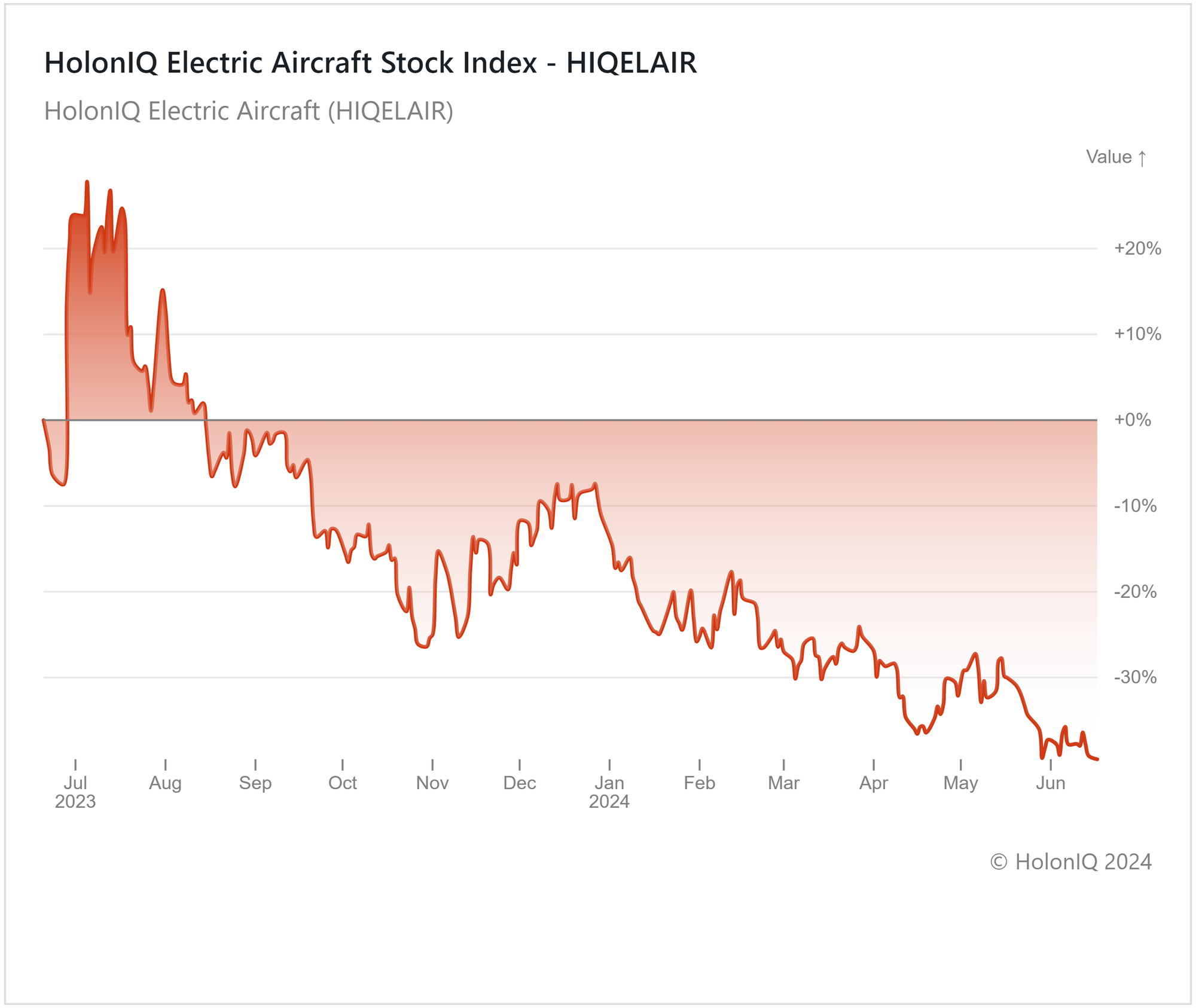

🛩️ Electric Aircraft Down 40%. $320M+ VC Funding.

Impact Capital Markets #117 looks at our Electric Aircraft Stock Index, major impact deals, M&A, and upcoming economic releases.

📈 Today's Global Economic Update: The Reserve Bank of Australia held its cash rate steady at a 12-year high of 4.35%. While many had hoped for a rate cut this year, higher inflation in the first quarter has diminished those prospects.

