⚡ Energy Storage Installed Capacity Reaches 90GW + Puerto Rico Impact 50

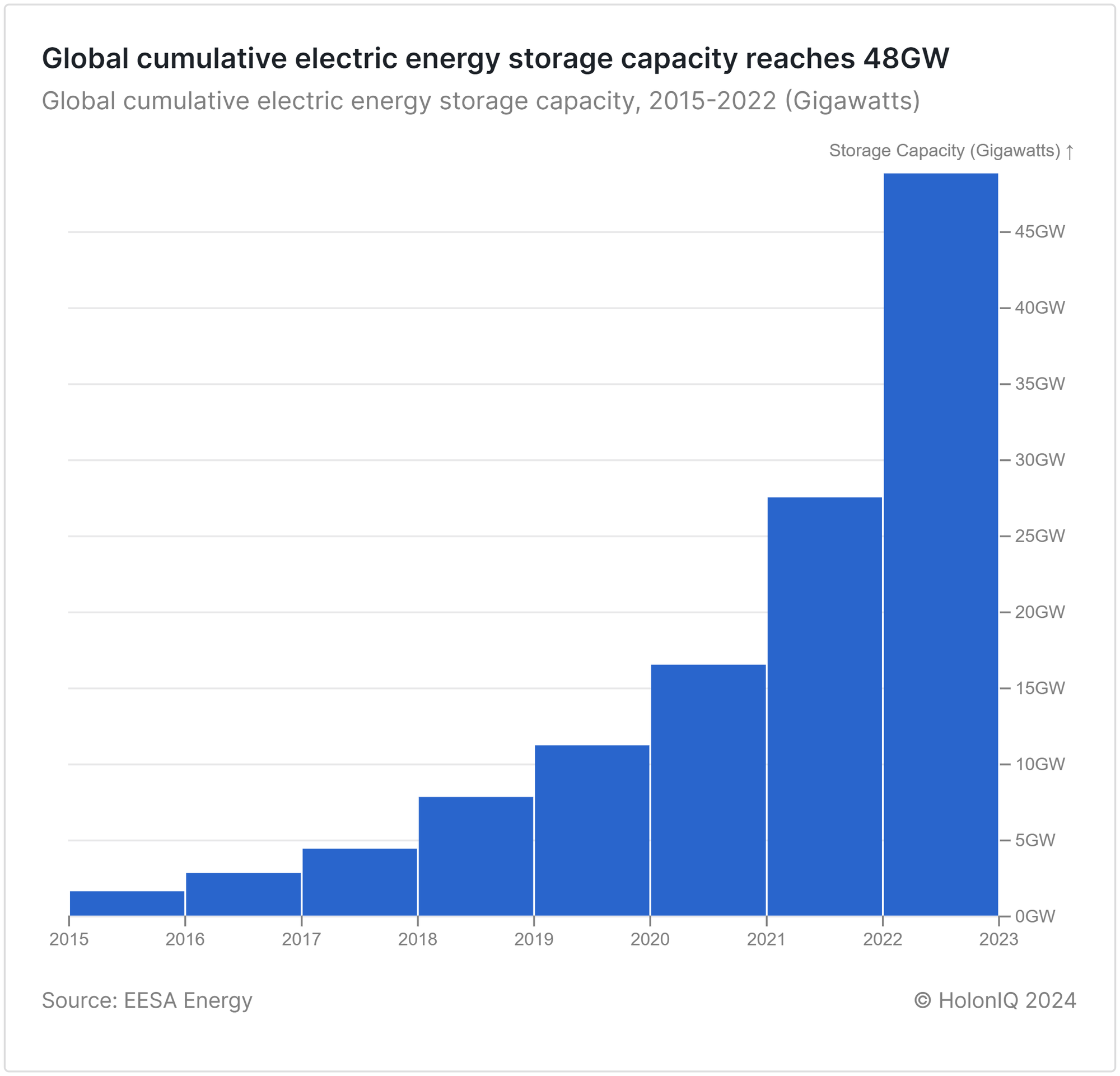

Cumulative battery energy storage capacity reached 90GW in 2023 led primarily by China, US and Europe, an increase from 48.8GW in 2022. This week we also spotlight inaugural Puerto Rico Impact 50 list.

