🔌 EV Charging + Latin America Climate Tech 50

EV Charging is becoming paramount to the global decarbonization movement as the transportation sector pivots to electrification instead of internal combustion. We preview the 2023 Latin America Climate Tech 50, highlighting the most promising startups working in the clean technology sector.

Happy Monday 👋

EV Charging is evolving fast and is critical infrastructure in the transport sector's energy transition from internal combustion to electrification. The 2023 Latin America Climate Tech 50 highlights the most promising startups working in the clean technology sector. Don't forget to check out the 2024 Global Climate Tech Outlook, and sign up for our Daily Newsletters Chart of the Day and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

This Week's Topics

- 🔌 EV Charging Market Map. Mapping 100+ global players across the landscape

- 📊 Charts Spotlight. Public EV chargers by country and barriers to EV adoption

- 📈 EV Charging Index. Stocks decline due to China's woes

- 🏆 Latin America Climate Tech 50. Latin America's most promising startups working in clean energy, zero-emission mobility, and sustainability

- 📊 Annual Climate Tech Outlook. 230 pages of trends, insights, and data

- 💰 Climate Tech Deals of the Week. Funding and M&A

🔌 EV Charging Landscape

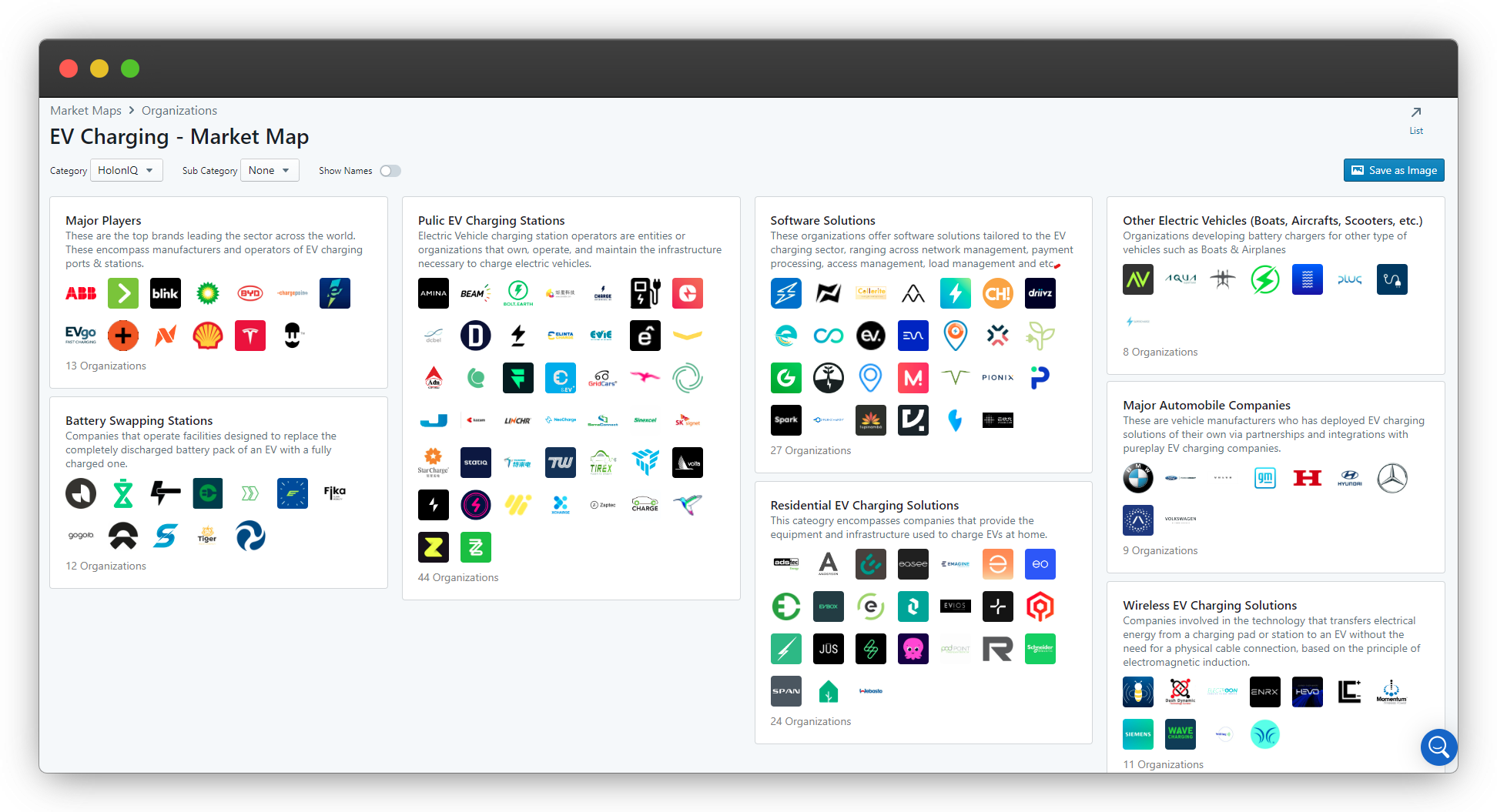

A vital component of the global energy transition is the adoption of EVs as an alternative to internal combustion vehicles. A key driver to accelerate EV adoption is the proportionate rollout of public fast charging points, which is akin to fuel stations catering to conventional cars. While the number of EV models available to consumers has grown exponentially, the public charging infrastructure has not.

