🩺 Digital and Telehealth Up 8%. $52M+ VC Funding.

Impact Capital Markets #96 looks at our Digital and Telehealth Stock Index, major impact deals, M&A, and upcoming economic releases.

Bonjour 🥖

📉 Today's Global Economic Update: China's industrial production increased by 6.7% YOY in April 2024, surpassing forecasts and accelerating from the previous month. This uptick was driven by strong export demand, even though indicators like retail sales still reflect weakness in China's domestic economy.

🔧 Deal of the Day: CoLab Software, a Canadian mechanical design tech company, raised a $21M Series B to expand its team.

What's New?

🩺 Digital and Telehealth. Digital and telehealth growth moderates, up 8%

💰 Funding. Mechanical engineering, medical devices and smart wallet service

💼 M&A. ABB acquires Siemens' wiring accessories business

📅 Economics. Japan inflation data, US GDP, balance of trade + more

🩺 Digital And Telehealth Growth Moderates, Up 8%

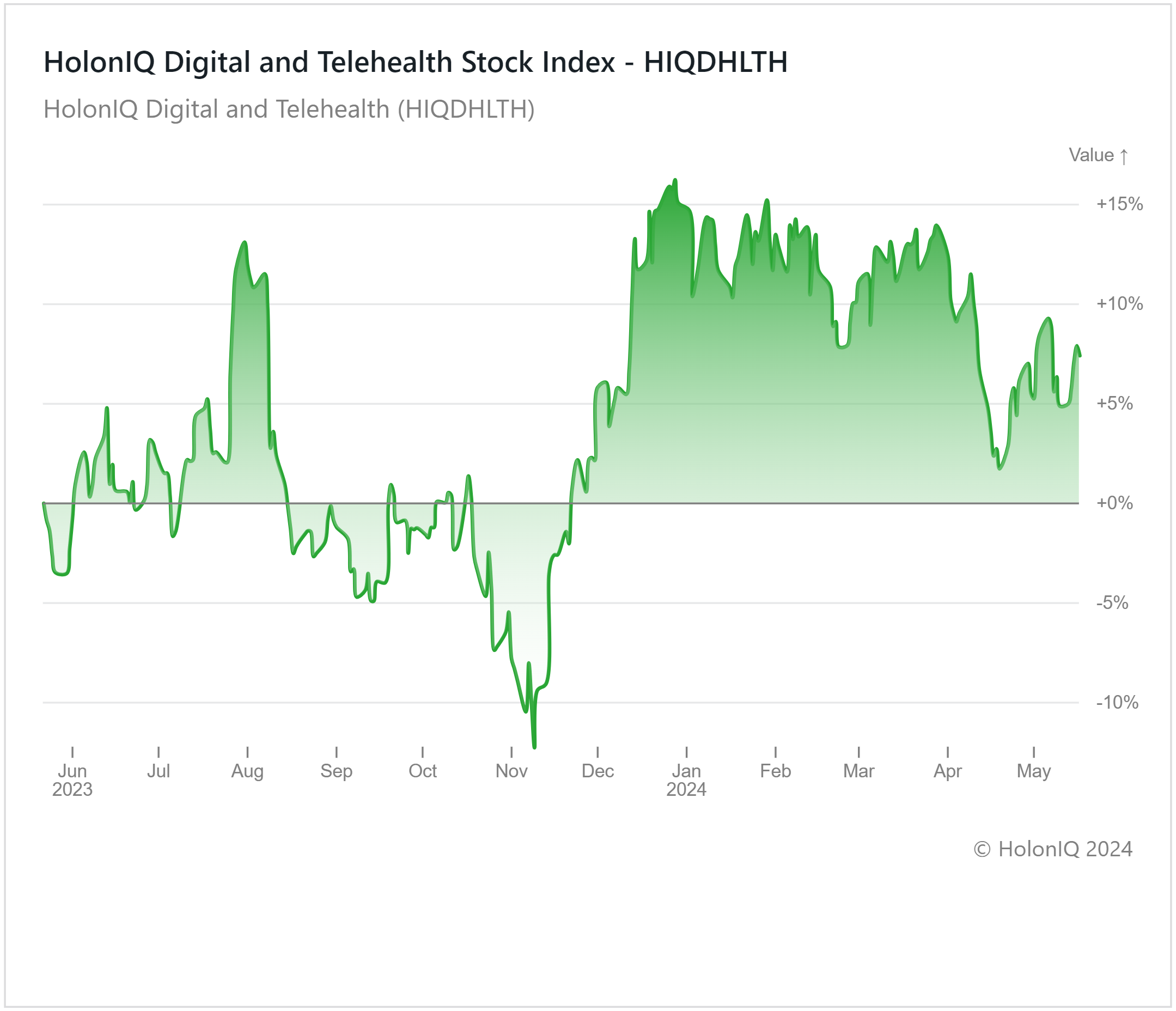

HolonIQ's Digital and Telehealth Index dropped by 12% in November 2023 but recovered sharply in December 2023. While the index has maintained its positive trajectory, the growth has moderated gradually over the last 3-5 months. Over the past 12 months, the index has risen by 8%. The pandemic accelerated the adoption of digital healthcare services, highlighting benefits like greater access to specialized medical expertise, reduced healthcare costs, and enhanced convenience for patients, particularly in remote or underserved areas. While usage has stabilized since then, it is likely to stay elevated compared to pre-Covid levels, as more people become accustomed to using these services. The rapid advancement of Artificial Intelligence (AI) is also contributing to growth in the sector, with AI and machine learning technologies becoming more integrated into healthcare, improving telehealth platforms with predictive analytics, personalized treatment plans, and better diagnostic capabilities.