Happy Monday 👋

Cumulative battery energy storage capacity reached 90GW in 2023, led primarily by China, US, and Europe, an increase from 48.8GW in 2022. This week, we also spotlight the inaugural Puerto Rico Impact 50 list. This list identifies high-potential startups in Puerto Rico driving positive change in education, health, and climate.

This Week's Topics

⚡ Energy Storage Systems. Industry landscape and mapping 100+ global players across key categories

📈 Micro-Mobility Stock Index. Index down 6%

🏆 Puerto Rico Impact 50. High-potential startups and scale-ups driving positive change in education, health, and climate

📊 Annual Climate Tech Outlook. 230+ pages of trends, insights, and data

💰 Climate Tech Deals of the Week. Funding, M&A and IPOs

Don't forget to check out the 2024 Global Climate Tech Outlook and sign up for our daily newsletters, Chart of the Day, and Impact Capital Markets. For unlimited access to over one million charts, request a demo.

⚡ Energy Storage Systems Industry Landscape

Parallel to the accelerated deployment of record renewable energy capacities, the deployment of energy storage systems has increased significantly over the last few years. Energy storage systems (ESS) are essentially giant batteries for the electrical grid. They take in excess electricity generated during times of low demand and store it for later use when demand is high. Cumulative battery energy storage capacity reached 90GW in 2023, an increase from 48.8GW in 2022.