As a positive response to lagging charging infrastructure, GM and Ford adopted Tesla's NACS charging standard in 2023. This enables EV charging equipment compatible between these brands and sets a broad standard across the market since Tesla, GM, and Ford account for 70% of the North American EV market. Subsequently, Rivian, Polestar, and charging operators Electrify America, Blink, ChargePoint, and EvGo announced the adoption of the NACS standard. In tech parlance, this is the equivalent of all smartphones adopting USB-C for charging. Additionally, Volkswagen has already deployed almost half of the 40,000 fast chargers it had planned to have ready by 2025. General Motors recently surpassed 1,000 fast-charging stalls, part of their ambition of setting up ~3,000 DC fast-charging stalls in major markets.

🔌 EV Charging - Market Map

📊 Charts Spotlight - Public EV Chargers by Country and Barriers to EV Adoption

Subscribe to the HolonIQ newsletter 'Chart of the Day', a daily newsletter that helps explain the global impact economy, from climate tech to education and healthcare.

It is not surprising that China leads the world in the number of installed EV chargers, given that China is the single largest EV market and the largest producer of EV batteries. In 2023, Chinese EV sales expanded by 38% to 9.49 million units, accounting for 31% of its domestic new car sales. Demand for plug-in hybrids rose 85% to 2.80 million units. In comparison, battery electric vehicle sales grew by 25% to 6.68 million units. China is ahead of Europe and North America in terms of rolling out charging infrastructure along with EV adoption, while Europe lags behind despite being the second-largest EV market. The availability of charging infrastructure is one of the factors holding back wider EV adoption globally.

Although EV charging stations represent modern technological shifts, they're still consumer-facing service points similar to fuel stations. Thus, the maintenance of such facilities and ease of use are essential factors that will have an impact on EV adoption. In the US, overall satisfaction with the DC fast charging experience dropped by 3%, while Level 2 charging stations saw a 2.5% drop. These are the lowest scores recorded since this data collection started in 2021. In Canada, only 17% of the 43,000 federally funded chargers are currently working.