💊 Deal of the Day: Elion Therapeutics, a New York-based biotechnology company, raised a $81M Series B to support its clinical trials.

What's New?

🛩️ Electric Aircraft. Electric aircraft down 40% YoY

💰 Funding. Biotechnology, fintech, autonomous driving + more

💼 M&A. Travel management, environmental services and building contract services

📅 Economics. BoE interest rate decision, balance of trade, inflation, + more

🛩️ Electric Aircraft Down 40% YoY

HolonIQ's Electric Aircraft Index has dropped by 40%, with a 15% decline over the past three months. This decline highlights significant challenges in the electric aircraft industry, particularly concerning the weight and energy density of batteries and their limited range. Despite technological advancements, the industry struggles to compete with traditional aviation, which is also innovating by adopting Sustainable Aviation Fuels (SAFs) and improving existing technologies. The increased global focus on reducing carbon emissions is adding pressure on the aviation industry, as the sector contributes 3% of global emissions. If traditional aviation continues to become more cost-effective and environmentally friendly, the market capture for electric aircraft becomes increasingly difficult. These challenges have hindered revenue growth for electric aircraft companies, and major stocks have seen their prices decline. Joby Aviation ($3.5B MCap) experienced a 32% drop in its stock price over the past twelve months, while Eve Holding ($1.2B MCap) declined 56% and Archer Aviation ($1.0B MCap) fell 20%.

💰 Funding

💊 Elion Therapeutics, a New York-based biotechnology company, raised a $81M Series B from Deerfield Management and the AMR Action Fund to support its clinical trials.

💸 Finbourne Technology, UK-based fintech company, raised a $69.8M Series B from Highland Europe and AXA Venture Partners (AVP) to expand its capabilities in the US, UK, Ireland, Singapore, and Australia.

🚗 TIER IV, a Japanese autonomous driving software, raised a $54M Series B to enhance software development.

🔋 Princeton NuEnergy, a New Jersey-based battery recycling company, raised a $30M Series A from Samsung to upgrade its recycling facilities.

🩺 Nomad Health, a New York-based Healthcare recruitment company, raised $22M from HealthQuest Capital to expand its product portfolio and meet demand for its staffing-enabling technology.

🚚 OneOrder, an Egyptian delivery management platform, raised a $16M Series A from Delivery Hero Ventures to support its expansion into the Gulf Cooperation Council.

💼 M&A

✈️ TravelPerk, a Spanish travel management platform, acquired AmTrav for $134M, a Chicago-based business travel agency.

🌍 True Environmental, a New York-based environmental service company, acquired Sphere 3 Environmental, a Texas-based environmental consulting firm.

🏢 Installed Building Products, an Ohio-based marketplace for commercial building projects, acquired Thrice Energy Solutions, an Oklahoma-based building services contractor.

📅 Economic Calendar

BoE Interest Rate Decision, US Retail Sales, Balance of Trade, Inflation, + More

Tuesday, June 18th 2024

🇦🇺 Australia RBA Interest Rate Decision

🇩🇪 Germany ZEW Economic Sentiment Index, June

🇺🇸 US Retail Sales Data, May

🇯🇵 Japan Balance of Trade, May

Wednesday, June 19th 2024

Thursday, June 20th 2024

🇬🇧 UK BoE Interest Rate Decision

🇺🇸 US Building Permits (Preliminary), May

🇯🇵 Japan Inflation Data, May

Friday, June 21st 2024

🇬🇧 UK Retail Sales Data, May

🇩🇪 Germany HCOB Manufacturing PMI (Flash), June

Monday, June 24th 2024

🇩🇪 Germany Ifo Business Climate, June

Tuesday, June 25th 2024

🇦🇺 Australia Westpac Consumer Confidence Change, June

🇨🇦 Canada Inflation Rate, May

Wednesday, June 26th 2024

🇩🇪 Germany GfK Consumer Confidence, July

Thursday, June 27th 2024

🇺🇸 US Durable Goods Orders, May

🇺🇸 US GDP Growth Rate, Q1

Friday, June 21st 2024

🇫🇷 France Inflation Rate (Preliminary), June

🇮🇹 Italy Inflation Rate (Preliminary), June

🇺🇸 US Core PCE Price Index, May

🇺🇸 US Personal Income & Spending, May

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com