🚗 EV Adoption Crosses Milestone in 31 Countries + North America Climate Tech 200

Electric vehicles have achieved a notable milestone in 31 countries, accounting for 5% of new vehicle sales. This percentage is considered a key indicator for widespread adoption.

Happy Monday 👋

In 31 countries, electric vehicle adoption has reached a significant milestone, with EVs constituting 5% of new vehicle sales. This serves as a significant indicator of widespread adoption. This week, we also spotlight the 2023 North America Climate Tech 200, highlighting the region's most promising startups in the climate technology sector and how they are faring in 2024.

This Week's Topics

🚗 EV Industry. EV adoption reaches a significant milestone in 31 countries

📈 Mining Index. Index up 36%

🏆 North America Climate Tech 200. $1.5B of fundraising in 2024 to date

📊 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data💰 Climate Tech Deals of the Week. Funding and M&A

Don't forget to check out the 2024 Global Climate Tech Outlook and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

🚗 EV Adoption Reaches a Significant Milestone in 31 Countries

Since 2020, sales of electric vehicles have increased worldwide, growing by 500% in just the last year. With the US, Europe, and China leading the way, EV sales of new cars are steadily rising in many of these nations. In April, 27.9% of all car sales in France were electric vehicles. The Nordic region leads the adoption of EVs, with Iceland having a 41% EV share and Norway an 80% EV share. In 2022, about one in seven new cars sold worldwide were electric. By 2023, this percentage had increased to one in five new vehicles sold.

The EV sector has surpassed adoption milestones in numerous nations since 2021. Before widespread adoption, a 5% market share is thought to be the point at which people's preferences for technology drastically change. 31 nations had reached this tipping point by the end of 2023, readying those nations for widespread adoption of electric vehicles. Since 15% of greenhouse gas emissions come from road transportation, this is a huge development for the global decarbonization movement and the EV industry. More and more nations are surpassing this tipping point at an increasing rate. Just 19 nations passed the cutoff in 2022; by 2023, that number had risen to 23 and, for the first time, some of the fastest-growing markets were in Southeast Asia and Eastern Europe. Western European data shows that in less than four years, the percentage of new electric vehicle (EV) cars might increase from 5% to 25%. Even though the EV industry has slowed down, the market is expected to grow moderately (22% YoY) in 2024, reaching sales of about 17 million units.

At the end of 2023, global EV sales reached 14 million units, up from approximately 2,000 units in 2018. Advancements in technologies around EVs and batteries, favorable government policies such as tax breaks and subsidies, growing consumer sentiment on climate change, and established automakers joining the fray, have propelled EV sales by approximately 500% over the last five years. While this growth was predominantly led by battery electric vehicles, throughout 2023, plug-in-hybrids (PHEVs) accounted for a larger share in EV sales compared to previous years. In 2023, sales of PHEVs recorded a 50% increase in comparison to 2022. This is largely due to their inherent advantage over battery-electric vehicles, which can run on the battery and the combustion engine. The current limitations of battery technology and charging infrastructure are barriers to pure EV adoption, and thus, PHEVs will play a vital role in driving EV growth in 2024.

📉 Mining Index Grows 36%

HolonIQ tracks thousands of listed climate tech companies worldwide and their acquisitions and investment transactions. Soon, we will launch a range of stock indices to track the daily performance of over ten sectors across Climate Technology.

Our Impact Capital Markets newsletter tracks over 60 impact stock indices, including climate tech, emerging economies, and over 50 indices tracking healthcare innovation and education technology. Subscribe to Impact Capital Markets for data-driven insights on capital powering impact.

HolonIQ's mining index increased 36% over the past year, showing a steady rise after an initial slowdown in the first quarter. The global drive for decarbonization has fueled sector growth, with mining providing essential materials for this transition, ensuring continued investment. Major stocks like Southern Copper Corp ($93B MCap), China Shenhua Energy ($118B MCap), and BHP Group Ltd ($150B MCap) have risen by 75%, 48%, and 8%, respectively, reflecting this trend. However, the sector faces challenges, as seen in Q3 2023 when stock prices fell due to decreased demand from China's heavy industry and real estate sectors, along with a decline in metal prices reported by the World Bank. Additionally, rising supply costs amid shifting demand present further difficulties. Addressing these challenges, embracing transformation towards purpose-driven, low-carbon, digitally enabled organizations, and leveraging ESG integration and technological advancements will support sustainable revenue growth in the mining sector.