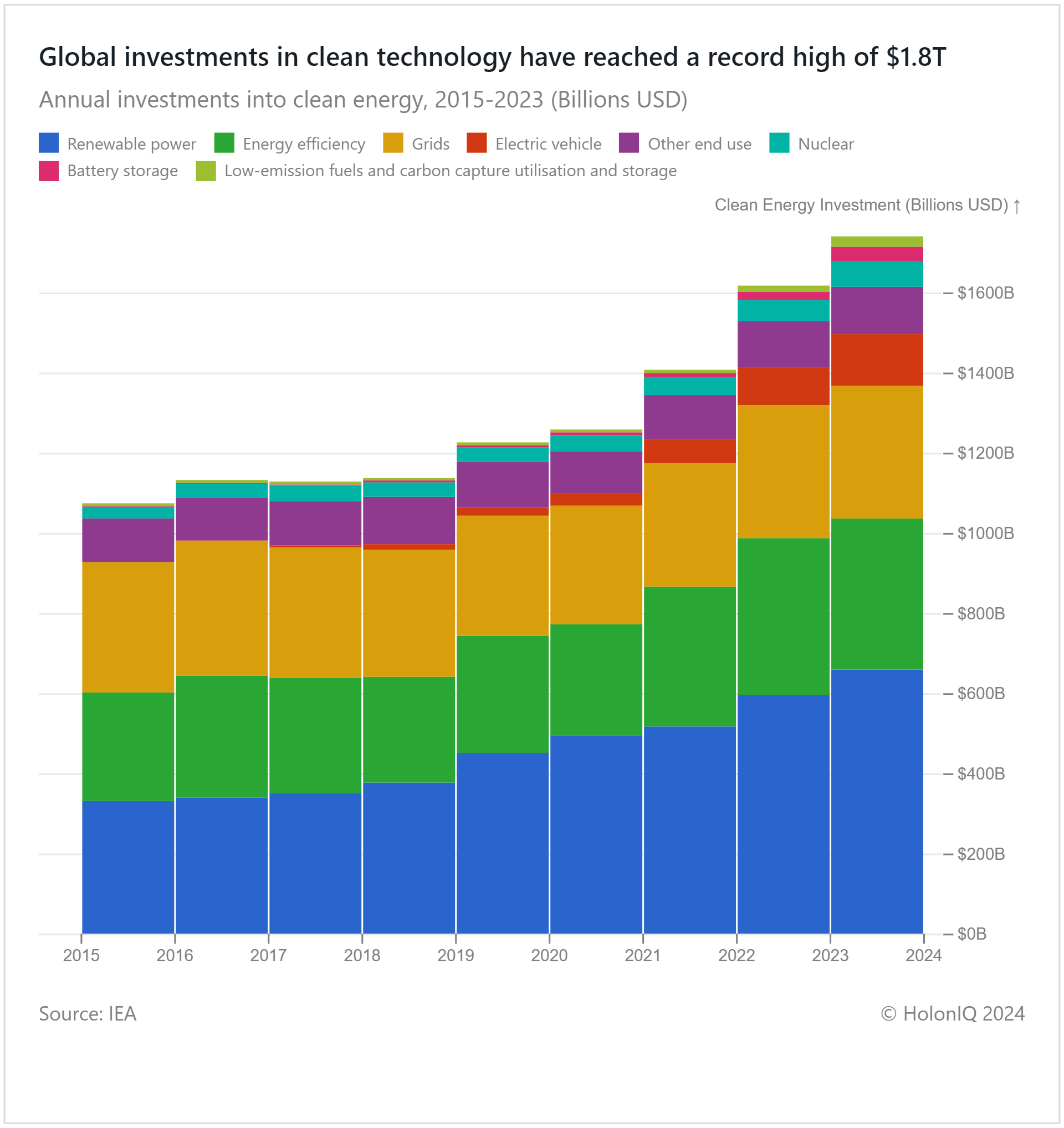

Utility-scale systems dominated the energy storage system boom in 2023, contributing 65% of the new capacity. Behind-the-meter battery storage solutions made up the remaining 35%. Notably, China, the EU, and the US were the primary drivers of this growth, collectively adding nearly 90% of the new capacity. This dominance reflects their existing leadership in clean energy installations. The increasing adoption of variable renewables like solar and wind is driving the need for energy storage systems. This challenge is particularly evident in the US, UK, and Europe, where a significant backlog of clean energy projects awaits connection to the grid. Energy storage systems can alleviate some of this load by conserving and storing the energy for future use. This record growth was primarily fueled by increased funding from both the private and public sectors. Global cumulative funding for battery energy storage reached $36B, up 76% from 2022.

