🚗 EV Share Down To 7.3% In The US + Indo-Pacific Climate Tech 100

EV share of new vehicle sales decreased to 7.3%, down from 8.1% in the previous quarter as range anxiety, lack of charging infrastructure, and economic uncertainty slowed down sales growth rates. This week we also highlight our Indo-Pacific Climate Tech 100.

Happy Monday 👋

EV share of new vehicle sales decreased to 7.3%, down from 8.1% in the previous quarter as range anxiety, lack of charging infrastructure, and economic uncertainty slowed down sales growth rates. This week we also highlight our Indo-Pacific Climate Tech 100, showcasing the region's most promising start-ups across the energy and storage, food systems, and mobility sectors.

This Week's Topics

🏆 Indo-Pacific Climate Tech 100. HolonIQ's inaugural list of the most promising Climate Tech start-ups from 14 IPEF partner countries

📈 EV adoption in the US. Down 15.2% from Q4 2023

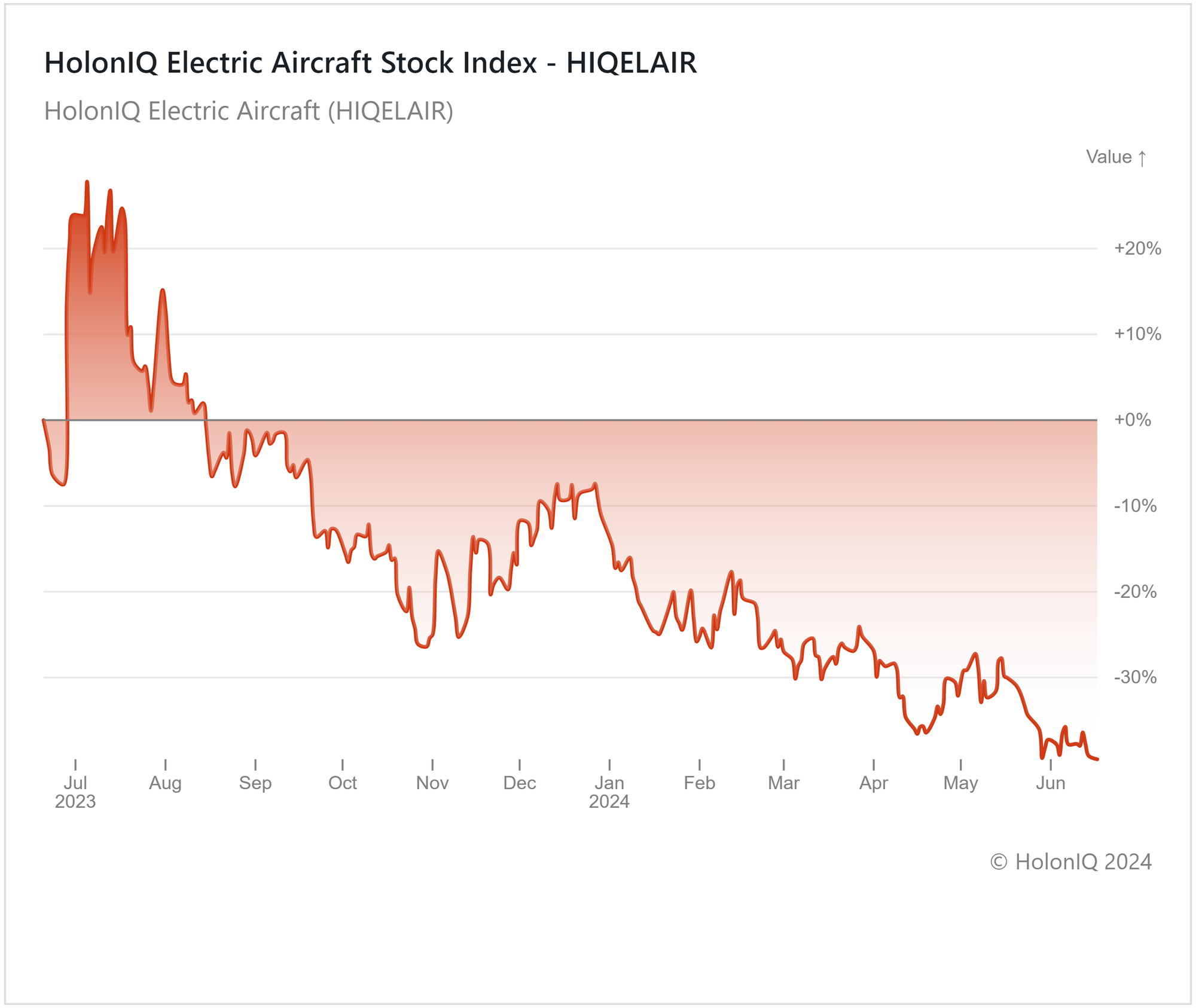

📊 Electric Aircraft Stock Index. 40% decline as companies struggle to bring products to market

📝 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data

💰 Climate Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Climate Tech Outlook and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

🏆 Indo-Pacific Climate Tech 100

The Indo-Pacific Climate Tech 100 includes companies from all 14 IPEF partner countries, representing the region's most innovative and promising climate tech companies. The cohort represents companies with a combined total valuation of over $20B, employing over 12,000 people in green jobs in IPEF economies. The Indo-Pacific Climate Tech 100 cohort attracts total aggregate revenue of $1.5B, growing at more than 20% year over year, and has raised over $12B in total funding to date.

In partnership with the Indo-Pacific Partnership for Prosperity (IP3), this ambitious climate tech initiative is designed to accelerate clean economy investment and climate impact in one of the world's largest and fastest-growing regions, the Indo-Pacific. 50 companies representing the Indo-Pacific Climate Tech 100 traveled from across the 14 IPEF partner countries to meet in person in Singapore last week with over 150 leading investors, philanthropies, and financial institutions seeking to raise $1-2B in fresh funding at the Forum.