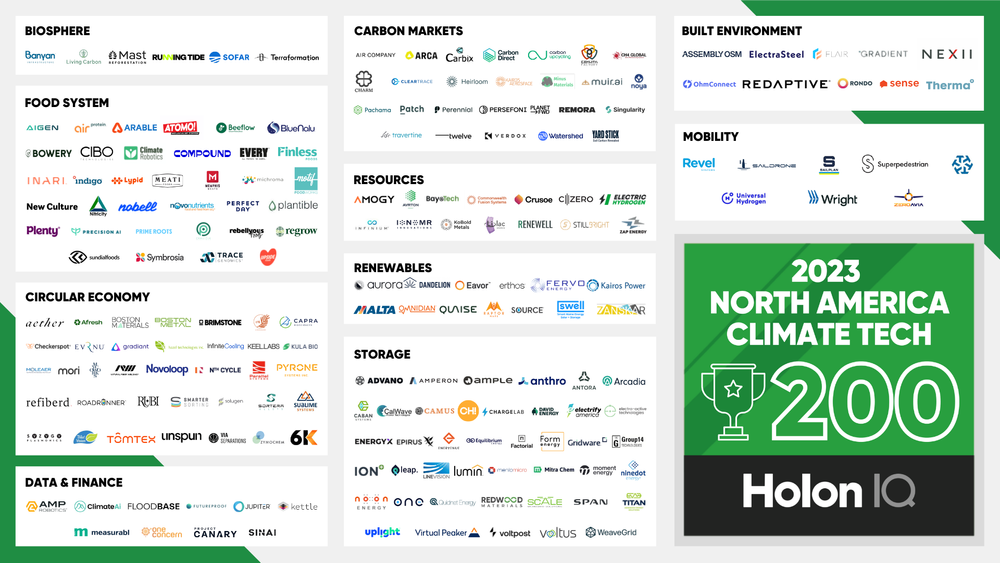

🏆 North American Climate Tech 200

The North America Climate Tech 200 is HolonIQ’s annual list of the most promising startups working in clean energy, zero-emission mobility, and sustainability.

North American companies are continuing to raise funds to expand their offerings and break into new markets. Energy storage developer NineDot Energy secured $225M in financing from investors including Manulife Investment Management to progress its pipeline of New York projects. Geothermal energy startup Fervo Energy raised $221M in February. Fervo, an enhanced geothermal start-up, uses directional drilling techniques pioneered by the oil and gas industry to extend its wells far beyond their surface footprints. US-based zero-emissions industrial heat and power solution provider Antora Energy raised $150M in Series B intending to use the proceeds to support the acceleration of the production of its thermal batteries to decarbonize industrial facilities.

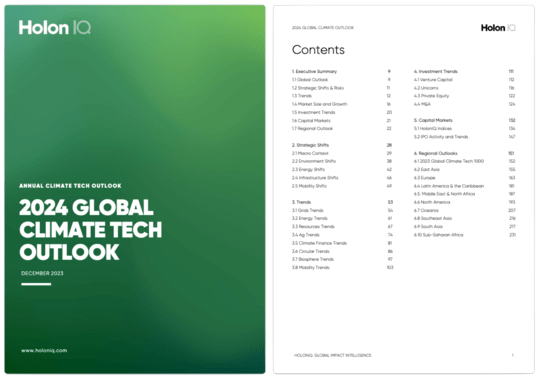

📊 2024 Global Climate Tech Outlook

HolonIQ's annual analysis of the evolving climate economy offers over 230 pages of in-depth insights on market data, investments, strategic shifts, and trends in energy, environment, infrastructure, and mobility. Download the extract or purchase the full report.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

⚡ Cloover, a German renewable energy finance provider, raised a $114M Seed from Lowercarbon Capital to grow its platform.

🧵 Syre, a Swedish textile impact company, raised a $100M Series A from TPG Rise Climate to set up two large textile recycling plants.

🏭 One Energy, an industrial energy company, raised a $35M Series A to cover its working capital.

♻️ Claros Technologies, a Minnesota-based sustainable material company raised a $22M Series B from the Ecosystem Integrity Fund and American Century Investments to advance R&D efforts.

🚗 Zypp Electric, an Indian fleet management startup, raised a $14M Series C from ENEOS to expand operations.

M&A

⚡️ Apricus Generation, a Florida-based energy investment firm, acquired Nexus Renewables, a Canadian renewable energy storage company.

⚡ Eaton, an Irish intelligent power management company, acquired Exertherm, a UK-based thermal monitoring solutions provider.

Thiank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com