💰 EdTech VC Pulls Back (again), But Big Bets on AI Continue.

Global VC slowed in Q1 2025, but average deal sizes grew as investors doubled down on AI, student mobility, and scalable models. Explore HolonIQ’s latest outlook. Join us in 🇬🇧 London and 🇺🇸 New York!

Hello 👋

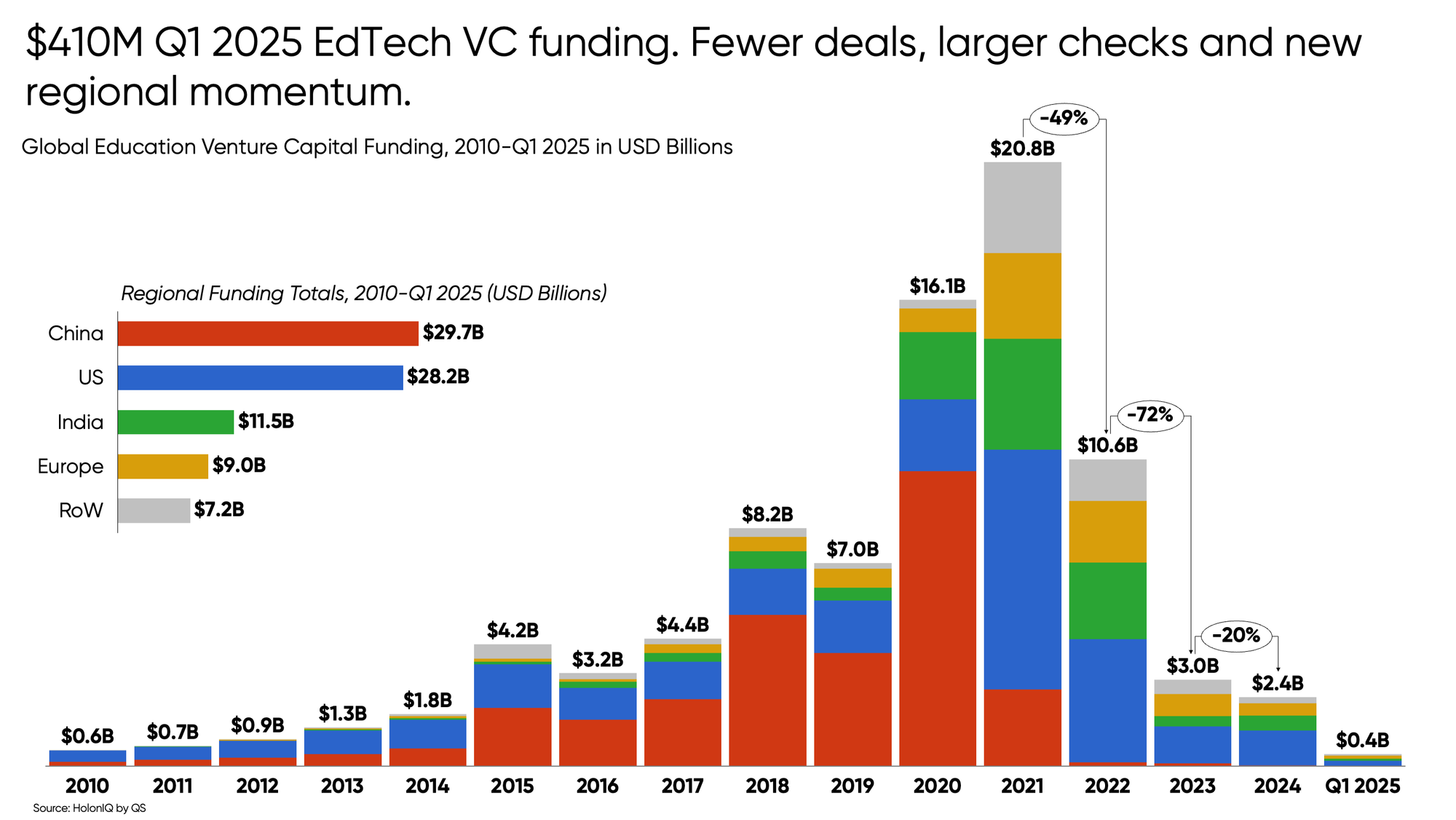

EdTech investment pulled back again in early 2025, but not evenly. Global VC funding dropped 35% year-over-year to $410M in Q1, with early-stage deals slowing sharply. Yet average check sizes rose to $7.8M as investors placed bigger bets on AI, student mobility, and scalable emerging market models. North America’s deal value halved, while MENA and South Asia gained momentum, signaling a slow but notable regional momentum. M&A activity also shrank, but deals in workforce learning and student services showed where confidence is growing. Investment is down, but not directionless.

Explore HolonIQ’s snapshot on the Q1 2025 Investment Outlook or request a demo for a deeper dive into global EdTech trends and every tracked deal year-to-date.

$410M in VC funding in Q1—investors focus on fewer, but strategic investments.

Venture funding for education fell 35% in Q1 year-over-year. Still, the average check size rose to $7.8M as investors doubled down on fewer, stronger plays. Just three startups—Leap Scholar, MagicSchool AI, and Campus—captured nearly half the capital, signaling investor focus on access, automation, and scale.

Education investment is down, but not out. While Q1 marked another drop in overall activity, capital is concentrating in categories with clearer ROI and long-term resilience, from workforce up-skilling to AI infrastructure. To go deeper, explore HolonIQ’s full Q1 2025 Investment Outlook on the platform or sign up for a demo, complete with every tracked deal year to date categorized by transaction.

Join us for London EdTech Week 🇬🇧 16-20 June

HolonIQ and the QS team will be out in force for London EdTech Week - join us at the Summit on Tuesday 17 June, or at many of the sessions, workshops and gatherings across London during the week. Learn More.

Early Bird Pricing 🐦 Open for the 2025 Back to School Summit — September 9 –11 in NYC 🇺🇸

Join 700 CEOs and influential leaders at the 2025 Back to School Summit, September 10–11 in New York City 🇺🇸. Two days of high-impact presentations, private roundtables, fireside chats, and curated networking with top companies, global foundations, and major institutional investors. Register now for Early Bird Tickets. Connect with us for the 2025 Sponsorship Brochure.

💪 Power Moves

🤖 Israel’s Center for Educational Technology and eSelf collaborated to allow all Israeli students to gain access to an AI tutor.

⛑️ The US president signs a new executive order to add 1M apprenticeships.

💡 California launched a statewide education data system to track student outcomes and inform better career planning.

💰 Education Funding

HolonIQ actively monitors and tracks capital flow in the education market, spanning all regions and transaction categories.

🏫 Instrumentl, a US-based company that has raised $55M in funding to develop its platform’s AI capabilities and expand its US footprint.

💬 Meadow, a New York City-based company, secured $14M to expand its operations of its student financial platform.

🎓 Emversity, an Indian program content and delivery partner, raised $5M to scale its operations and expand skilled workforce training across India.

🖥️ Panorama Education, a US-based education technology company, acquired Class Companion to enhance personalized learning and student success through AI.

📢 Knovia Group, a private equity firm, acquired Babington, an apprenticeship provider, adding to its existing portfolios that currently include competing apprenticeship giant Paragon Skills.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com