📈 EV Share of Total New-Vehicle Down To 7.3%

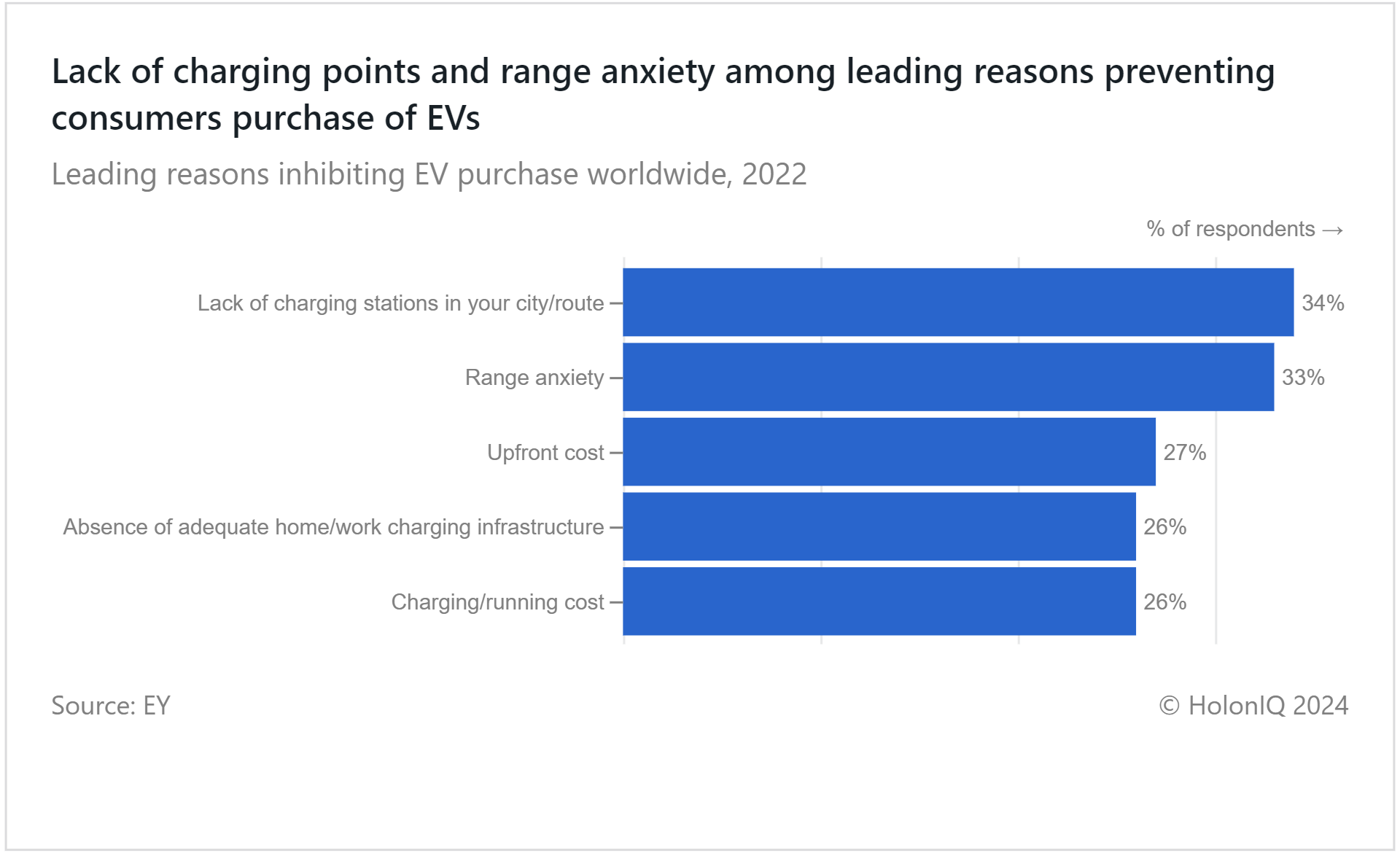

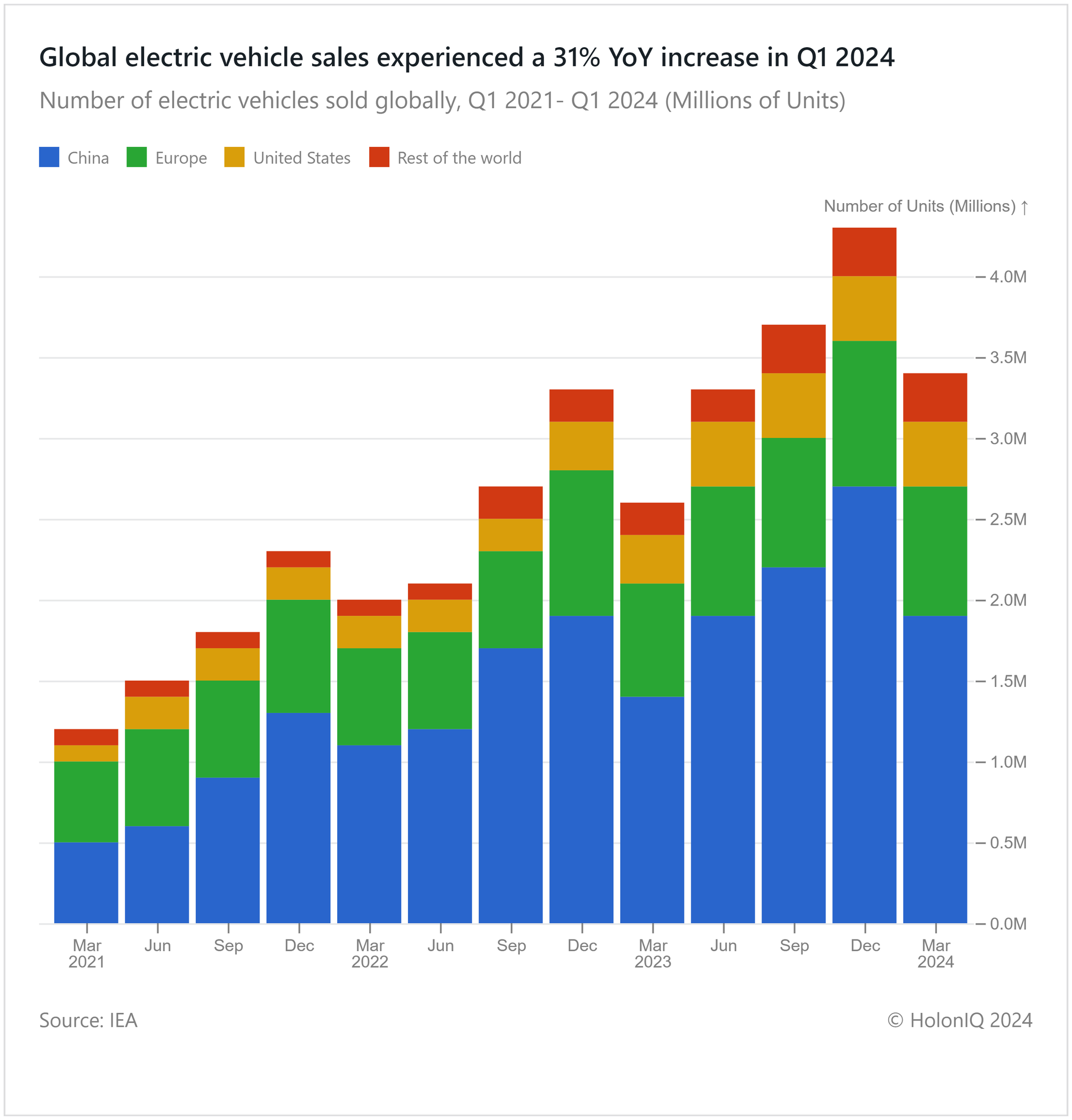

EV share of new vehicle sales decreased to 7.3%, down from 8.1% in the previous quarter. In the first quarter of the year, Americans bought 268,909 new electric vehicles, a decrease from the record of 317,168 vehicles. While EV sales continue to grow in the US and the world, the growth rate has slowed notably. Sales in Q1 rose 2.6% YoY but fell 15.2% compared to Q4 2023. Rapid charging station infrastructure issues have emerged as a tangible problem as EV penetration accelerates. Several automakers have said concerns about driving range and charging infrastructure are increasing. These issues may lead consumers to have second thoughts about buying an EV.

Q4 EV sales increased year over year by 40% – a strong result by any measure, except when compared to the growth the industry saw in previous quarters. The market posted a 49% gain in Q3, and EV sales were up 52% year over year in Q4 2022. By volume, EV sales in Q4 were higher than in Q3 by roughly 5,000 units.

🛩️ Electric Aircraft Down 40% YoY

