🔋 EV Charging Decline 49% YoY. $3.2B Biopharma Acquisition.

Impact Capital Markets #132 looks at our EV Charging Stock Index, major impact deals, M&A, and upcoming economic releases.

Ciao 🍕

📈 Today's Global Economic Update: Australia's Westpac Consumer Sentiment index dropped 1.1% to 82.7 in July due to inflation and rate hike fears. The Mortgage Rate Expectations Index surged 12.8% to 159.2, with 60% anticipating higher rates.

🤖 Deal of the Day: Hebbia, a New York-based generative AI platform, raised a $100M Series B to enhance its AI-powered document search technology.

What's New?

🔋 EV Charging. EV charging decline 49% YoY

💰 Funding. Generative AI, digital banking, biopharmaceuticals + more

💼 M&A. Biopharmaceutical, professional services and healthcare staffing

📅 Economics. US inflation, UK GDP, balance of trade + more

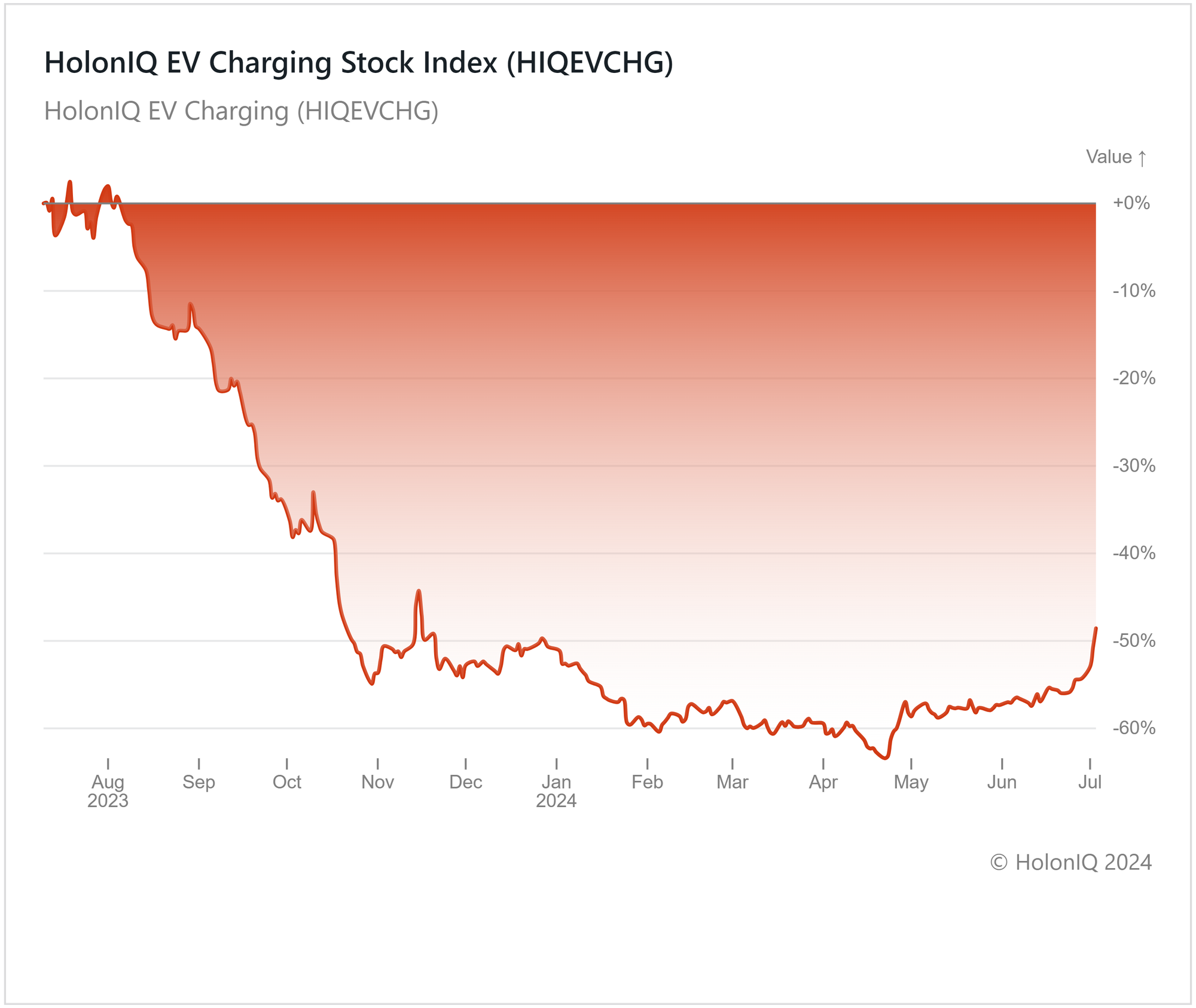

🔋 EV Charging Decline 49% YoY

HolonIQ’s EV charging index declined by 49% over the past year, while it has experienced a 30% rise in the past 3 months. This recovery, which started in late June, was fueled by major stocks in the index outperforming expectations for EV sales. The growth in EV sales is closely linked to the EV charging industry. The initial decline in the index was caused by a slowdown in EV sales growth, political factors, and a shortage of EV charging stations to meet demand. The EU's imposition of 37.6% tariffs on Chinese EVs, along with US plans to significantly increase tariffs, has made investors cautious. To meet the demand for EV charging stations, the Biden administration announced a $7.5 billion investment, although there have been delays in execution. Some consumers are reverting to traditional vehicles due to the lack of charging stations. Despite the rise of super and smart charging options, they are still more expensive than home charging. Additionally, the need for adaptors across different regions, due to various companies using different charging points, complicates the charging process. Despite these challenges, the EV charging market is driven by the increasing adoption of electric vehicles and the global push for greener transportation, with the index expected to grow overall.

