🚗 EV Adoption Crosses Milestone in 31 Countries + South Asia Climate Tech 100

In 31 countries, electric vehicle adoption has reached a significant milestone, with EVs constituting 5% of new vehicle sales. This is a key indicator of mass adoption. This week, we also spotlight the 2023 South Asia Climate Tech 100, highlighting the region's most promising startups.

Happy Monday 👋

In 31 countries, electric vehicle adoption has reached a significant milestone, with EVs constituting 5% of new vehicle sales. This serves as a significant indicator of widespread adoption. This week, we also spotlight the 2023 South Asia Climate Tech 100, highlighting the region's most promising startups in the climate technology sector and how they are faring in 2024.

This Week's Topics

🚗 EV Industry. EV adoption reaches a significant milestone in 31 countries

📈 Battery Tech and Lithium Index. Index up 4% as increasing demand for plug-in-hybrids and energy storage solutions counter the slump

🏆 South Asia Climate Tech 100. 652.9M of fundraising in 2024 to date

📊 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data💰 Climate Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Climate Tech Outlook and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

🚗 EV Adoption Reaches a Significant Milestone in 31 Countries

Global EV sales have been increasing at a rapid pace since 2020, witnessing 500% growth since 2018. Led primarily by China, the US, and Europe, EVs are gradually accounting for a larger share of new vehicle sales in quite a few countries. In April, France saw EVs account for 27.9% of all automotive sales. Nordic countries lead in EV adoption, with Norway seeing an 80% EV share and Iceland with a 41% EV share. Globally, around 1-in-7 new cars sold were electric in 2022, while in 2023, this improved to 1-in-5 new cars sold being electric.

Since 2021, the EV industry has been passing an adoption milestone in many countries. A 5% market share is considered the threshold before mass adoption, after which technological preferences rapidly flip. At the end of 2023, 31 countries had passed this tipping point, indicating that these countries are now positioned to see mass adoption of electric vehicles. This is a significant development not just for the EV industry but also for the global decarbonization movement, given that road transportation accounts for 15% of GHG emissions. The number of countries crossing this tipping point is also increasing at a rapid pace. In 2022, only 19 countries crossed the threshold, and in 2023, this increased to 23 countries. Southeast Asia and Eastern Europe had some of the fastest-growing markets for the first time. Evidence from Western Europe demonstrates how EV adoption can jump from 5% to 25% of new cars in less than four years. Despite the slowdown seen in the growth of the EV industry, the market is poised to see a moderate 22% YoY growth in 2024, reaching approximately 17 million units in sales.