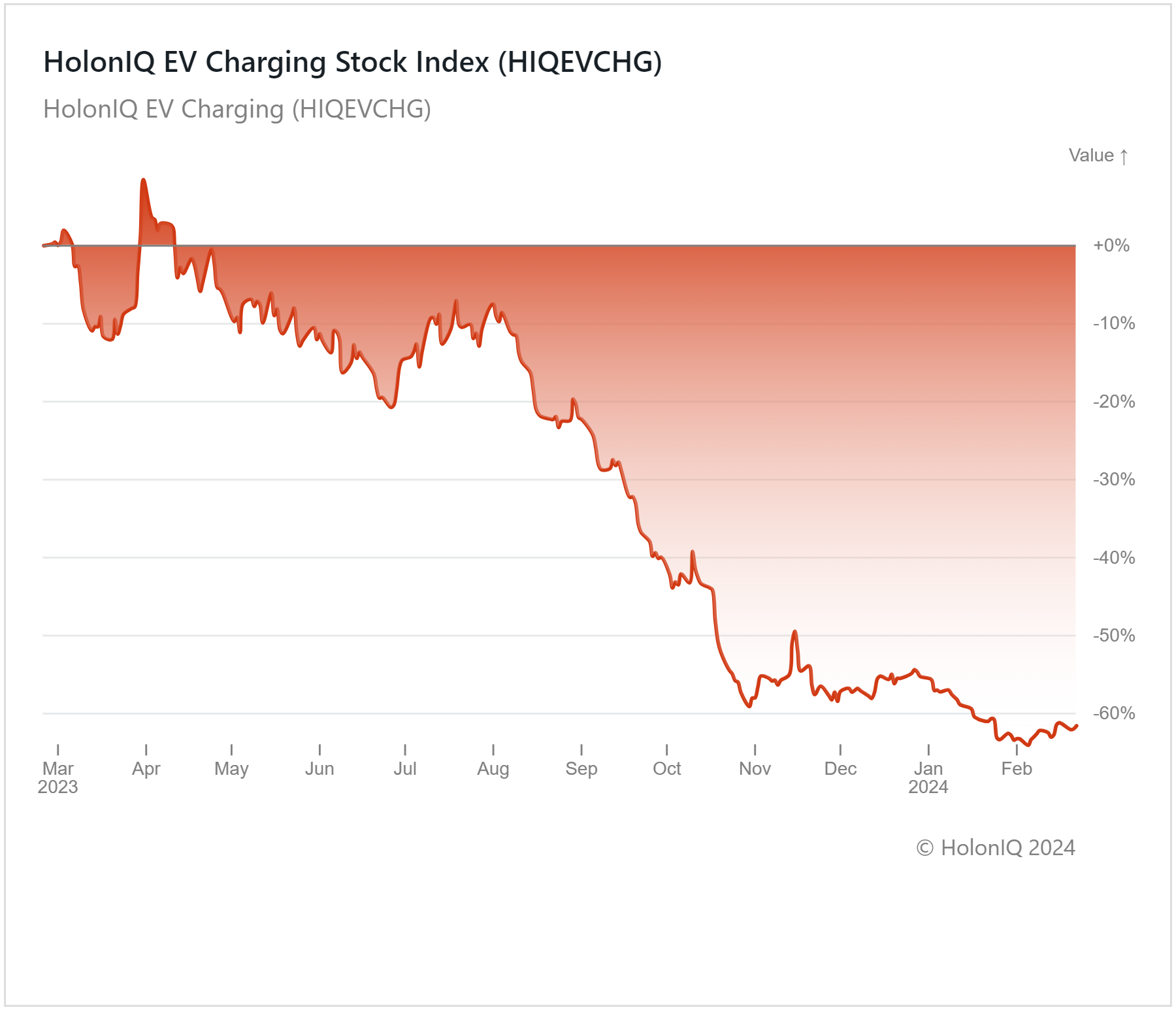

📈 Capital Markets - EV Charging Index

HolonIQ tracks thousands of listed climate tech companies around the world and several acquisitions and investments each year. Soon, we will launch a range of stock indices to track the daily performance of over 10 different sectors across Climate Technology.

Our new Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

Holon IQ’s EV Charging Index fell by over 60% in the past year as major stocks in the index registered significant declines. ChargePoint Holdings (MCap: $970M), Tesla (MCap: $628B), and BYD (MCap: $72B) all decreased, weighing down on the index. An exception was ABB Ltd. (MCap: $82B), which saw significant gains over the last 12 months.

The downturn in the EV charging market is primarily linked to developments in China, the largest EV market globally. China’s property market slump has led to a slowdown in macroeconomic conditions, driving down the demand for EVs. In Europe, the energy price fluctuations caused by the Russia-Ukraine conflict have increased EV charging costs, suppressing demand. However, things could be taking a turn for the EV industry in 2024, with January seeing record EV sales numbers globally. As EVs on the road continue to rise, EV charging has seen significant developments over the last few months, with the deployment of new charging infrastructure accelerating. With EV output in China picking up pace and governments around the world implementing policies to incentivize EV adoption, the outlook for the EV charging sector is improving.

