🪨 Critical Minerals Rise 20%. $580M+ VC Funding Day.

Impact Capital Markets #85 looks at our Critical Minerals stock index, major impact deals, M&A, and upcoming economic releases.

Zdravo 🍷

📉 Today's Global Economic Update: The Federal Reserve kept interest rates unchanged in May, due to ongoing inflation and a slow job market. The Federal Open Market Committee indicated that rate cuts are likely to come only in the second half of the year. Chair Powell signalled policymakers were also not considering raising rates, believing the current policy is adequate to meet the 2% inflation target.

💊 Deal of the Day: BridgeBio Pharma, a biopharmaceutical company, raised $200M to develop its oncology programs.

What's New?

🪨 Critical Minerals. Critical minerals index rises 20%

💰 Funding. Biopharmaceuticals, healthcare, green hydrogen + more

💼 M&A. Healthcare staffing, mining, digital assets

📅 Economics. UK GDP, China inflation, employment data + more

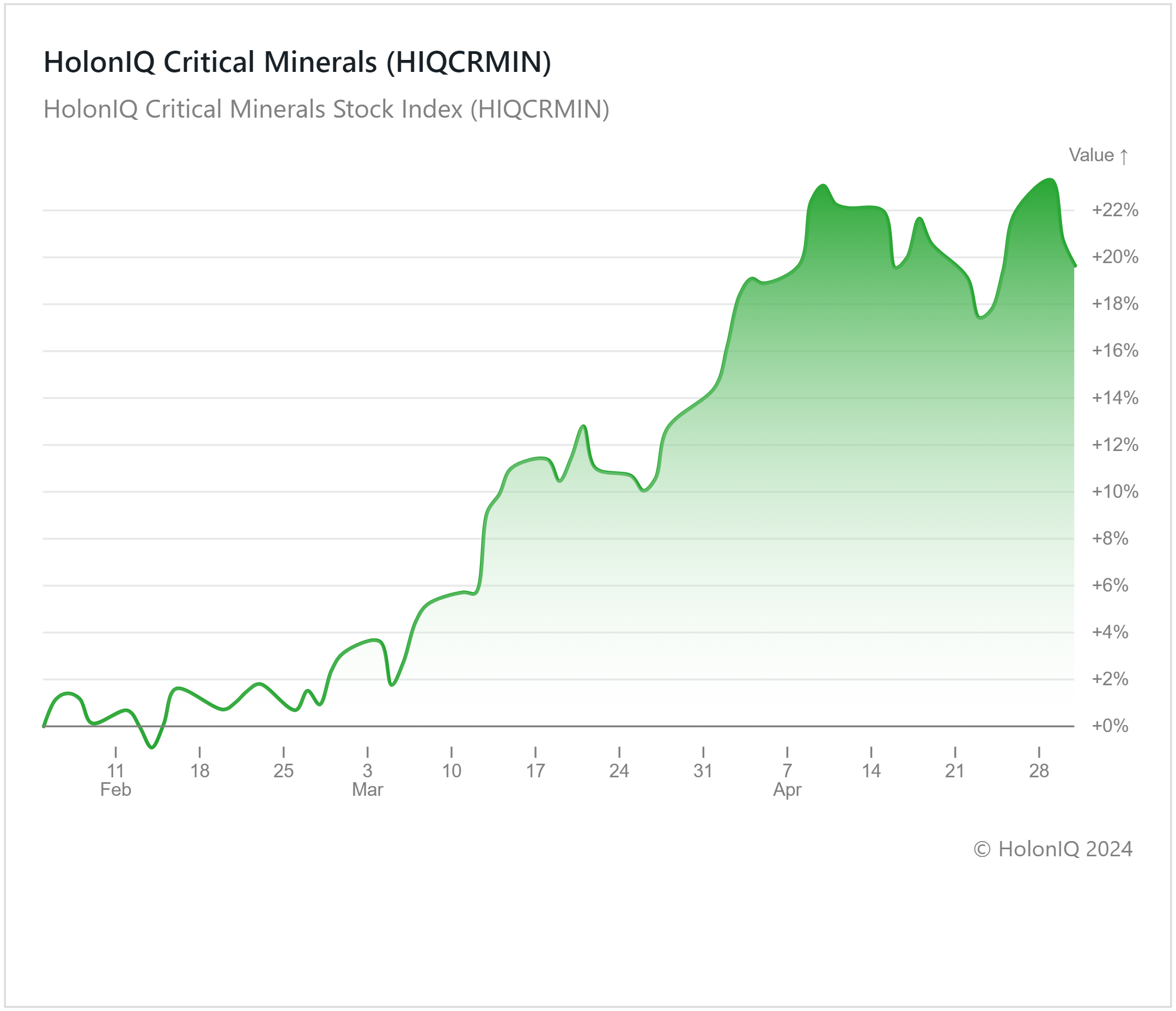

🪨 Critical Minerals Index Rises 20%

HolonIQ’s Critical mineral index has risen by 20% in the past 3 months. On a year-on-year basis, the index declined 6%, reaching lows of over 20% in March. The decline was primarily driven by to slower growth rate in electric vehicle sales and an oversupply of EV batteries in the market.

However the green energy transition and a decline in the U.S. dollar strength has driven the index higher in the last three months. Analysts predict that copper prices could skyrocket by over 75%, fueled by the push for renewable energy by 2025. Major copper mining stocks have shown greater returns in the past 3M due to the increasing demand for copper, such as Southern Copper ($70B MCap) and Freeport-McMoRan ($56B MCap), earning returns of 44% and 29%, respectively. The outlook for 2024 & 2025 remains optimistic as governments hasten their decarbonization goals, with increasing EV adoption in their countries remaining a crucial aspect of that. Furthermore, the EV industry itself is expected to see an uptick led by the increasing sales of hybrid vehicles. Critical minerals are significant in EV production, hence the index is expected to grow further.