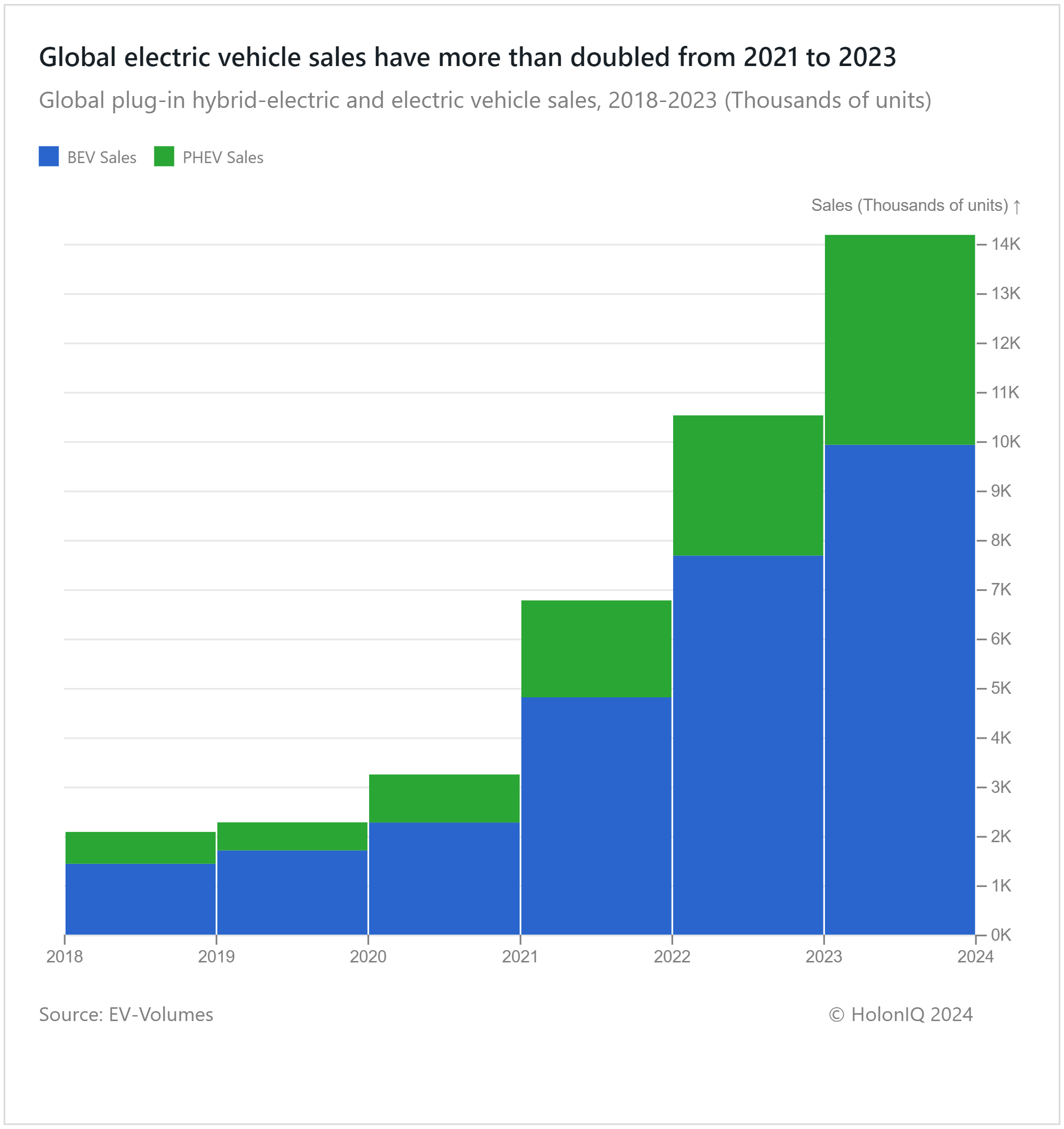

🚗 Global EV Sales Increased by 500% Since 2018, Led by Battery Electric Vehicles

At the end of 2023, global EV sales reached 14 million units, up from approximately 2,000 units in 2018. Advancements in technologies around EVs and batteries, favorable government policies such as tax breaks and subsidies, growing consumer sentiment on climate change, and established automakers joining the fray have propelled EV sales by approximately 500% over the last five years. While this growth was predominantly led by battery electric vehicles, throughout 2023, plug-in-hybrids (PHEVs) accounted for a larger share in EV sales in comparison to previous years. In 2023, sales of PHEVs recorded a 50% increase in comparison to 2022. This is largely due to the inherent advantage that they offer over battery-electric vehicles, which can run on the battery as well as on the combustion engine. The current limitations of battery technology and charging infrastructure are barriers to pure EV adoption, and thus, PHEVs will play a vital role in driving EV growth in 2024.

