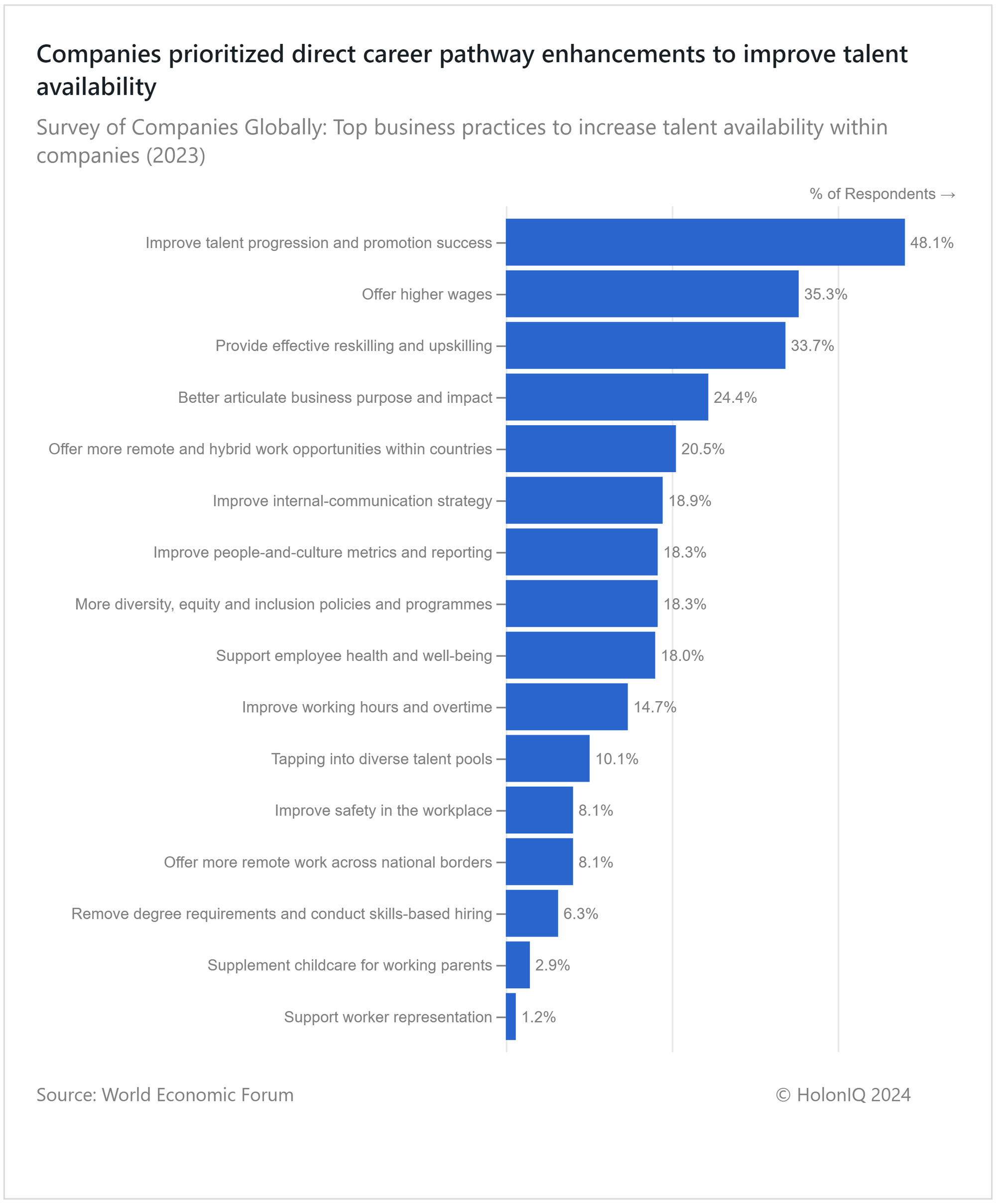

📊 Charts Spotlight - Career development is key for talent retention

Subscribe to HolonIQ's 'Chart of the Day,' a daily newsletter that helps explain the global impact economy, from climate tech to education and healthcare.