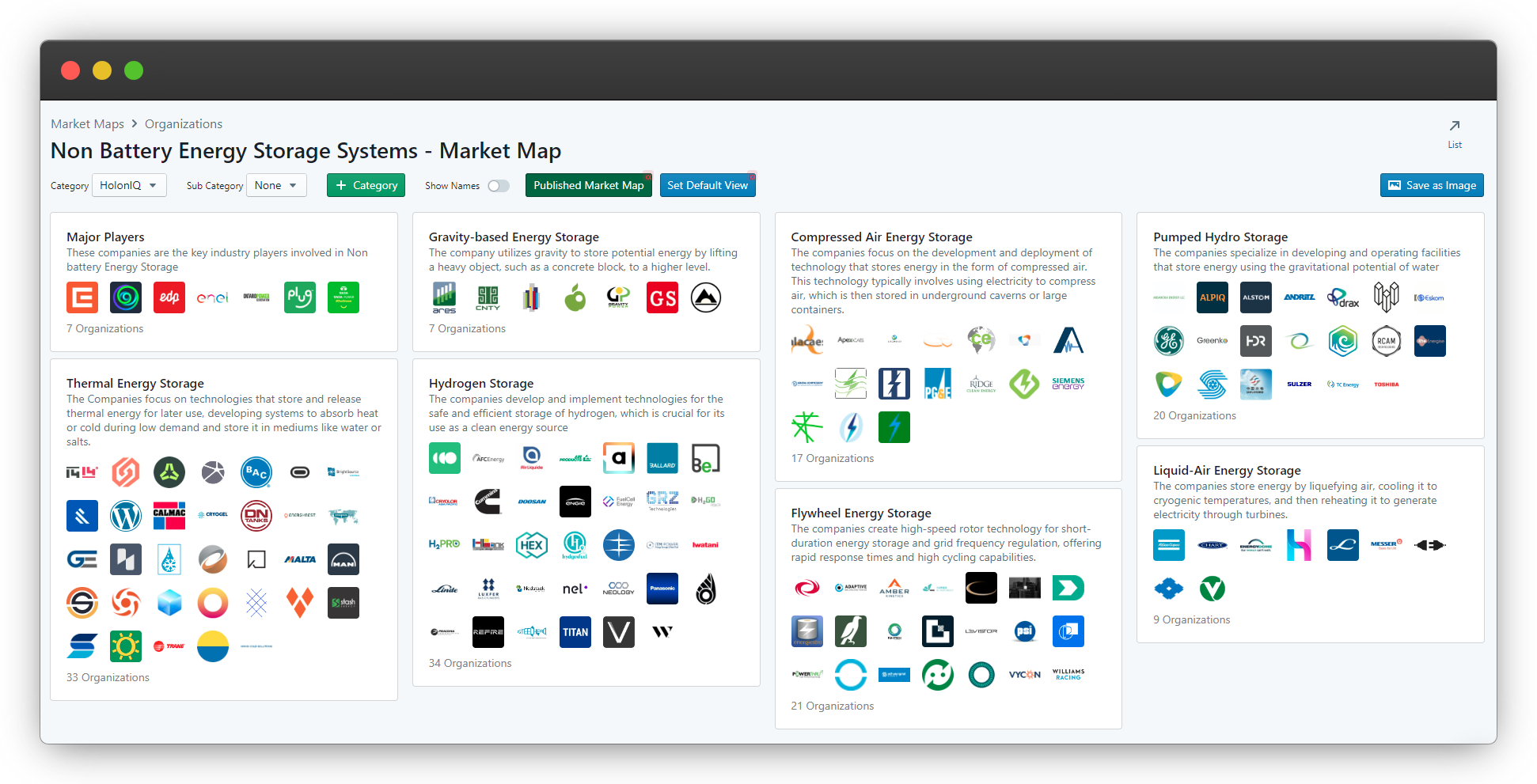

In addition to deploying battery energy storage systems (BESS), alternative energy storage systems are also being developed worldwide. Alternative energy storage systems include pumped hydro, thermal sand batteries, and fly-wheel storage. China launched the world's largest compressed air energy storage power station with a 300MW system in Shandong province. This power station is claimed to have the highest efficiency and lowest cost among similar facilities globally. In the same week Hydrostor, a company based in Toronto, proposed building two large compressed air energy storage facilities, one in Australia and one in California.

✈️ Non Battery Energy Storage Systems - Market Map

The Non-Battery Energy Storage Market Map represents a variety of cutting-edge choices for efficient and environmentally friendly energy storage. Although they are the most common option, batteries have drawbacks such as high costs and a lack of technological standardization. Alternatives include pump hydro storage systems, which use the elevation differential in a water reservoir to generate electricity, and gravity-based systems, which store and release energy through gravitational potential energy. Hydrogen storage aims to produce and store hydrogen in fuel cells to produce clean energy. Thermal energy storage stores heat or cold for heating and cooling applications, compressed air storage compresses air underground for power generation, and flywheel energy storage employs revolving flywheels to release energy efficiently.