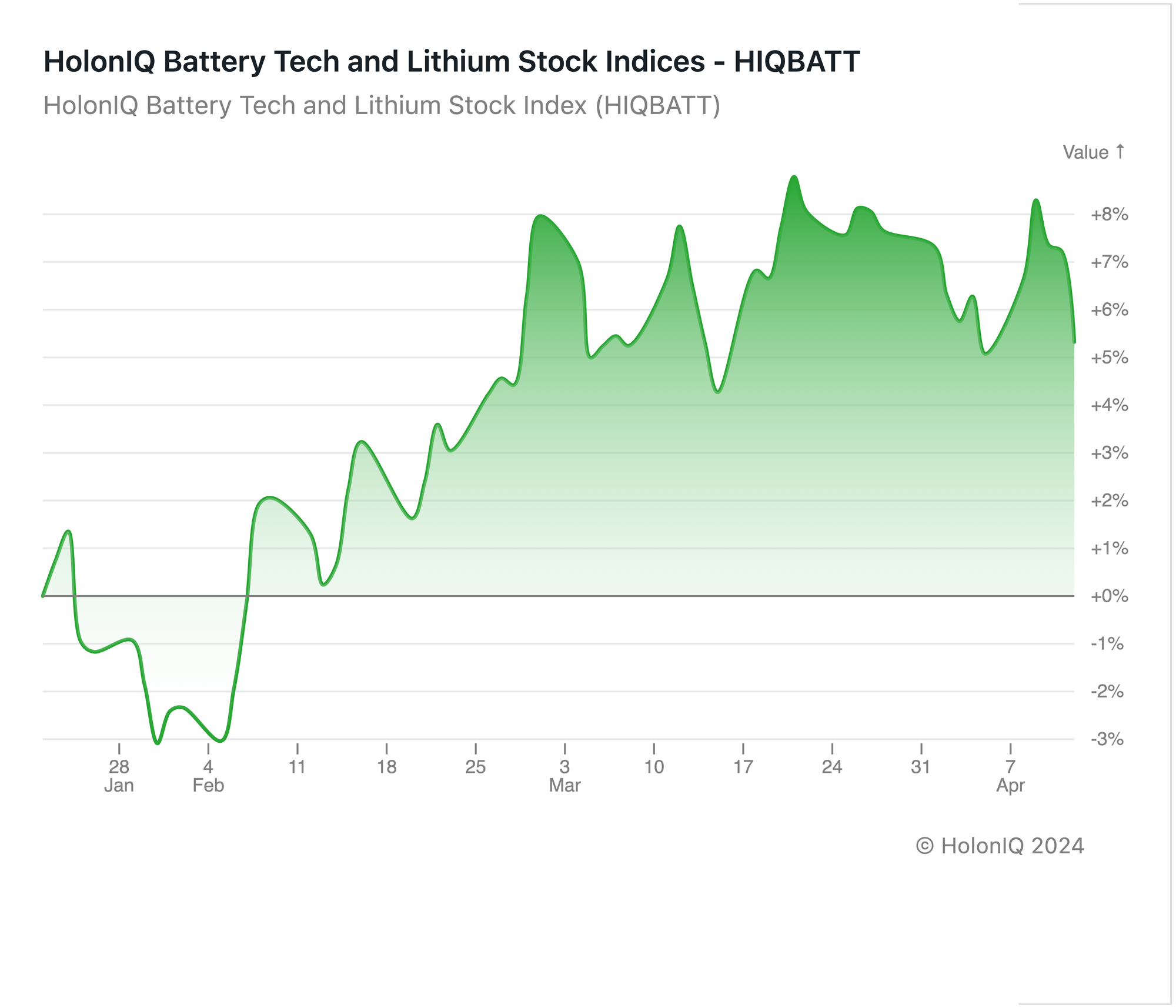

🔋 Battery Tech and Lithium Up 4%

HolonIQ tracks thousands of listed climate tech companies worldwide, along with acquisitions and investment transactions. Soon, we will launch a range of stock indices to track the daily performance of over ten different sectors across Climate Technology.

Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

HolonIQ’s Battery tech & Lithium index has recorded a 5% growth in the past three months amidst market fluctuations in the global EV market. This growth has been primarily led by Toyota Motor Corp. (MCap: $331B), and CATL (MCap: $117B).

The lithium-ion battery market is anticipated to experience rapid growth in the coming years, driven by the increasing demand for hybrid and electric vehicles, as well as advancements in battery technologies such as the emergence of solid-state batteries at a commercial scale. The attractiveness of solid-state batteries was made further evident when, in February, Chinese battery giants CATL, BYD ($82B MCap), and NIO teamed up to establish the China All-Solid-State Battery Collaborative Innovation Platform (CASIP) to develop next-gen EV batteries that will compete globally. Increased lithium production and reduced electric vehicle sales have resulted in an oversupply in the market, which has impacted the profitability of these companies. However, the cost reduction in battery manufacturing stemming from technological advances coupled with an anticipated increase in demand is expected to result in an upward trajectory for the remainder of the year.