In 2023, companies indicated the most effective way to attract and retain talent was to invest in their employees' career pathways. This benefits companies by reducing turnover costs and keeping employees productive. Employees appreciate these programs, feeling their employer values their future growth. Interestingly, other perks like work-from-home options weren't a major indicator of talent attractiveness or retention.

📈 Capital Markets - Publishers Index Retraces Gains to End Flat

HolonIQ tracks hundreds of listed education companies worldwide, as well as acquisitions and investment transactions. Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

HolonIQ’s Publishers index retraced gains seen earlier in the quarter, to end flat. The widespread adoption of generative AI can have a significant impact on the publisher index. Publishers like News Corp have reportedly engaged in discussions with OpenAI to potentially license their content, amidst legal concerns surrounding the utilization of third-party content for training artificial intelligence systems. Last month, News Corp completed a share buyback in March, while Pearson unveiled intentions to repurchase shares worth over $200M. Informa expanded their stock buyback to $1.5B, which could be a positive sign for shareholders. With the market adapting to the new valuations, publishing companies are also enhancing their AI study tools, suggesting prospective growth for the index ahead.

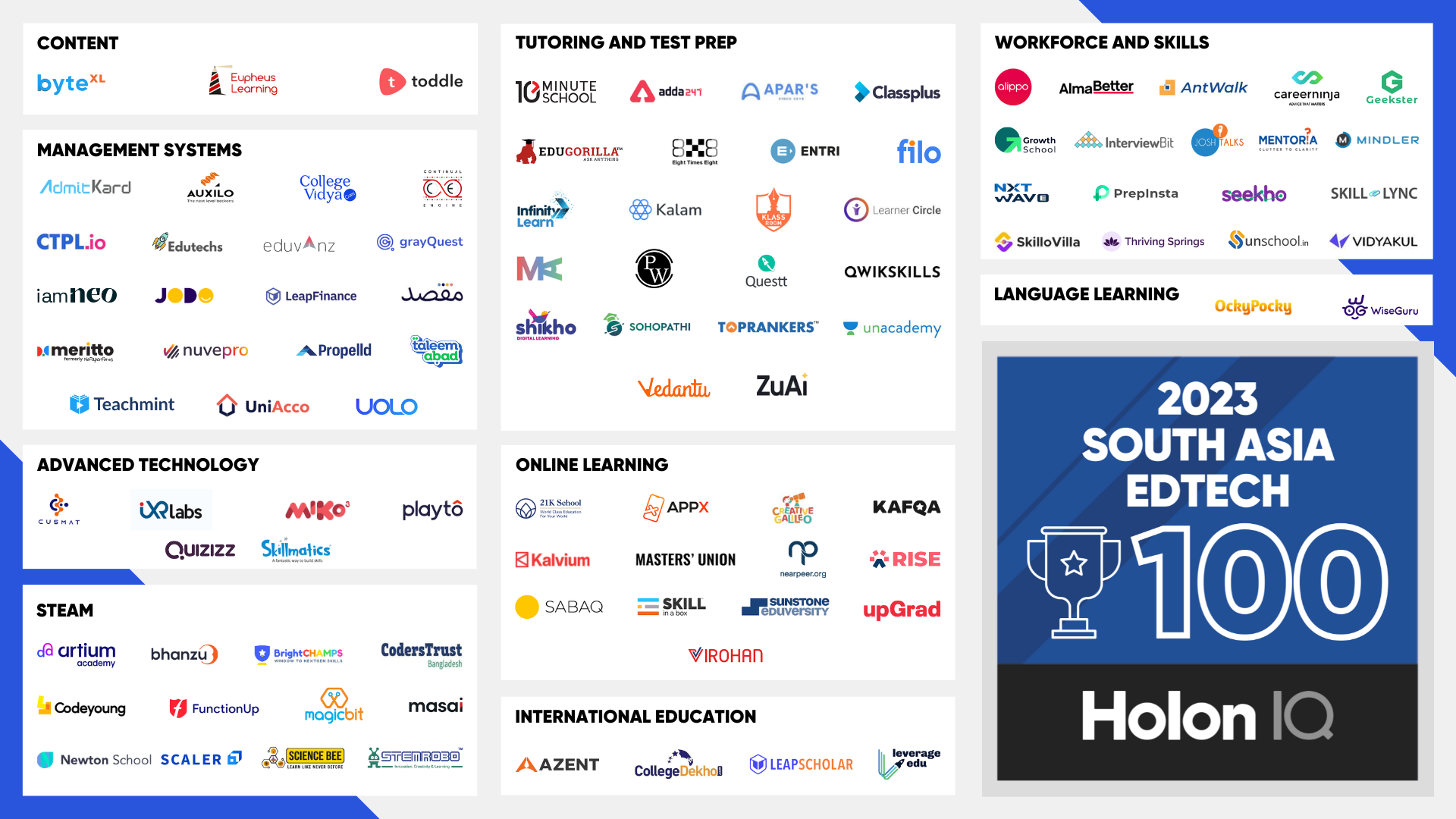

🏆 South Asia EdTech 100

Each year, HolonIQ identifies the 1000 most promising EdTech startups globally. Region by region, we build a picture of each market and how technology is used in education, from PreK to Lifelong Upskilling. This week, we are revisiting the 50 most promising EdTech startups in South Asia.

A couple of cohort members stood out with their latest actions in the EdTech space. Shikho (a Bangladeshi Edtech that provides test prep services) launched an offline test prep center in Dhaka, marking a shift towards omnichannel operations. ByteXL (an Indian IT learning platform) partnered with the Chaitanya Bharathi Institute of Technology to bridge the skills gap by ensuring students receive training in the industry's most in-demand modern technologies.

🍎 Back to School Summit 10-11 Sept NYC