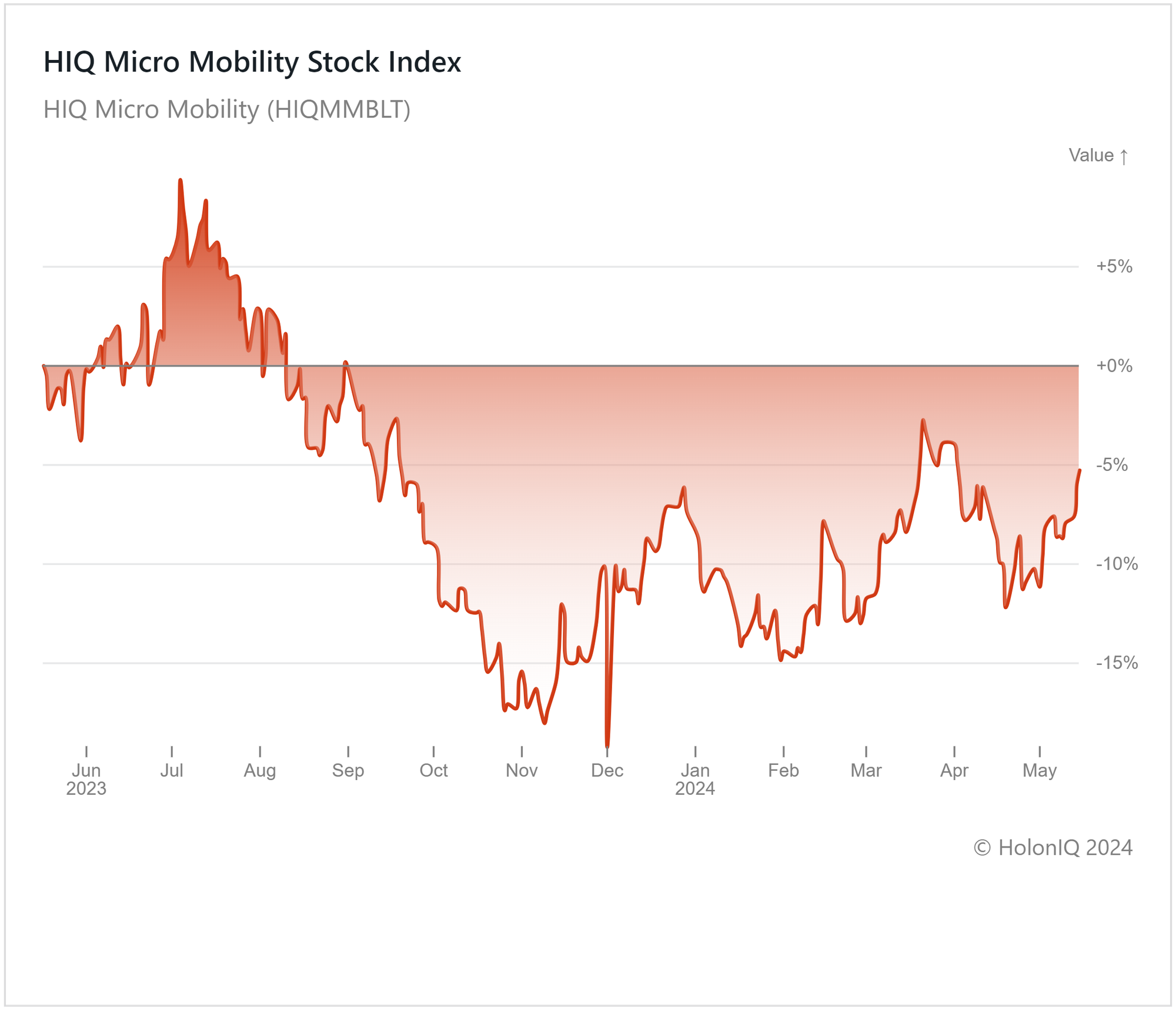

🛴 Micro Mobility Index Down 6%

HolonIQ’s Micro Mobility Index has declined since its downturn in August 2023, currently standing at -6%. Tight monetary policy, uncertain conditions in Ukraine and the Middle East, and a slowdown in economic recovery in China, along with hikes in raw material prices, have been deemed as factors behind the poor earnings of firms, including Bafang Electric ($850M MCap). Bafang Electric saw sales decline, with its stock price decreasing 41%. However, some firms in the index with most of the operations exposed to the sector, including Yamaha Motors ($10B MCap) and Giant Manufacturing ($3B MCap), saw their prices increase by 23% and 5%, respectively.

Although the micromobility sector has encountered challenges, there remains potential as macroeconomic conditions stabilize. Consumers are increasingly favoring sustainable alternatives, and as governments pursue greener initiatives and aim to alleviate pressure on public transport, micro-mobility companies will experience heightened investment and government backing. Advancements in lighter, more efficient, and durable batteries have expanded the range and capabilities of e-scooters and e-bikes, making them increasingly viable for everyday commuting.