HolonIQ's Electric Aircraft Index has dropped by 40%, with a 15% decline over the past three months. This decline highlights significant challenges in the electric aircraft industry, particularly concerning the weight and energy density of batteries and their limited range. Despite technological advancements, the industry struggles to compete with traditional aviation, which is also innovating by adopting Sustainable Aviation Fuels (SAFs) and improving existing technologies. The increased global focus on reducing carbon emissions is adding pressure on the aviation industry, as the sector contributes 3% of global emissions. If traditional aviation continues to become more cost-effective and environmentally friendly, the market capture for electric aircraft becomes increasingly difficult. These challenges have hindered revenue growth for electric aircraft companies, and major stocks have seen their prices decline. Joby Aviation ($3.5B MCap) experienced a 32% drop in its stock price over the past twelve months, while Eve Holding ($1.2B MCap) declined 56% and Archer Aviation ($1.0B MCap) fell 20%.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape across all world regions. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🚚 Waabi, a Canadian autonomous truck startup, raised a $200M Series B from Uber and Khosla Ventures to develop and launch autonomous trucks powered by generative AI.

🚗 TIER IV, a Japanese autonomous driving software, raised a $54M Series B to enhance software development.

🤖 Vecna Robotics, a warehouse automation technology company, raised a $40M Series C to expand operations.

🔋 Princeton NuEnergy, a New Jersey-based battery recycling company, raised a $30M Series A from Samsung to upgrade its recycling facilities.

🔥 Molten Industries, an Oakland-based energy startup, raised a $25M Series A to build its first modular reactor.

🚜 Balwaan Krishi, an Indian agri-tech e-commerce platform, raised a $4.8M Series A from JM Financial Private Equity to advance product development.

M&A

🔆 Nextracker, a California-based solar tracking systems company acquired Ojjo, for $119M, a California-based solar foundation manufacturer.

⛽ Shell, a UK-based oil & gas company signed a definitive agreement to acquire Pavilion Energy, a Singaporean integrated energy services provider.\

🌍 True Environmental, a New York-based environmental service company, acquired Sphere 3 Environmental, a Texas-based environmental consulting firm.

🏢 Installed Building Products, an Ohio-based marketplace for commercial building projects, and acquired Thrice Energy Solutions, an Oklahoma-based building services contractor.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com