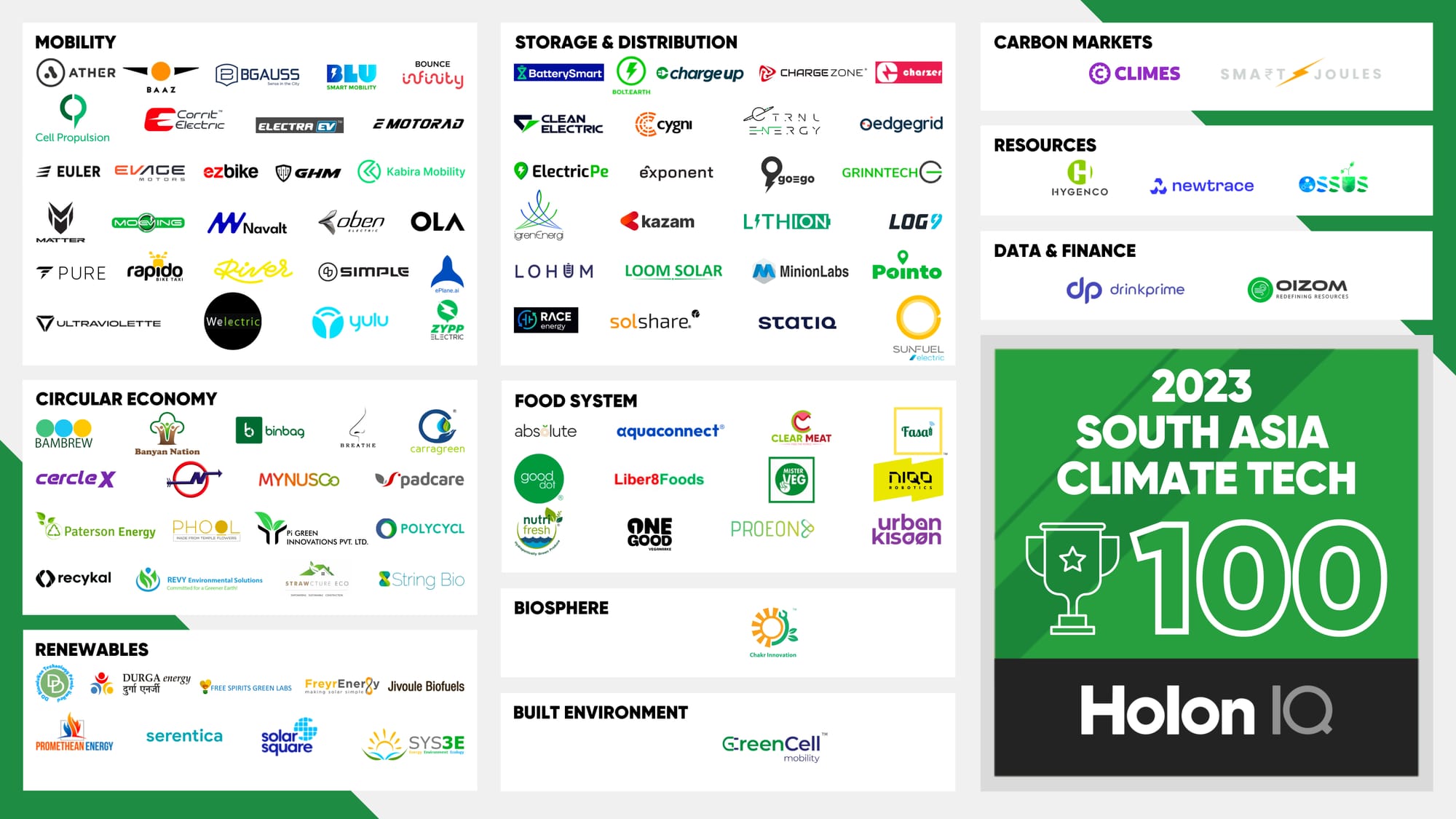

🏆 South Asia Climate Tech 100

The South Asia Climate Tech 100 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

Companies in the South Asia Climate Tech 100 have raised $652.9M in funding to date in 2024 as markets normalize and investment activities pick up. Indian-based companies operating in the solar energy, battery energy storage, and micro-mobility segments have received most funding. India-based Serentica Renewables secured $421M to advance the development of a 530-MW hybrid wind and solar power project in India, while battery tech start-up Lohum raised a $54M series B funding round. Ola Electric secured $50M, a few months after securing a $240M debt financing round with the State Bank of India.

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

🛻 Windrose Technology, a China-based electric heavy-duty truck developer raised a $110M Series B to set up a new supply chain center and production facility and implement the fast-charging infrastructure.

🌱 Loam Bio, an Australia-based biotech company that uses a microbial fungi-seed coating to help soil store more carbon and improve crop health, raised $100M to scale up its operations.

🔩 Magnus Metal, an Israeli-based technology company that specializes in industrial, high-volume digital casting for metal alloys, raised a $74M Series B funding.

🌱 Spiber, a Japan-based biotech company, raised $65M to accelerate mass production of its brewed protein product.

⚡ GridBeyond, an Irish smart energy company, raised a $55.3M Series C from Klima to scale up its operations.

🌊 Captura, a California-based direct ocean carbon capture company, raised a $45.3M Series A to expand operations and its business reach.

🥩 Mosa Meat, a Netherland-based cultivated meat manufacturer raised $42.4M to support the “next phase” of the company’s growth, with a public tasting of its burger imminent ahead of its launch in Singapore.

M&A

📦 U.S. International Paper (IP.N), a global producer of planet-friendly packaging, pulp, and other fiber-based products, and one of the world's largest recyclers is acquiring British packaging firm DS Smith (SMDS.L) in an all-share deal valuing the company $7.2B.

☀️ Stellantis, an Italian automaker, is acquiring 49.5% of 360 Energy Solar, one of Argentina's leading solar power producers for $100M in a push towards making its plants more energy self-sufficient.

🌿 Alpiq, a Swiss energy company, acquired a controlling stake in P2X Solutions Ltd for $50.2M, a Finnish green hydrogen producer.

🏞️ J-power, a Japanese Hydroelectric power generation company, acquired Genex Power, an Australian renewable energy company with a portfolio of renewable energy generation and storage projects in Australia including large-scale batteries, pumped-storage hydropower, wind, and solar.

☀️ Nova Clean Energy, a US-based energy company, acquired a 1GW solar and wind portfolio from BNB Renewables, another US-based energy company to develop the portfolio to serve the fast-growing energy demand in the region.

🌍 Levelup, a Singapore-based climate tech company, acquired Zevero, a UK-based provider of a carbon intelligence platform.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com