🏆 Puerto Rico Impact 50

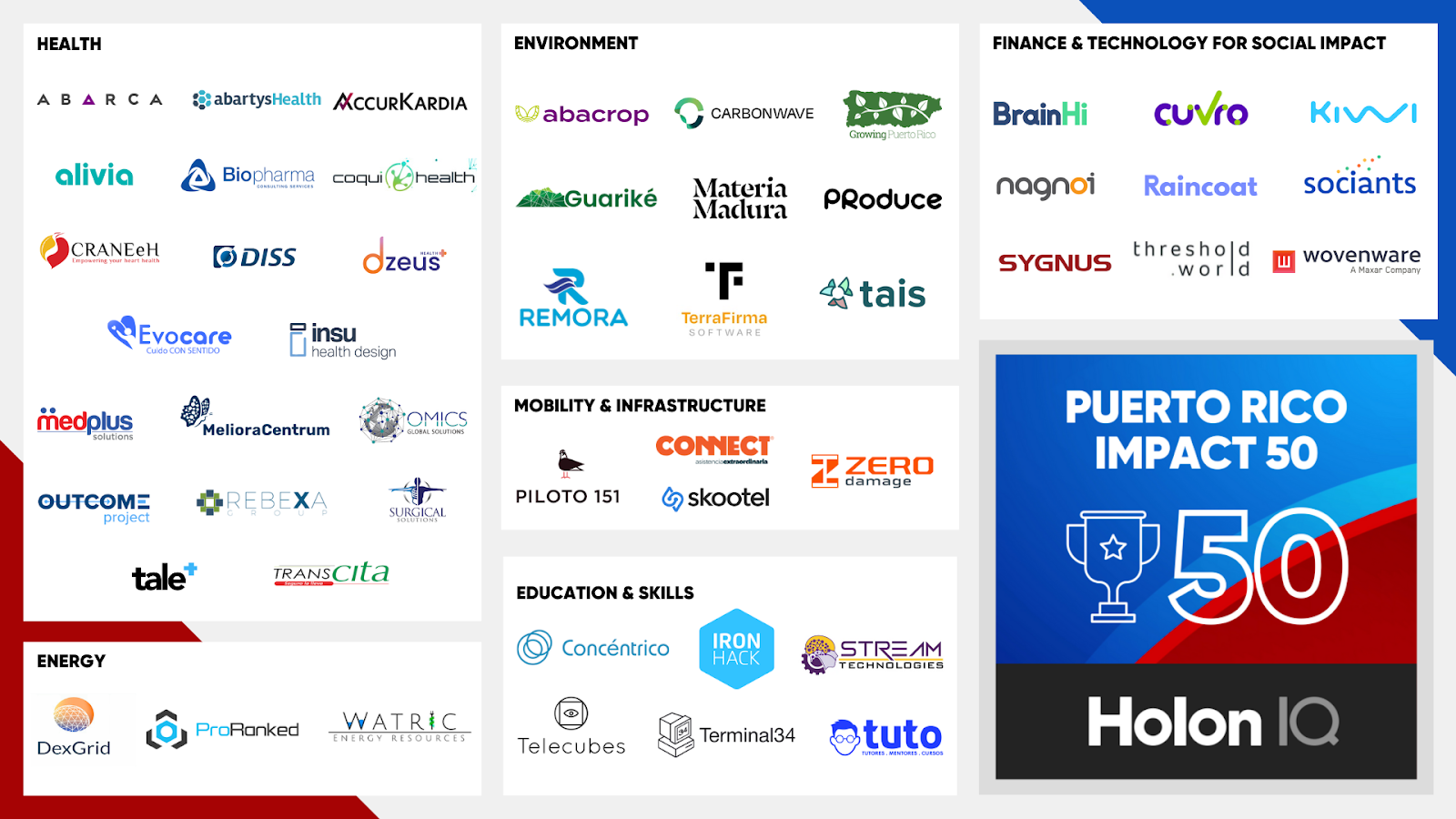

As part of Puerto Rico Impact Week, HolonIQ launched its inaugural Puerto Rico Impact 50 list. This list identifies high-potential startups and scale-ups in Puerto Rico driving positive change in education, health, and climate.

The Puerto Rico Impact 50 reflects a strong emphasis on health innovation. Health tech companies comprise over a third of the cohort, followed by Finance & Technology for impact at 18%, Environment at 18%, and Education & Skills at 12%. The remaining startups tackle mobility and infrastructure. 43% of the cohort was founded 8+ years ago, illustrating the more mature age profile, particularly in the health segment.

💰 Climate Tech Deals of the Week

HolonIQ actively monitors and tracks deals in the Climate Tech landscape, spanning across all regions of the world. Subscribe to our Daily Capital Markets newsletter to peruse the top deals for each day.

Funding

⛽ HIF Global, a Chilean e-fuels company, raised $164M to expand the e-fuels market in Japan and establish CO2 supply chains.

☢️ Newcleo, a UK-based energy company, raised $94M to develop their advanced nuclear reactor technology.

🔄 Cylib, a German battery recycling firm, raised a $59.4M Series A from World Fund and Porsche Ventures to expand its operations.

⚡️ Enspired, an Austrian AI energy trading company, raised a $27.5M Series B from Zouk Capital to expand into new markets.

🚚 Glydways, a California-based autonomous transport and clean energy tech firm, raised $20M to develop their on-demand Personal Rapid Transit (PRT) technology.

M&A

🗑️ Belfor Franchise Group, a Michigan-based franchise company of service-oriented brands, acquired JUNKCO+, a Kentucky-based waste removal and demolition company.

♻️ RePack, a Finnish company providing reusable packaging solutions, acquired Oceansix, a German company that creates innovative products from recycled materials.

IPO

🚗 Zeekr, a Chinese EV manufacturer's IPO, raised $441M from 21 million American Depositary Shares (ADS) priced at $21 each.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com