Registration for our flagship Back to School Summit in New York on September 10-11, is now open. This year, we're bringing over 500 global education leaders together for three incredible tracks: Higher Education and Workforce, Foundation and Philanthropy, and Technology and Finance.

📖 2024 Global Education Outlook

HolonIQ's annual analysis of the global education economy offers over 180 pages of in-depth insights on market data, investments, strategic shifts, and trends in education. Download the extract or purchase the full report.

💰 Education Deals of the Week

HolonIQ actively monitors and tracks capital flow in the Education market, spanning across all regions and transaction categories. Subscribe to our Daily Capital Markets newsletter to see the top deals daily.

Funding

📊 Anthology, a higher education enterprise software solutions provider has raised $250M in capital to invest in its strategic initiatives and core EdTech solutions

🪜 NextWork, a New Zealand based online learning platform focusing on technology upskilling, secured $2.3M in a pre-seed round to upskill displaced workers.

🧠 memoryOS, the Swedish EdTech firm focused on improving memory, received a new investment from Vesna Capital, a Ukrainian investment fund.

M&A

🧒 Wonderschool, a platform that helps early educators start childcare centers and preschools out of their homes, acquired ChildcareMatters to help childcare providers from administrative burnout.

📝 Everfield, a vertical and specialist software operator, has acquired assessment and credentialing company MyKnowledgeMap. This acquisition will advance MyKnowledgeMap's growth in the university sector.

🧑💻 Visma, a software developer for the private and public sectors acquired Meebook, a Danish digital learning platform provider for primary schools. This move will help Visma secure its position in the Nordic market.

📑 Vklass, a personalized learning platform for schools, acquired Samverka.nu, an internship management platform. This integration will allow Vklass to provide a holistic service to its clients.

📈 Edflex, a company providing training resources for businesses, acquired OfcourseMe, an Italian developer of personalized learning solutions. EdFlex's acquisition will help establish its content aggregator position in the EU market.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com