Stocks within the index have experienced positive returns, supported by strong financials. Dexcom ($52B MCap) beat analysts' expectations with 24% revenue growth in the first quarter of 2024, driven by increased awareness of the benefits of its real-time continuous glucose monitoring system and strong customer additions. Its stock price also rose by 12% over the year. Labcorp ($18B MCap) also reported a strong first quarter in 2024, with significant revenue growth and a 7% increase in EPS to $3.68. Its stock price underpinned these financials, increasing 12% YoY.

💰 Funding

🔧 CoLab Software, a Canadian mechanical design collaboration company, raised a $21M Series B from Insight Partners to expand its team.

💉 Atraverse Medical, a California-based medical device company, raised a $12.5M Seed to expand their R&D efforts.

💳 Kudos, a California-based AI-powered smart wallet service, raised a $10.2M Series A from QED Investors to expand operations.

💼 M&A

🔌 ABB, a Swiss electrification and automation provider signed a definitive agreement to acquire Siemens' wiring accessories business in China.

📅 Economic Calendar

Japan Inflation Data, US GDP, Balance of Trade + More

Monday, May 20th 2024

🇦🇺 Australia Westpac Consumer Confidence Index, May

🇦🇺 Australia RBA Meeting Minutes

Tuesday, May 21st 2024

🇨🇦 Canada Inflation Data, April

🇯🇵 Japan Balance of Trade, April

Wednesday, May 22nd 2024

🇬🇧 UK Inflation Data, April

🇺🇸 US FOMC Minutes

Thursday, May 23rd 2024

🇩🇪 Germany HCOB Manufacturing PMI (Flash), May

🇯🇵 Japan Inflation Data, April

Friday, May 24th 2024

🇬🇧 UK Retail Sales Data, April

🇺🇸 US Durable Goods Orders Data, April

Monday, May 27th 2024

🇩🇪 Germany Ifo Business Climate Index, May

Wednesday, May 29th 2024

🇯🇵 Japan Consumer Confidence Index, May

🇩🇪 Germany GfK Consumer Confidence, June

🇩🇪 Germany Inflation Data Preliminary, May

Thursday, May 30th 2024

🇺🇸 US GDP Growth Data, Q1

🇨🇳 China NBS Manufacturing PMI, May

Friday, May 31st 2024

🇫🇷 France Inflation Data Preliminary, May

🇪🇦 Euro Area Inflation Data (Flash), May

🇮🇹 Italy Inflation Data Preliminary, May

🇮🇳 India GDP Growth Data, Q1

🇨🇦 Canada GDP Growth Data, Q1

🇺🇸 US Core PCE Price Index, April

🇺🇸 US Personal Income & Spending, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com