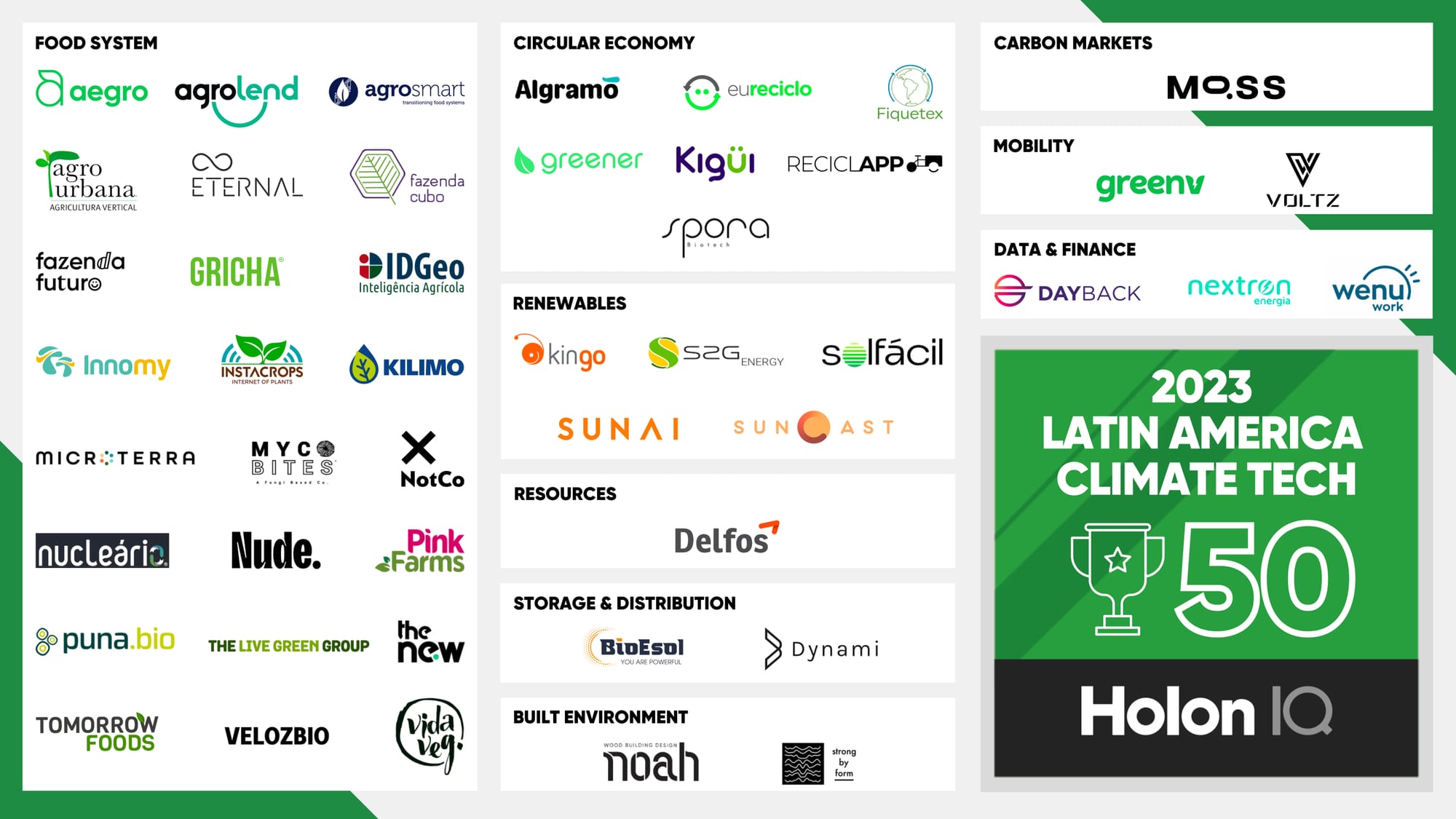

🏆 Latin America Climate Tech 50

The Latin America Climate Tech 50 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

Latin American startups were led by Brazil, which accounted for 64% of the VC funding in the climate tech landscape. The majority of this funding was allocated to Renewables, reflecting the region's potential for wind and solar power generation due to favorable geographical conditions. Notably, all the funding was directed solely towards startups in solar energy, accentuating the potential opportunities within the wind sector. Food Systems led the list, representing nearly half of the startups, followed by Circular Economy. Renewables was the third largest sector, only accounting for 10% of the list.

📊 2024 Global Climate Tech Outlook

2024 is a fresh start, and the stage is set for the next wave of Climate Technology. Just a few weeks ago, we launched the 2024 Global Climate Tech Outlook, HolonIQ's annual analysis of the new climate economy, presenting over 230 pages of detailed market data, investment & analysis, strategic shifts, and trends in energy, the environment, infrastructure, and mobility. Download the extract or purchase the full report. You may also be interested in our Global Economic Outlook, Global Health Tech Outlook, or Global Education Outlook.

We have a jam-packed agenda for 2024 including a major new market sizing release and many exciting new initiatives. Stay tuned or Connect with HolonIQ to learn more about how we support forward-thinking institutions, governments, and organizations worldwide as they navigate the challenges and opportunities ahead.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🔋 Ascend Elements, a Massachusetts-based battery materials recycler, raised a $162M Series D to build sustainable lithium-ion battery materials in the US.

🚗 May Mobility, an autonomous vehicle pioneer, secured a $105 million Series D funding to drive technological advancements and expand services in the US, Canada, and Japan.

🧲 Niron Magnetics, a Minnesota-based provider of rare earth-free permanent magnets, raised $25M from Samsung Ventures to expand its production facilities and scale manufacturing capacity.

⚡ Daze, an Italy-based provider of EV charging solutions, raised a $16.1M Series A from CDP Venture Capital to support its business expansions.

🌱 Trace Genomics, a California-based industry leader in DNA-based soil intelligence, raised a $10.5M Series B to expand its commercial growth.

🚗 Pure EV, an Indian motor vehicle company that develops e-mobility and energy storage systems for the EV industry, raised $8M to scale up its EV two-wheeler playbook.

M&A

💧 HASA, Inc., a leading provider of safe, clean, and clear water treatment for recreational, municipal, and industrial water sanitization, acquired Chem Eleven Products, Inc. and select related assets from its parent company, FSTI, Inc.

🌿 Emirates Flight Catering, a UAE-based inflight catering company, acquired Bustanica, Duabai's largest indoor vertical farm, located close to Al Maktoum International Airport (DWC) at Dubai World Central.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com