💰 Funding

💊 BridgeBio Pharma, a biopharmaceutical company, raised $200M from Omega Funds and Cormorant Asset Management to develop its oncology portfolio.

🏥 Transcarent, a California-based healthcare platform provider, raised a $126M Series D from General Catalyst and 7wire Ventures to accelerate its AI capabilities.

🧬 Karius, a California-based healthcare company, raised a $100M Series C to expand its reach.

💧 Stargate Hydrogen, an Estonia-based green hydrogen company, raised a $45M Seed from UG Investments and IPCEI to scale its operations.

🦴 Livara Health, a California-based musculoskeletal (MSK) care provider, raised a $15M Series B from A1 Health Ventures to accelerate tech and clinical innovation.

💼 M&A

👩⚕️ Knox Lane, a California-based investment firm, acquired All Star Healthcare Solutions, a Florida-based healthcare staffing agency.

⛏️ Contango ORE, a Texas-based mining company, entered into a definitive agreement to acquire HighGold Mining, a Canadian gold exploration company.

🎨 Shutterstock, a New York-based creative platform, entered into a definitive agreement to acquire Envato, an Australian digital creative assets company.

📅 Economic Calendar

UK GDP, China Inflation, Employment Data, Balance of Trade + More

Friday, May 3rd 2024

🇺🇸 US Employment Data, April

🇺🇸 US ISM Services PMI, April

Tuesday, May 7th 2024

🇦🇺 Australia RBA Interest Decision

🇩🇪 Germany Balance of Trade Data, March

🇨🇦 Canada Ivey PMI s.a, April

Wednesday, May 8th 2024

🇨🇳 China Balance of Trade Data, April

Thursday, May 9th 2024

Friday, May 10th 2024

🇬🇧 UK GDP Data, Q1

🇨🇦 Canada Employment Data, April

🇺🇸 US Michigan Consumer Sentiment (Preliminary), May

🇨🇳 China Inflation Data, April

Like getting this newsletter? For unlimited access to more deals and economic updates, request a demo.

Thank you for reading. Have a great week ahead!

Have some feedback or want to sponsor this newsletter? Let us know at hello@holoniq.com