💰 Funding

🤖 Hebbia, a New York-based generative AI platform, raised a $100M Series B from Andreessen Horowitz to enhance its AI-powered document search technology.

💻 TymeBank, a South African digital banking platform, raised a $77.8M Series B from Norrsken22 and Blue Earth Capital to expand operations in South Africa and the Philippines.

💊 SciRhom, a German biopharmaceutical company, raised a $70M Series A to expand the reach of new autoimmune treatments.

💰 Dezerv, an Indian wealth-tech platform, raised a $32M Series B from Premji Invest to accelerate growth and strengthen its financial position.

🔋 Poen, a Korean battery waste remanufacturer, raised a $28M Series B to accelerate its technology advancement.

🎯 Awign, an Indian work fulfillment platform, raised a $24.5M Series C from Mynavi Corporation to enhance technology & enter into new markets.

💼 M&A

🦠 Eli Lilly and Company, an Indiana-based biopharmaceutical company, signed a definitive agreement to acquire Morphic Holding for $3.2B, a Massachusetts-based biopharmaceutical company.

🔌 Accenture, an Irish professional services company, acquired Excelmax Technologies, an Indian semiconductor design services provider.

🩺 GQR, a California-based global workforce solutions firm, acquired Uniti Med, a Nebraska-based healthcare staffing company.

📅 Economic Calendar

US Inflation, UK GDP, Balance of Trade + More

Tuesday, July 9th 2024

Thursday, July 11th 2024

🇬🇧 UK GDP Data, May

🇺🇸 US Core Inflation Data, June

🇺🇸 US Inflation Data, June

Friday, July 12th 2024

🇺🇸 US PPI Data, June

🇺🇸 US Michigan Consumer Sentiment (Preliminary), July

🇨🇳 China Balance of Trade, June

Tuesday, July 16th 2024

🇩🇪 ZEW Economic Sentiment Index, July

🇨🇦 Inflation Data, June

🇺🇸 Retail Sales, June

Wednesday, July 17th 2024

🇬🇧 Inflation Data, June

🇺🇸 Building Permits (Preliminary), June

🇯🇵 Balance of Trade, June

Thursday, July 18th 2024

🇬🇧 Employment Data, May

🇪🇦 Deposit Facility Data

🇪🇦 ECB Interest Rate Decision

🇯🇵 Inflation Data, June

Friday, July 19th 2024

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com